Equity Trend Following Performance Around the Globe

By Larry Swedroe|October 15th, 2020|Research Insights, Larry Swedroe, Factor Investing, Trend Following, Academic Research Insight, Other Insights|

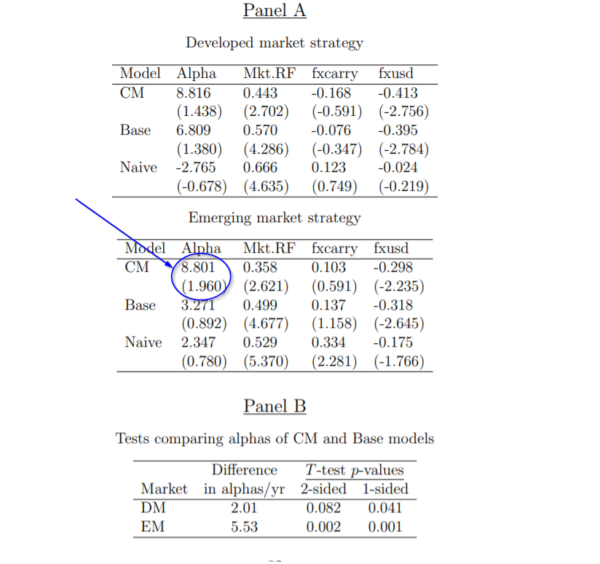

Time-series momentum (TSMOM) historically has demonstrated abnormal excess returns. Also [...]

News and its Impact on Risk and Returns Around the World

By Wesley Gray, PhD|October 12th, 2020|Research Insights, AI and Machine Learning, Macroeconomics Research|

How news and its context drive risk and returns around [...]

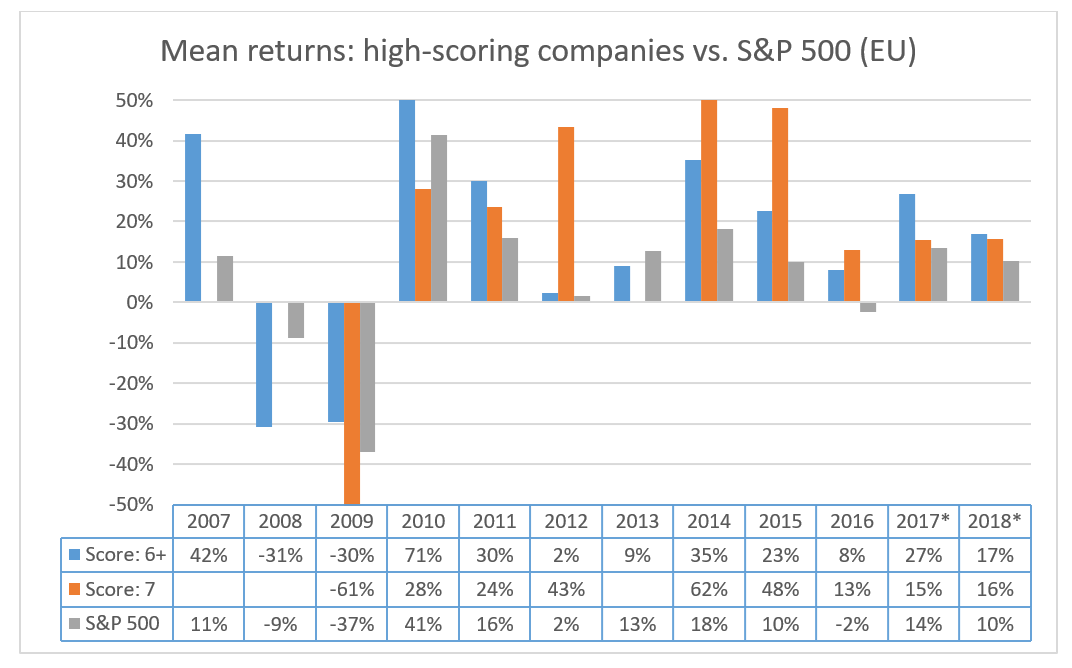

Value Investing Factor Research: How to Improve the Piotroski F-Score Measure.

By Mikhail Subbotin|October 8th, 2020|Factor Investing, Research Insights, Academic Research Insight, Guest Posts, Value Investing Research|

Introduction This project builds on research conducted by J. Piotroski, [...]

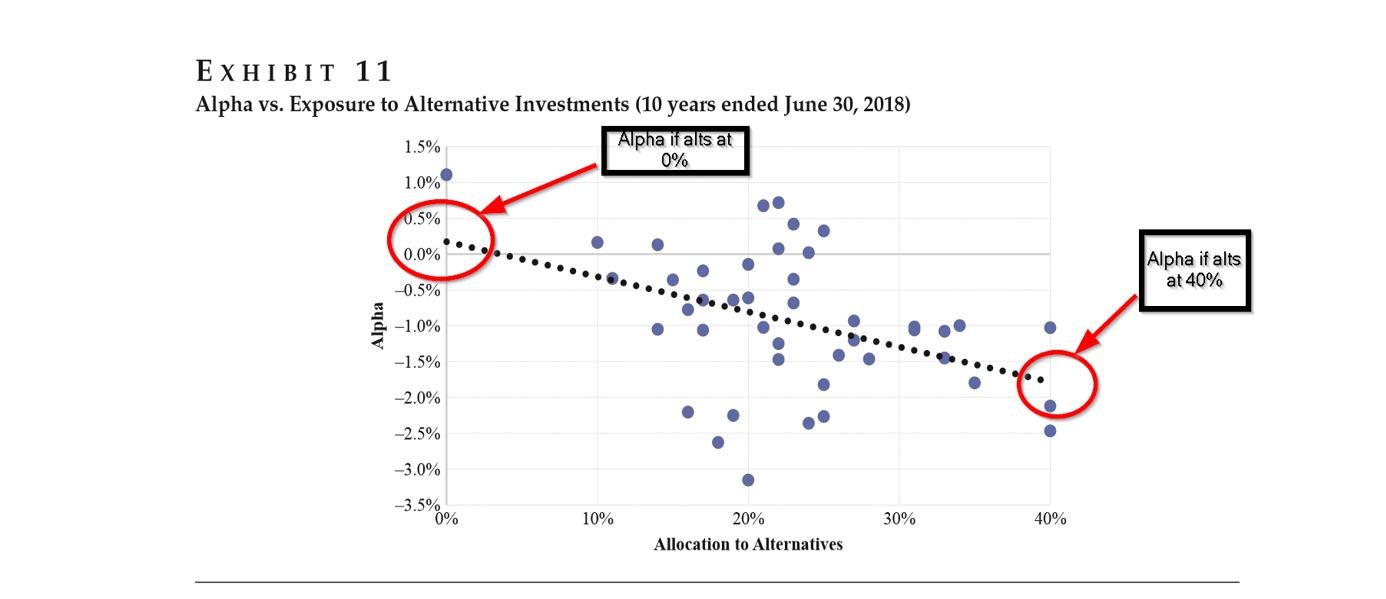

Institutional Investment Strategies: Keep it Simple

By Tommi Johnsen, PhD|October 5th, 2020|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Active and Passive Investing, ETF Investing|

Institutional Investment Strategy and Manager Choice: A Critique Richard M. [...]

DIY Asset Allocation Weights: October 2020

By Ryan Kirlin|October 2nd, 2020|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

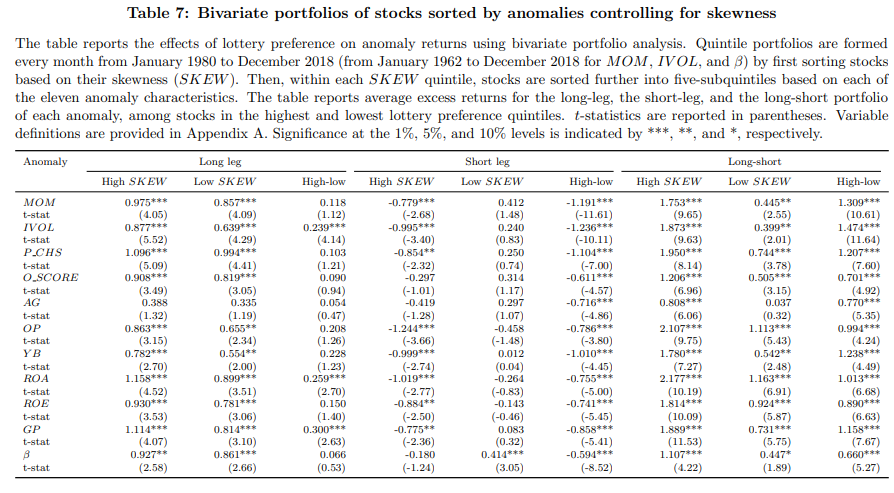

Lottery Preferences and Their Relationship with Factor Investing

By Larry Swedroe|October 1st, 2020|Skewness, Research Insights, Larry Swedroe, Academic Research Insight, Behavioral Finance, Low Volatility Investing|

Among the assumptions in the first formal asset pricing model, [...]

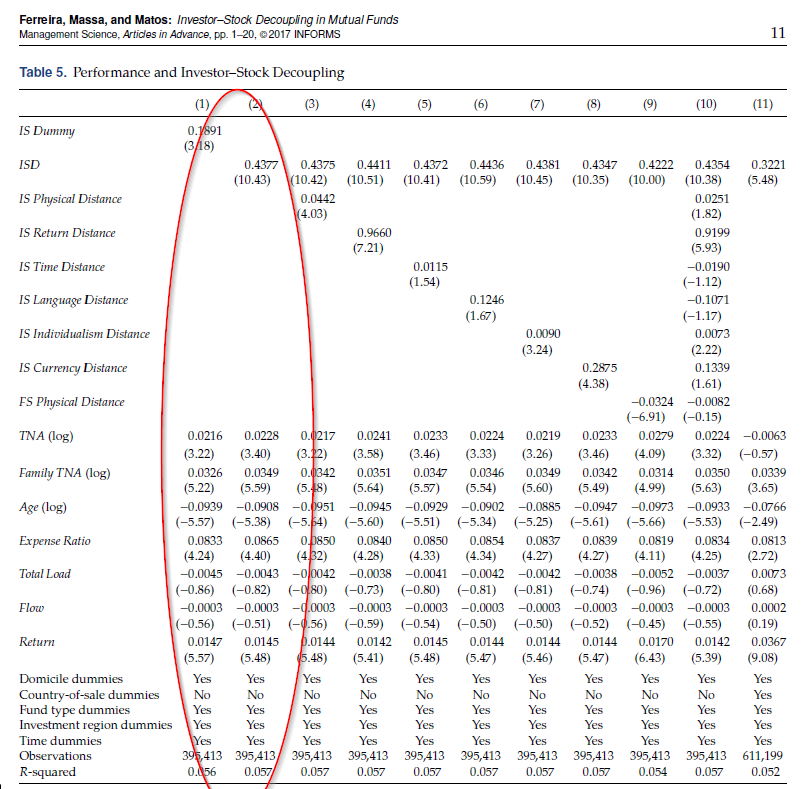

ETFs and Mutual Funds Should Pay More Attention to Their Investor Base

By Wesley Gray, PhD|September 28th, 2020|Research Insights, Basilico and Johnsen, Academic Research Insight, ETF Investing|

Investor-Stock Decoupling in Mutual Funds Miguel A. Ferreira, Massimo Massa, [...]

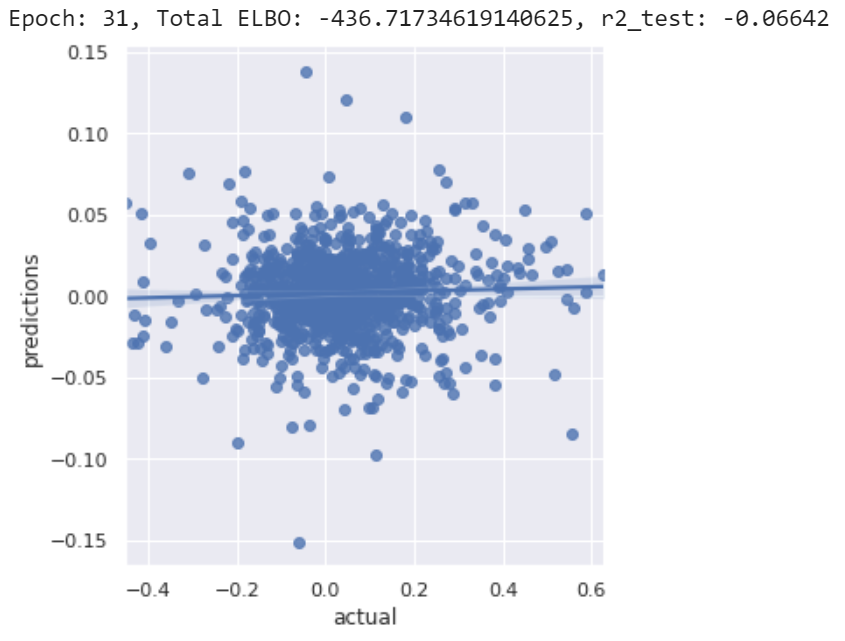

How To Design Machine Learning Models – A Market Timing Example

By Jin Won Choi|September 24th, 2020|Factor Investing, Research Insights, Guest Posts, AI and Machine Learning, Tactical Asset Allocation Research|

We at ENJINE are big believers in the potential of [...]

Intangible Capital and the Value Factor: Has Your Value Definition Just Expired?

By Tommi Johnsen, PhD|September 21st, 2020|Research Insights, Basilico and Johnsen, Academic Research Insight, Value Investing Research|

Intangible Capital and the Value Factor: Has Your Value Definition [...]

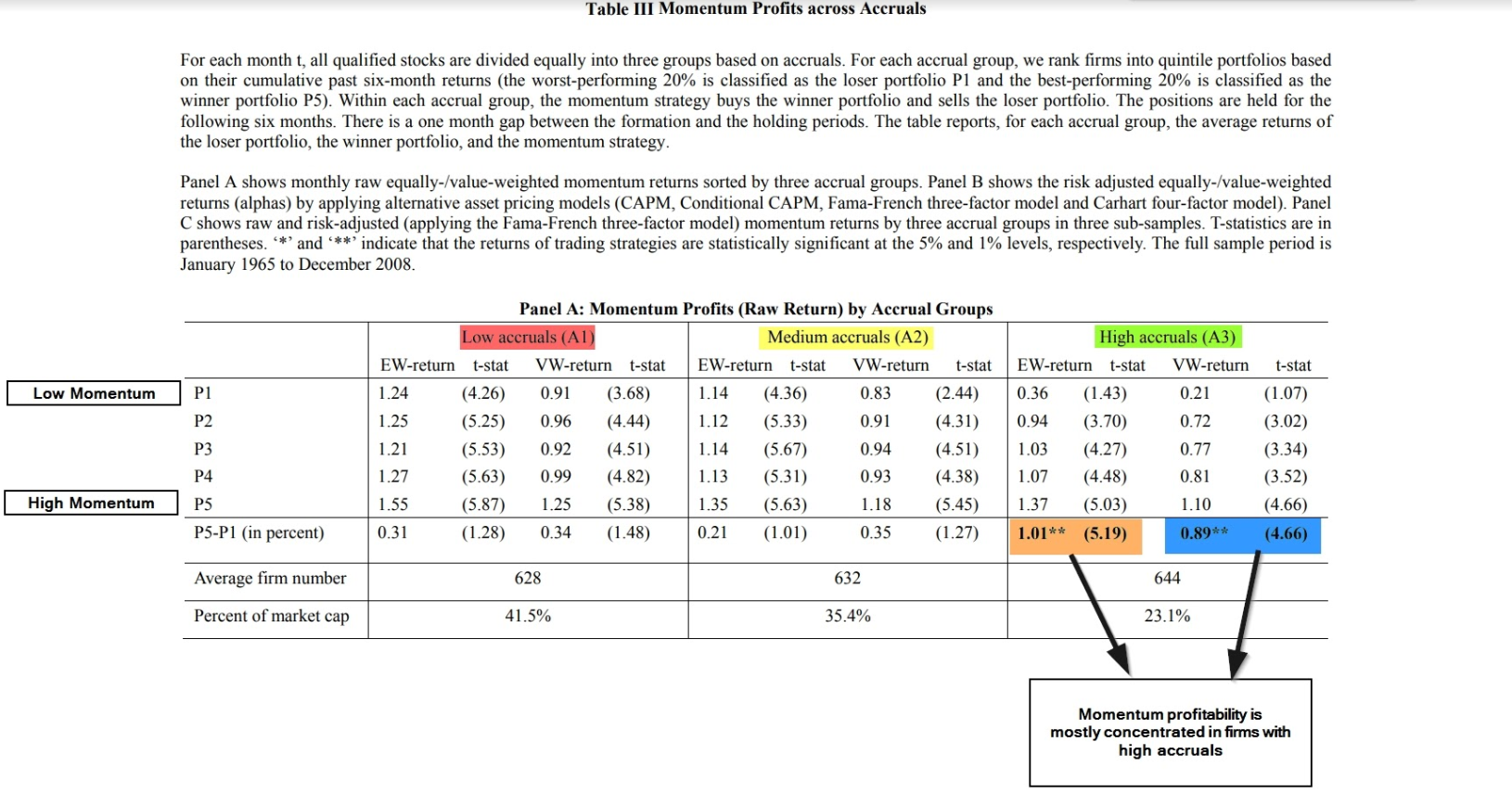

Accruals and Momentum and Their Implications for Factor Investors

By Larry Swedroe|September 17th, 2020|Larry Swedroe, Factor Investing, Research Insights, Other Insights, Momentum Investing Research|

The price momentum and accruals (the difference between accounting earnings [...]