Been thinking about availability bias and how it affects stock returns.

This isn’t a new paper, but it is interesting nonetheless–An “oldie but goodie.”

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=971202

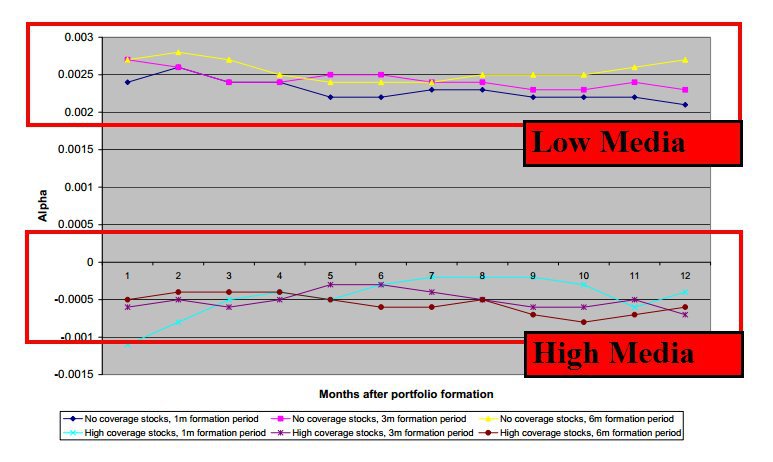

By reaching a broad population of investors, mass media can alleviate informational frictions and affect security pricing even if it does not supply genuine news. We investigate this hypothesis by studying the cross-sectional relation between media coverage and expected stock returns. We find that stocks with no media coverage earn higher returns than stocks with high media coverage even after controlling for well-known risk-factors. These results are more pronounced among small stocks and stocks with high individual ownership, low analyst following, and high idiosyncratic volatility. Our findings suggest that the breadth of information dissemination affects stock returns.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Here is another great paper on the subject:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=870498

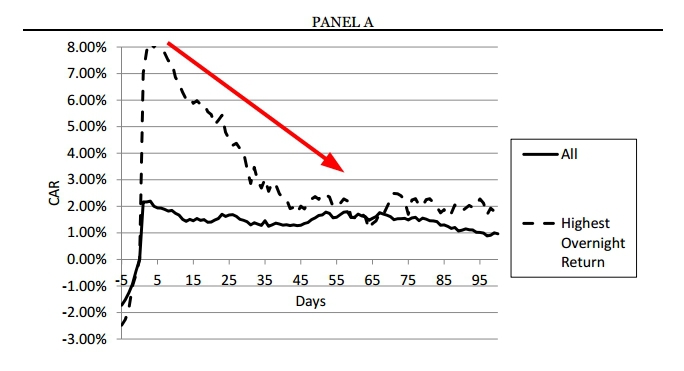

We use the popular television show Mad Money hosted by Jim Cramer to test theories of attention and limits to arbitrage. Stock recommendations on Mad Money constitute attention shocks to a large audience of individual traders. We find that stock recommendations lead to large overnight returns which subsequently reverse over the next few months. The spike-reversal pattern is strongest among small, illiquid stocks that are hard-to-arbitrage. Using daily Nielsen ratings as a direct measure of attention, we find the overnight return is strongest when high income viewership is high. We also find weak price effects among sell recommendations. Taken together, the evidence supports the retail attention hypothesis of Barber and Odean (2008) and illustrates the potential role of media in generating mispricing.

Watch out for the herd! High-flying Cramer picks come back to reality very quickly…

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.