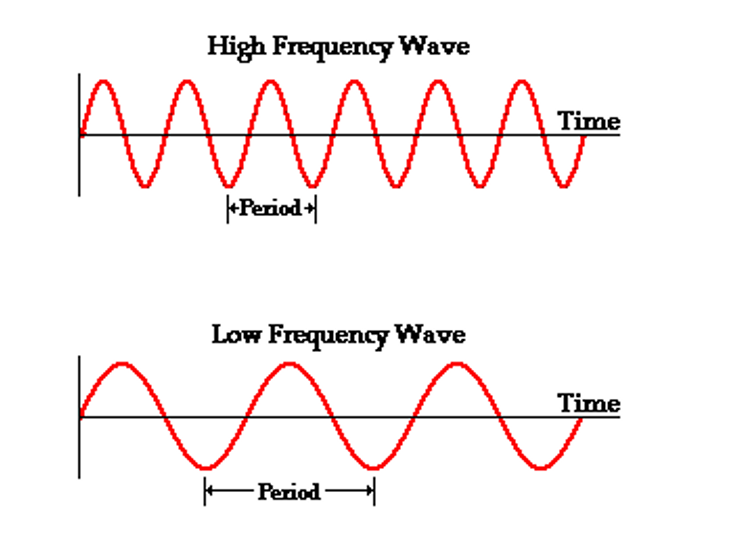

An Introduction to Digital Signal Processing for Trend Following

By Henry Stern|August 13th, 2020|Research Insights, Trend Following, Guest Posts|

Original: August, 2020 Updated: March, 2025 Overview Digital signal processing [...]

What is Sequence Risk and Can Trend Following Help Reduce It?

By Tommi Johnsen, PhD|August 10th, 2020|Research Insights, Trend Following, Basilico and Johnsen, Academic Research Insight|

Reducing Sequence Risk Using Trend Following and the CAPE Ratio [...]

Cross-Asset Signals and Time-Series Momentum

By Larry Swedroe|August 6th, 2020|Factor Investing, Research Insights, Larry Swedroe, Academic Research Insight, Momentum Investing Research|

In their paper “Time Series Momentum,” published in the May [...]

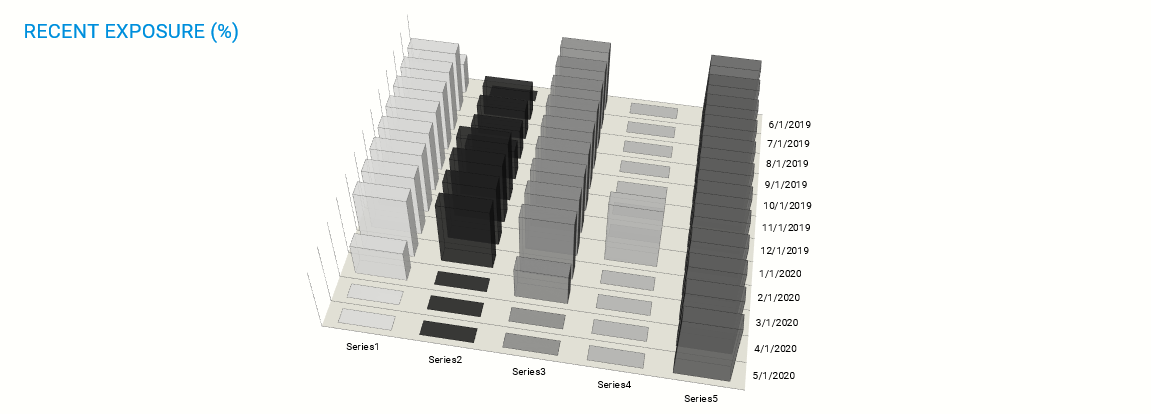

DIY Asset Allocation Weights: August 2020

By Ryan Kirlin|August 4th, 2020|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

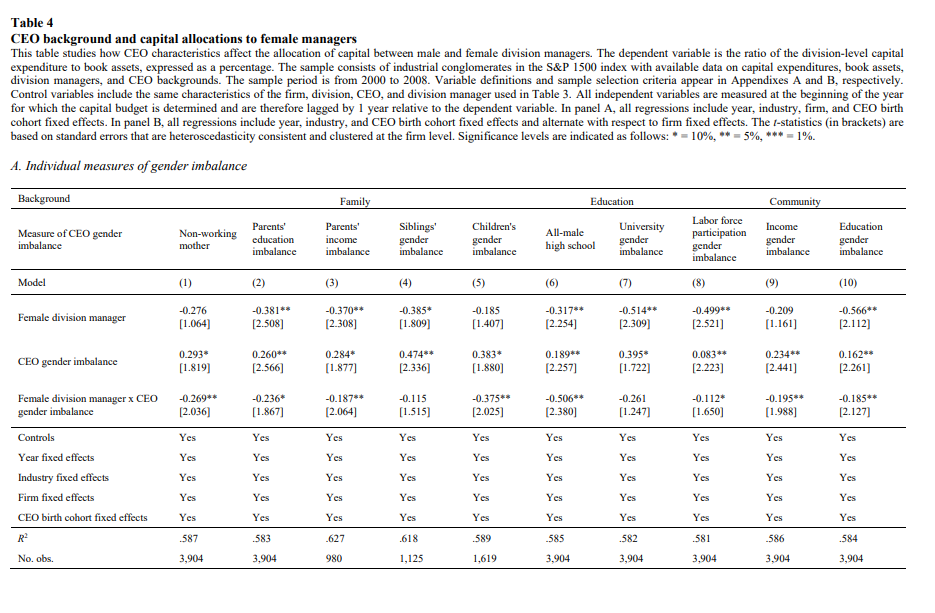

CEOs Formative Years and the Gender Gap

By Wesley Gray, PhD|August 3rd, 2020|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

The Origins and Real Effects of the Gender Gap: Evidence [...]

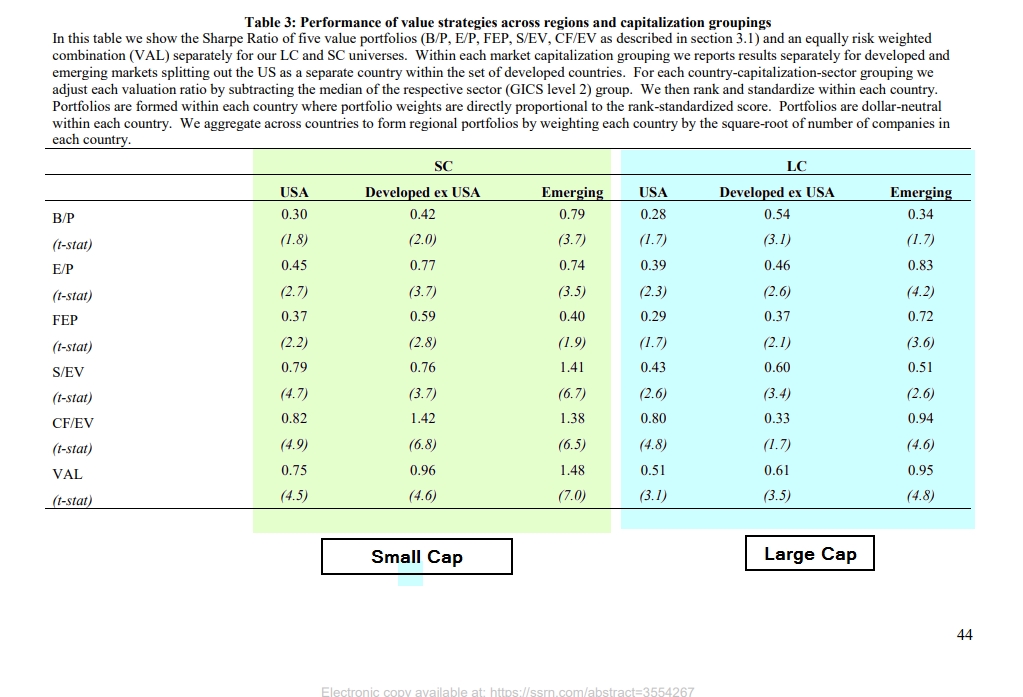

Is Systematic Value Dead???

By Larry Swedroe|July 30th, 2020|Research Insights, Factor Investing, Larry Swedroe, Academic Research Insight, Value Investing Research|

Value investing is the age-old investment strategy that buys securities [...]

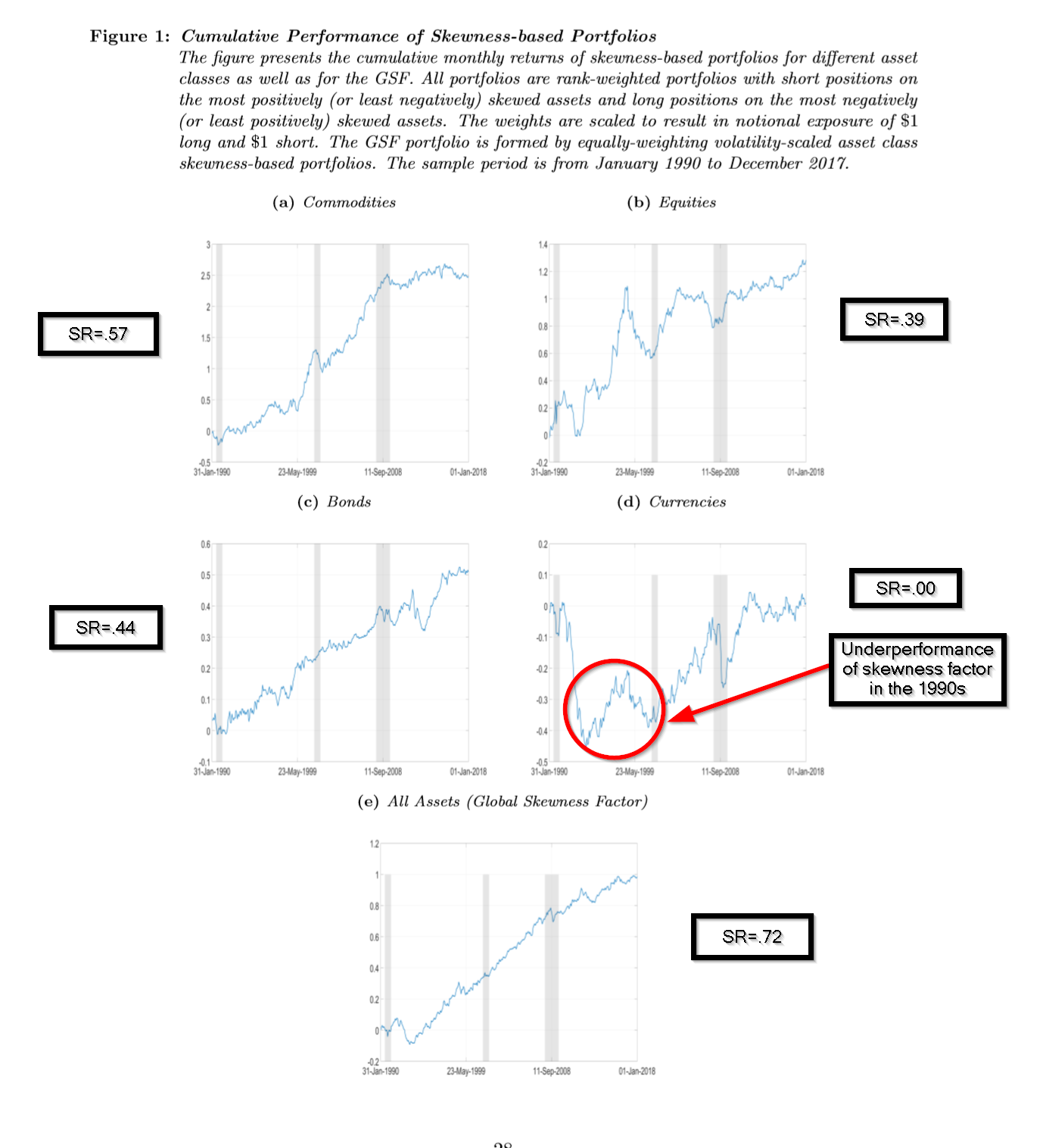

Relative Skewness: A New Risk Factor?

By Tommi Johnsen, PhD|July 27th, 2020|Skewness, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

Cross-Asset Skew Nick Baltas and Gabriel SalinasWorking Paper, SSRNA version [...]

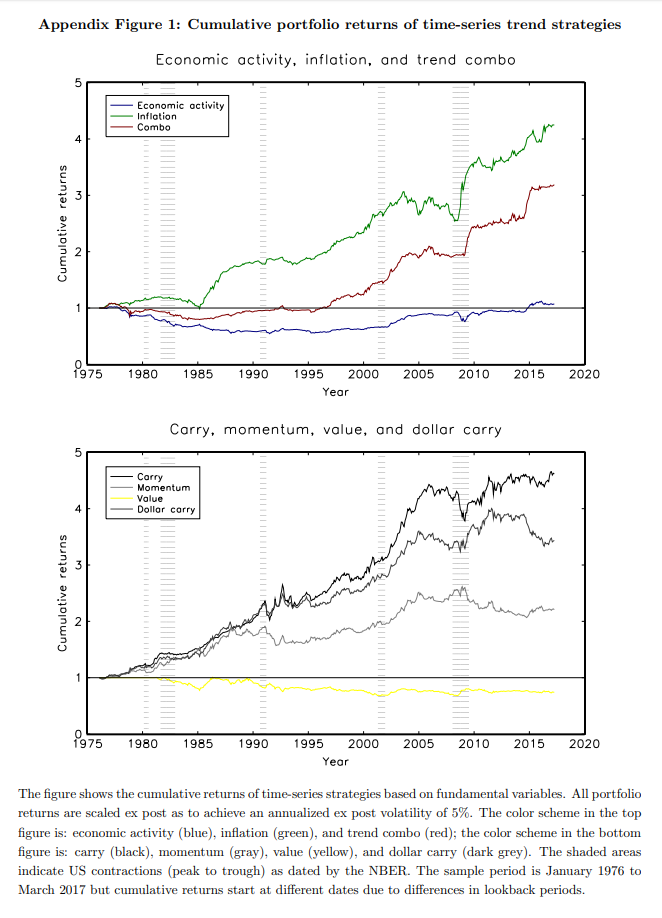

Fundamental Momentum, the Carry Trade, and Currency Returns

By Larry Swedroe|July 23rd, 2020|Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight, Momentum Investing Research|

Momentum in prices is the tendency of assets that have [...]

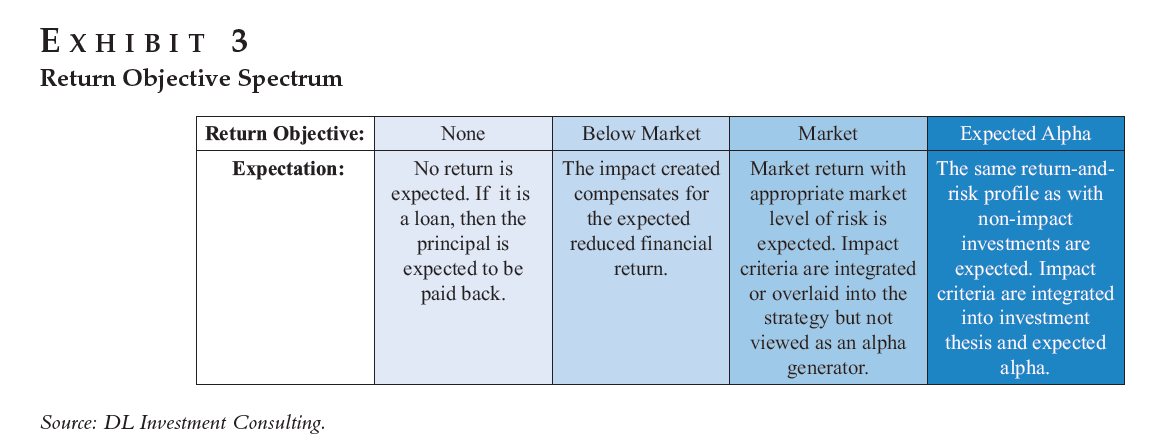

What is Impact Investing?

By Wesley Gray, PhD|July 20th, 2020|Financial Planning, ESG, Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Value Investing Research|

Impact Investing 2.0: Not Just for Do-Gooders Anymore Diana LiebermanThe [...]

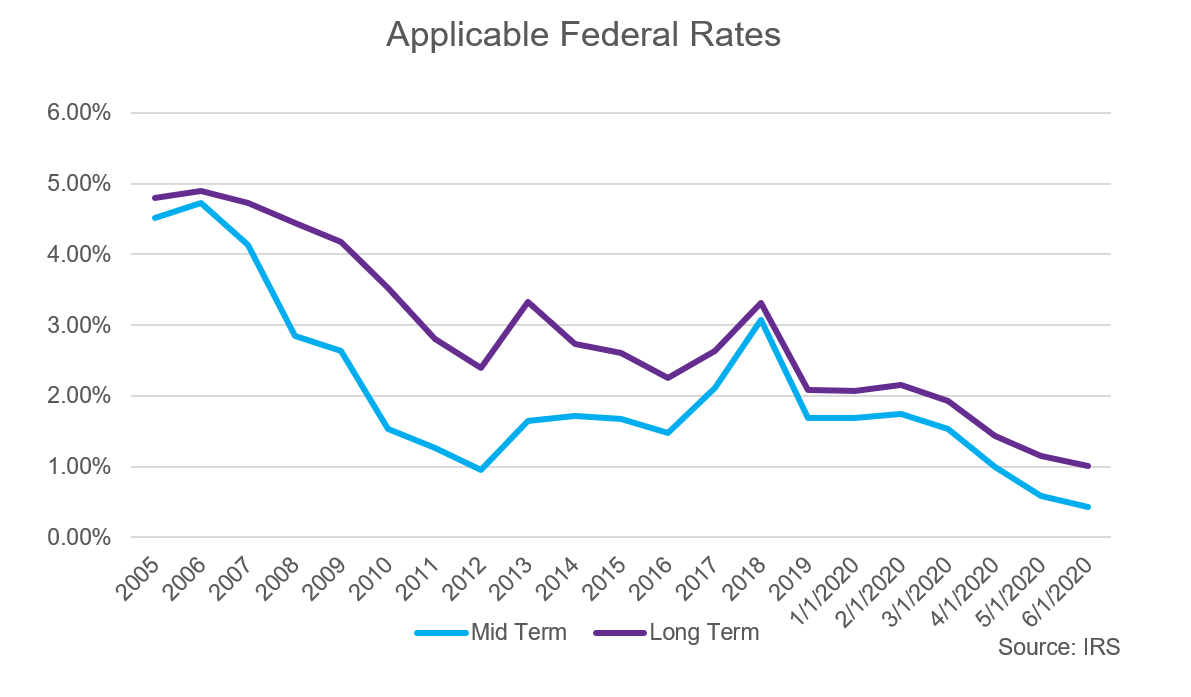

Planning Opportunities: Why Gift It, If You Can Loan It?

By Brian Bobeck|July 16th, 2020|Financial Planning, Research Insights, Guest Posts, Investment Advisor Education|

The coincidence of historically low-interest rates and the increased gift tax [...]