Artificial Intelligence, Textual Analysis and Hedge Fund Performance

By Larry Swedroe|October 18th, 2024|Research Insights, AI and Machine Learning|

There’s no reason to think that the use of AI should lead to persistent fund outperformance, with any advantages gained likely being short lived.

Artificial intelligence, firm growth, and product innovation

By Tommi Johnsen, PhD|October 15th, 2024|Tommi Johnsen, Asset Growth, Research Insights, Academic Research Insight, AI and Machine Learning|

AI-powered growth concentrates among larger firms and is associated with higher industry concentration. Our results highlight that new technologies like AI can contribute to growth and superstar firms through product innovation.

The Sahm Rule as a Recession Indicator

By Larry Swedroe|October 11th, 2024|Research Insights, Larry Swedroe, Other Insights, Macroeconomics Research|

Because the Sahm rule focuses solely on the unemployment rate, caution is warranted before assuming it is signaling a recession.

Global Factor Performance: October 2024

By Wesley Gray, PhD|October 8th, 2024|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index website.

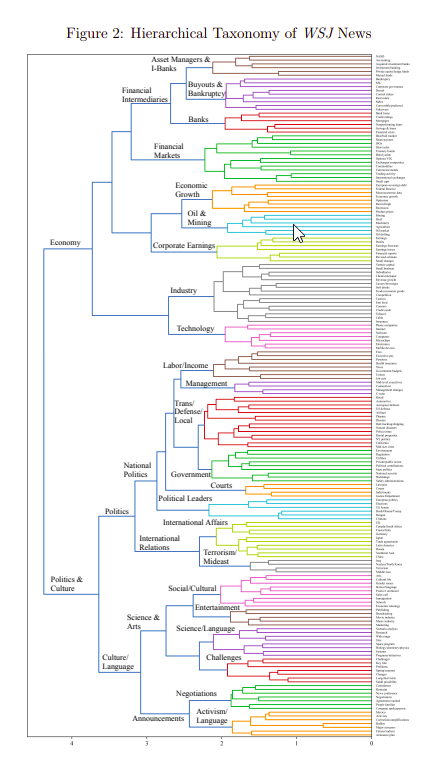

Reading the WSJ May Make You a Better Economist

By Elisabetta Basilico, PhD, CFA|October 7th, 2024|Elisabetta Basilico, Research Insights, Academic Research Insight, Other Insights, Behavioral Finance|

How can textual analysis of business news, specifically The Wall Street Journal (WSJ), be used to measure the state of the economy?

The Hidden Cost of Index Replication

By Larry Swedroe|October 4th, 2024|Transaction Costs, Larry Swedroe, Research Insights, Other Insights|

An index-tracking approach generally lacks flexibility, which detracts from performance, leaving returns on the table. Intelligent design can overcome such issues. For example, an S&P 500 Index could choose to rebalance one month ahead of the scheduled reconstitution, minimizing the impact of reconstitution. Direct index funds are already engaging in such strategies with ETFs.

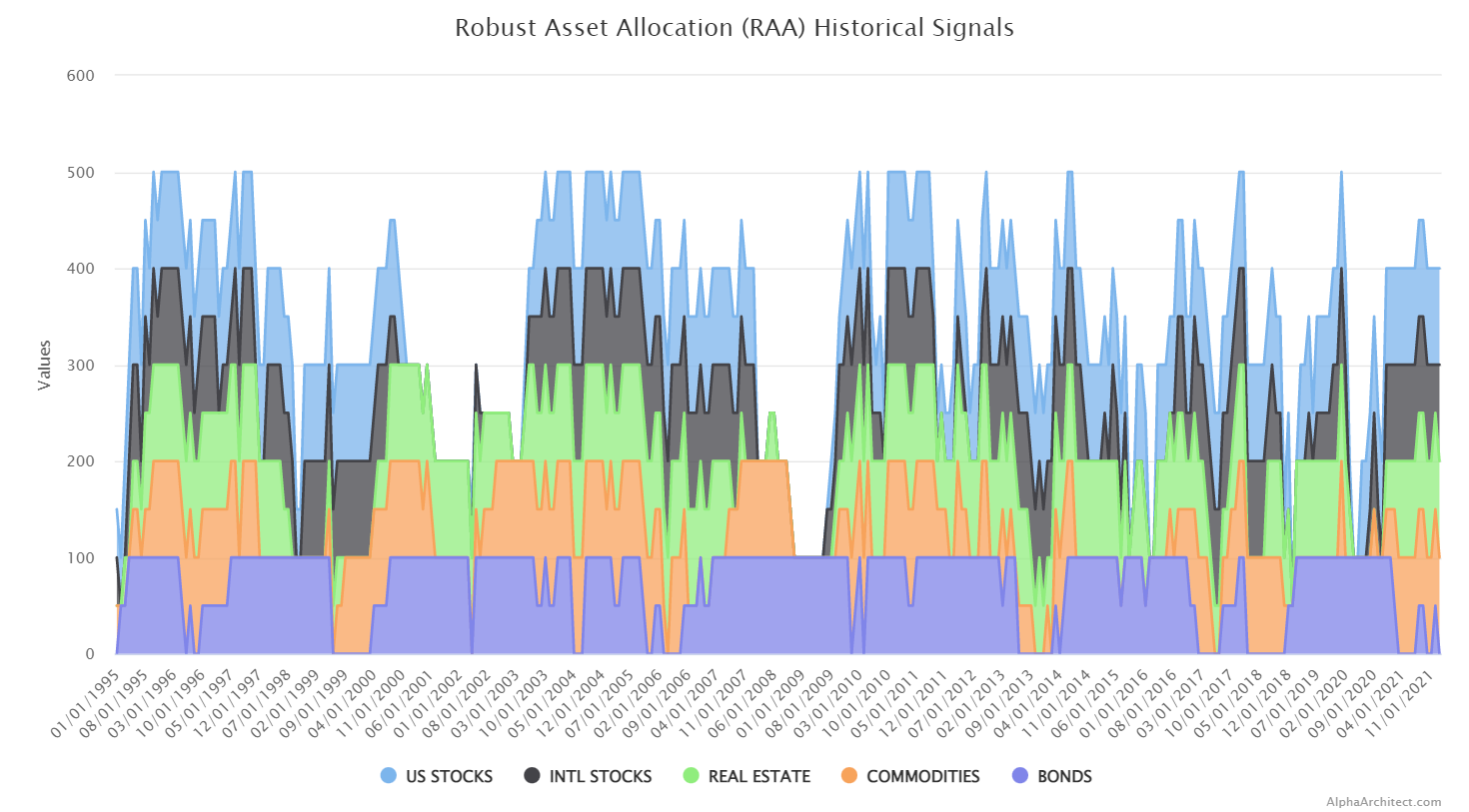

DIY Trend-Following Allocations: October 2024

By Ryan Kirlin|October 1st, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Current Exposures: Full exposure to domestic equities. Full exposure to international equities. Full exposure to REITs. No exposure to commodities. Full exposure to intermediate-term bonds.

Analysts set price targets using trailing P/E ratios

By Tommi Johnsen, PhD|September 30th, 2024|Tommi Johnsen, Research Insights, Academic Research Insight, Behavioral Finance, Value Investing Research, Active and Passive Investing|

Trailing twelve-month P/E ratios account for 91% of the variation in analysts’ price targets. We construct a new kind of asset-pricing model around this fact and show that it explains the market response to earnings surprises.

Can Skewness Identify Future Outperforming Mutual Funds

By Larry Swedroe|September 27th, 2024|Skewness, Research Insights, Factor Investing, Larry Swedroe, Other Insights|

While the skewness metric did demonstrate that it could select funds with managers skilled a security selection, the fund’s expenses and implementation meant that the fund was just about able to cover its expenses, and that was before the negative impact of active management on after-tax returns—and the finding was not statistically significant at even the 10% level of confidence.

We’ll be at the Astoria Macro Summit – October 29th

By Wesley Gray, PhD|September 24th, 2024|Conferences, Investor Education|

John and his team have assembled a stellar cast of characters for their inaugural Astoria Macro Summit at the Nasdaq Exchange in NYC on October 29, 2024. At a minimum, you'll see me moderate a panel with 200lb brains Cullen Roche, Corey Hoffstein, Ben Lavine, and Pankaj Patel!