Who is the greatest stock picker of all time?

Many investors’ knee-jerk reaction is Warren Buffett.

Understandable response, but is that the answer? Maybe not…

So who is the greatest investor of all time?

A few years ago, I asked this question of a mentor and friend. His answer surprised me. Without a moment’s hesitation, he replied that it was Peter Lynch. Our conversation went something like this…

Me: Lynch, what about Buffett? Surely his results over such a long period of time speak for themselves?

Friend: Buffett isn’t a stock picker, his success is largely due to factor bets such as value and quality. Lynch, on the other hand, was a genuine stock picker.

Me: What makes you say that?

Friend: He performed well, even when experiencing outflows. Buffett never had to manage outflows.(1) Also, the magnitude of his out-performance was so large that it’s statistically unlikely that his performance was due to luck.

Buffett versus Lynch: Some Background

I’ve thought about Buffett vs. Lynch question several times over the years. So it was with great enthusiasm that I read a recent AQR paper: Superstar Investors.(2) Dan Villalon and Jordan Brooks compare the performance of 4 super investors:

- Warren Buffett

- Bill Gross

- George Soros

- Peter Lynch

We will consider the results of AQR’s paper shortly. But first, it might be helpful to learn a little more about Peter Lynch and how his investment approach differed from that of Warren Buffett.

One thing that stood out about Lynch was his flexibility. Lynch wasn’t value, he wasn’t growth, he wasn’t size and he wasn’t quality. Instead, he was all of those things at the same time. For example, in his book, One Up on Wall Street, (3) Lynch describes the way he categorizes stocks into different kinds of opportunities:

- Slow Growers – aging companies growing slightly faster than GDP. Usually bought for their dividends and buybacks.

- Stalwarts – large quality companies that are profitable and are growing slightly faster than slow growers.

- Cyclicals – A company whose sales and profits rise and fall in a regular if not completely predictable fashion.

- Fast Growers – Small, aggressive new enterprises growing at 20-25% per year.

- Turnarounds – Battered bruised and possibly in or facing bankruptcy. The performance of these stocks is largely uncorrelated to the broad market.

- Asset Plays –A company that’s sitting on something valuable that the market has overlooked, for example, real estate.

This was very unusual. I can confidently say – as a professional portfolio manager that has invested with hundreds of fund managers – that almost nobody invests like this. Fund managers usually stick to a style (e.g. large-cap growth), a particular valuation methodology (e.g. free cash flow to the firm, forecast over 10 years with a terminal value) or a type of company (e.g. profitably companies with reinvestment opportunities at fair prices). In other words, each manager has one philosophy/opportunity/method that they stick with.(4)

But a rigid process is not a panacea: this approach might create blind spots and/or constrain their ability to identify the best investments. A strong philosophical bent helps on the fundraising front because most clients and consultants want managers to avoid “style drift.” Lynch was different. Lynch was often labeled a growth manager, and yet, only 3 of the 6 categories above have anything to do with revenue or earnings growth.

Not only was Lynch unique among fund managers, but his eclectic approach was also quite different to Buffett’s. The Oracle of Omaha has focused primarily on opportunities within his “circle of competence.” The outline of this “circle” can be roughly drawn around the following sectors:

- Banking

- Insurance

- Media

- Consumer non-durables

Buffett also holds relatively few, concentrated positions. This is in stark contrast to Lynch, who owned approximately 1,400 stocks at the time he wrote One Up on Wall Street!

Lynch was a true all-rounder, comfortable investing in all sorts of opportunities. Meanwhile, Buffett’s investment process has gradually migrated over time through 3 stages:

- Early – Graham and Dodd net-nets, deep value (“cigar butts”) and merger arbitrage.

- Middle – great companies (i.e. an enduring “moat “) at reasonable prices (the influence of Charlie Munger).

- Late – Private investments, special one-off deals, and securities.

The Buffett style migration appears to have been driven by 4 factors:

- Changes in market conditions. By the 1970s, there were fewer net-nets available in the market.

- The influence of Charlie Munger. Munger helped Buffett to appreciate that, “time is the friend of a wonderful business.”

- Size. Managing increasing amounts of money meant that Buffett had to shift his investment process away from “cigar butts” and merger arbitrage and focus instead on companies with a “moat” and buying whole companies.

- Reputation. Buffett’s reputation ensures that he has access to opportunities that few can match.

For readers wanting to learn more about the evolution of Warren Buffett’s investment strategy over time, I suggest two excellent books Warren Buffett’s Ground Rules: Words of Wisdom from the Partnership Letters of the World’s Greatest Investor by Jeremy Miller and Inside the Investments of Warren Buffett: Twenty Cases by Yefei Lu.(5)

Buffett Versus Lynch: The Evidence

Let’s return to the AQR Superstar Investors paper. The focus of the paper is to examine the investment performance of 4 superstar investors to see how much of their performance can be explained by to systematic exposure to one or more factors.

Warren Buffett Factor Analysis

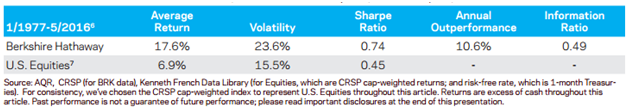

Warren Buffett’s investment performance during his tenure at Berkshire Hathaway is nothing short of legendary, beating the market by over 10% per year from January 1977 through to May 2016. Risk-adjusted returns are also impressive with a Sharpe ratio of 0.74 and an information ratio of 0.49.

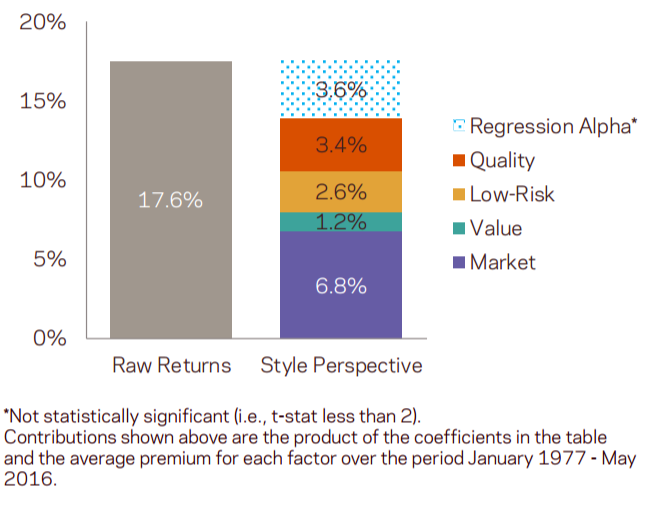

But it seems that the majority of Buffett’s phenomenal performance can be explained by exposures to several factors.

AQR explains:

We find that this alpha becomes statistically insignificant when controlling for some of the investment styles Buffett describes in his writings.

The “Buffett Factors” can be described below:

- Market: the U.S. equity market factor from Kenneth French’s data library

- Value: the HML factor from Kenneth French’s data library

- Low-Risk: the “Betting-Against-Beta” (BAB) factor10 from AQR’s data library

- Quality: the “Quality-Minus-Junk” (QMJ) factor11 from AQR’s data library

Of the 10.6% out-performance achieved by Buffett, 7% can be explained by the factors listed above, leaving an “alpha” of 3.6%. Furthermore, the t-statistic for this alpha is not statistically significant. Buffett’s portfolio reflects a cheap-stock portfolio with quality and low-beta characteristics.(6)

Does this mean that Buffett has no skill? Far from it! As the executive summary to the AQR paper points out:

Though our results may seem compelling, we have the clear benefit of hindsight. Any “alpha” that comes out of our analysis is thus understated. These great investors “figured it out” first, had the ability to stick to their philosophies, and rightly deserve their reputations.

It’s also worth pointing out that a large part of Buffett’s performance can be explained by the use of leverage. AQR explains:

One of the ways that Berkshire Hathaway was able to add so much return above that of the market is Berkshire’s access to cheap leverage via its insurance business, allowing it to harvest greater amounts of these style exposures than most traditional investors could.

And just how much leverage was used? AQR again:

To get an idea of magnitude, for every dollar invested in BRK from 1977 through May 2016, investors on average got about $1 exposure to the stock market (the market beta) and an additional $1.3 dollars exposure to the other factor premia shown in Exhibit 1 (the sum of the betas to the value, low-risk and quality factors from the regression).

Peter Lynch Factor Analysis

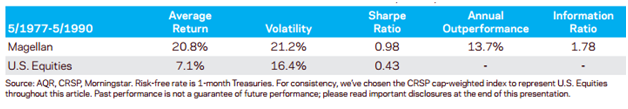

Lynch’s record is also extraordinary, annual out-performance of 13.7% per year, not to mention a Sharpe ratio of 0.98 and an information ratio of 1.78. These sorts of figures are virtually unheard of in traditional long-only asset management.

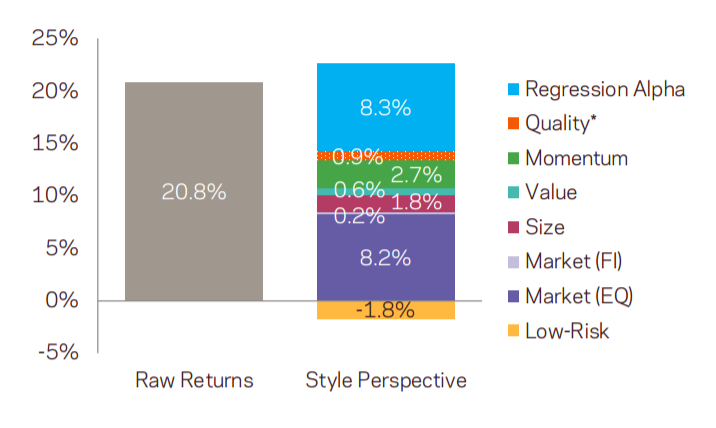

But how much of Lynch’s performance can be explained by systematic factor exposures? This is where Lynch’s flexible approach to considering all sorts of investments makes the analysis challenging.

AQR explains:

Like other superstars covered here, Lynch was public about his investment philosophy, having authored multiple books on the topic. Yet, Lynch’s philosophy was arguably less parsimonious than that of the other superstars: he had various checklists for various categories of companies, making the task of evaluating Magellan’s track record via broad factors more difficult (and maybe less relevant)

Unable to pinpoint exactly what drove Lynch’s performance based on public records, the authors chose to go with a cadre of the most-used factors from academic research. The “Lynch Factors” include the following:

- Market: both the U.S. equity market factor from Kenneth French’s data library and the Barclays U.S. Aggregate Bond Index

- Size: the SMB factor from Kenneth French’s data library

- Value: the HML factor from Kenneth French’s data library

- Momentum: the UMD factor from Kenneth French’s data library

- Quality: the QMJ factor from AQR’s data library

- Low-Risk: the BAB factor from AQR’s data library

Of the 13.7% out-performance achieved by Lynch, 5.4% can be explained by the factors listed above, leaving a whopping “alpha” of 8.3%. Also important, the t-statistic for this alpha is highly statistically significant.

Lynch Wins the Factor Horse Race

Roughly 66% of Warren Buffett’s outperformance can be explained by systematic exposure to various factors over time, leaving 34% of the out-performance unexplained. Presumably, this is alpha or stock-picking skill. On the other hand, approximately 40% of Peter Lynch’s Buffett’s outperformance can be explained by systematic exposure to various factors over time, leaving 60% of the out-performance unexplained. Thus we can conclude that the majority of Lynch’s performance was due either to stock-picking skill or dumb luck (highly unlikely as we’ll discover later on in this article).

This is the main reason why my friend believed that Lynch was a better stock picker than Buffett. But perhaps there is more to the story?

But Factors Aren’t Everything

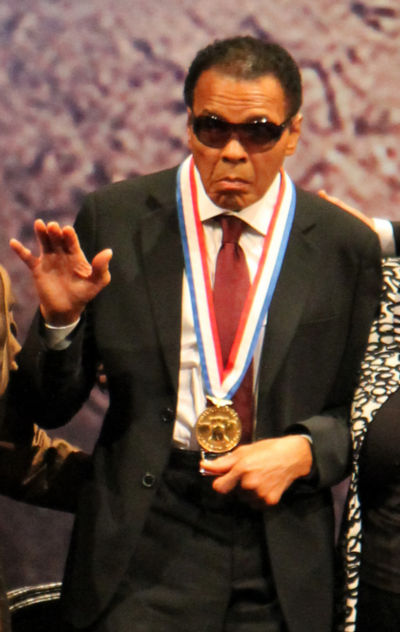

Answering that question is about as difficult as trying to answer who was the greatest heavyweight boxing champion of all time. Was it Muhammad Ali, Joe Louis or Rocky Marciano?

Funnily enough, there was such an attempt, the computer-generated Super Fight. (7)

between Rocky Marciano and Muhammad Ali. As Wikipedia reports:

Punch-by-punch details of the boxer’s records during their prime were entered into an NCR 315 computer. Also their strengths, weaknesses, fighting styles and patterns and other factors and scenarios that the boxers could go through were converted into formulas…… The two fighters sparred for between 70 and 75 rounds, exchanging mainly body blows with some head shots in-between, which were later edited together according to the findings of the computer. Braddock, Louis, Schmeling, Sharkey and Walcott also recorded commentary to be used in the film.

What was the result?

American and Canadian audiences were shown a version where the computer had determined that Marciano would have knocked Ali out in the 13th round; whilst European audiences were shown another ending in which Ali was depicted the winner by KO also in the 13th Round…Ali attended a screening of the film the night of the release. He immediately relaunched legal proceedings against Woroner, again stating defamation of character, alleging the film’s marketing had misled audiences worldwide to believe the fight was actual, whilst also stating any version of the film which depicted him losing was a result of him not taking the simulation seriously…Ali later dropped the lawsuit upon discovering his depicted win in European theatres, whilst also having been made aware of the filmmakers plans to destroy remaining prints of the film to prevent potential legal action.

What might it look like if we were to create a “super fight” as it were between Buffett and Lynch? And who would win?

Establishing the Ground Rules

To answer these questions, I came up with a list of 11 criteria, based on academic research and experience, that could reasonably be used to award the title of the world’s greatest investor. My list is by no means exhaustive of definitive. I acknowledge that trying to compare two heavyweight investors in their prime is an impossible task. Still, it’s a worthwhile thought experiment that can help us explore what it takes to beat the market.

My 11 criteria are as follows:

- Factor Correlation. Higher factor correlations suggest that systematic factor exposures are the primary driver of performance. The lower the better.

- Alpha. High alpha coefficients suggest that performance is driven by stock-picking skill (as opposed to factor exposures).The higher, the better.

- Risk-adjusted performance. Sharpe ratio (absolute risk) and Information ratio (relative risk). The higher, the better.

- Investment vehicle. Open vehicles are subject to flows from investors and consequently require a minimum-level of liquidity. Investor flows tend to rise (fall) after a period of strong (weak) performance. Investors in closed vehicles have greater freedom to invest as they are not subject to the whims of investors.

- Capacity. All other things being equal, the larger the sum of money managed, the harder it is to consistently out-perform the market.

- Leverage. Leverage boosts returns both on the upside and on the downside. All other things being equal, a levered equity portfolio is expected to out-perform an unlevered equity portfolio over the long-term, although the reverse is true during a bear market.

- Unlisted investments. Unlisted investments are expected to offer higher returns due to the illiquidity premium (assuming that they were bought at sensible valuations).

- Longevity. The longer the period of out-performance the better.

- Calendar-year out-performance. A simple measure of performance consistency. In other words, was the out-performance due to a single spectacular year or several years? I examined the period from 1977-1990 during which Peter Lynch ran the Magellan Fund.

- Time spent in a bear market. The number of years was the S&P 500 in a bear market (as defined by Ned Davis Research) during each investor’s career. The assumption is that it’s tougher to beat the market during a bear market, particularly if the investment vehicle is also open as the likelihood of suffering redemptions increases.

- Probability of out-performance due to luck. A mathematical calculation of the chances that the level of out-performance was simply due to luck.

And the Winner is?

The title of World’s Greatest Investor goes to Peter Lynch with a score of 9/11:(8)

| Category | Buffett | Lynch | Winner |

| Factor Correlation (9) | High | Low | Lynch |

| Alpha (10) | Low | High | Lynch |

| Risk-Adjusted Performance (Sharpe and Information Ratios) | 0.74 & 0.49 | 0.98 & 1.78 | Lynch |

| Investment Vehicle | Private (closed) | Public (open) | Lynch |

| Capacity | $5.3 billion (11) | $14 billion | Lynch |

| Leverage | Yes | No | Lynch |

| Unlisted Investments | Yes | No | Lynch |

| Longevity | 50+ Years | 13 Years | Buffett |

| Calendar Year Outperformance | 12/13 | 13 years | Buffett |

| Time Spent in a Bear Market (12) | 31.37% | 46.15% | Lynch |

| Probability of Outperformance due to Luck | Approximately 1 in 51,500 (13) | Approximately 1 in 500,000 (14) | Lynch |

Lynch ran an open investment vehicle and was subject to the vagaries of retail investors. On the other had Buffett, as the controlling shareholder of Berkshire Hathaway, was largely free to operate as he saw fit.

Buffet was free to use leverage and to invest in private investments, while Lynch was not. The size of the stock portfolio managed by Lynch in 1990 dwarfed the size of the Berkshire Hathaway’s investment portfolio at the time. The fact that Lynch was able to defy gravity and still outperform despite managing so much money really singles him out as unique in my mind.

Buffett’s returns were more consistent and the longevity of his record easily eclipses that of Lynch, who unusually for a fund manager, decided to retire while he was ahead. Buffett’s returns were also slightly more consistent than Lynch’s, which isn’t surprising considering that Lynch ran a higher risk (i.e. more volatile) portfolio.

Lynch spent a greater percentage of his career investing in bear markets, which would have tested his skills as a fund manager. It also proves that his phenomenal performance wasn’t just a “fair weather” record earned during a calm market environment.

It is highly unlikely that the performance records of both investors were due to luck. That said, the probability that Lynch’s results were due to luck is far, far smaller than the probability that Buffett’s results were due to luck.

Conclusions

So what should we make of all of this? Both Buffett and Lynch are incredible investors but their performance edge came from two very different sources.

In Buffett’s case, the edge came from creating an environment that allows him to invest for the long-term, free from the constraints that apply to most institutional investment managers. He used this freedom to consistently apply a disciplined process designed to exploit factors (although Buffett may not have described it this way back in 1966 when he took control of Berkshire Hathaway) and to let it compound over time.

For Lynch, the edge came from developing a way of looking at markets that a) allowed him to see opportunities in many different places and b) was flexible enough to take advantage of them all. He developed the skill of categorizing companies by their story – the “two-minute drill” –following the narrative that he created over time. He liked to own lots of different stories. In contrast, most fund managers look for the same type of story over and over again, making it difficult for them to out-perform when their particular approach is out of favor with the market.

So who really is the greatest? I don’t know, but it sure is fun trying to figure it out.

P.S. For readers interested in further analysis of Peter Lynch’s investment record, please visit The Personal Finance Engineer.(15) and A Wealth of Common Sense (16)

References[+]

| ↑1 | see here for an example time period when even Buffett would have experienced outflows. |

|---|---|

| ↑2 | Source: AQR paper: Superstar Investors by Dan Villalon and Jordan Brooks |

| ↑3 | Source: One Up on Wall Street |

| ↑4 | Here is a piece that elaborates on the subject of what good managers look like and do. |

| ↑5 | Source: Warren Buffett’s Ground Rules: Words of Wisdom from the Partnership Letters of the World’s Greatest Investor by Jeremy Miller and Inside the Investments of Warren Buffett: Twenty Cases by Yefei Lu |

| ↑6 | This construction is similar in nature to the Quantitative Value process |

| ↑7 | Source: Wikipedia, Super Fight |

| ↑8 | Source: AQR, Superstar Investors |

| ↑9 | Source: AQR, Superstar Investors |

| ↑10 | Source: AQR, Superstar Investors |

| ↑11 | Source: 1990 Berkshire Hathaway Annual Report |

| ↑12 | Years (percentage) during the investment career – Buffett 51 years (to 2016) and Lynch 13 years – where the S&P 500 suffered a bear market. Source: Ned Davis Research and quoted in the 2017 Stock Trader’s Almanac. |

| ↑13 | Source: Warren Buffett: Oracle or orang-utan? |

| ↑14 | Source: Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies, by Jeremy Siegel |

| ↑15 | Source: Deconstructing Peter Lynch |

| ↑16 | Source: Peter Lynch’s Track Record Revisited |

About the Author: Dan Grioli

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.