The Predictive Ability of P/E Ratio: Evidence from Australia and New Zealand

- Basu and O’Shea

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

We find negative relationship between historical price-earnings (P/E) ratio and following year’s stock returns in Australia and New Zealand. The existence of P/E effect is consistent with prior research in US market but the effect seems to be stronger and short-lived. Whilst the excess returns of low P/E stocks are not explained by the market risk factor, they are not significant after controlling for size, value, and momentum. We also find evidence of a positive relationship between P/E ratio and the following year’s earnings growth that suggests that investors are generally good at assessing relative earnings growth prospect of companies.

Alpha Highlight:

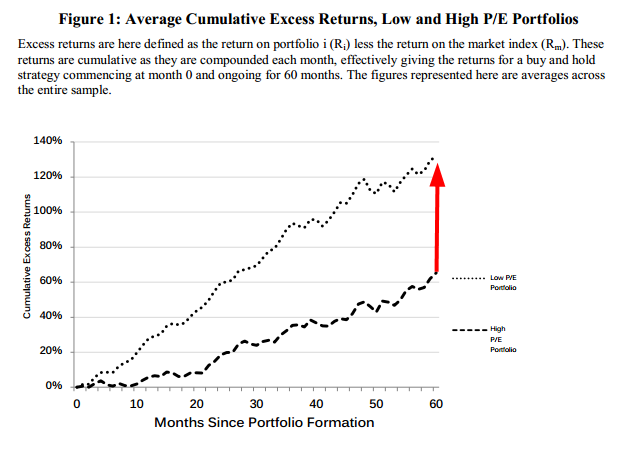

Here is the invested growth chart for cheap and expensive. As expected, cheap wins–by a long shot!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

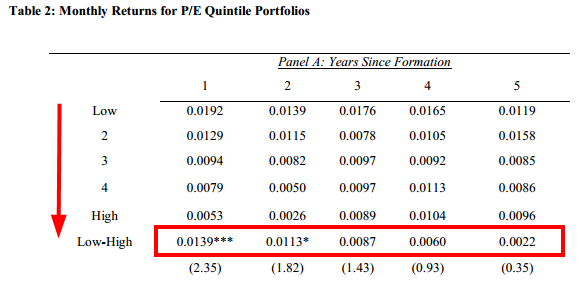

Just how strong are the results. The details are presented in table 1:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

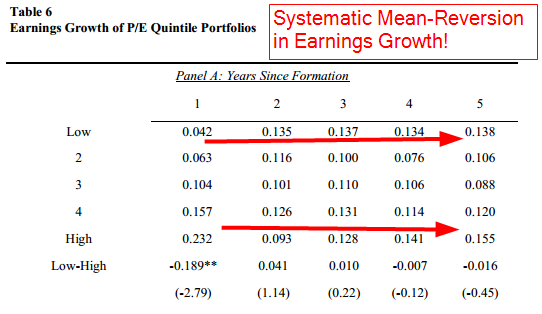

The authors take the analysis a level deeper ala Lakonishok, Shleifer, and Vishny (1994) and look at the relation between P/E and future earnings growth.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The authors find a positive relationship and make an important point that highlights investor bias:

From these results, we infer that investors correctly assess the relative earnings growth prospects of different firms but they seem to overestimate growth potential of certain firms resulting in bidding up of their prices and subsequent disappointment leading to lower future returns.

Buying cheap down under seems like the way to go!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.