The passive investing revolution is truly upon us. Ever since 1975, when Jack Bogle introduced the first index mutual fund, passive indexing has marched on relentlessly.

Jack Bogle is everywhere. He was on TV this morning expounding on the infallible logic of passive investing, a subject he’s written books about, including, “The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns.”

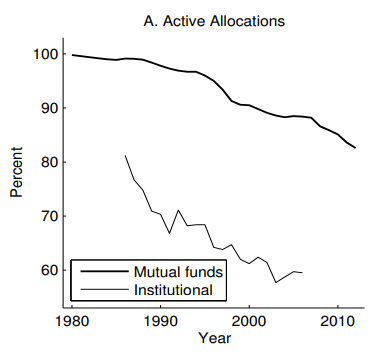

As Vanguard has increasingly taken over the world, active management has been in decline. According to Robert Stambaugh, nearly all equity mutual funds were active in 1980, but by 2012, that figure had been reduced to 83%:

So it appears that the cat is out of the bag, and investors are finally wising up to the fact that active management is a fool’s game. After years of being hoodwinked by Wall Street, investors have finally seen the light.

An Old Debate

Yet this is not a new idea. People have been engaged in the active/passive debate for decades. For instance, in “Securities In An Insecure World,” a lecture delivered by Ben Graham in 1963, Graham foreshadows the same commentary that is taking place today, over 50 years later.

In his speech, Graham observes that while for a time many thought equities would never go up again, Wall Street has a short memory.

From the speech:

They are returning to the idea that for the smart investor the question of stock market fluctuations does not have to be considered to any great extent…[One claim made]…is a denial that the “stock market” exists at all, meaning thereby that what the market averages do is of no real importance to the intelligent, well-advised investor or speculator. It seems to be a ruling tenet of Wall Street that if you practice the proper kind of selectivity in investments you don’t have to worry about what the stock market does as a whole, as shown by the average, for at all times the good stocks will be going up and the bad ones will be going down and all you need to do is pick the good stocks and forget about the stock-market averages…

[This] claim which is that there is no real “stock market” but only, as the Wall Street people like to say, only “a market of stocks”—deserves a moment or two of discussion. What they mean by saying this is that investment results depend only on what happens to individual securities, some of which will go up and others down, and that it is illusory to talk about what happens to the market as a whole as having a major bearing on how the investor fares.I disagree with that point of view…[The] most important reason why the investor should not be led to emphasize his selection of individual stocks, and to neglect the general level of the stock market is the fact that there is no indication that the investor can do better than the market averages by making his own selections or by taking expert advice.

Here is where Graham goes off on the stock-picking industry — 50+ years ago!

The outstanding support for that pessimistic statement is found in the record of the investment funds, which represent a combination of about the best financial brains in the country, and a tremendous expenditure, of money, time, and carefully directed effort. The record shows that the funds have had great difficulty as a whole in equaling the performance of the 30 stocks in the Dow Jones Averages or the 500 Standard & Poors Index. If an investor had been able, by some rough across-the-board diversification to make up a portfolio approximating these averages he would have had every reason to expect about as good results as were shown by the very intelligent and careful stock selections by the investment-fund managers. But the great justification for the mutual funds is that very few investors actually do follow such a sound and simple policy…

Take the case where an individual stock is favored by one of my own fraternity of security analysis is because he is optimistic about its future earnings and general prospects. To the extent that investors generally agree that this company has good future prospects to that extent its prospects are also likely to be fully reflected and perhaps over-reflected in the market prices. Sometimes you find the contrary case where a Wall Street man may say “Nobody likes this stock, nobody has confidence in it, but I have confidence in it and I know its results are going to be better in the future.” That’s an interesting and valuable conclusion if true. The trouble is that in most cases you can’t rely on its dependability. The man may be right or he may be wrong in saying that some unpopular stock is going to have a very good future. That is the dilemma all investors face in trying to make money out of forecasts as to the future prospects of any individual security…

Ben Graham is channeling his inner Jack Bogle and seems to be making a good argument for the Efficient Market Hypothesis, which would be formalized a few years later. Yet Graham is known as the father of value investing, which is an explicitly active strategy.

How can we square these views? Some additional commentary from Graham in his speech is illuminating:

My recent crusade has been to persuade Wall Street that it has made a mistake, and harmed itself, in suppressing the word “speculation” from its vocabulary. Speculation is not bad in itself; overspeculation is. It is important that the public should have a fairly good idea of the extent to which it is speculating, not only when it buys a “hot issue” at a completely silly price, but even when it buys into a wonderful concern such as IBM at 70 times its highest recorded earnings. To my mind the most valuable contribution that security analysts could make to the art of investing would be the determination of the investment and speculative components in the current price of any given common stock, so that the intending buyer might have some notion of the risks he is taking as well as what profit he might make…

Let me raise a final question: Despite rather discouraging results from endeavors to predict market moves or to select the most attractive companies, can the intelligent investor follow any policies of common-stock selection that promise better than average results? I think it is possible for some strong-minded investors to do this, by buying value rather than prospects or popularity…

According to an old Wall Street story, when a certain broker was asked by a client to recommend issues to buy, he always asked in returns, “What is your preference? Do you want to eat well or to sleep well?” I am optimist enough to believe that by following sound policies almost any investor—even in this insecure world—should be able to eat well enough without having to lose any sleep.

Although Graham understood the logic of passive, he also believed that there was a role for active investing, for instance by buying value (veruss “prospects or popularity”), and doing so in an intelligent way.

Fleeing the Temple of Efficient Markets?

As the passive revolution continues, Vanguard continues to evolve. Notably, over the past few years, the firm launched its first actively managed smart beta ETFs, focused on four factors: global value, global momentum, global liquidity, and global minimum volatility.

Others from the Efficient Markets religion are also showing some philosophical flexibility. Burton Malkiel, in his 1973 book,”A Random Walk Down Wall Street,” famously said of the performance of active managers, “A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well…” Today, Professor Malkiel has changed his tune. He is Chief Investment Adviser of robo advisor, Wealthfront, which recently launched PassivePlus, an approach that invests in five factors: value, momentum, high dividend yield, low market beta, and low volatility.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.