We highlighted a few weeks ago that Smart Beta is More Expensive Than You Think.

Smart Beta and other closet-indexers are everywhere, but what happened to old-fashioned high-conviction active management in the mid/large cap space? Last I checked the market isn’t totally efficient and people are still not 100% rational. It seems that there should be some opportunities for those who are prepared to demonstrate some conviction. So who are these intrepid souls?

Data:

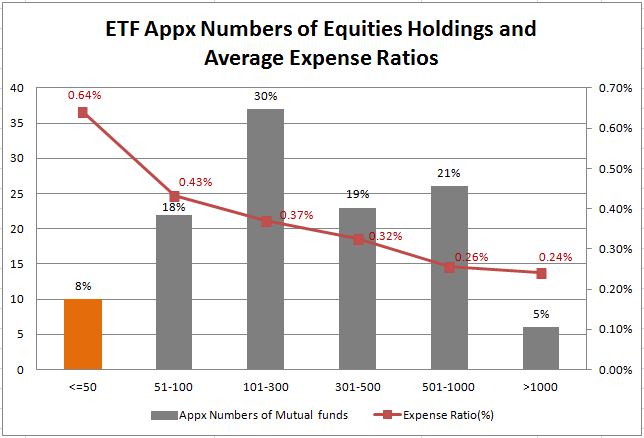

- ETF: Our samples of ETFs are from ETF database. We sort our samples by categories, “U.S. Equity, Large-cap, mid-cap, value, growth, and blend”. After excluding “fund of funds” and missing data, our sample include 124 ETFs.

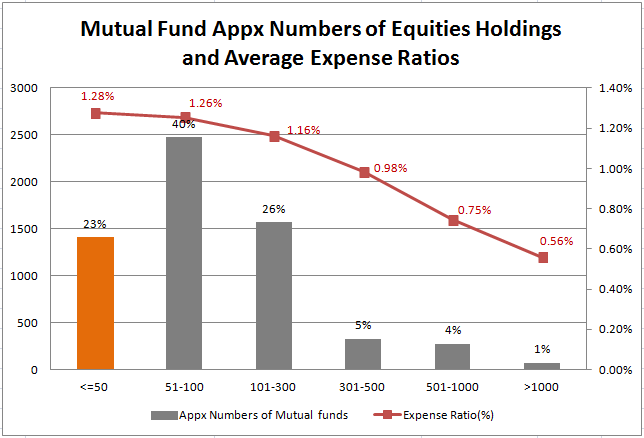

- Mutual Fund: Samples of Mutual funds are from Morningstar Premium Fund Screener. We use the same sorting options as the ETFs and we get 6,133 samples (missing data excluded).

Key evidence:

Focused ETF funds (with stock holdings <=50) only accounts for 8% of the funds in the universe. This percentage is consistent with the finding in the article “SEC Denies Precidian Active ETF Request.”

- On average, most ETFs are lower-cost index trackers, and not actively managed.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

There is a higher percentage of mutual funds that are focused (about 23%) compared with ETFs. The average expensive ratio of focused mutual funds is 128 bps. The more “active” the fund–the higher the cost–on average.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

There seems to be a lack of focused ETFs, but a glut of expensive focused mutual funds. When will we see active ETFs finally take off? Maybe never?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.