- Title: Factor Investing in the Bond Market

- Authors: Patrick Houweling and Jeroen van Zundert

- Publication: Financial Analysts Journal, Vol. 3 No. 2, 2017 (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2516322)

What are the research questions?

- Can the concepts contained in equity “factors” translate to the corporate bond market?

- Do single factor bond portfolios generate alpha?

- Do multifactor bond portfolios contribute additional value?

What are the Academic Insights?

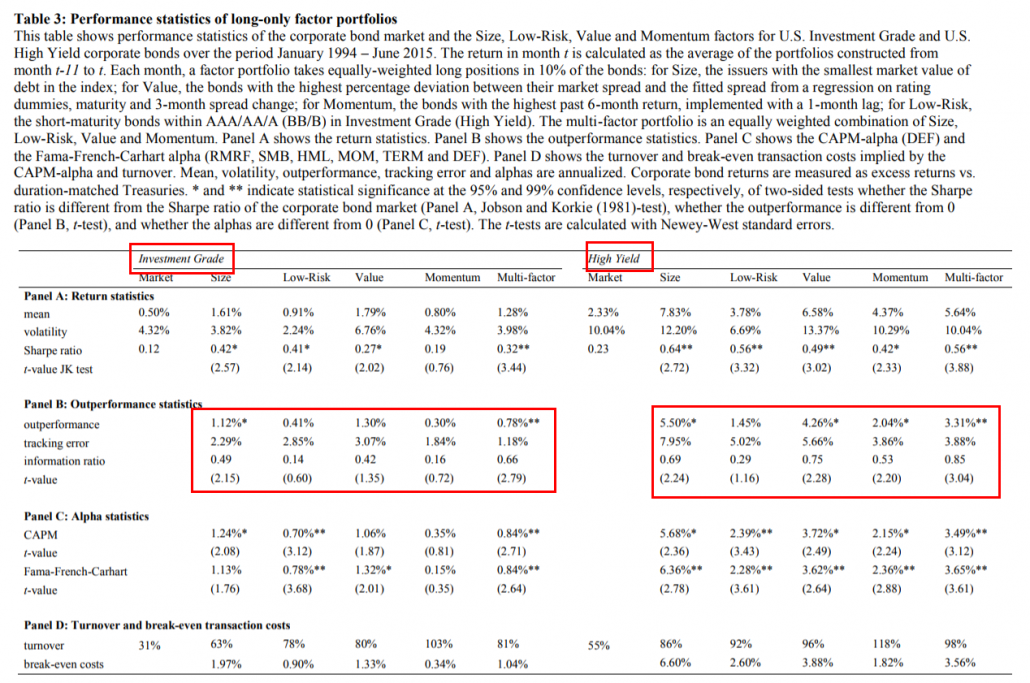

- YES. Using bond characteristics only, definitions for Value (based on differential between actual vs “fair” credit spread), Low Risk (based on maturity, and credit rating), Momentum (based on previous six month return with one month lag) and Size (based on total company debt) were defined and used to construct single and multifactor portfolios.

- YES. For the Investment Grade universe of bonds and using the IG bond market return as the risk adjustment, positive alphas were observed for Size (1.12% sig), Low Risk (.41% not sig), Value (1.3% not sig) and Momentum (.30% not sig) factors. For the High Yield universe of bonds, and using the HY bond market return as the risk adjustment, positive alphas were observed for Size (5.5% sig), Low Risk (1.45% not sig), Value (4.26% sig) and Momentum (2.04% sig) factors.

- YES. When combined into a multifactor bond portfolio, large reductions in tracking error, increases in the information ratio as well as significant alphas were observed. Outperformance relative to the IG and HY bond markets were .78% (sig) for the IG multifactor bond portfolio and 3.31%(sig) for the HY multifactor bond portfolio.

Returns were presented after transactions costs.

Why does it matter?

The few existing studies on factors in the corporate bond market examine only one or two factors. This study includes four factors using a consistent methodology throughout the single data set. The time period covered 1994-2015. The authors used monthly constituent data from the Barclays U.S. Corporate Investment Grade Index and the Barclays U.S. Corporate High Yield Index.

The results indicate that investors should explicitly include factors in their strategic allocation to the corporate bond market. Performance attributes of multifactor bond portfolios include diversification benefits, lower tracking error (risk); and higher information ratios (return to risk).

The authors conducted robustness tests with respect to the factor definitions used and found that although equity factor definitions do produce alpha when applied to bonds, they are lower (with the exception of momentum) than when bond specific definitions are used.

What is the most important chart from the paper?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.