Excess Returns Podcast: Systematic Value Investing (Wes)

By Wesley Gray, PhD|June 5th, 2020|Podcasts and Video, Factor Investing, Research Insights, Media, Value Investing Research|

Recently I was invited to talk with Justin and Jack [...]

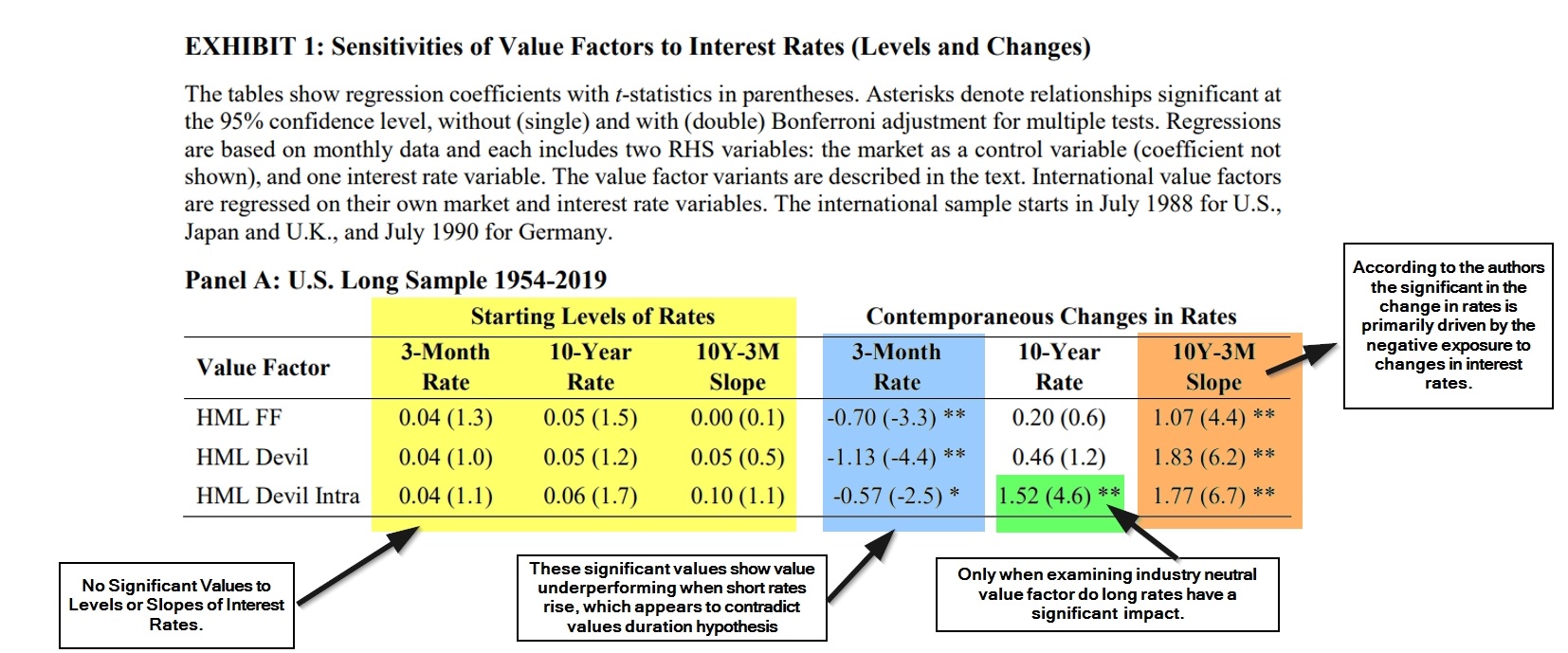

Do Interest Rates Explain Value’s Underperformance?

By Larry Swedroe|June 4th, 2020|Larry Swedroe, Factor Investing, Research Insights, Value Investing Research, Tactical Asset Allocation Research, Macroeconomics Research|

From January 2017 through March 2020, the value premium, defined [...]

DIY Asset Allocation Weights: June 2020

By Ryan Kirlin|June 2nd, 2020|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

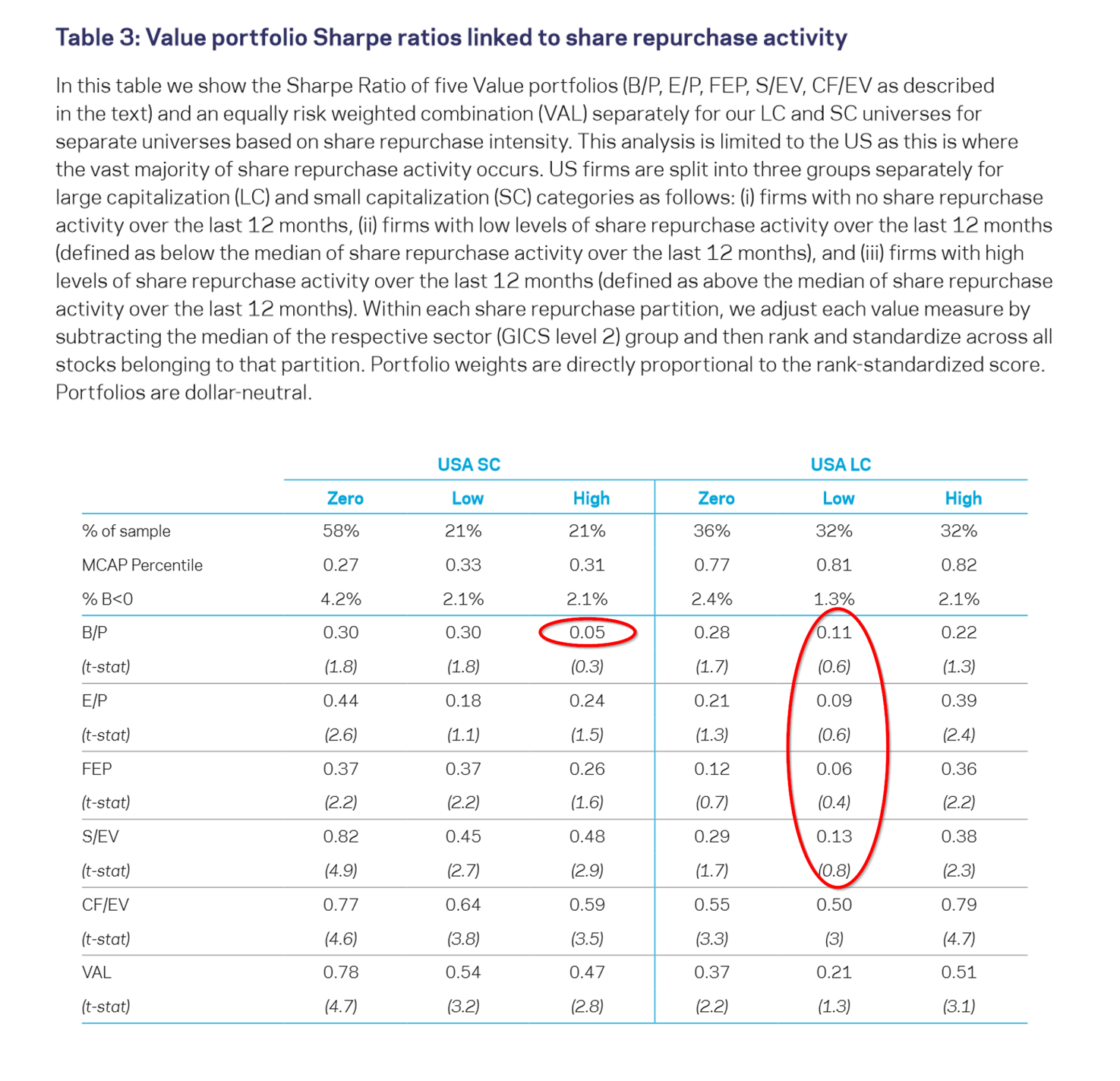

Is value dead? Has the story changed? No.

By Tommi Johnsen, PhD|June 1st, 2020|Research Insights, Basilico and Johnsen, Academic Research Insight, Value Investing Research|

Is (systematic) Value Investing Dead? Ronen Israel, Kristoffer Laursen and [...]

Smart(er) Investing – The Easy Way

By Wesley Gray, PhD|May 29th, 2020|Podcasts and Video, Women in Finance Know Stuff, Factor Investing, Research Insights, Academic Research Insight|

Most of the time we make you "earn your education" [...]

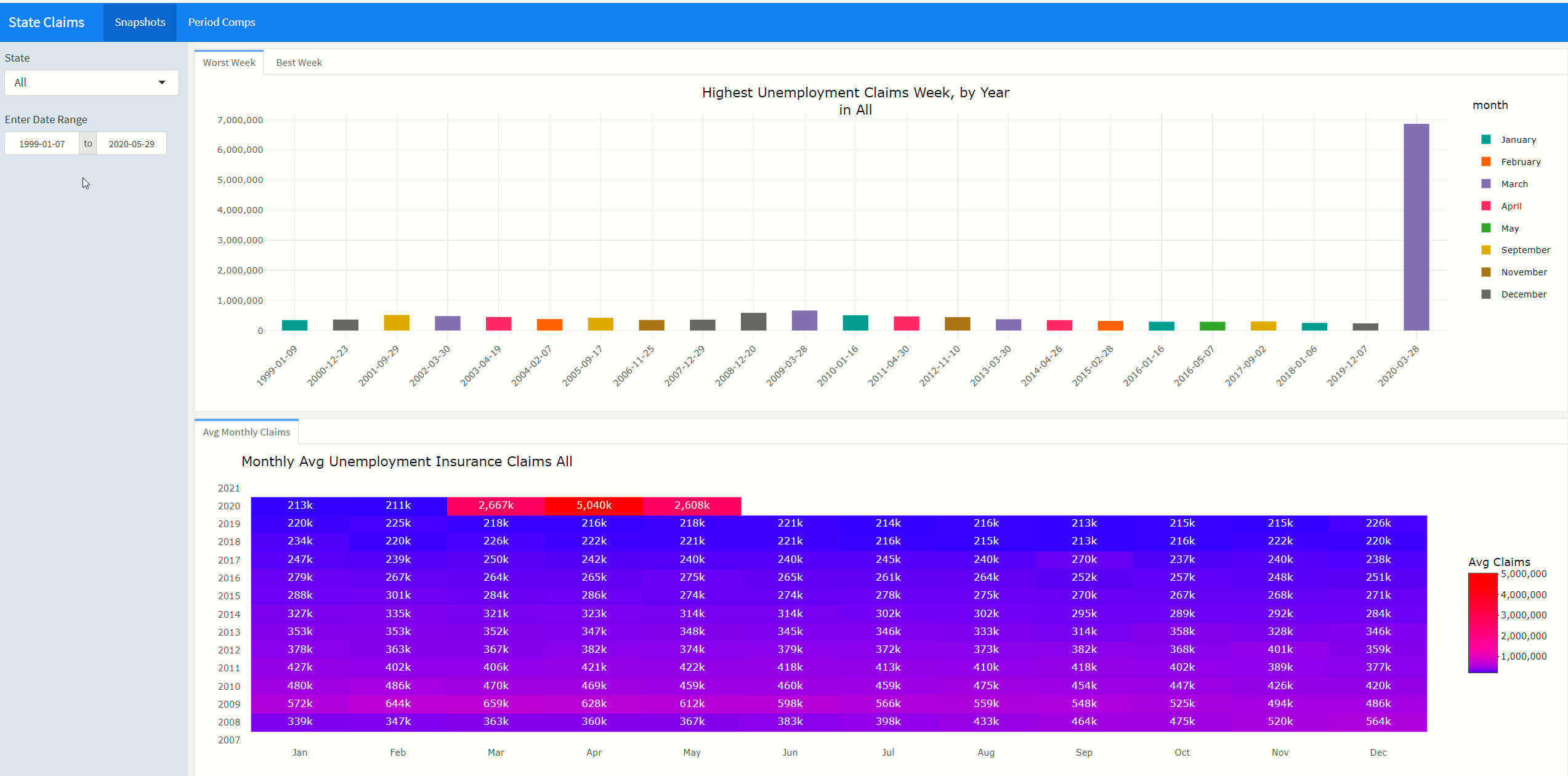

Free Tool Announcement: Visualizing Unemployment Claims

By Wesley Gray, PhD|May 29th, 2020|Tool Updates, Investor Education, Macroeconomics Research|

Our friend Jonathan Regenstein, over at http://www.reproduciblefinance.com/, convinced me that [...]

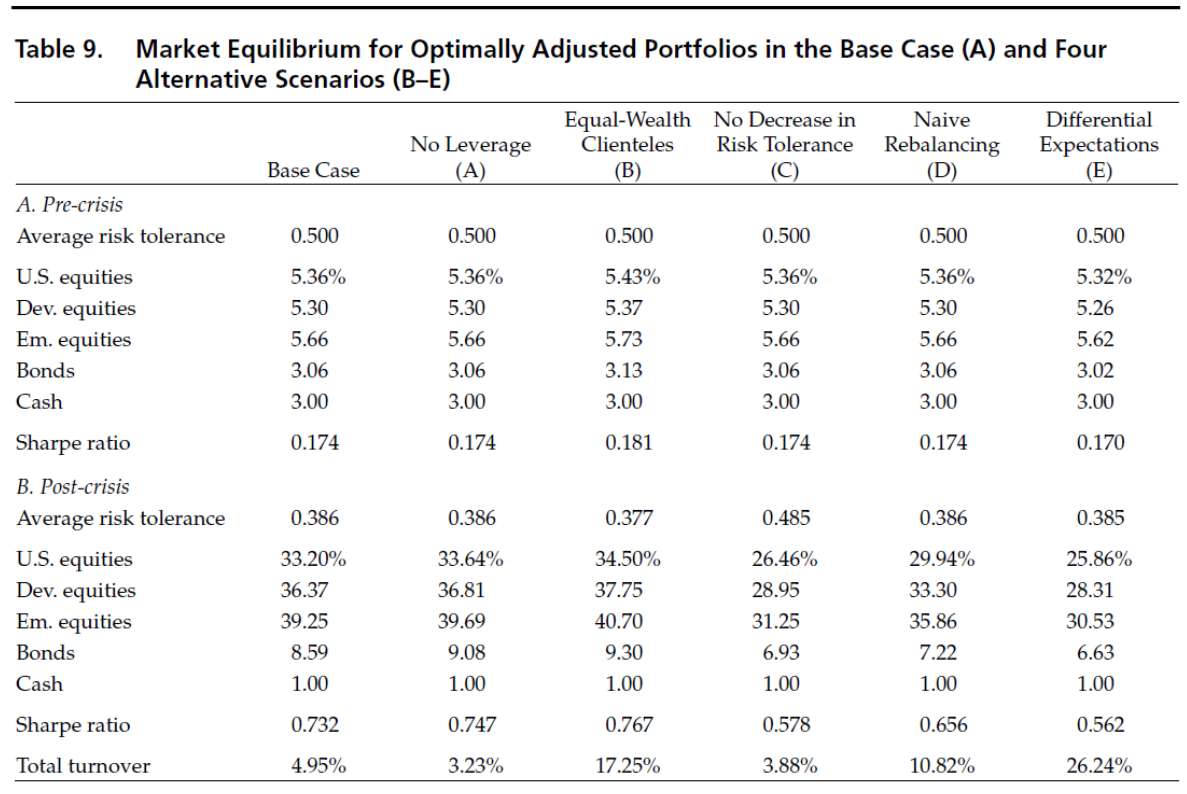

Tactically Adjusting Everything in a Financial Crisis? Bad Idea.

By Wesley Gray, PhD|May 26th, 2020|Research Insights, Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

Flight to Quality and Asset Allocation in a Financial Crisis [...]

Foreign Dividend Withholding Tax Refunds: A Practical Walkthrough

By Julia Bricker|May 22nd, 2020|Guest Posts, Other Insights, Tax Efficient Investing|

The world of withholding tax recovery on foreign dividends and [...]

Prospect Theory Helps Explain Return Anomalies

By Larry Swedroe|May 19th, 2020|Research Insights|

The field of behavioral finance provides us with fascinating insights [...]

Compound Your Knowledge Ep 29: What’s the Story Behind EBIT/TEV?

By Jack Vogel, PhD|May 19th, 2020|Compound Your Knowledge, Research Insights, Podcasts and Video, Media, Value Investing Research|

This week we discuss Ryan's article examining the Enterprise Multiple, [...]