Individual Investor Behavior: What Does the Research Say?

By Wesley Gray, PhD|July 22nd, 2022|Research Insights, Academic Research Insight, Behavioral Finance|

Many market commentators, financial advisors, and professionals are quick to point that that individuals are terrible investors. Of course, it's not exactly clear that professionals are much better than individuals, but it is certainly true that most investors should simply buy low-cost index funds (or factor funds!) and gets their hands out of the cook jar. What's nice about this paper is that the assertions that individuals are poor investors -- and exactly why they fail to do well -- are backed by peer-reviewed research. One can leverage these insights to help investors find solutions that will solve their problems and put them in a better position to be successful.

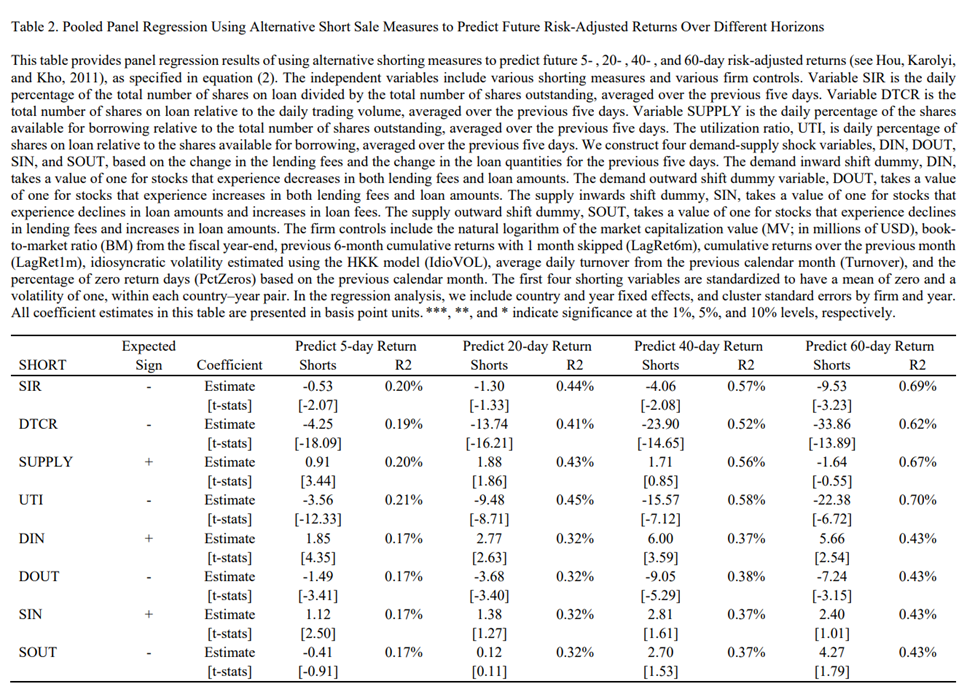

Short Sellers Are Informed Investors

By Larry Swedroe|July 21st, 2022|Research Insights, Larry Swedroe, Academic Research Insight, Behavioral Finance|

Using multiple short sale measures, we examine the predictive power of short sales for future stock returns in 38 countries from July 2006 to December 2014. We find that the days-to-cover ratio and the utilization ratio measures have the most robust predictive power for future stock returns in the global capital market. Our results display significant cross-country and cross-firm differences in the predictive power of alternative short sale measures. The predictive power of shorts is stronger in countries with non-prohibitive short sale regulations and for stocks with relatively low liquidity, high shorting fees, and low price efficiency.

Relative Sentiment and Machine Learning for Tactical Asset Allocation: Out-of-Sample Results

By Raymond Micaletti|July 19th, 2022|Relative Sentiment, Research Insights, Trend Following, AI and Machine Learning, Tactical Asset Allocation Research|

We examine Sentix sentiment indices for use in tactical asset allocation. In particular, we construct monthly relative sentiment factors for the U.S., Europe, Japan, and Asia ex-Japan by taking the difference in 6-month economic expectations between each region's institutional and individual investors. These factors (along with one-month forward equity returns) then serve as inputs to a wide array of machine learning algorithms. Employing combinatorial cross-validation and adjusting for data snooping, we find relative sentiment factors have robust and significant predictive power in all four regions; that they surpass both standalone sentiment and time-series momentum in terms of informational content; and that they demonstrate the ability to identify the subsequent best- and worst-performing global equity markets from along a cross-section. The results are consistent with previous findings on relative sentiment, discovered using unrelated datasets.

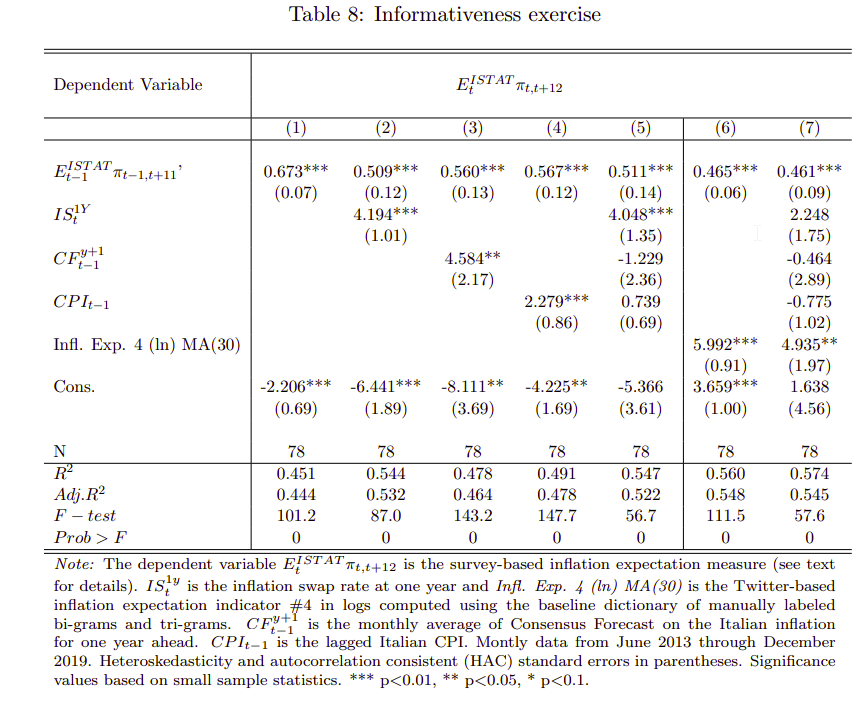

Can We Measure Inflation with Twitter

By Elisabetta Basilico, PhD, CFA|July 18th, 2022|Inflation Investing, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

Drawing on Italian tweets, we employ textual data and machine learning techniques to build new real-time measures of consumers’ inflation expectations. First, we select keywords to identify tweets related to prices and expectations thereof. Second, we build a set of daily measures of inflation expectations around the selected tweets, combining the Latent Dirichlet Allocation (LDA) with a dictionary-based approach, using manually labeled bi-grams and tri-grams. Finally, we show that Twitter-based indicators are highly correlated with both monthly survey-based and daily market-based inflation expectations. Our new indicators anticipate consumers’ expectations, proving to be a good real-time proxy, and provide additional information beyond market-based expectations, professional forecasts, and realized inflation. The results suggest that Twitter can be a new timely source for eliciting beliefs.

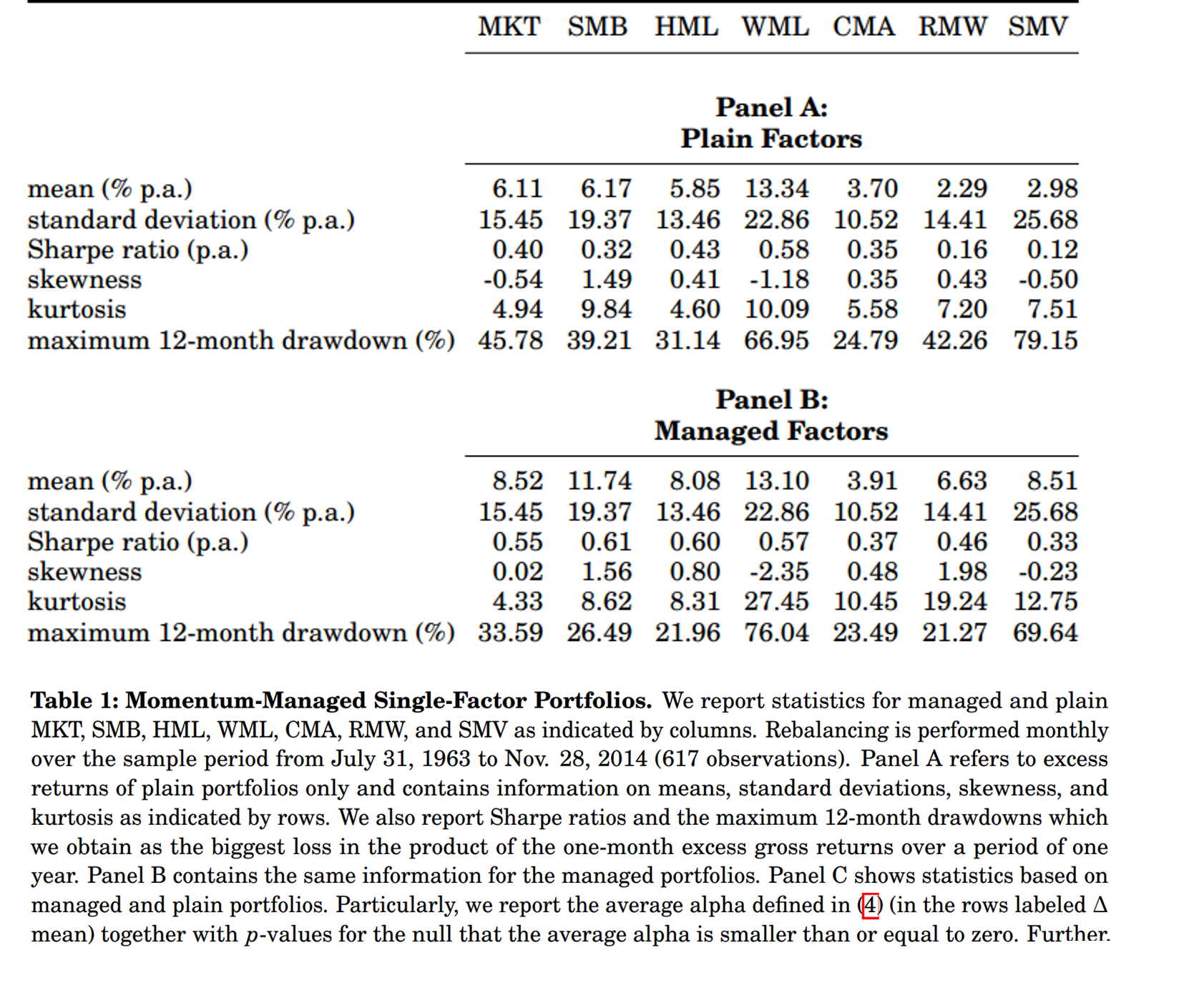

Momentum Everywhere, Including in Factors

By Larry Swedroe|July 14th, 2022|Larry Swedroe, Factor Investing, Research Insights, Trend Following, Academic Research Insight, Value Investing Research, Momentum Investing Research|

Managed portfolios that exploit positive first-order autocorrelation in monthly excess returns of equity factor portfolios produce large alphas and gains in Sharpe ratios. We document this finding for factor portfolios formed on the broad market, size, value, momentum, investment, prof- itability, and volatility. The value-added induced by factor management via short-term momentum is a robust empirical phenomenon that survives transaction costs and carries over to multi-factor portfolios. The novel strategy established in this work compares favorably to well-known timing strategies that employ e.g. factor volatility or factor valuation. For the majority of factors, our strategies appear successful especially in recessions and times of crisis.

Alpha Architect Welcomes Alexander Clark to the Team

By Wesley Gray, PhD|July 12th, 2022|Business Updates|

We are pleased to announce the addition of Alexander Clark to the Alpha Architect team. In his capacity as Vice President – Marketing, Alex will consult with Alpha Architect’s clients to develop strategic solutions that align with their investment philosophy to drive deeper client relationships.

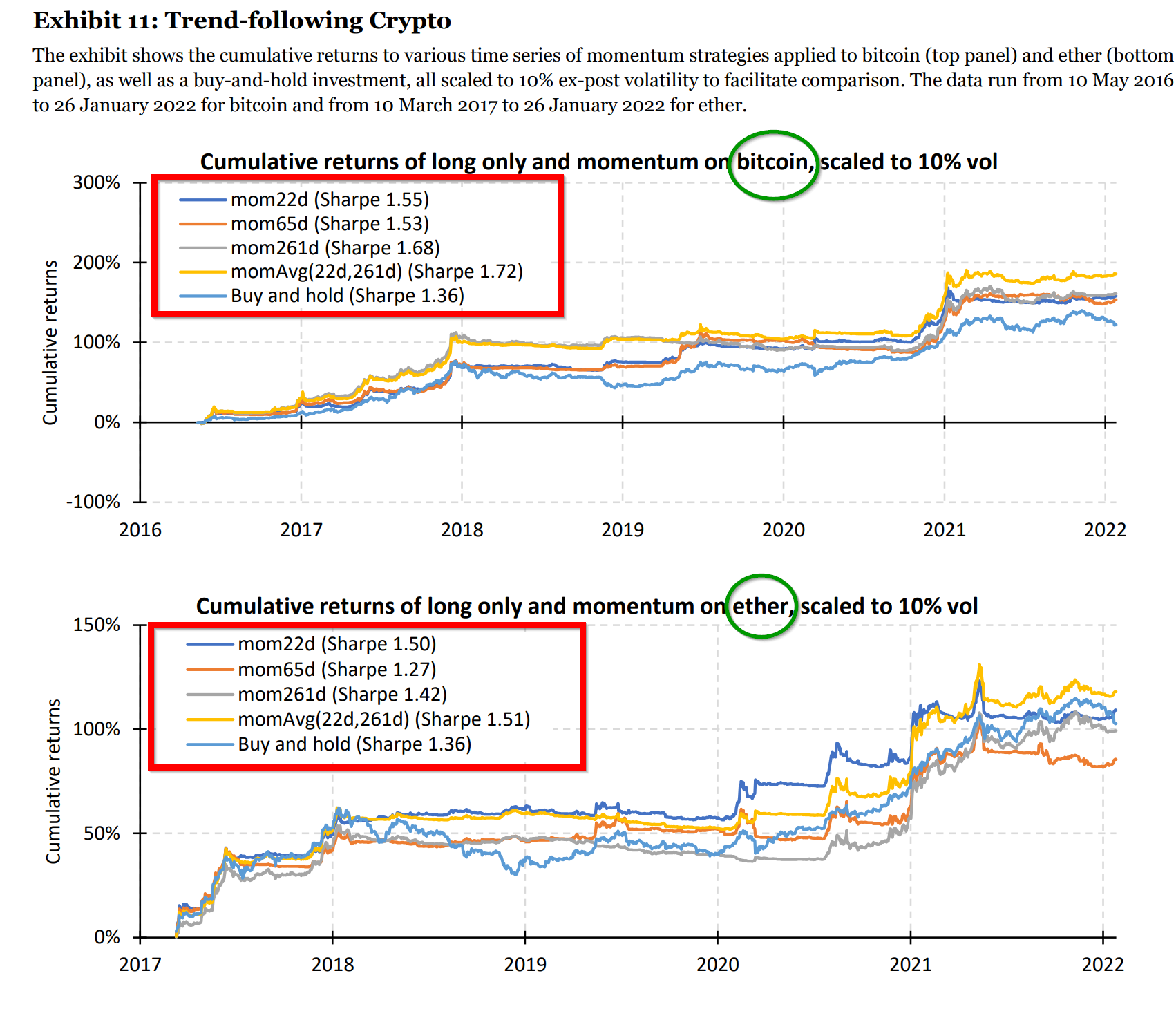

An Investor’s Guide to Crypto

By Tommi Johnsen, PhD|July 11th, 2022|Crypto, Research Insights, Basilico and Johnsen, Trend Following, Academic Research Insight|

We provide practical insights for investors seeking exposure to the growing cryptocurrency space. Today, crypto is much more than just bitcoin, which historically dominated the space but accounted for just a 21% share of total crypto trading volume in 2021. We discuss a wide variety of tokens, highlighting both their functionality and their investment properties. We critically compare popular valuation methods. We contrast buy-and-hold investing with more active styles. We only deem return data from 2017 representative, but the use of intraday data boosts statistical power. Underlying crypto performance has been notoriously volatile, but volatility-targeting methods are effective at controlling risk, and trend-following strategies have performed well. Crypto assets display a low correlation with traditional risky assets in normal times, but the correlation also rises in the left tail of these risky assets. Finally, we detail important custody and regulatory considerations for institutional investors.

Global Factor Performance: July 2022

By Wesley Gray, PhD|July 8th, 2022|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

March for the Fallen Training…in Spain!

By Wesley Gray, PhD|July 7th, 2022|Research Insights, MFTF Training Series|

Pat, Brandon, and I are hitting a 35-mile run through the Pyrenees mountains (in Spain) via the Peades dera Aigua. (Thanks to Pat for the motivation!)

The event is a preparatory opportunity for March for the Fallen and we will be reflecting on the fallen and the sacrifices of Gold Star families. I will have all my dog tags in tow.

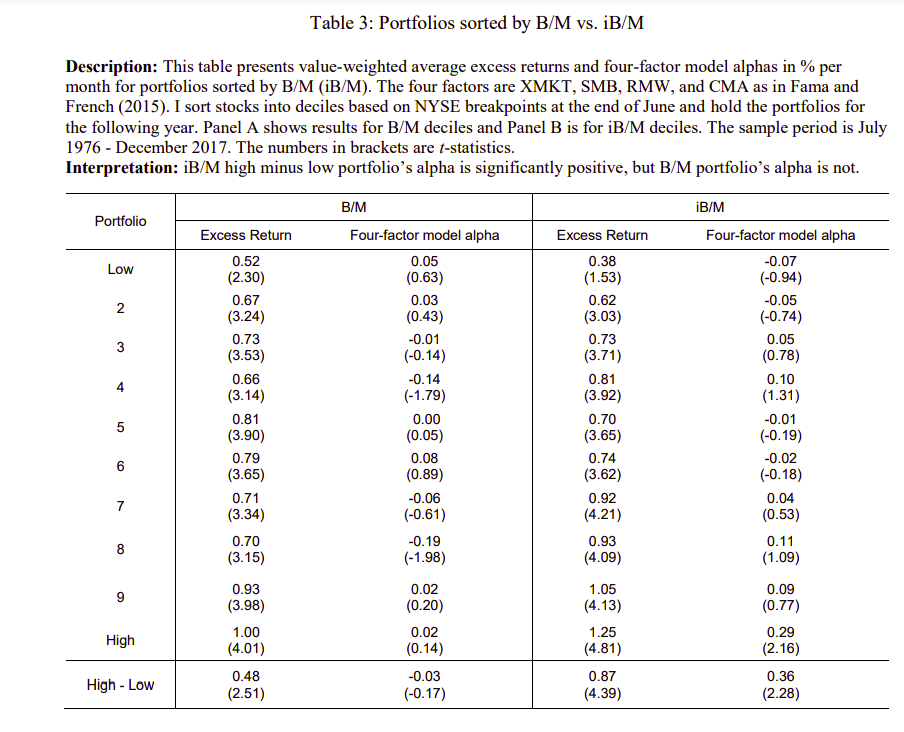

Does Intangible-Adjusted Book-to-Market Work?

By Elisabetta Basilico, PhD, CFA|July 6th, 2022|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Value Investing Research|

The book-to-market ratio has been widely used to explain the cross-sectional variation in stock returns, but the explanatory power is weaker in recent decades than in the 1970s. I argue that the deterioration is related to the growth of intangible assets unrecorded on balance sheets. An intangible-adjusted ratio, capitalizing prior expenditures to develop intangible assets internally and excluding goodwill, outperforms the original ratio significantly. The average annual return on the intangible-adjusted highminus-low (iHML) portfolio is 5.9% from July 1976 to December 2017 and 6.2% from July 1997 to December 2017, vs. 3.9% and 3.6% for an equivalent HML portfolio