Market Efficiency in Real-Time

- Jeffrey Busse and Clifton Green

- A recent version of the paper can be found here.

Abstract:

The Morning Call and Midday Call segments on CNBC TV provide a unique opportunity to study the efficient market hypothesis. The segments report analysts’ views about individual stocks and are broadcast when the market is open. We find that prices respond to reports within seconds of initial mention, with positive reports fully incorporated within one minute. Trading intensity doubles in the first minute, with a significant increase in buyer- (seller-)initiated trades after positive (negative) reports. Traders who execute within 15 seconds of the initial mention make small but significant profits by trading on positive reports during the Midday Call.

Data Sources:

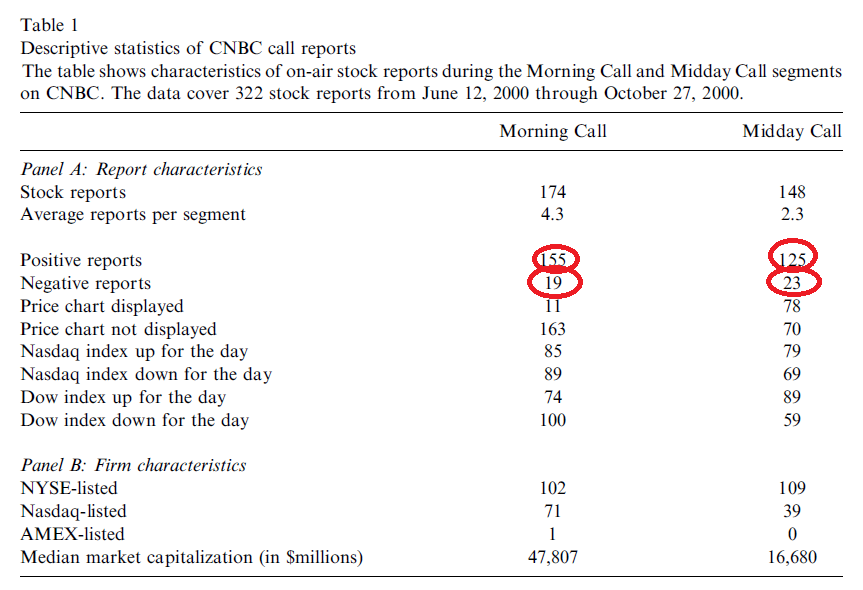

The authors video tape CBNC Morning Call and Midday Call segments from June 12 through October 27, 2000. Their final sample consists of 322 stock reports over 84 trading days.

Discussion:

This is one of the more fascinating pieces of academic research I’ve seen. Why do I say that? Well, the authors put together a video that is simply too cool to pass up. The video shows the real-time price reactions to a discussion on CNBC:

The video above captures the essence of this work: markets react immediately to news presented on CBNC.

The efficient market debate is one of the more entertaining conversations pieces out there–not quite as good as raw political debates, but for finance geeks it is certainly on par. A central tenant of the debate revolves around how the market responds to price-relevant news. Efficient market proponents rightfully believe that twenty dollar bills don’t sit on the ground for long periods of time; inefficient market proponents rightfully believe that twenty dollar bills can sit around.

So how can both parties be correct at the same time?

Well, it all depends on the cost of recovering the twenty dollar bill. If the $20 bill is sitting on the sidewalk and everyone can see it, sure, it’s going to get scooped up; however, if the $20 bill is buried in a heap of steaming manure that involves some serious work to uncover–by all means, you can have the $20 bill!

This paper is all about showing that $20 dollar bills sitting in broad daylight don’t sit around long–in fact, they sit around for about 15 seconds, on average (probably faster these days with the increase in high-frequency trading desks).

The authors in this paper examine how prices react to potential information events on CBNC’s Morning Call and Midday Call.

Here is my favorite video of all time from CBNC: Santelli’s rant on the “losers”.

[youtube url=”http://youtu.be/zp-Jw-5Kx8k”]And while I’m not sure how market prices reacted to Santelli’s price-relevant information for the entire US economy, the authors identify how price-relevant information discussed on CBNC is piped into stock prices instantly–the $20 bills don’t sit around long!

First, some of the more interesting results from the paper:

1. Reports on CNBC are almost always positive–not surprising; you can’t sell negativity.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

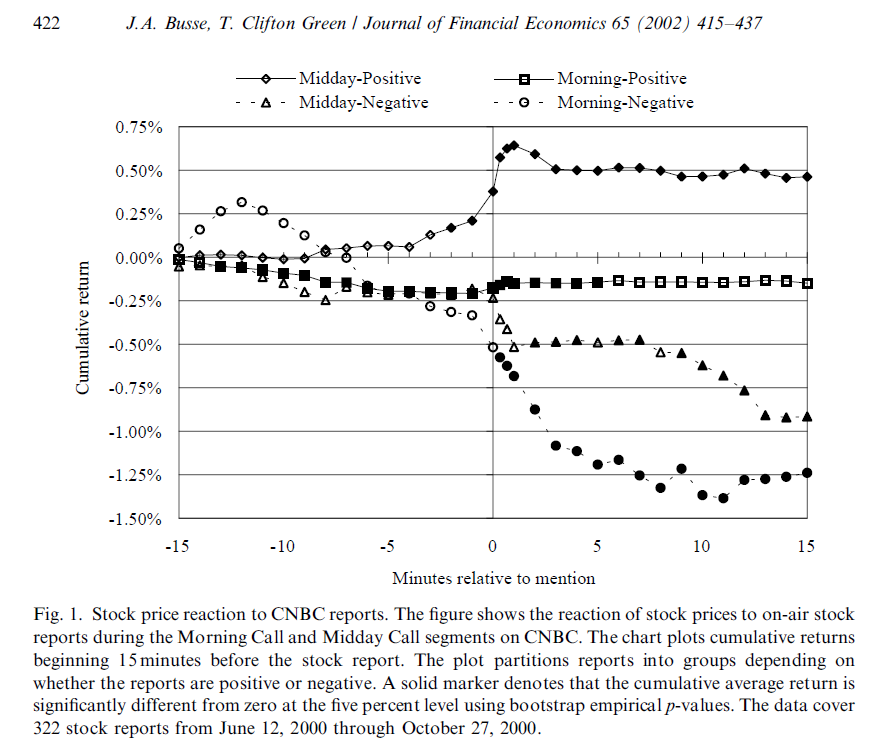

2. Prices react to CNBC commentators–admit it, you’ve heard someone mention a stock on CBNC and then pulled it up on your Bloomberg or Yahoo Finance.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

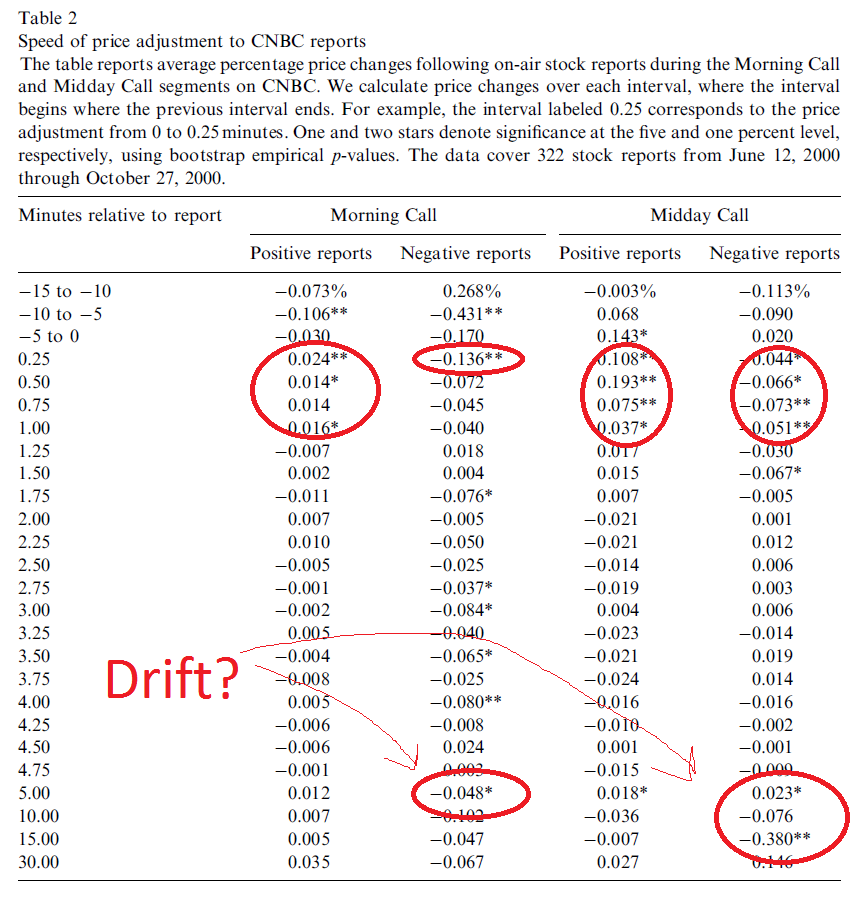

Here is a more nuanced look:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The results seem to suggest that market prices quickly incorporate positive news, but negative news seems to have a drift. This result is actually consistent with numerous studies in the earnings announcement space.

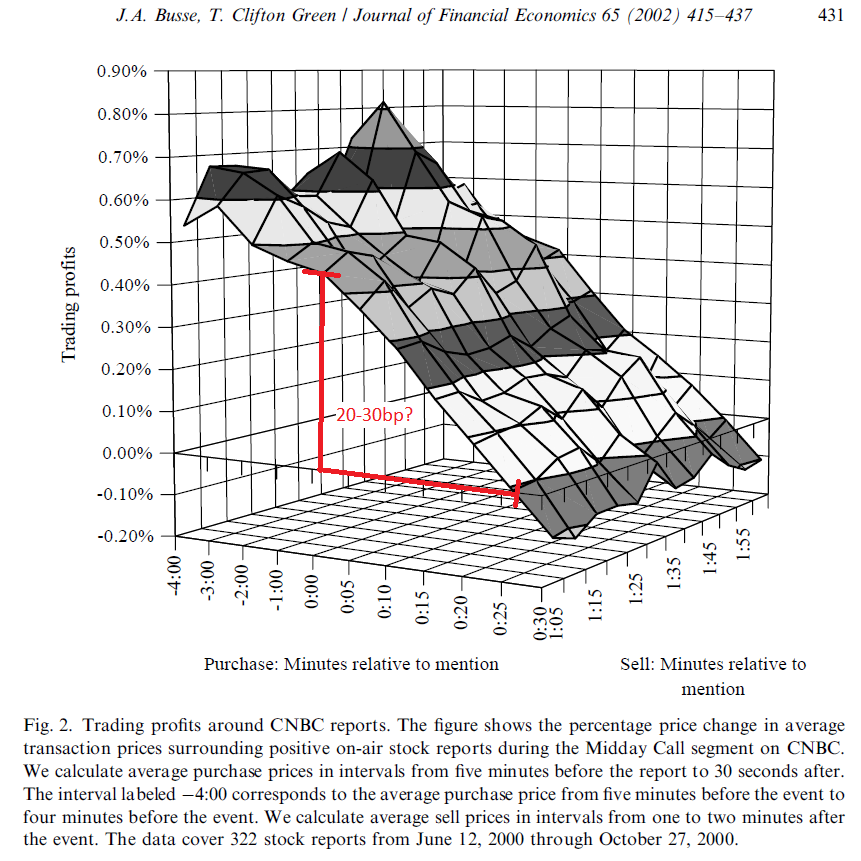

3. There are some potential trading profits

3D graphs give me serious brain damage, but this one seems relatively straight forward. From the looks of it, if you could trade the exact second the positive report was mentioned and were to bail 25 seconds later, you’d score around 40bp, but take off some heavy transactions costs for market impact/spread/commissions and maybe you’re in the 20-30bp range? Who knows. The key assumption is you literally traded the second the positive news came out–which is probably unrealistic…

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Investment Strategy:

- Watch CNBC more than you already do.

- Be ready to pull the trigger when someone discusses a stock either positively or negatively

- Do a quick flip for positive mentions, hold a bit longer for negatively mentioned stocks.

- Make some money

Commentary:

I don’t really expect anyone to try this strategy, save some bored prop desk traders who have the capability and time to do so (many probably already do this). Nonetheless, I thought the insights from this paper were fascinating. Here are some things I took away from the read:

- Markets react to attention-gaining events and participants likely suffer from “limited attention” syndrome.

- Media and promotion play a huge role in market efficiency.

- $20 dollar bills sitting in broad daylight don’t hang out for long.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.