Is the Cross-Section of Expected Bond Returns Influenced by Equity Return Predictors?

- Chordia, Goyal, Nozawa, Subrahmanyam and Tong

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

Using a comprehensive cross-section and time-series of corporate bond returns assembled from multiple data sources, we analyze whether commonly analyzed equity return predictors also predict bond returns. There is a surprisingly strong monthly lead from equity to bond returns, indicating that new information gets reflected in the equity market first…Finally, consistent with a relatively sophisticated institutional clientele, bonds are efficiently priced in that none of the behaviorally-motivated variables predict returns after accounting for transactions costs, though some risk-based variables continue to do so.

Alpha Highlight:

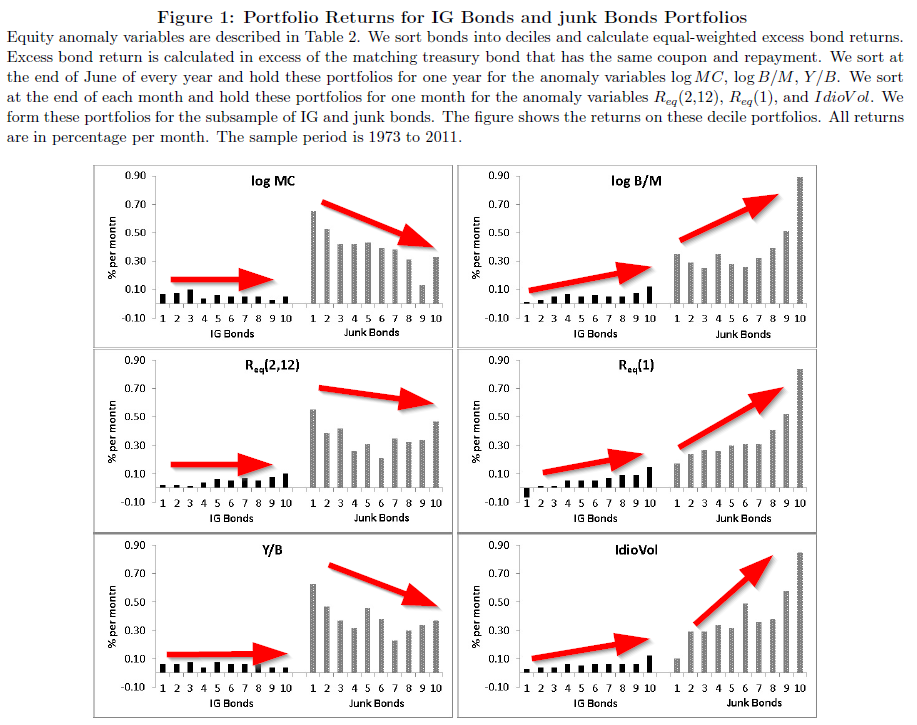

In this paper, the authors test whether cross-sectional equity return predictors also predict bond returns. To be specific, paper sorts corporate bonds into 10 decile portfolios based on equity characteristics like Size (log MC), Value (log B/M), Momentum, Past month’s equity return, Accruals, Asset Growth, Idiosyncratic Volatility, and so on.

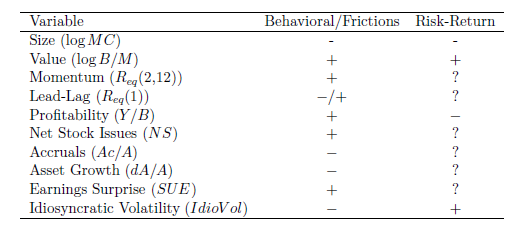

Chart below provides the expected signs of these variables under two categories of arguments, behavioral and risk-return.

The next step in the research process is to check the predictive power of these variables from 1973 to 2011. The detailed sorting and holding methods can be found in the descriptions of the graph below. The paper finds that some predictors, such as size, value, profitability, and past returns, are strong predictors of bond returns (red arrows moving in a direction ==> predictability; red arrows moving flat ==> no predictive ability). Other variables, like accounting accruals and earnings surprises, are not very predictive. The economic significance of predictable varaibles is higher for junk bonds that it is for investment grade (IG) bonds.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The paper also investigates whether or not there are arbitrage opportunities in bond markets. After transaction costs are considered, the bond market is extremely efficient.

This no-free-lunch evidence jibes with my anecdotal evidence: The smartest people I know are bond traders and not equity traders.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.