Unless you live under a rock, you’ve probably heard that Professor Richard Thaler earned the recent Nobel Prize. (The University of Chicago is on fire these days with Eugene Fama and Lars Hansen winning the prize in 2013!)

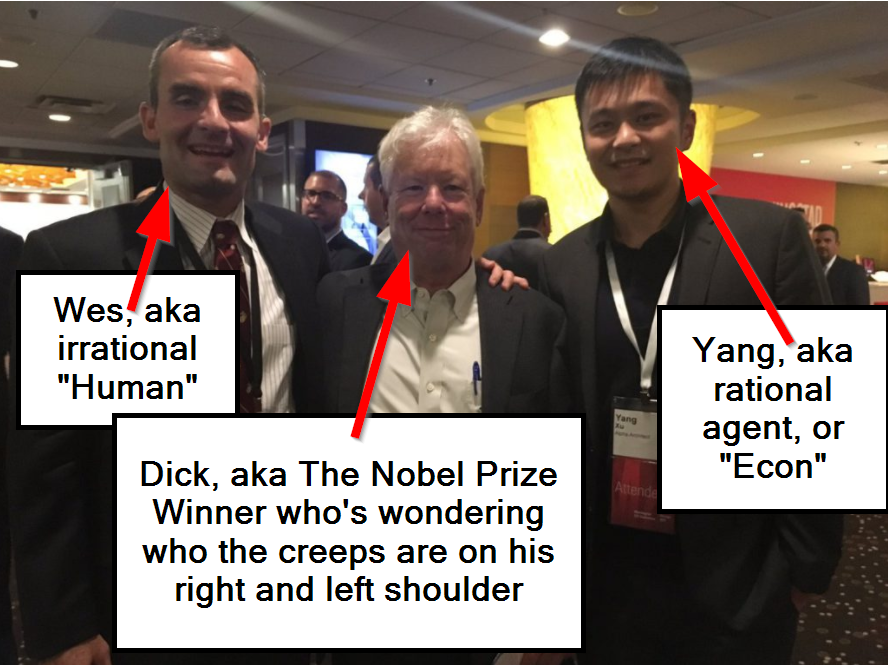

I had the fortunate opportunity to interact with both the “rational market” and “irrational market” geniuses (Fama and Thaler, respectively) before they were too famous.(1)

- Prof. Fama was my dissertation advisor.

- Prof. Thaler was my second-year curriculum paper advisor.

I’m not sure I left a great impression on either of these gentlemen.

Prof. Fama, quoted in the WSJ, said the following about me:

He kinda talked like the kids I grew up with in kind of a tough neighborhood in Boston, not like a normal PhD student.

And I’m pretty sure Prof. Thaler still thinks I’m crazy. As my 2nd-year paper advisor, I had to ask him to sign off on the paperwork so I could get a 4-year sabbatical from the Ph.D. program and join the Marines.

All I remember him saying was the following:

Wait…Are you serious?

But what the heck, while I may not have put on a good show for the Nobel Prize winners, they certainly left a lasting impression on me with their work ethic and intellect.

Prof. Fama was impressive for many reasons, but my biggest lesson learned from him was simple: grind harder and longer than the competition and you will win.

My lessons from Prof. Thaler were a bit different. Prof. Thaler was impressive because of his ability to fight against groupthink. As many readers may already know, the University of Chicago’s finance faculty tilts towards the “efficient market hypothesis” and assumes rationality among “economic agents.” This is a broad brush stroke, and the devil is always in the detail, but that is the general scene. So when Dick Thaler–known for his beliefs that markets/people can be irrational–would stroll into a University of Chicago finance seminar (famous for intense debate and discussion), eyes would start to roll and the intellectual fireworks would begin. Almost inevitably, the discussion would end up being Dick Thaler vs. everyone else. Dick would be on the side of markets/people systematically make poor decisions; the rest of the faculty would be on the side of markets/people are rational and the world should be viewed through the efficient market hypothesis.

In many respects, it was Dick against the world. And he’s always held his own. Impressive.

In some sense, Dick Thaler’s personality and research are simultaneously captured in his new book, “Misbehaving,” which is really a story of Dick’s journey from being considered a heretic in economic circles to being viewed as a hero in economic circles (now with the official Nobel Prize Crown).

In honor of Prof. Thaler, I added his, “Misbehaving,” book alongside Eugene Fama’s book, “The Theory of Finance.”

Dick’s book, Misbehaving, brings up a basic point that behavioral economics is economics. Behavioral economics is simply, “economics done with strong injections of good psychology and other social sciences…the primary reason for adding ‘Humans’ to economic theories is to improve the accuracy of the predictions…”

When stated in those terms it is hard to argue with Thaler. Economics should clearly include the realities of human behavior because humans are making the decision in the economy!

But the idea that human misbehavior might be an important component of understanding economic observations has been on shaky ground. Prof. Thaler says as much in his conclusion:

After a life as a professional renegade, I am slowly adapting to the idea that behavioral economics is going mainstream.

I’m glad Prof. Thaler can finally feel normal in the economics profession. The Nobel Prize is certainly proof that he’s on the top of the profession.

I personally need to thank Prof. Thaler, because he improved my understanding of economics. Moreover, his co-authored paper, “A Survey of Behavioral Finance,” laid the foundation for how I think about markets and also helped me craft the core ethos behind our investment strategies. Thanks. Three cheers for being irrational.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.