Wes Discusses Merging Education, Investing, and the Marines w/ Lagniappe Podcast

By Wesley Gray, PhD|July 5th, 2022|Factor Investing, Podcasts and Video, Tax Efficient Investing, ETF Investing|

In this episode, Wes talks with Doug and Greg about why Alpha Architect is abnormal, the method to their madness, how Wes challenged Eugene Fama (and nearly won), how Alpha Architect is responding to today’s volatile markets, and what the future looks like for value investors.

DIY Asset Allocation Weights: July 2022

By Ryan Kirlin|July 1st, 2022|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

No exposure to domestic equities. No exposure to international equities. No exposure to REITs. Full exposure to commodities. No exposure to intermediate-term bonds.

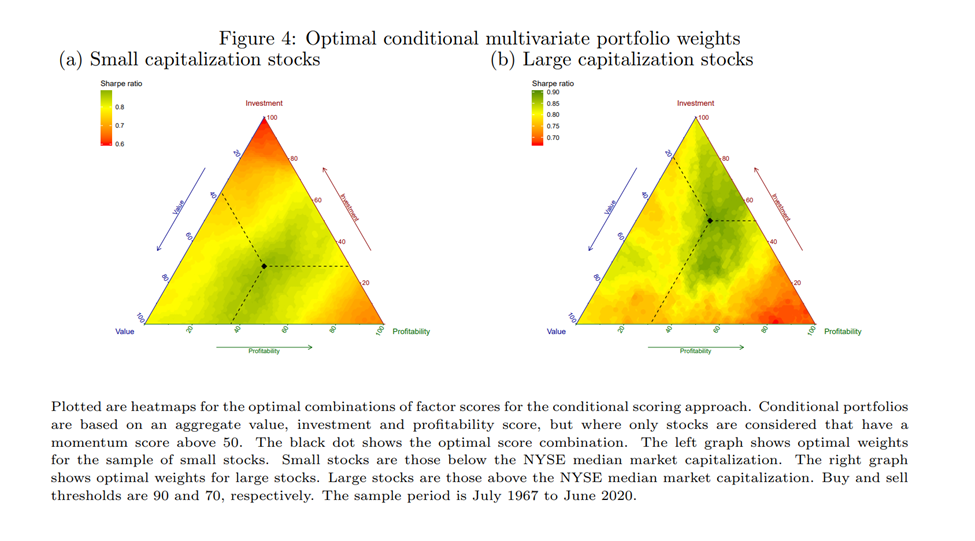

Combining Factors in Multifactor Portfolios

By Larry Swedroe|June 30th, 2022|Research Insights, Factor Investing, Larry Swedroe, Value Investing Research, Momentum Investing Research|

Reschenhofer’s findings demonstrate the important role that portfolio construction rules (such as creating efficient buy and hold ranges or imposing screens that exclude stocks with negative momentum) play in determining not only the risk and expected return of a portfolio but how efficiently the strategy can be implemented (considering the impact of turnover and trading costs)—wide (narrow) thresholds reduce (increase) portfolio turnover and transactions costs, thereby increasing after-cost returns and Sharpe ratios. His findings also provide support for multiple characteristics-based scorings to form long-only factor portfolios, encouraging the combination of slow-moving characteristics (such as value, investment and/or profitability) conditional on fast moving characteristics (such as momentum), to reduce portfolio turnover and transactions cost. Fund families such as AQR, Avantis, Bridgeway and Dimensional use such an approach, integrating multiple characteristics into their portfolios conditional on momentum signals.

Calculating Supply Chain Climate Exposure

By Tommi Johnsen, PhD|June 28th, 2022|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

To manage climate risks, investors need reliable climate exposure metrics. This need is particularly acute for climate risks along the supply chain, where such risks are recognized as important, but difficult to measure. We propose an intuitive metric that quantifies the exposure a company has to customers, or suppliers, who may in turn be exposed to climate risks. We show that such risks are not captured by traditional climate data. For example, a company may seem green on a standalone basis, but may still have meaningful, and potentially material, climate risk exposure if it has customers, or suppliers, whose activities could be impaired by transition or physical climate risks. Our metric is related to scope 3 emissions and may help capture economic activities such as emissions offshoring. However, while scope 3 focuses on products sold to customers and supplies sourced from suppliers, our metric captures the strength of economic linkages and the overall climate exposure of a firm’s customers and suppliers. Importantly, the data necessary to compute our measure is broadly accessible and is arguably of a higher quality than the currently available scope 3 data. As such, our metric’s intuitive definition and transparency may be particularly appealing for investors.

How I Invest My Own Money: Robust to Chaos.

By Wesley Gray, PhD|June 24th, 2022|Financial Planning, Podcasts and Video, Research Insights|

A lot of people ask me how I invest my own money, and I am always happy to oblige. But I have never discussed the topic in the public (unlike my friend Meb, who has a post dedicated to the subject). However, this past week Justin and Jack asked if they could grill me on my personal portfolio for their excellent podcast, "Excess Returns."

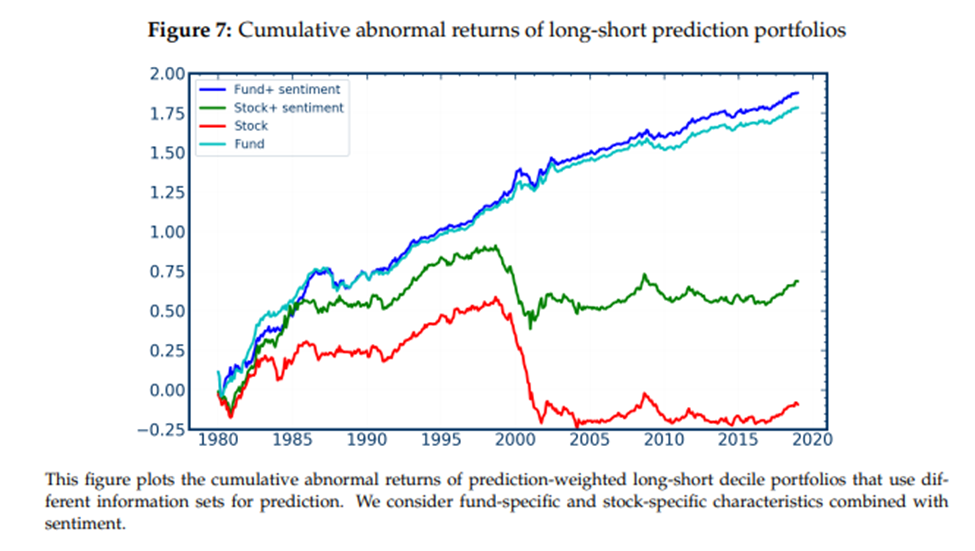

Can Machine Learning Identify Future Outperforming Active Equity Funds?

By Larry Swedroe|June 23rd, 2022|Research Insights, Factor Investing, Larry Swedroe, Trend Following, Academic Research Insight, AI and Machine Learning, Value Investing Research, Momentum Investing Research|

We show, using machine learning, that fund characteristics can consistently differentiate high from low-performing mutual funds, as well as identify funds with net-of-fees abnormal returns. Fund momentum and fund flow are the most important predictors of future risk-adjusted fund performance, while characteristics of the stocks that funds hold are not predictive. Returns of predictive long-short portfolios are higher following a period of high sentiment or a good state of the macro-economy. Our estimation with neural networks enables us to uncover novel and substantial interaction effects between sentiment and both fund flow and fund momentum.

Using Institutional Investor’s Trading Data in Factors

By Tommi Johnsen, PhD|June 22nd, 2022|Insider and Smart Money, Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight|

The authors investigate how the interaction between entries and exits of informed institutional investors and market anomaly signals affects strategy performance. The long legs of anomalies earn more positive alphas following entries, whereas the short legs earn more negative alphas following exits. The enhanced anomaly-based strategies of buying stocks in the long legs of anomalies with entries and shorting stocks in the short legs with exits outperform the original anomalies, with an increase of 19–54 bps per month in the Fama–French five-factor alpha. The entries and exits of institutional investors capture informed trading and earnings surprises, thereby enhancing the anomalies.

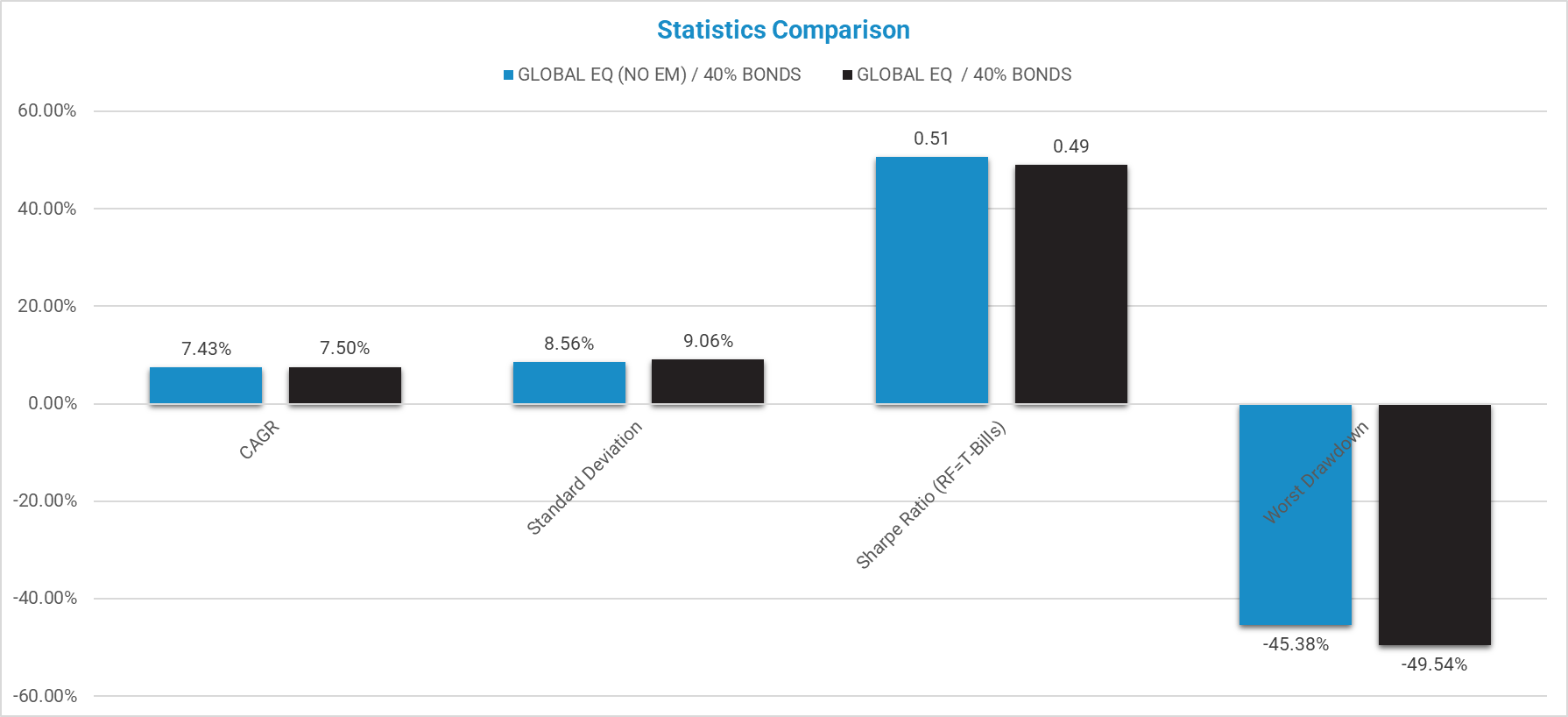

Does Emerging Markets Investing Make Sense?

By Wesley Gray, PhD|June 17th, 2022|Factor Investing, Research Insights, Key Research, Value Investing Research, Momentum Investing Research, Active and Passive Investing, Macroeconomics Research|

The analysis above suggests that portfolios that include or exclude emerging allocations are roughly the same. For some readers, this may be a surprise, but for many readers, this may not be "news." That said, even if the data don't strictly justify an Emerging allocation, the first principle of "stay diversified" might be enough to make an allocation.

Of course, the assumptions always matter.

Arbitrage and the Trading Costs of ETFs

By Larry Swedroe|June 16th, 2022|Transaction Costs, Larry Swedroe, Research Insights, Academic Research Insight, ETF Investing|

This article examines ETF creations and redemptions around price deviations and finds that the expected arbitrage trades are relatively rare in a broad sample of equity index ETFs. In the absence of these trades, price deviations persist much longer. Creation and redemption activity appears to be constrained when exchange conditions would lead to a costlier arbitrage trade, and the size of the price deviations mainly impact the likelihood rather than the amount of trading. The authors also find some evidence that creations and redemptions are less likely to trade on price deviations when they would be required to trade the underlying stocks against broad market movements. Their results suggest that several factors may discourage the built-in ETF arbitrage mechanism and that investors may receive poorer trade execution in these conditions as a result.

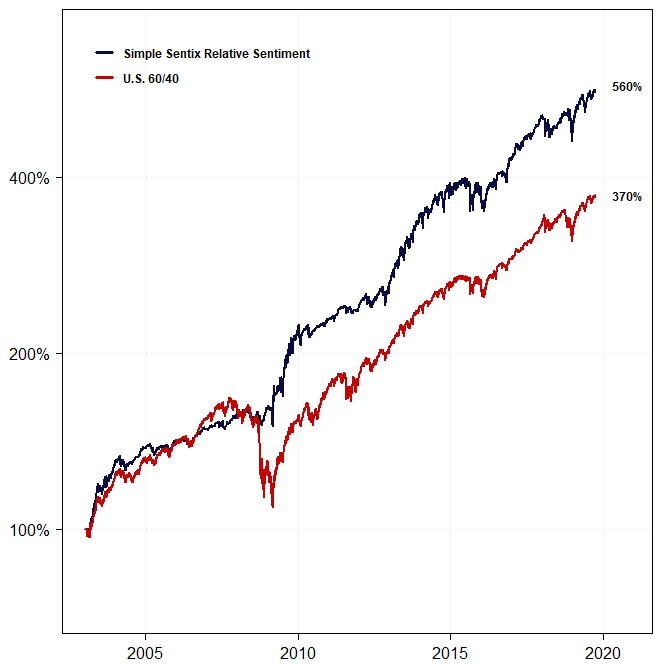

Relative Sentiment and Machine Learning for Tactical Asset Allocation

By Raymond Micaletti|June 15th, 2022|Relative Sentiment, Research Insights|

The application of machine learning models to Sentix relative sentiment data appears to extract more predictive information than our original, simplistic approach was capable of.