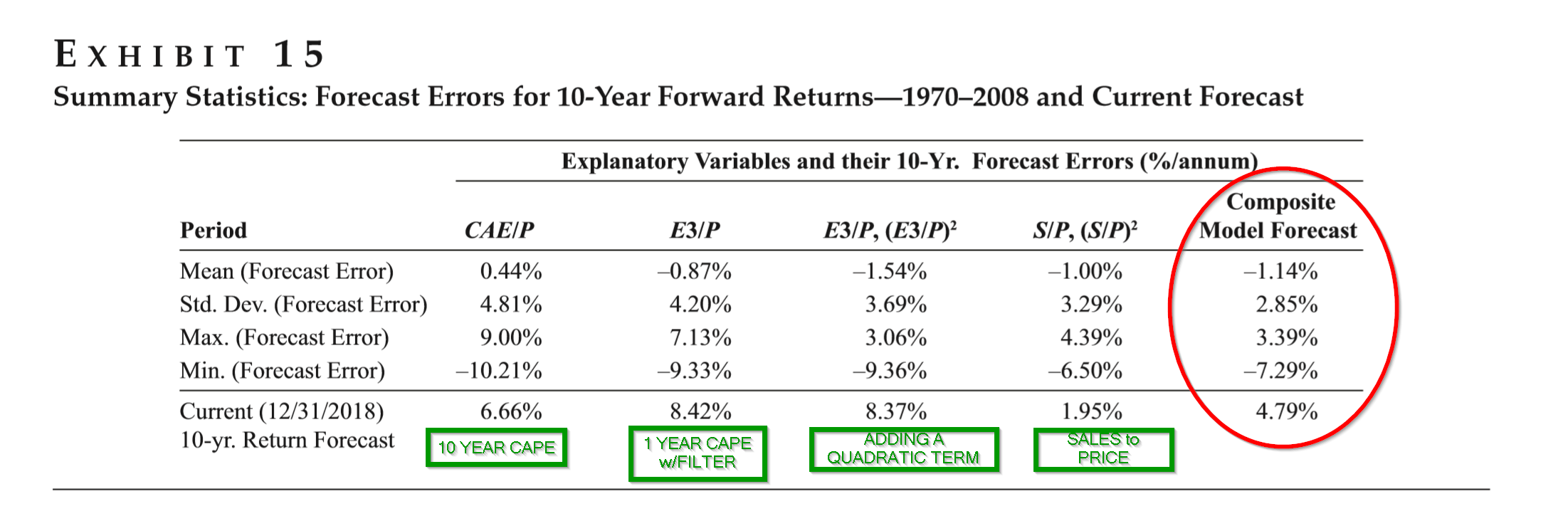

An Easy Way to Simplify and Improve the Shiller CAPE Ratio as a Prediction Tool

By Tommi Johnsen, PhD|November 16th, 2020|Research Insights, Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

Ultra-Simple Shiller’s CAPE: How One Year’s Data Can Predict Equity [...]

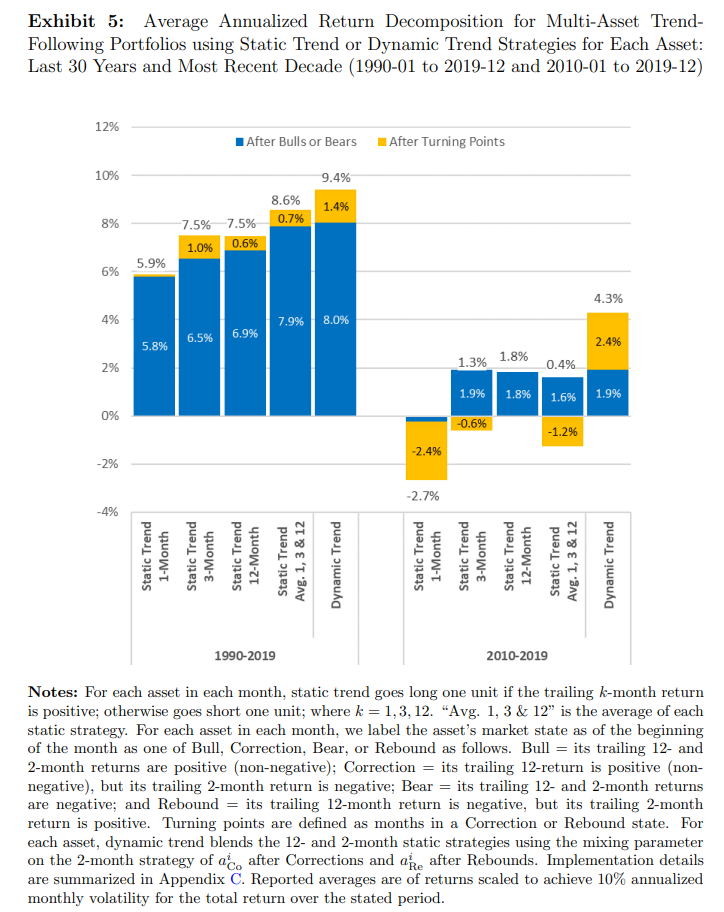

Trend Following Research: Breaking Bad Trends

By Larry Swedroe|November 12th, 2020|Larry Swedroe, Factor Investing, Research Insights, Trend Following, Academic Research Insight, Other Insights, Momentum Investing Research|

Momentum is the tendency for assets that have performed well [...]

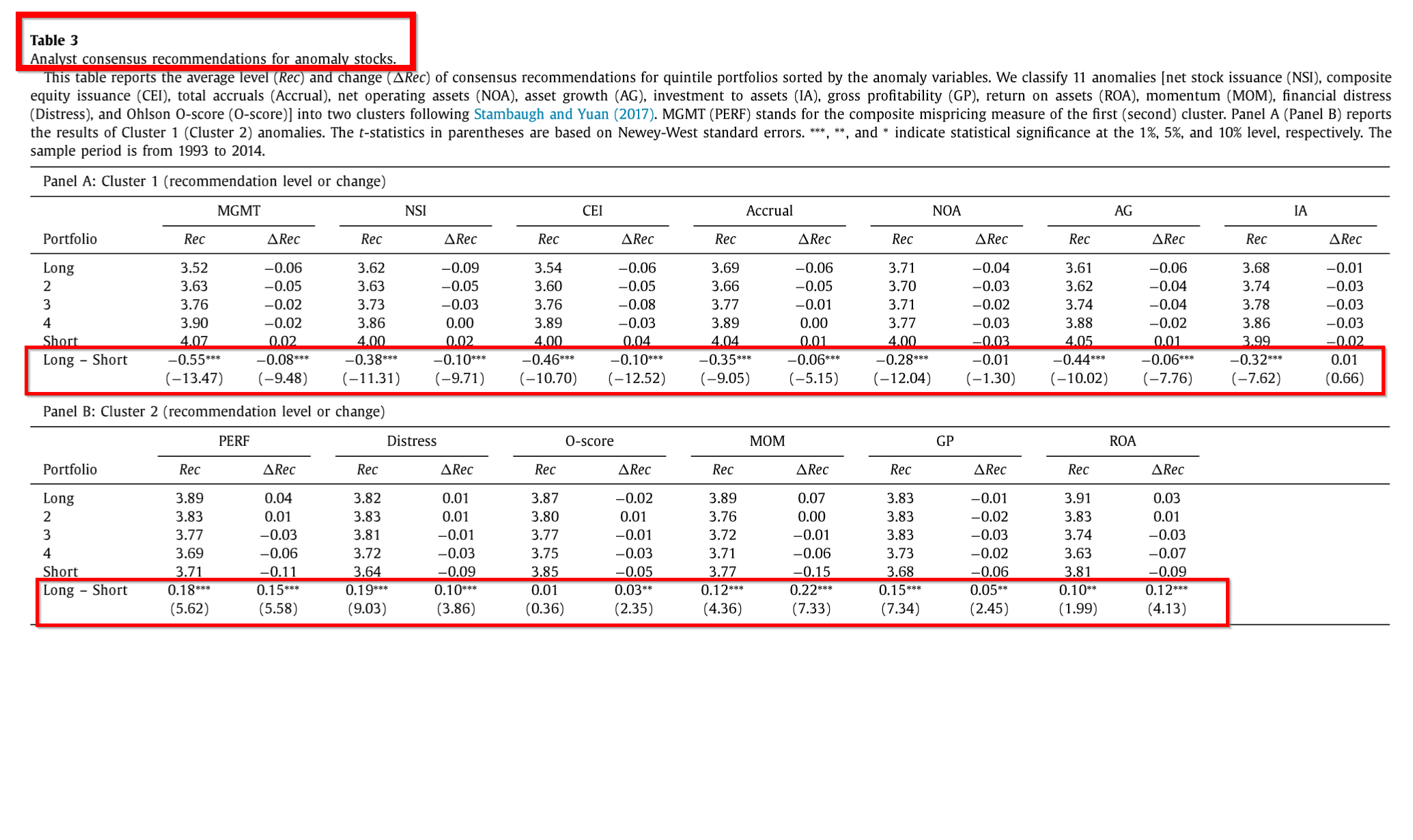

Do Analysts Exploit Factor Anomalies when recommending stocks?

By Tommi Johnsen, PhD|November 9th, 2020|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight|

Security Analysts and Capital Market Anomalies Li Guo, Frank Weikai [...]

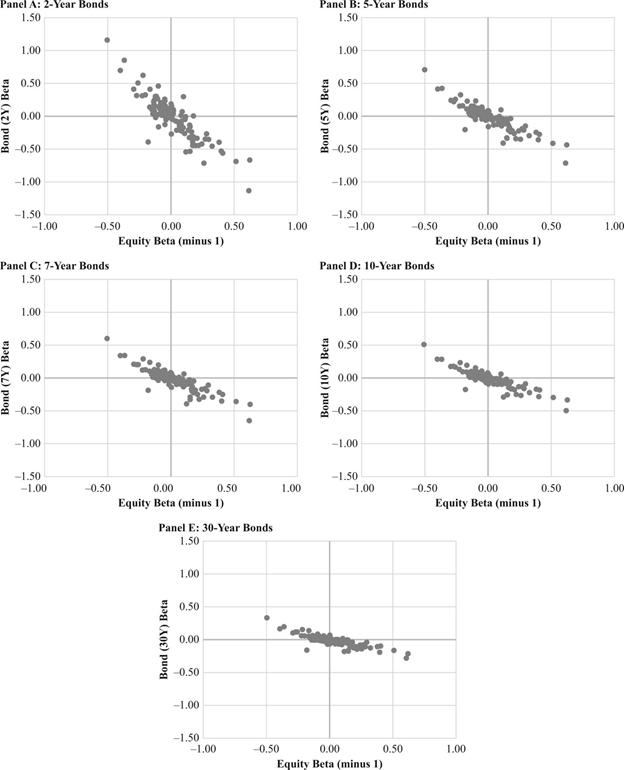

Should Treasury Bills Be The Risk-Free Asset in Asset Pricing Models?

By Larry Swedroe|November 5th, 2020|Larry Swedroe, Research Insights, Factor Investing, Academic Research Insight, Other Insights, Low Volatility Investing, Macroeconomics Research|

In virtually all studies on asset pricing and asset pricing [...]

DIY Asset Allocation Weights: November 2020

By Ryan Kirlin|November 3rd, 2020|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

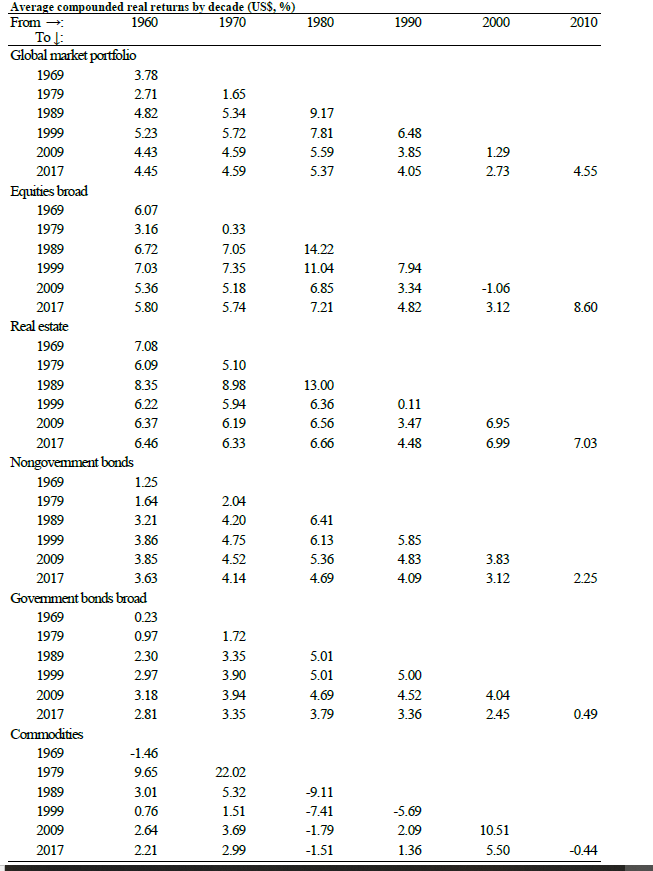

How Do You Think the Global Market Portfolio Has Performed from 1960-2017?

By Wesley Gray, PhD|November 2nd, 2020|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight, Active and Passive Investing, Macroeconomics Research|

Historical Returns of the Market Portfolio Ronald Doeswijk, Trevin Lam [...]

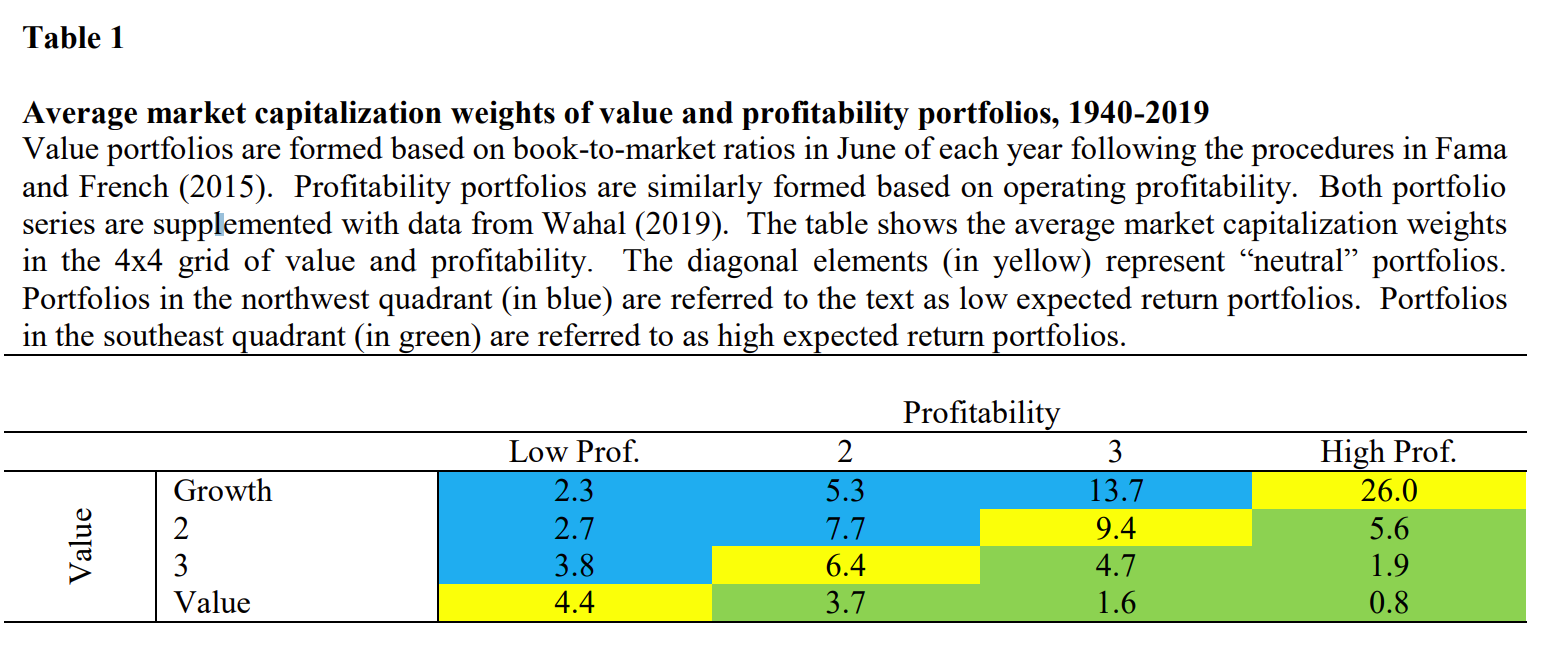

Combining Value and Profitability Factors to Improve Performance

By Larry Swedroe|October 29th, 2020|Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight, Value Investing Research|

Prior Research on Value and Profitability Factors The 1997 publication [...]

Does Portfolio Timing Based on Volatility Signals Outperform Buy and Hold?

By Tommi Johnsen, PhD|October 26th, 2020|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Low Volatility Investing, Tactical Asset Allocation Research|

On the Performance of Volatility-Managed Portfolios Scott Cederburg, Michael S. [...]

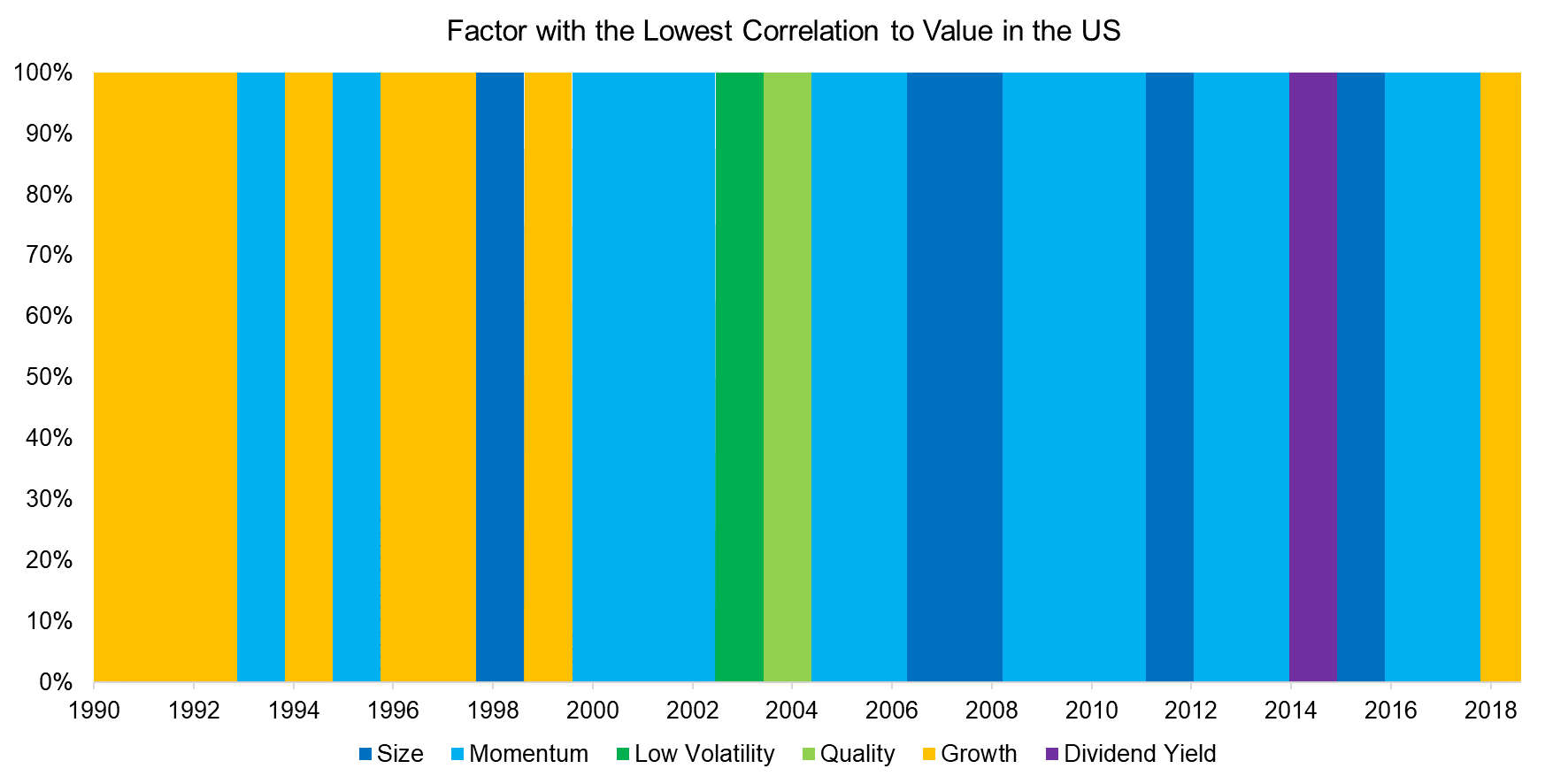

Building Factor Portfolios Based with the Lowest Correlations

By Nicolas Rabener|October 22nd, 2020|Skewness, Factor Investing, Research Insights, Guest Posts|

INTRODUCTION The two basic rules of asset allocation are: i) [...]

Can A Computer Read Employee Emails and Detect Fraud?

By Wesley Gray, PhD|October 19th, 2020|Research Insights, Basilico and Johnsen, Academic Research Insight, Investment Advisor Education, AI and Machine Learning|

Zero-Revelation RegTech: Detecting Risk through Linguistic Analysis of Corporate Emails [...]