CEO Interviews on CNBC

- Young Han Kim and Felix Meschke

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

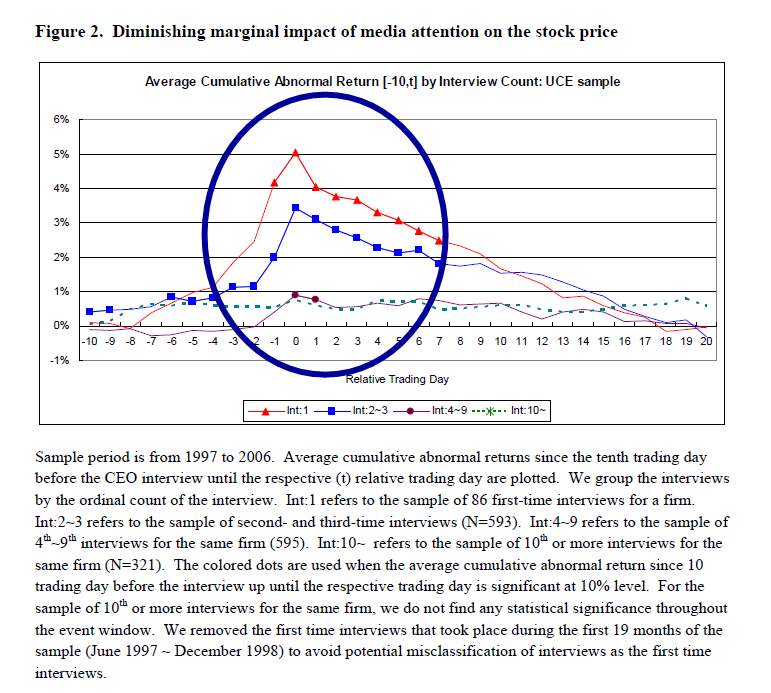

We investigate whether media attention systematically affects stock prices through the trading of individual investors by exploiting the substantial discrepancy between perceived and actual information content of 6,937 CEO interviews on CNBC. The average cumulative abnormal stock return over the [-2, 0] trading day window is 1.62%, yet prices exhibit strong reversion of 1.08% over the following ten trading days. The magnitude of price response is positively correlated with the viewership as well as the language tone of the CEO. We find that individual investors are net buyers on the interview days, and that they keep on buying if the interview was both carried out by attractive anchorwoman and was watched by more male viewers. The price reversal is attributable to abnormal short-selling volume on interview day. Moreover, we find that the price run-up before the interviews is largely driven by individual investors that are excited even at the pre-announcement of the interview. We also find evidence of asymmetric attention cascade coming from CNBC interview upon the tone of media coverage of the firm, tilted towards the negative.

Data Sources:

SDC Platinum, Execucomp, IRRC, CRSP/COMPUSTAT, GAO, and Stanford Lawsuit Clearing House.

Alpha Highlight:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Paper measures the price effect of CEO giving an interview on CNBC.

- Overall find from days -2 to 0 (interview day) firms experience a positive 4-factor abnormal return of 1.62%, but then experience a negative abnormal return of -1.08% over the next ten days.

- This effect is larger for NASDAQ firms, technology firms, and during the 1997-2001 (tech bubble) time period.

- Finds that there is abnormal amount of trading by individual investors on days the CEO is interviewed by CNBC.

- Also find that short interest increases on days that CEOs interview on CNBC, which can help explain the price reversal.

- Find that higher viewership leads to higher announcement day returns, as well as a higher return reversal.

Commentary:

- Hotter anchors generate more interest from male traders (not surprising)

CNBC Alpha Boost?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.