The Explosive Growth of Private Credit: Is There a Bubble?

By Larry Swedroe|November 15th, 2024|Transaction Costs, Private Equity, Larry Swedroe, Research Insights, Other Insights|

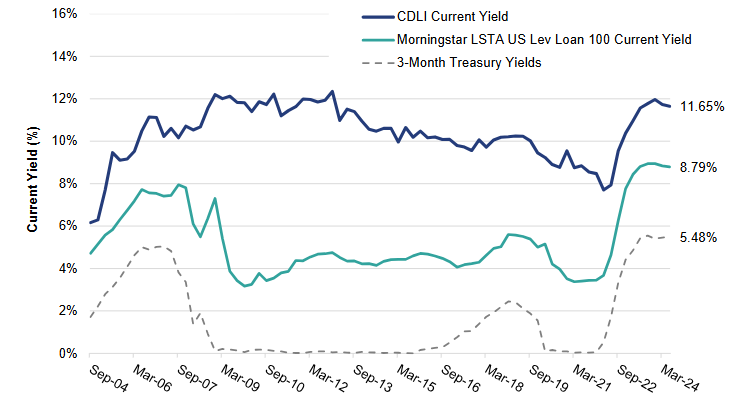

The growth rate of private credit has been so rapid (growing to nearly $2 trillion by the end of 2023, roughly ten times larger than it was in 2009), that concerns about there being a bubble have been raised.

Rethinking Asset Growth in Asset Pricing Models

By Tommi Johnsen, PhD|November 13th, 2024|Tommi Johnsen, Asset Growth, Research Insights, Factor Investing, Academic Research Insight|

Measures of asset growth add considerable explanatory power to asset [...]

Markets Becoming More Efficient: The Disappearing Index Effect

By Larry Swedroe|November 8th, 2024|Larry Swedroe, Research Insights, Other Insights, Active and Passive Investing|

Greenwood and Sammon’s findings of a disappearing index effect provides further support for the findings of McLean and Pontiff, Does Academic Research Destroy Stock Return Predictability? 2016. Once anomalies are well recognized by the market they decline and may even disappear, though limits to arbitrage can allow them to persist. Their findings also provide support for Andrew Lo’s The Adaptive Markets Hypothesis (2004). The bottom line is that markets are becoming more efficient, raising the hurdles for active managers to generate alpha.

Accessing Private Markets: What Does It Cost?

By Elisabetta Basilico, PhD, CFA|November 4th, 2024|Transaction Costs, Private Equity, Elisabetta Basilico, Research Insights, Academic Research Insight, Other Insights|

By quantifying how non-performance-based fees dominate the cost structure, this research questions whether current fee models effectively align with investor interests, which could influence future fee arrangements and industry standards.

Using Trading Volume to Optimize Portfolio Construction and Implementation

By Larry Swedroe|November 1st, 2024|Transaction Costs, Larry Swedroe, Research Insights, Other Insights|

The authors of the research discussed developed a machine learning model that can accurately predict trading volume for individual stocks. They then demonstrated how this model can be used to construct a portfolio that outperforms a traditional market-cap weighted portfolio.

DIY Trend-Following Allocations: November 2024

By Ryan Kirlin|November 1st, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. Full exposure to REITs. No exposure to commodities. Full exposure to intermediate-term bonds.

Should I be an ETF Advisor or Sub-Advisor?

By Wesley Gray, PhD|October 30th, 2024|ETF Operations|

As someone who has spent considerable time in the ETF landscape, we feel a deep sense of gratitude for the opportunity to share insights on a decision that can significantly impact aspiring ETF entrepreneurs: whether to serve as an advisor or a sub-advisor. One of my teammates, Patrick Cleary, put together a great article that sheds light on the complexities and implications associated with each role. A link to his article, "We want to launch an ETF. Should I be the ETF Advisor or Sub-Advisor?," is here.

Can Artificial Intelligence outsmart seasoned equity analysts?

By Tommi Johnsen, PhD|October 28th, 2024|Tommi Johnsen, Research Insights, Academic Research Insight, AI and Machine Learning|

If the task is to identify a firm’s true profitability, can AI outsmart seasoned analysts?

Academic Anomalies Formed After Information Events

By Larry Swedroe|October 25th, 2024|Predicting Market Returns, Research Insights, Factor Investing, Larry Swedroe, Other Insights, Behavioral Finance|

The hurdles to adding alpha for active managers are getting higher—investment practitioners make use of it as soon as or shortly after it is available.

FinTech Credit and Entrepreneurial Growth

By Elisabetta Basilico, PhD, CFA|October 21st, 2024|Elisabetta Basilico, Banking Institutions, Research Insights, Academic Research Insight, Other Insights|

Access to automated online credit boosts sales, transactions, and customer capital for firms, particularly in regions underserved by traditional banks.