People love to talk about the stock market. It’s practically a law of human nature.

What is the market telling us? Where is it going from here? Should I get in? Out? Is it fairly valued?

We don’t really know where the market is heading and are fairly confident nobody else knows either, nonetheless, its fun to pontificate on the subject.

Predictably, perhaps, when the Dow Jones surpassed 17,000 for the first time recently, it spurred a flurry of articles in the financial press. Seemingly everyone has a view as to whether the bull run can continue.

Although there are a number of lenses useful for assessing market conditions, many feel that Robert Shiller’s CAPE (Cyclically-adjusted PE ratio) index is among the more reliable yardsticks for measuring market valuations (we explain the CAPE ratio here). Note: CAPE is not a superhero; there are other ways to value the market).

Bob Shiller recently discussed his index, expressing concern about current valuations (we examined this about a year ago).

Is there a basis for concern?

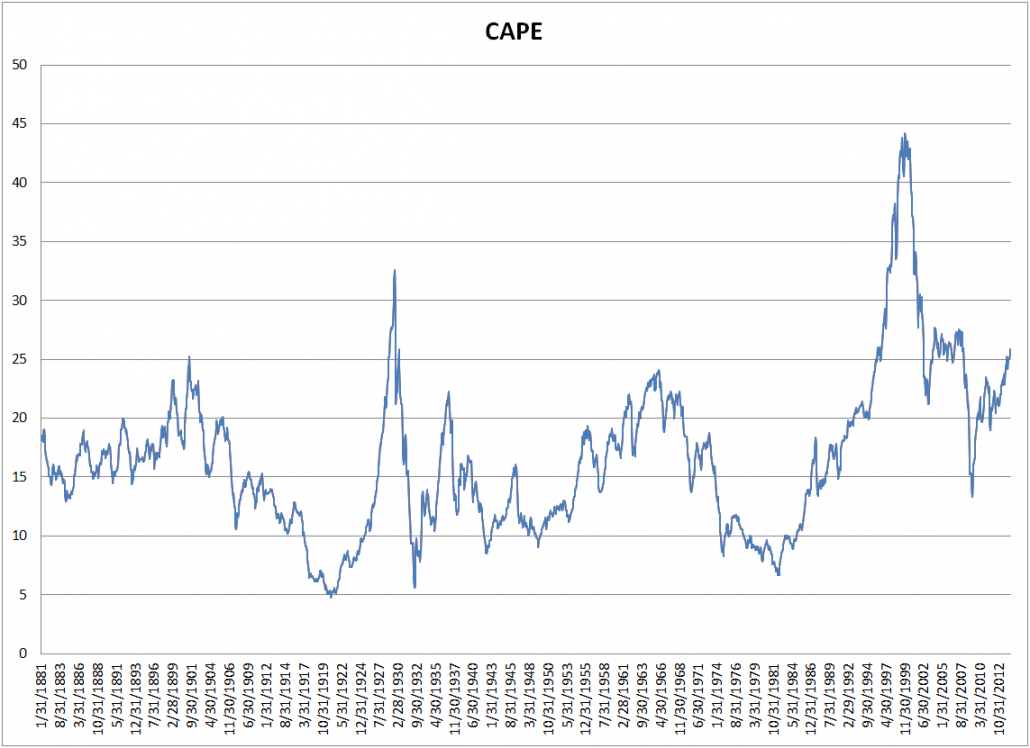

Based on a review of the Shiller CAPE index (shown below – data from Shiller’s website and the Federal Reserve website), the market certainly appears to be expensive. Currently the CAPE index is in the 93rd percentile based on the past 133 years of data!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

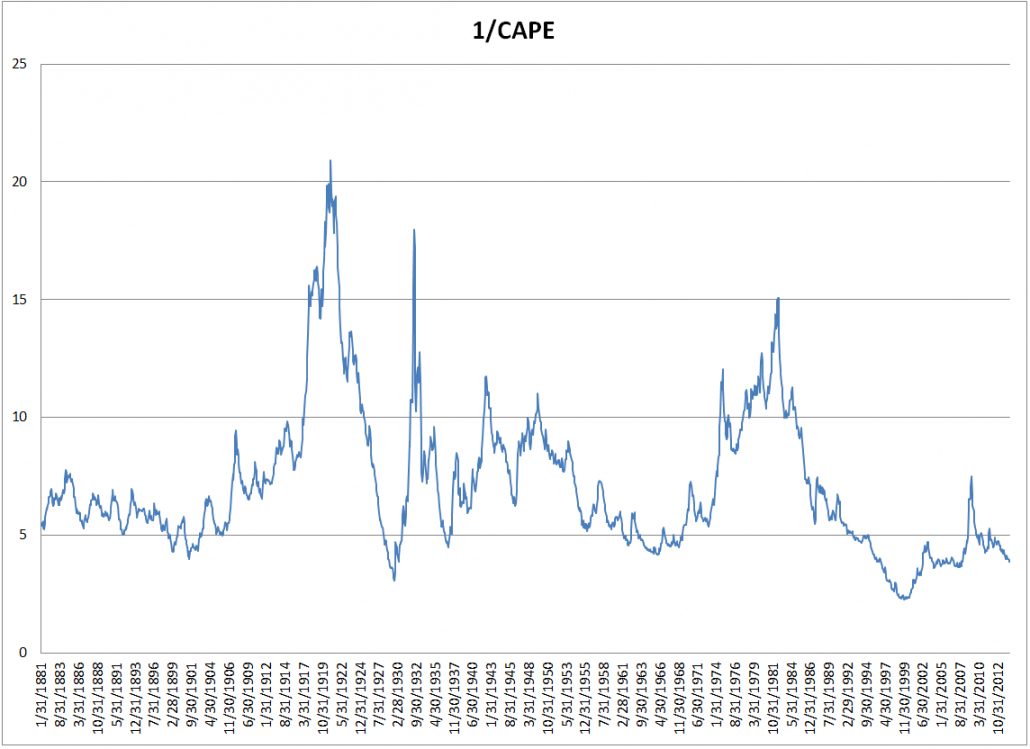

We prefer equity “yield” metrics to multiples, since yield formats make it easier to compare across other asset classes, such as REITs or bonds. The inverse of the CAPE index (1/CAPE) can be thought of as an “earnings yield.” This inverse is the cyclically-adjusted earnings over the current price. Here is the historical graph of 1/CAPE (now a “lower” number is considered more expensive).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

This is obviously the same basic framework as with multiples, but it does provide some additional perspective as we now can make more directly compare equity yields with yields on other asset classes.

Again, based on the CAPE and 1/CAPE ratios, the market is surely expensive. No argument there.

But what about alternatives to investing in stocks?

What yields can be had in other asset classes? Bonds seems like a reasonable place to start. Let’s compare our stock market yield versus what we can get on a 10-year treasury bill.

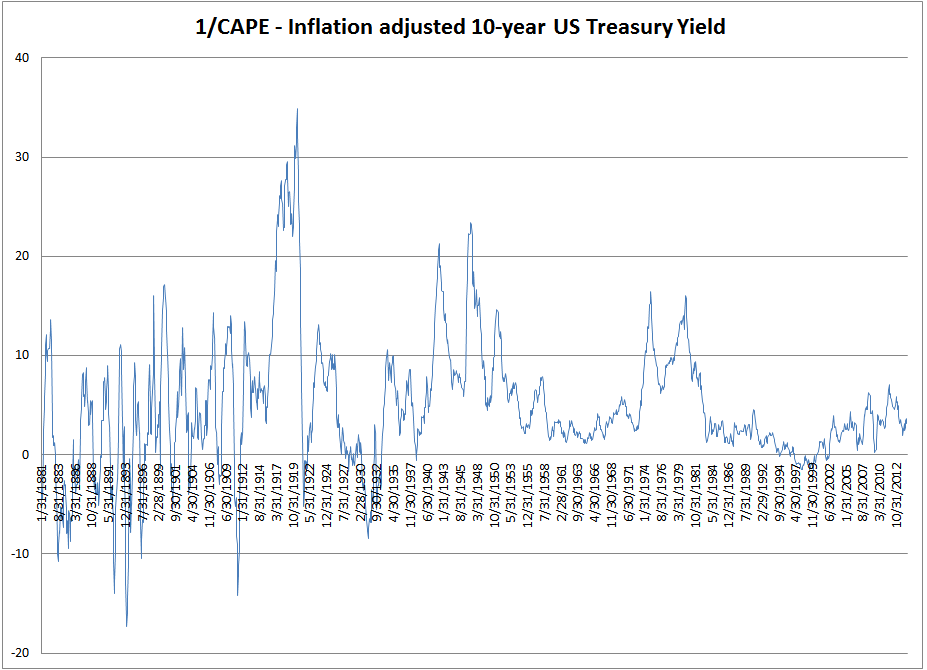

If we take the “earnings yield” (1/CAPE) and subtract the inflation adjusted 10-year U.S. Treasury yield, we can examine how expensive the market is relative to the bond alternative (a stock investor would prefer a higher spread, all else being equal). The inflation adjusted yield is calculated as the 10-year yield minus inflation, where inflation is measured as change in consumer CPI year over year.

The spread between stocks and bond yields is presented below:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The figure above is not screaming overvaluation for stocks. The current “excess” yield over the inflation-adjusted US Treasury rate does not appear too high, when compared to historical excess spreads.

In fact, the current value of 3.13% is only slightly below the median value of 3.51%, falling in the 46th percentile.

So if bonds are your risk-free alternative to stocks, then the market does not appear to be extraordinary expensive on a relative basis.

That being said, who knows where the market will go from here!

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.