Here is an interesting working paper on the use of fundamental analysis in stock selection. The authors take a dynamic regression “machine learning-esque” approach to building out statistical fair-value Ben Graham and David Dodd would be proud. Of course, this isn’t surprising if you’ve read our treatise on systematic value investing.

Fundamental Analysis Works

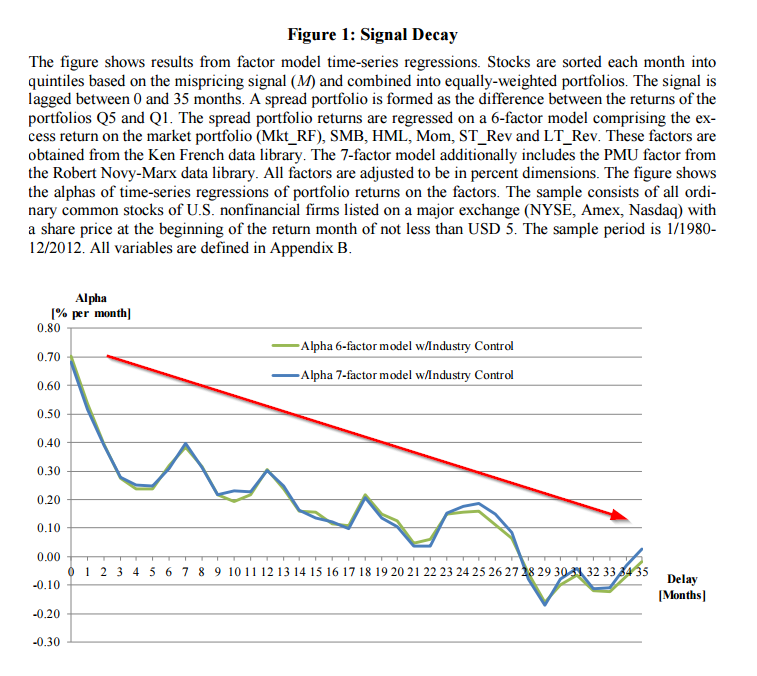

Stock prices cannot be the outcome of a rational efficient market if fundamental analysis based on public information is profitable. Our approach to fundamental analysis estimates the intrinsic fair values of stocks from the most common quarterly balance sheet and income statement items that were last reported in Compustat. Taking the view of a statistician with little knowledge of the theory of finance, we show that the most basic form of fundamental analysis yields trades with risk-adjusted returns of up to 9% per year. The trading strategy relies on convergence of market prices to their fair values. The greatest rate of convergence occurs in the month after the mispricing signal and subsequently decays to zero over the subsequent 28 months. Profits from trading are present for both large and small firms in economically significant magnitudes.

The punchline is summarized in the chart below:

- Balance sheet and income sheet items seem helpful in predicting future returns

- Turnover/activity is required to exploit the edge

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.