Demographic Changes, Financial Markets, and the Economy

- Robert Arnott and Denis Chaves

- A version of the paper can be found here.

Abstract:

It seems natural that the shifting composition of a nation’s population ought to influence GDP growth and perhaps also capital markets returns. Entrepreneurialism, innovation, and invention tend to be associated with young adults. Accordingly, GDP growth should perhaps be best when there is a preponderance of young adults in a population. Investing for retirement is associated with middle-age, with a shift in preferences toward bonds with late-middle-age. So, stock and bond returns might be best in populations with growing rosters of these age groups, respectively. Our data—spanning over 60 yearsand 22 countries in our main tests and roughly 175 countries in out-of-sample robustness checks—support all of our priors.

We confirm what others have already demonstrated, but we extract markedly more statistical significance by adapting a polynomial curve-fitting technique pioneered by Fair and Dominguez (1991),to this new purpose. In our work, we find that a growing roster of young adults (age 15–49) is very good for GDP growth, a growing roster of older workers is a little bad for GDP growth, and a growing roster of young children or senior citizens is very bad for GDP growth…

Data Sources:

The authors access demographic information and GDP data from the United Nations and the Penn World Table, which document data from over 200 countries back to 1950. Stock and bond data sources are primarily from Global Financial Data. The final sample for the authors main results consists of 200 observations in 22 countries. Because this study is cross-country, the reliability of data from one country to the next is quite different–something to think about throughout the analysis.

Discussion:

Tell me you can predict daily stock returns, silver futures (see below), or the weather and I’ll show you the nearest insane asylum.

Mention that you can predict how many 60-year-olds there will be in America in 20 years from now, and I’ll have a lot of faith in your estimate. Why have faith? Well, we know with certainty that today’s 40-year-olds will be tomorrow’s 60-year-olds. And the fact demographic forecasts are relatively sane compared to run-of-the-mill forecasts, suggests they may create predictable events and situations in the future.

The authors of this paper (one of whom I know from my days as a PhD student at Chicago–Denis Chaves) develop a few hypotheses before diving into their work to test how demographics affect stock returns and the broader economy:

- A growing workforce should be good for growing GDP–that is a no-brainer: more people=more product=more GDP. However, the authors test specifically if the per capita GDP growth increases with a growing workforce as a percentage of the population. If more people in the population are working relative to the past, we should see increases in the per capita GDP, and vice versa.

- Entrepreneurs, inventors, and innovators tend to be young adults. How many 50-year-olds are inventing the next Microsoft? Not many. One would imagine that having more young adults would boost the economic drivers that lead to increased per capita GDP.

- Young people are focused on investing in stocks and providing goods and services to the market; old people are focused on pulling equity capital from the markets, investing in bonds, and consuming goods and services.

So what do the authors find?

Some of the key results are below:

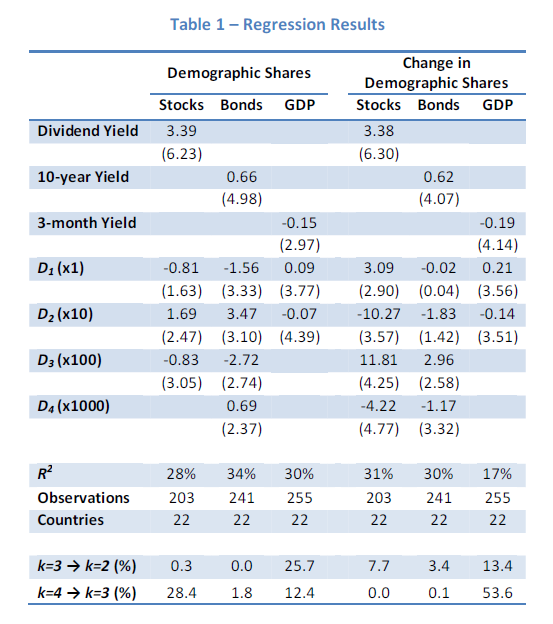

Table 1 relates 5-year excess stock market returns to a bunch of control variables we already know predict future exces returns–dividend yield, 10-year yields, and 3-month yields–and some ‘demographic variables’ that highlight the share of a population in a particular age cadre, or the changes in a particular age cadre.

Unfortunately, interpreting results from Table 1 is not intuitive; however, the authors present figures that capture the intuition behind their results very succinctly:

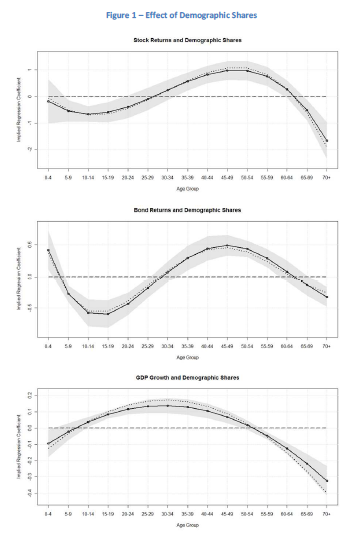

The key takeaways from these graphs are the following:

- Demography matters for long-term stock returns–having large components of working age citizens is a boon, lots of young/old people hurts returns.

- Demography matters for bond returns–similar pattern to equity, except large youth populations are bad for bonds, and large elderly populations are relatively ‘less bad’ for returns compared to stocks.

- Per capita GDP is strongly related to demographics–youth and elderly populations are a drag, large working populations are a boon.

So demographics appear to be strongly related to per capita GDP growth as well as asset returns. Perhaps the correlation is a statistically anomaly, or perhaps you believe in the 3 stories outlined at the beginning of this post, regardless, let’s see what forecasts are in store for the world, GIVEN, we believe the statistics of the past…

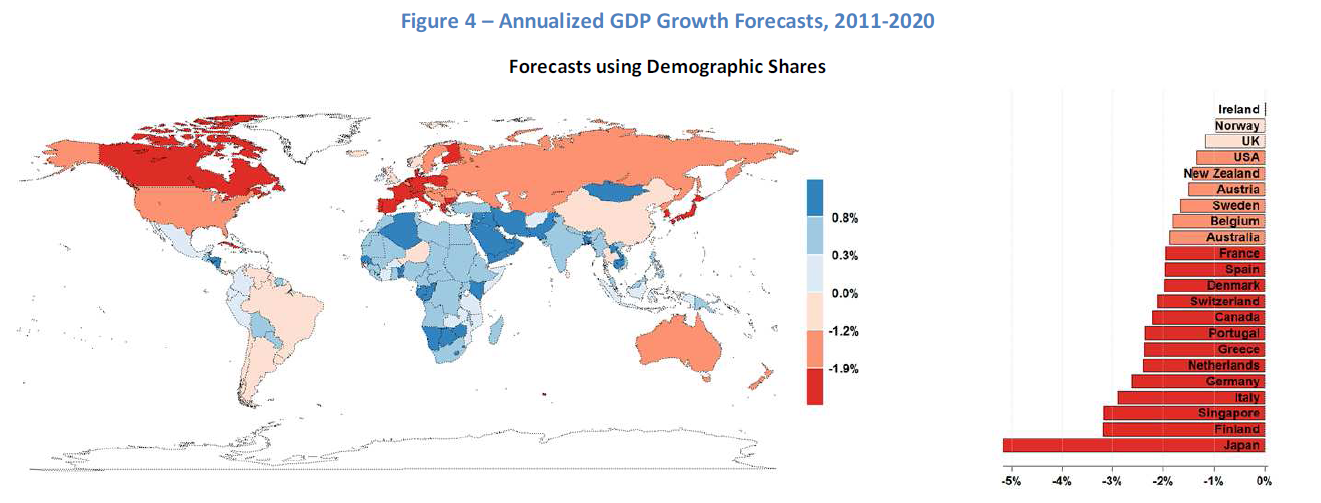

First, let’s see what the authors show us regarding GDP forecast relative to past trends:

Looks bad for developed world, good for developing world.

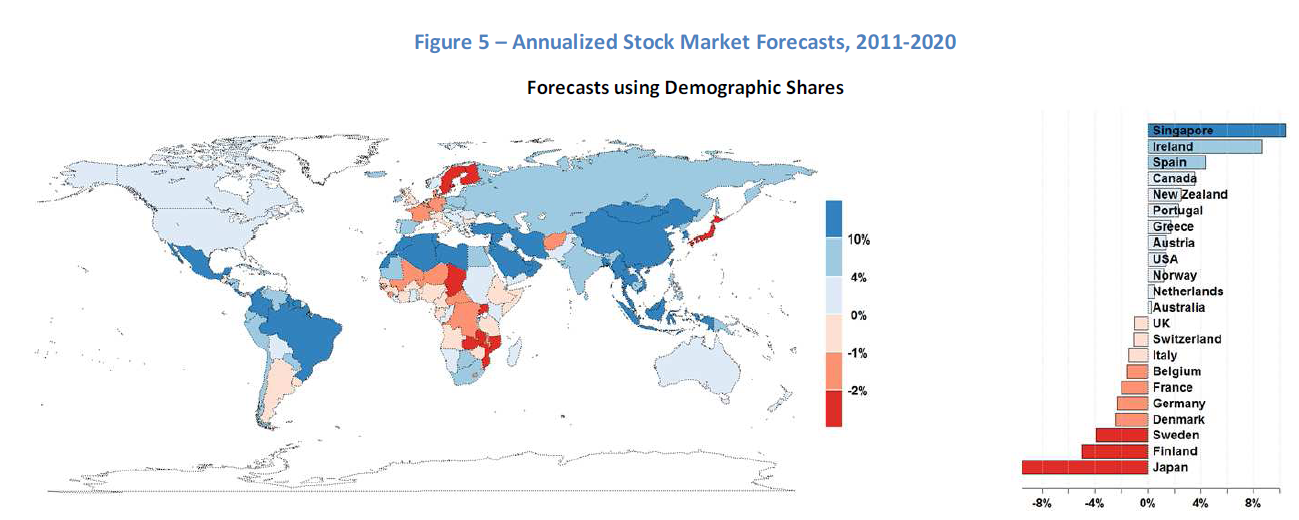

How about stock returns? Good for younger countries, bad for older countries.

And bonds? Old people need something to invest in, right? Well, bonds will likely do okay in the older/developed countries.

Investment Strategy:

- Identify demographic trends and how they relate to GDP and asset returns

- Stay away from countries with low birth rates and a bunch of retirees (Japan, Finland, and Sweden are great examples of where to find long-term bearish equity markets).

- Invest in countries with large and growing working populations for the foreseeable future (India, Latin America, and select Asia regions)

Commentary:

This paper is really an exercise in using sophisticated statistical techniques (i.e., closet data-mining) to exploit inherently limited data, but hey, everyone always says you should know your history, correct? I personally like the authors’ approach and the null hypothesis that demographics should have huge effects on economic phenomena.

Take the most extreme example of a one-country world: let’s say it is 2010 and right now 50% of the population is working at some business, and 50% of the population is retired (assume 0% kids). If we know with certainty that 100% of the population will be retired and too old to work around 2045, we can also estimate that GDP will be close to zero (who is able to work at the firms?) and the stock market will be close to zero (everyone wants their cash so they can retire and live off their nest egg, and firms aren’t producing anything so their NPV is zero??). Of course, this is a unrealistic, not-well-thought-out scenario, but the point is demographics matter and have real effects on the world we live in.

Heck, here is another example I just thought of: pretend the population of the world goes to 25 billion, water/pollution/food become extremely scarce, and we engage in a nuclear wars over resources that destroys all productive capital and labor in the world–that would probably affect the stock market, eh?

Other ‘outside the box’ elements to include in a long-term “trend-spotting” model would be politics, corruption, stability, environmental sustainability (reach the book Collapse) etc. So while Africa looks great on demographic metrics, it’s hard to get the stock market cooking when guerrillas are killing one another in the streets and there is no functioning stock market…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.