Fortune has an interesting article on Warren Buffett’s performance over the past 5 years (12/31/2008 through 12/31/2013)

Furthermore, though Buffett doesn’t specifically talk about this in his annual letter to shareholders, these results capped a five-year period, year-end 2008 to year-end 2013, in which the S&P 500 beat Berkshire’s gain in book value per share — the first such period in Berkshire’s history. For the five years, the S&P index jumped 128%. Berkshire’s book value per share rose by only 91%. Source: http://finance.fortune.cnn.com/2014/03/01/buffett-berkshire-hathaway-earnings/

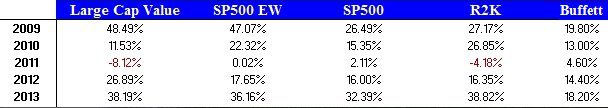

We did our own analysis of the past 5 years. The Berkshire letter states the following book value growth percentages for the past 5 years (ending December 31, 2013):

- 2009: 19.8%

- 2010: 13.0%

- 2011: 4.6%

- 2012: 14.4%

- 2013: 18.2%

- The source for Buffett’s returns–the annual letter.

These returns correspond to total return of 91.47% and a compound annual growth rate of 13.87%. Not bad!

But you could have done much better by doing nothing!!!

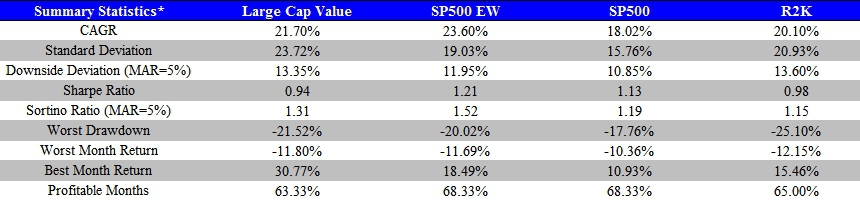

Below we post the following asset classes from 12/31/2008 through 12/31/2013:

- Large Cap Value = The top market cap and top B/M quintile Fama French equal-weight portfolio

- Source: Ken French’s website)

- S&P 500 EW = S&P 500 Equal-Weight Index Total Return Index

- Source: Bloomberg

- S&P 500 = S&P 500 Total Return Index

- Source: Bloomberg

- R2K = Russell 2000 Total Return Index

- Source: Bloomberg

Buffett lagged the S&P 500 by nearly 400bps. That is fairly tragic. But how about arguably more appropriate benchmarks such as the large cap value index or the S&P 500 equal-weight index? Buffett tilts cheap and he position sizes more akin to equal-weighting than he does towards market-cap weighting (see: http://www.cnbc.com/id/22130601) Buffett loses by 8-10%+ a year. That IS tragic.

So what is the message?

This is not a message saying Warren Buffett is a clown. We have clearly cherry picked a 5-year period where Buffett “lost his touch,” but the long-haul record of Buffett is undeniable: Buffett is a certifiable investment stud for the ages. If I could have his children, I would. So what is the point of highlighting Buffett’s Berkshire Beatdown? We think this is a chance for all of us to eat some humble pie. Buffet’s underperformance is a reminder that investing is incredibly difficult and even over a relatively long horizon the greatest managers/strategies can endure a pain train. We have first-hand insight on this cruel reality, because we crank the numbers on every strategy fathomable and there is no such thing as a strategy that works “all the time.” All the best systems have drawdown events and 5yr periods (sometimes 10yr periods) where they underperform the benchmark. The strategies that don’t have these characteristics can be sold by Bernie Madoff and Associates. Good luck with that. Buffett has been, currently is, and always will be an investment genius who can create value above and beyond a market-cap weighted passive index. I truly believe that. However, he still has to play in the same universe we play in. A universe filled with massive volatility, uncertainty, and fickle psychology. How’s the humble pie taste? Mine is excellent.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.