Reinhart (and another Reinhart) and Rogoff have another paper in their series about “Why debt sucks.”

The title of their newest work is “Debt Overhangs: Past and Present.”

Headline:

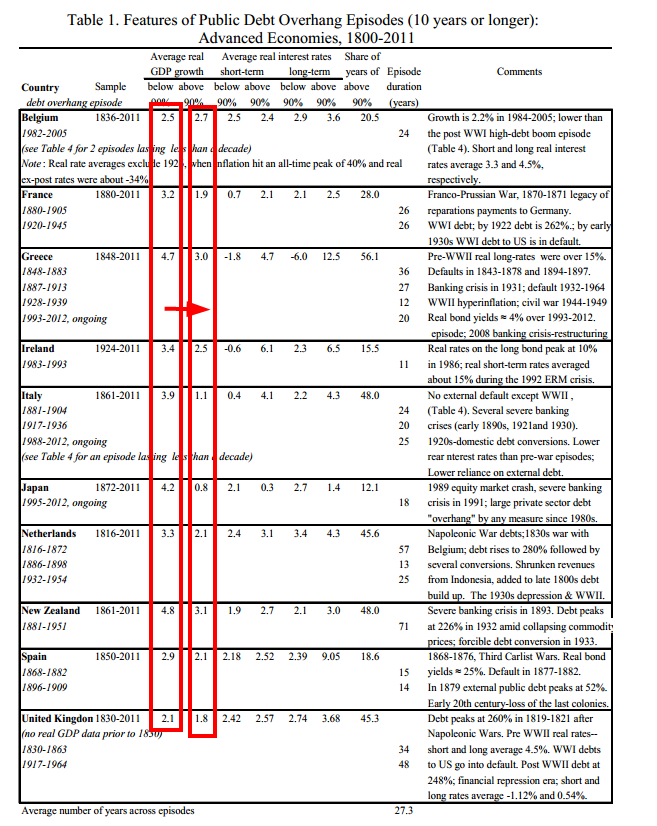

We identify the major public debt overhang episodes in the advanced economies sincethe early 1800s, characterized by public debt to GDP levels exceeding 90% for at least five years. Consistent with Reinhart and Rogoff (2010) and other more recent research,we find that public debt overhang episodes are associated with growth over one percent lower than during other periods. Perhaps the most striking new finding here is the duration of the average debt overhang episode. Among the 26 episodes we identify, 20 lasted more than a decade. Five of the six shorter episodes were immediately after World Wars I and II. Across all 26 cases, the average duration in years is about 23 years. The long duration belies the view that the correlation is caused mainly by debt buildups during business cycle recessions. The long duration also implies that cumulative short fall in output from debt overhang is potentially massive. We find that growth effects are significant even in the many episodes where debtor countries were able to secure continual access to capital markets at relatively low real interest rates. That is, growth-reducing effects of high public debt are apparently not transmitted exclusively through high real interest rates.

Money Shots:

First, a table outlining what happens before debt overhang (<90% debt/gdp) and after debt overhang (>90% debt/gdp). Yuck!

And to state the obvious, if the debt is killing potential GDP by a certain % each year (even if it is small), the magic of compounding KILLS the economy over the long haul.

Keynsian Beatdown?

God knows I love a great rebuttal. I really do think there is an excellent argument that allowing the government to fill a demand gap can be an effective way to prevent the world from going into a negative feedback loop and eventually a depression. Fine, Krugman and his cat deserve credit. But, in the end, the Keynesian economic “miracle” really depends on the assumption that people are too stupid to realize that money borrowed by the government today will have to be paid back at some point in the future (ie., if the government moves to fill the current demand gap, the people simply offset that demand by pulling back even further, so on net no new demand was created)…and if the government is an inefficient method of filling a demand gap because of bureaucracy, corruption, etc., the people are going to be really pissed when they eventually have to pay back the government debt.

Okay, so I’m the first one to admit that “the people” are not always perfectly rational and the idea that “the people” are going to cut their personal budgets to perfectly offset the increased government spending to create a net-zero demand situation is kinda insane. But at some level, people can only be fooled so many times (take a gander at some PEW polls http://pewresearch.org/pubs/2001/poll-concern-raising-debt-limit-higher-spending). Moreover, as this paper highlights, too much debt can cause some serious issues over the long-term for an economy–Keynesian magic is not a free lunch.

Of course, a great depression, which would follow if we cut budgets and let the whole enchilada take its natural course, can also cause some serious GDP potential growth issues. D’oh!

So what is the answer? Well, I simply don’t know and have too many things on my mind these days, but I do know that there is probably no definitive answer such as “stimulate forever” or “austerity forever.”

In all likelihood, the common sense answer is that after many years of spending more money than you’ve earned you gotta take a pain pill in the form of a depression, or a long drawn out debt-hangover induced slug of multiple years of less-than-potential GDP growth. I prefer swift and fast pain, but that’s just me.

Why does too much debt suck?

I’m not an expert on all things macroeconomic. I’ll admit it, I started taking Tom Sargent’s macro class at Chicago when he taught his course to the economic PhDs; however, I quickly decided that was a bad idea after every class began with the following:

So without thinking too hard about why debt sucks, I came up with a few intuitive reasons that are related to what Reinhart, Reinhart, and Rogoff discuss, but in terms I understand:

Loss of Freedom: With a heavy debt burden, the typical choice is no longer “How am I going to spend my hard-earned dollars today?”, but “How in the heck am I going to pay off my debt???”

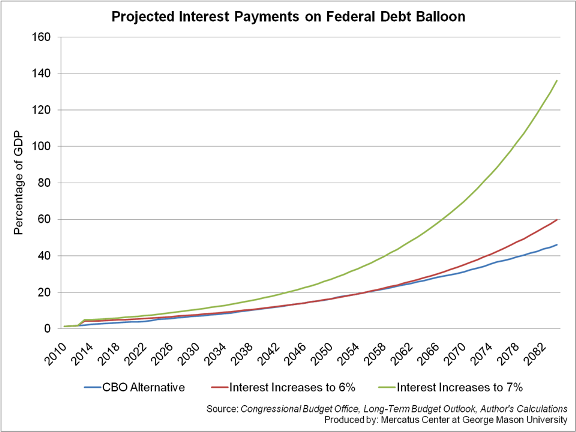

Interest Payments: Compounding can work for…or against you.

Loss of Flexibility: Related to point on freedom. With a heavy debt burden, your ability to absorb short-term shocks is highly limited.

Exciting to see what happens next…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.