Pension Plan Funding and Stock Market Efficiency

- Francesco Franzoni and Jose M. Marin

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

The paper argues that the market significantly overvalues firms with severely underfunded pension plans. These companies earn lower stock returns than firms with healthier pension plans for at least 5 years after the first emergence of the underfunding. The low returns are not explained by risk, price momentum, earnings momentum, or accruals. Further, the evidence suggests that investors do not anticipate the impact of the pension liability on future earnings, and they are surprised when the negative implications of underfunding ultimately materialize. Finally, underfunded firms have poor operating performance, and they earn low returns, although they are value companies.

Data Sources:

CRSP, Compustat

Alpha Highlight:

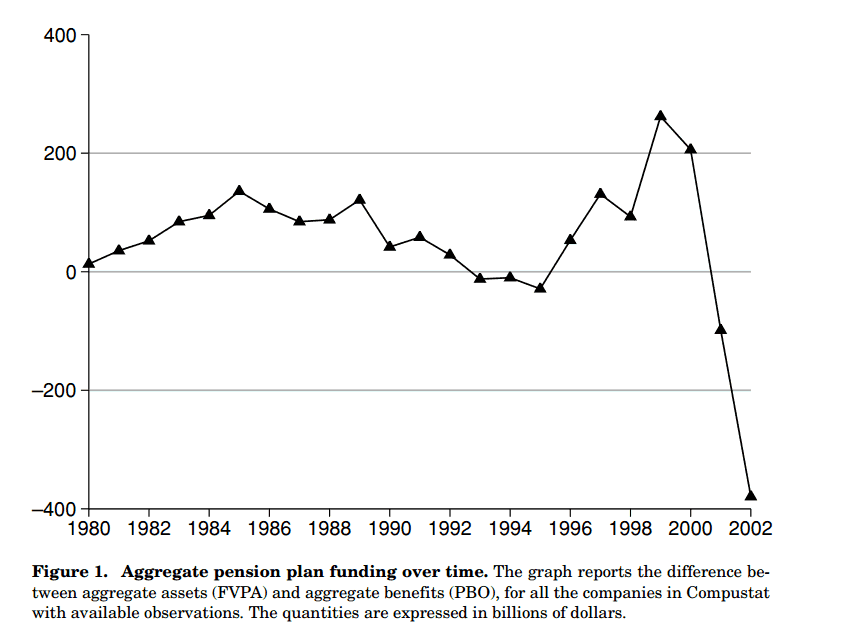

Fact 1: Even the private sector can’t meet expected promises:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Maybe we can make some money off the union bosses sticking private firms with too many unfunded obligations? Oh yes we can…

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

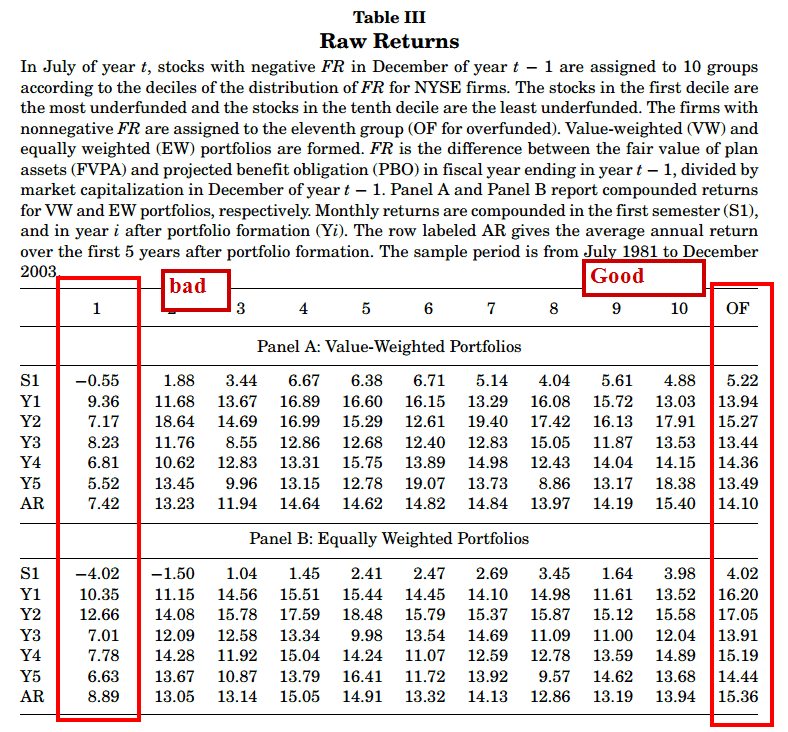

- Compute the funding ratio (FR) as the difference between the fair value of plan assets minus the projected benefit obligation all scaled by market capitalization.

- See the paper for the exact definition of this variable.

- A negative funding ratio (FR) means that the company’s definied benefit plan is underfunded, as the projected benefits are greater than the plan assets.

- Of all companies with negative FRs, creates deciles using NYSE breakpoints.

- Create portfolio on July 1st of year t and hold until June 30th of year t+1.

- Short the decile with the largest negative FR and earn 0.89% 3-factor alpha per month!

Commentary:

- Surprisingly the firms with the largest negative FRs are small value firms, which are expected to have higher returns.

- These firms also have low accruals and high momentum, which would predict higher returns.

- These firms do have high distress scores (Altman and Olhson measures), so distress may explain the negative returns.

- Returns are largest (when shorting) for the first 6 months after portfolio formation.

- Returns around earnings announcements are also significantly higher (when shorting).

- Returns appear to persist up to 5 years after first identifying a severly underfunded company.

- There is no symmetry in returns, as companies with the largest FRs (most overfunded) do not earn significantly positive alpha.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.