Public Service Announcement:

To all the free-market pro-competition haters of the world that believe government regulation solves all our problems, please read the following paper.

Short-Selling Bans Around the World: Evidence from the 2007–09 Crisis

- Alessandro Beber and Marco Pagano

- A recent version of the paper can be found here: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1502184

- The published version can be found here: http://onlinelibrary.wiley.com/doi/10.1111/j.1540-6261.2012.01802.x/pdf

Abstract:

Most regulators around the world reacted to the 2007-09 crisis by imposing bans or constraints on short-selling. These were imposed and lifted at different dates in different countries, often applied to different sets of stocks and featured varying degrees of stringency. We exploit this variation in short-sales regimes to identify their effects on liquidity, price discovery and stock prices. Using panel and matching techniques, we find that bans (i) were detrimental for liquidity, especially for stocks with small capitalization and no listed options; (ii) slowed down price discovery, especially in bear markets, and (iii) failed to support prices, except possibly for U.S. financial stocks [Author comment: Did we really need to support the largest leaches known to mankind?].

Data Sources:

Daily data for 16,491 stocks in 30 countries from January 2008 to June 2009.

Comment:

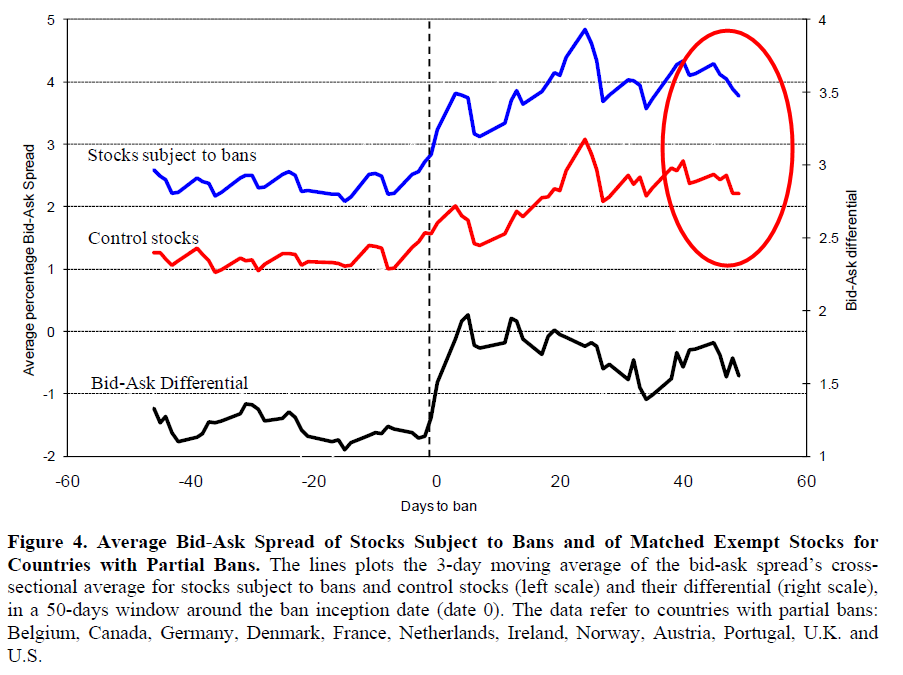

Bid/Ask spreads increase:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

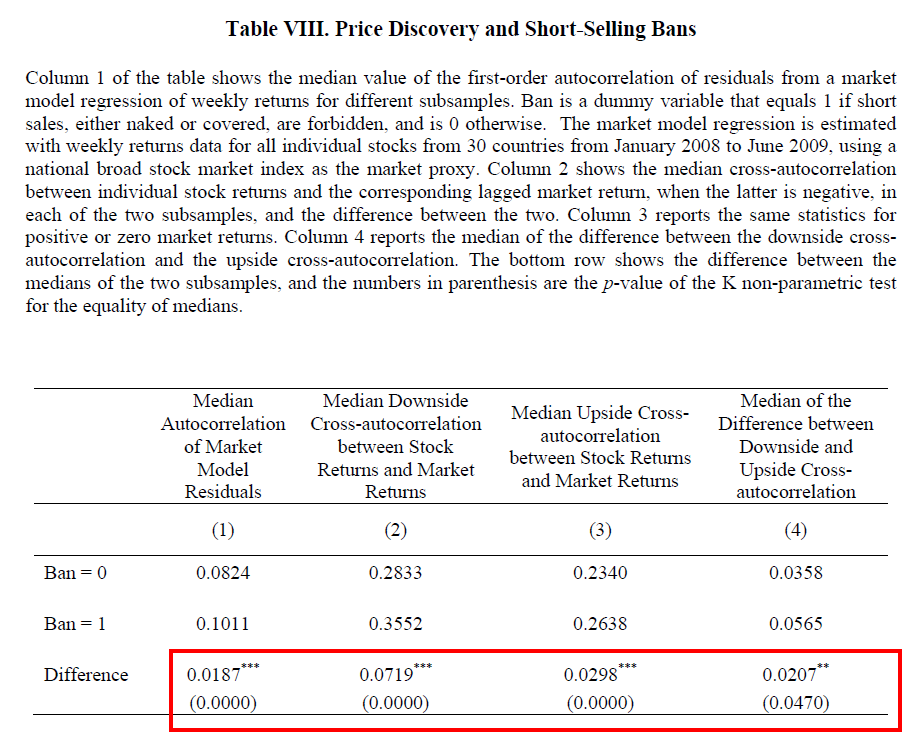

Price discovery sucks:

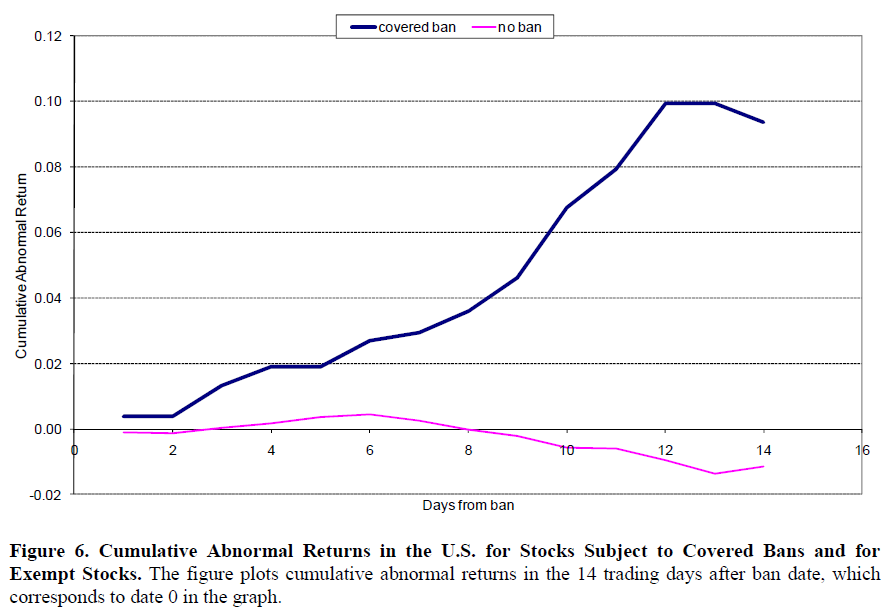

And crappy stocks get overvalued:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Key Takeaway: Stay out of the Markets, Mr. Government.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.