Many mutual funds will be sending you a very special gift in the coming weeks — their annual capital gains distributions.

Mutual fund investors get the pleasure of filling government coffers with more of their hard-earned wealth–yippee!

http://www.reuters.com/article/2013/12/11/funds-investors-gains-idUSL1N0JQ1DU20131211

Capital gains pain has arrived for U.S. mutual fund investors, to the tune of up to 60% of net asset value, according to the article.

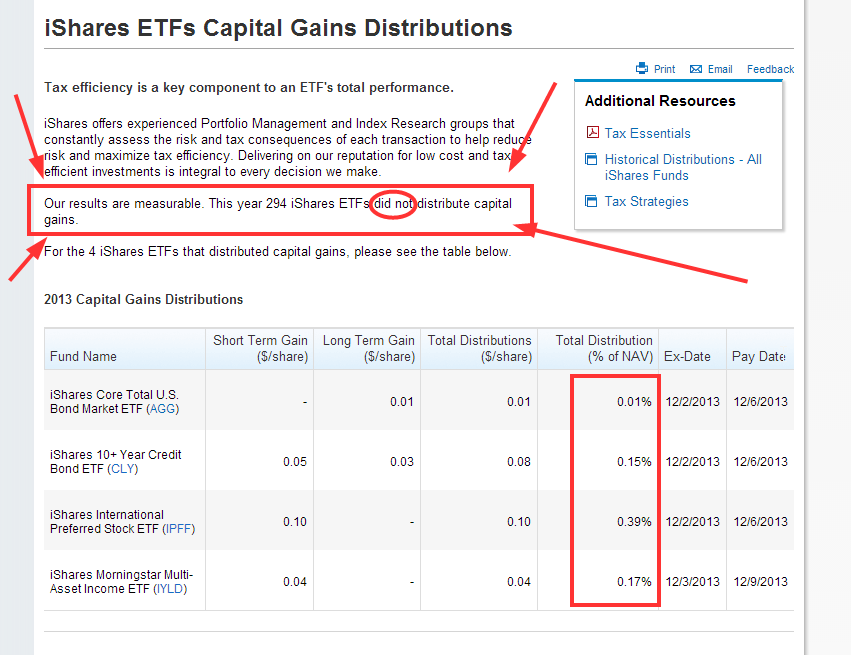

Meanwhile, back in ETF land, investors are hardly paying any taxes:

Let us all remember that Taxes are More Important than Alpha …you can also review this truism here

So let’s recap ETFs versus Mutual Funds:

- Lower fees, on average

- More transparency

- More investor control

- WAY better taxes

Why do mutual funds exist again? Oh, I forgot…mutual funds are WAY better for asset managers:

- Stickier assets

- Lower transparency

- Less investor control

- Cash drag

- Ability to leverage current distribution channels

- etc. etc. etc…

The big argument might be that mutual funds possess magical powers to generate alpha. The evidence that mutual funds add value isn’t convincing.

However, there is evidence that mutual funds LOVE the broker distribution channel…hawking product…ohhhh….yeaaaaahhh…

Mutual Fund Performance and the Incentive to Generate Alpha

To rationalize the well-known underperformance of the average actively managed mutual fund, we exploit the fact that retail funds in different market segments compete for different types of investors. Within the segment of funds marketed directly to retail investors, we show that flows chase risk-adjusted returns, and that funds respond by investing more in active management. Importantly, within this direct-sold segment, we find no evidence that actively managed funds underperform index funds. In contrast, we show that actively managed funds sold through brokers face a weaker incentive to generate alpha, and significantly underperform index funds.

Any predictions on when ETFs will overtake Mutual Funds? 5 years? 10 years? Never?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.