Want to identify how to replicate an expensive, tax-inefficient mutual fund with ETFs?

Interactive Brokers has a pretty cool tool that does exactly that!

Check out their “Mutual Fund Replicator.”

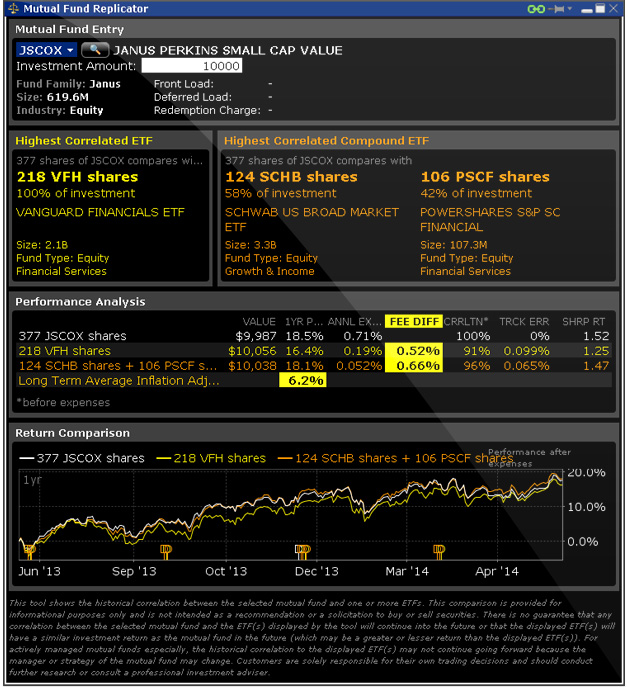

In the example below, the IB system examines the Janus Perkins Small Cap Value Fund, highlighting that it can be synthetically replicated with a portfolio consisting of 58% SCHB and 42% PSCF.

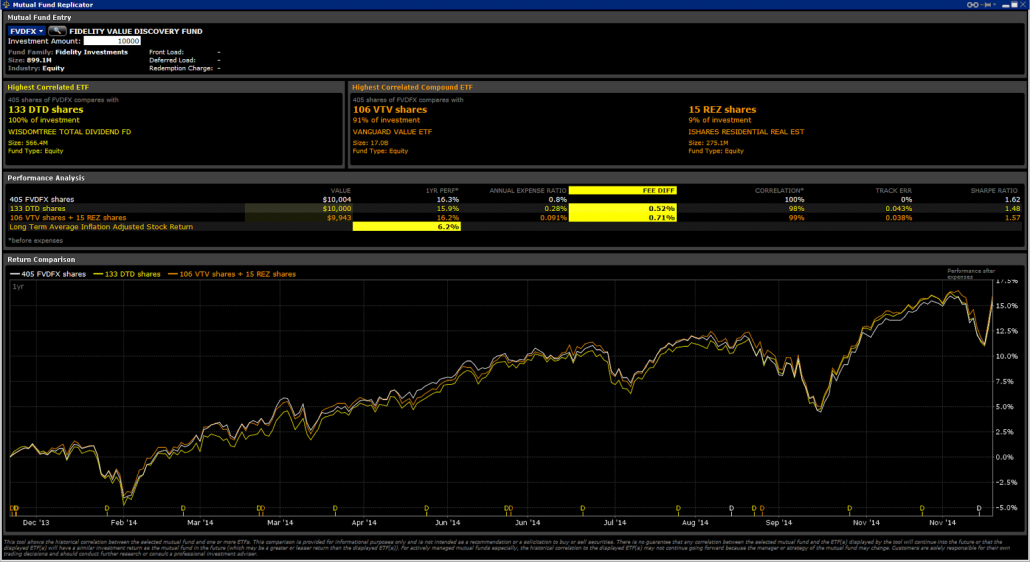

We went ahead and tried the system out on a random large cap value fund: The Fidelity Value Discovery Fund (FVDVX).

FVDVX is a 900mm large cap value fund with 92 holdings spread across mega-cap holdings ($10B and higher).

The fees aren’t ridiculous (80bps), but the fund can be replicated with a high degree of precision by simply investing 91% in Vanguard’s Value ETF and 9% in the iShares Residential Real Estate ETF.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.