Is a quantitative defensive factor strategy feasible? Yes.

By Tommi Johnsen, PhD|January 8th, 2024|Asset Growth, Volatility (e.g., VIX), Quality Investing, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Low Volatility Investing|

We examine the research around the question of what the proper framework for building a defensive factor strategy is.

Crowded Trades Increase Crash Risks

By Larry Swedroe|January 5th, 2024|Liquidity Factor, Larry Swedroe, Research Insights, Guest Posts|

Crowded equity positions in anomalies remain and have significant impacts in terms of risk and return dynamics.

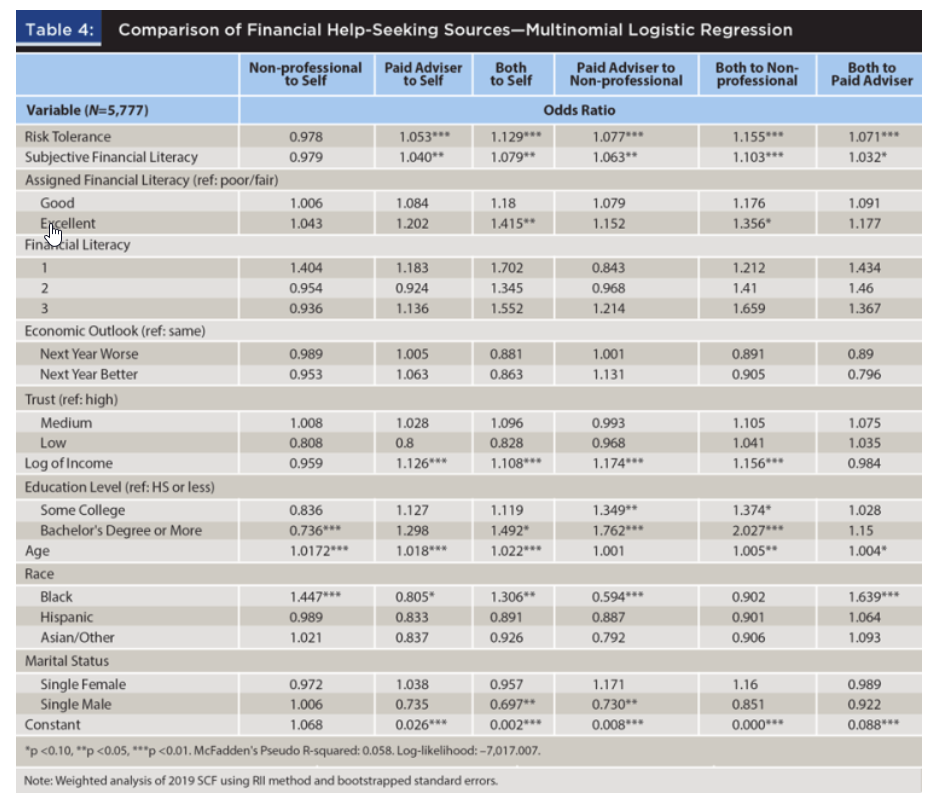

Do racial barriers prevent Black and Hispanic households from pursuing financial advice?

By Elisabetta Basilico, PhD, CFA|January 2nd, 2024|Financial Planning, Intangibles, Research Insights, Basilico and Johnsen, Academic Research Insight, Corporate Governance|

This article seeks to examine what research says about the interplay between risk tolerance, financial literacy, and trust and their collective impact on the pursuit of financial advice by Black and Hispanic households.

DIY Trend-Following Allocations: January 2024

By Ryan Kirlin|January 2nd, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. Full exposure to REITs. No exposure to commodities. Partial exposure to intermediate-term bonds.

Fifty Shades of Grey Swans: Timeless Risks with a Modern Twist

By Matt Tracey|December 29th, 2023|Research Insights, Guest Posts|

The world is complex and ever-changing; news travels at warp speed, events happen fast, and popular narratives can distract and mislead us. Many risks important for our portfolios are new, hidden, or nuanced in some underappreciated way—and likely to be misunderstood and mispriced in the markets. Other risks can hide in plain sight. Good risk management can be described as a balancing act that employs the first principles of investing, lessons from history, behavioral psychology, a little math, and even our imagination in service of our objective: to detect and defend against the risks we can foresee and fortify our portfolios against those we cannot. In short: we need informed creativity, not calculation.

The Financial Distress Puzzle

By Larry Swedroe|December 29th, 2023|Quality Investing, Research Insights, Larry Swedroe, Guest Posts, Size Investing Research|

The empirical research findings demonstrate that the return premium generated by being long low-distress risk stocks and short high-distress risk stocks is persistent and that the capital asset pricing model (CAPM) and the Fama-French three-factor models cannot explain it. Hence, we have the distress puzzle, or anomaly.

Are stock returns predictable at different points in time?

By Tommi Johnsen, PhD|December 26th, 2023|Empirical Methods, Predicting Market Returns, Research Insights, Basilico and Johnsen, Academic Research Insight|

For many benchmark predictor variables, short-horizon return predictability in the U.S. stock market is local in time as short periods with significant predictability (“pockets”) are interspersed with long periods with no return predictability.

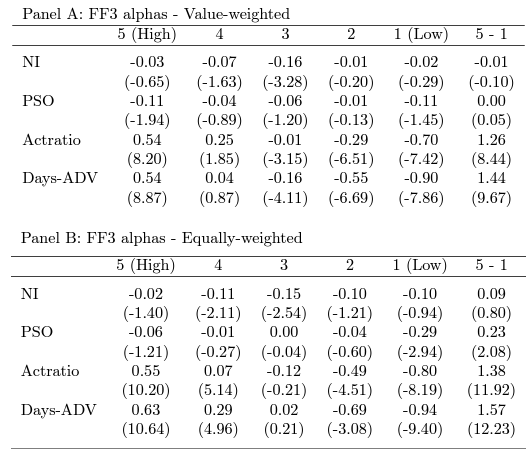

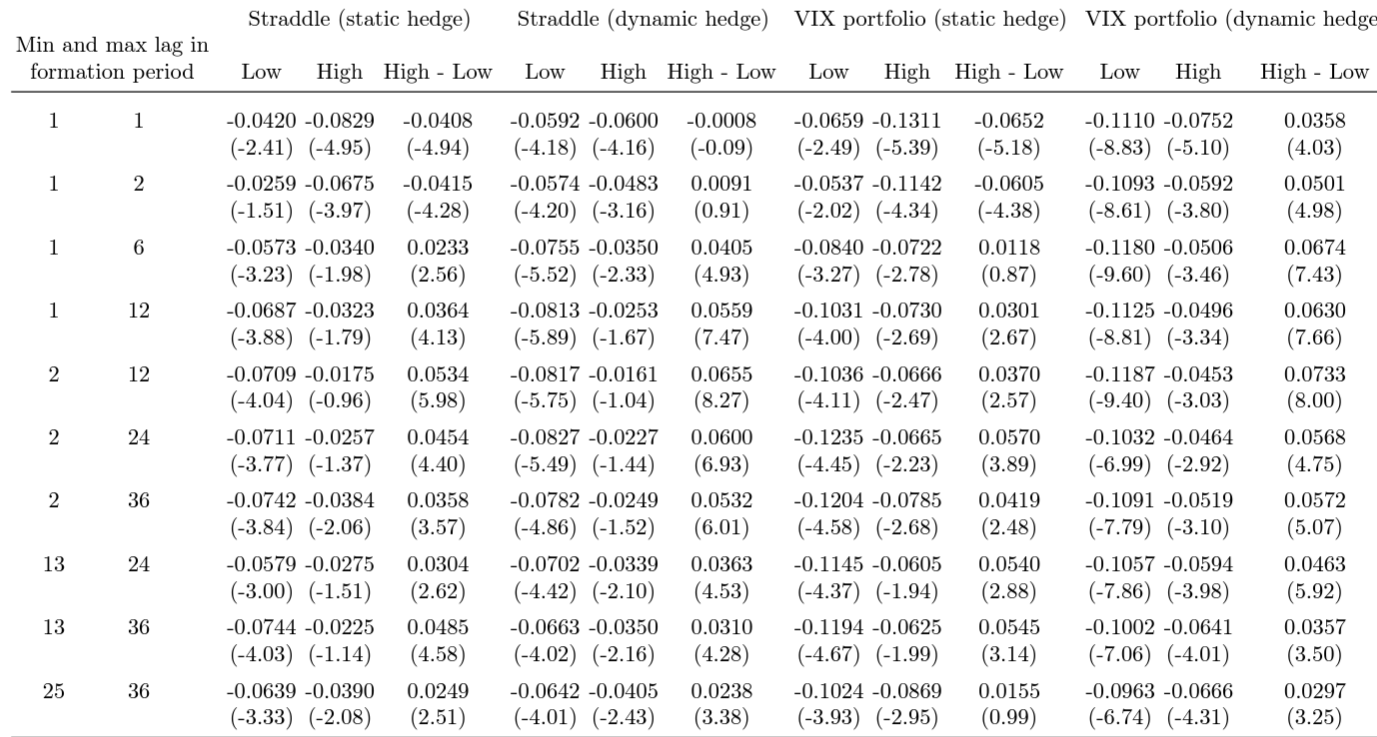

Momentum Everywhere, Including Equity Options

By Larry Swedroe|December 22nd, 2023|Options, Factor Investing, Research Insights, Momentum Investing Research|

Option returns display momentum, meaning that firms whose options performed well in the previous 6 to 36 months are likely to see high option returns in the next month as well.

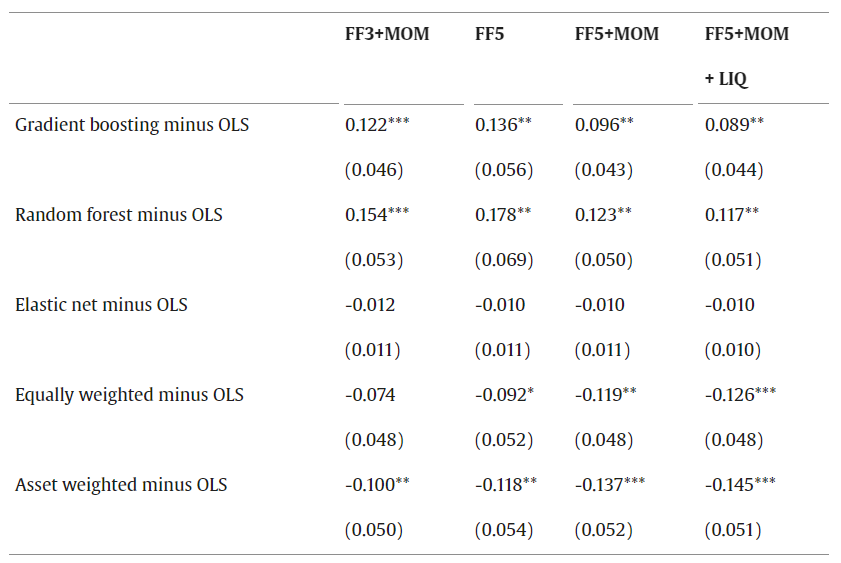

Can Machine Learning help to select mutual funds with positive alpha?

By Elisabetta Basilico, PhD, CFA|December 19th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning, Corporate Governance|

Can machine-learning methods be used to predict the performance of active mutual funds, specifically in terms of alpha net of all costs? Answer: yes.

The Temptation of Factor Timing

By Larry Swedroe|December 15th, 2023|Factor Investing, Research Insights, Larry Swedroe, Tactical Asset Allocation Research|

The timing of equity factor premiums has a strong allure for investors because academic research has found that factor premiums are both time-varying and dependent on the economic cycle.