An Economic Framework for ESG Investing

By Wesley Gray, PhD|March 22nd, 2021|ESG, Research Insights, Basilico and Johnsen, Investment Advisor Education, Academic Research Insight, AI and Machine Learning|

Responsible Investing: The ESG Efficient Frontier Pedersen, Fitzgibbons, and PomorskiJournal [...]

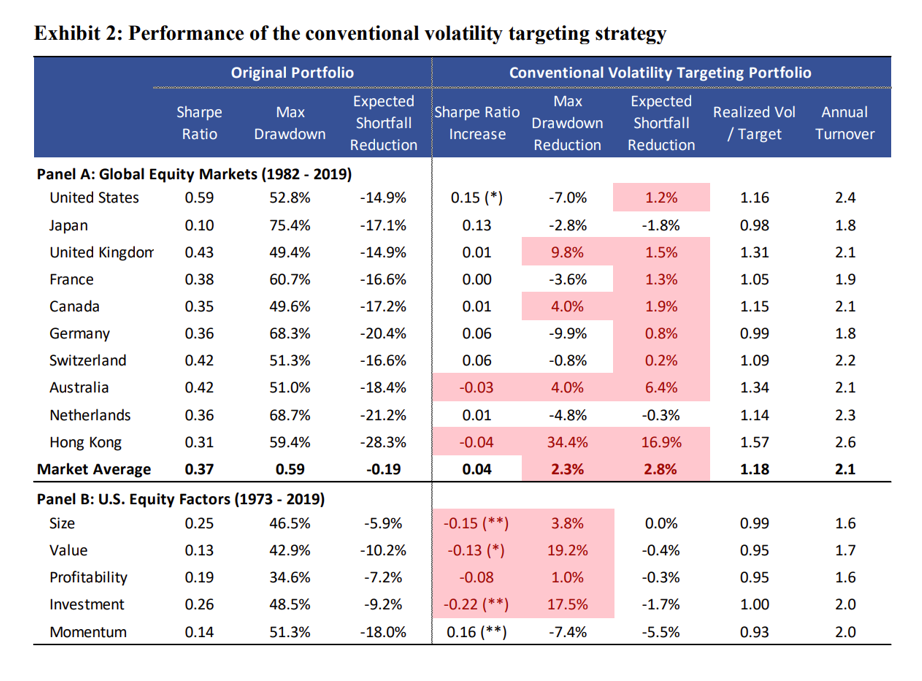

Conditional Volatility Targeting

By Larry Swedroe|March 18th, 2021|Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight, Other Insights|

Financial economists have long known that volatility and returns are [...]

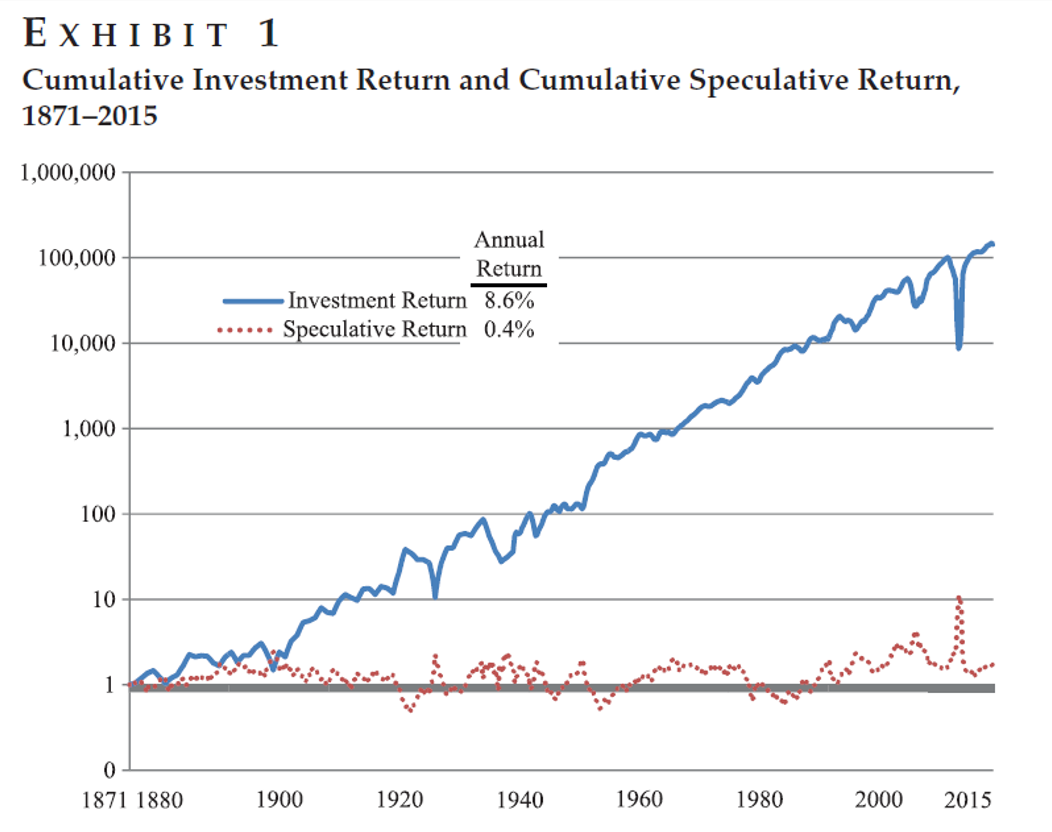

How to Predict Stock Returns (using a simple model)

By Jack Vogel, PhD|March 16th, 2021|Predicting Market Returns, Research Insights, Academic Research Insight, Other Insights|

Jack Bogle, the founder of Vanguard, created a simple explanation [...]

How to Measure the Liquidity of Cryptocurrency?

By Wesley Gray, PhD|March 15th, 2021|Crypto, Transaction Costs, Research Insights, Basilico and Johnsen, Academic Research Insight|

In this blog we discuss the academic research surrounding the [...]

Low Volatility Factor Investing: Risk-Based or Behavioral-Based or Both?

By Tommi Johnsen, PhD|March 8th, 2021|Volatility (e.g., VIX), Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Low Volatility Investing|

Betting against correlation: Testing theories of the low-risk effect Cliff [...]

Global Factor Performance: March 2021

By Wesley Gray, PhD|March 8th, 2021|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index [...]

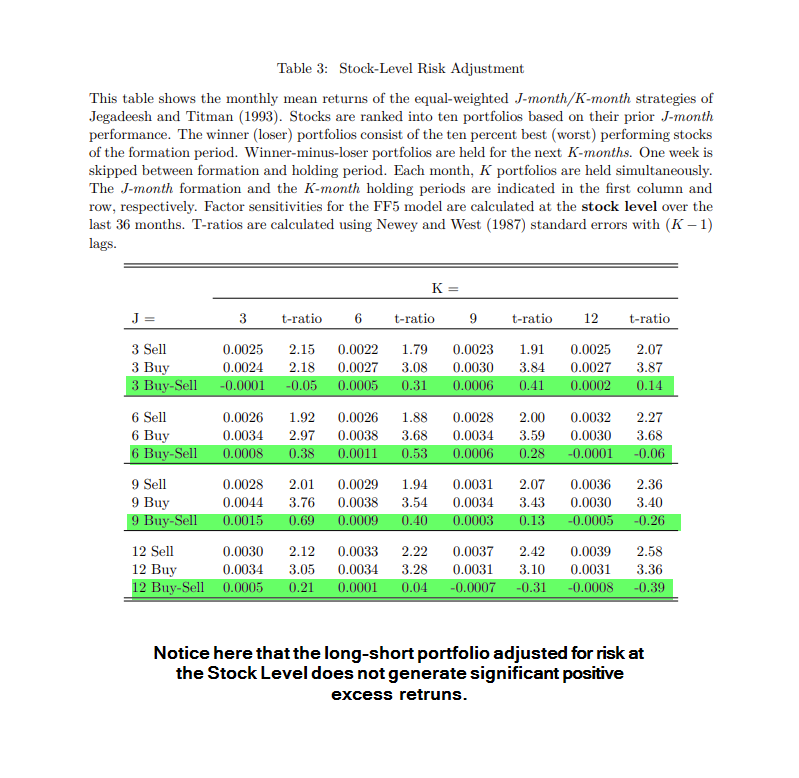

Momentum Factor Investing: What’s the Right Risk-Adjustment?

By Wesley Gray, PhD|March 4th, 2021|Research Insights, Factor Investing, Momentum Investing Research|

Momentum? What Momentum? Erik Theissen and Can YilanciA version of [...]

DIY Asset Allocation Weights: March 2021

By Ryan Kirlin|March 2nd, 2021|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

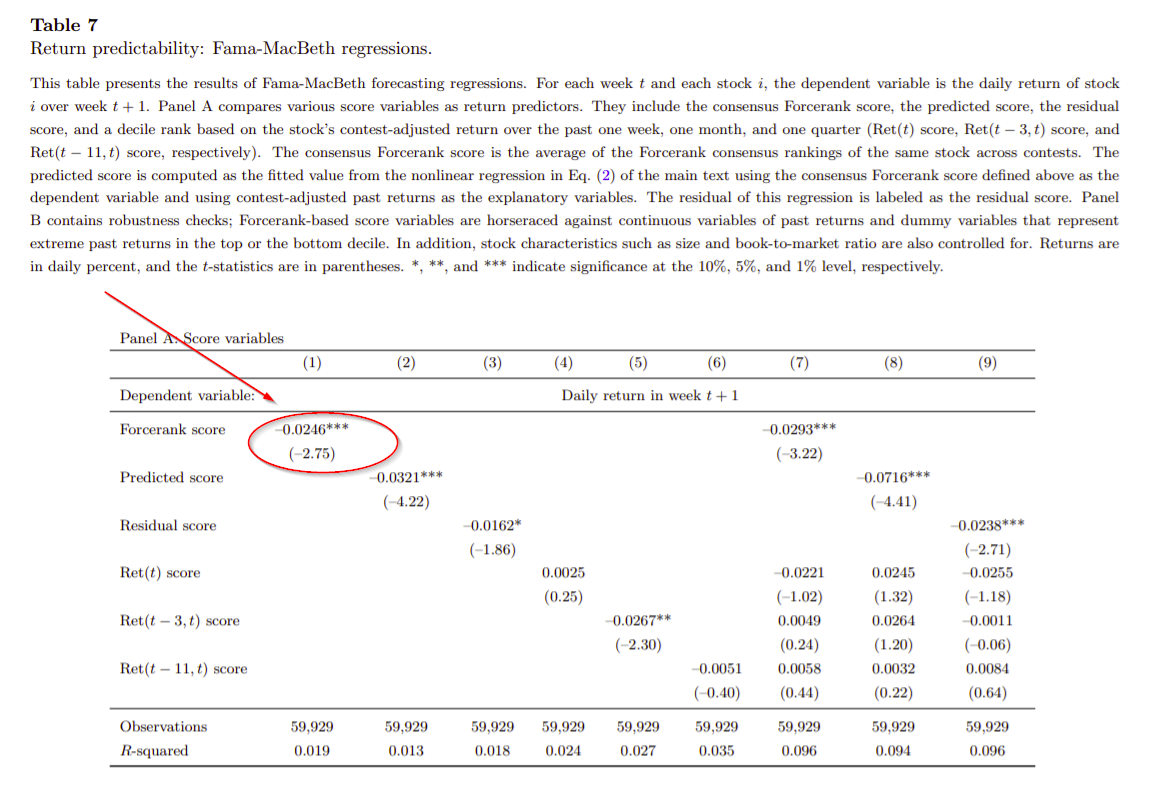

Does Crowdsourced Investing Work?

By Wesley Gray, PhD|March 1st, 2021|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance|

Extrapolative Beliefs in the Cross Section: What Can We Learn [...]

The Forecasting Power of Value, Profitability, and Investment Spreads

By Larry Swedroe|February 25th, 2021|Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight, Other Insights, Value Investing Research|

Studies such as the 2019 paper “Value Return Predictability Across [...]