Watching stock prices drop quickly can be terrifying. In late January, every big decline in stock prices was greeted with lots of media coverage, cable news networks rolling out their “market in turmoil” graphics, and an army of perma-bears promoting their forecasting abilities.

The internal angst we feel as markets decline could also be a result of experiencing large declines in the dollar value of our portfolios. “Jake” from the economicpic blog has a great post about how the recent stock market decline could have been the largest portfolio dollar decline many investors have experienced.

Because of the terrifying nature of market declines, one of the valuable services an adviser should provide is help in selecting an asset allocation that suits their client’s investment objective and risk preferences. This process starts by understanding two aspects of risk – Risk Tolerance and Risk Capacity. Michael Kitces has a great article discussing those aspects and how they should interact in selecting an appropriate asset allocation.

I want to dig a little deeper into Risk Capacity to show that investors shouldn’t be too afraid of a quick stock market decline.

Life Cycle of Capital

The first step in understanding how much an investor might be affected by a stock market decline is to understand who might be most at risk.

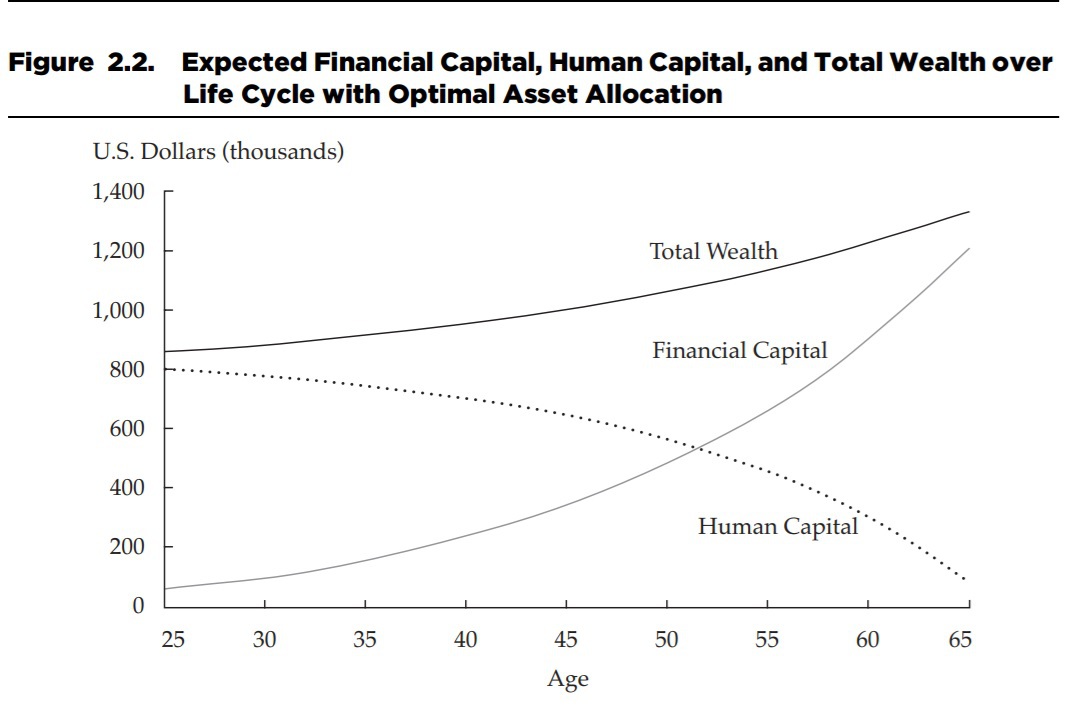

A young investor with not much in retirement savings could be just as wealthy as an investor with a large retirement account at the end of their working career. To help understand why, study the following chart from the CFA Institute, Lifetime of Financial Advice: Human Capital, Asset Allocation, and Insurance:

The graph above shows that at a young age an investor’s wealth is largely made-up of the present value of future savings (Human Capital) and typically not much in retirement savings (Financial Capital). As the investor ages their Human Capital is converted to Financial Capital through ongoing savings and investing.

Why is this important?

This analysis is important because if the stock market declines a young investor’s Financial Capital is affected some, but it shouldn’t affect the value of their Human Capital. Therefore, a young investor’s holistic wealth hasn’t actually declined much. In addition, after a stock market decline, a young investor should be able to invest their Human Capital at a higher rate of return and thus be better off. Michael Batnick wrote a great post about this concept and shows that young investors should be hoping for a stock market crash!

Sequence of Return Risk

Sadly, for older investors, the opposite is also true. Older investors, whose Human Capital has already been converted into Financial Capital (and especially those just starting retirement) might be most at risk of stock market declines. This concept is called Sequence of Return Risk.

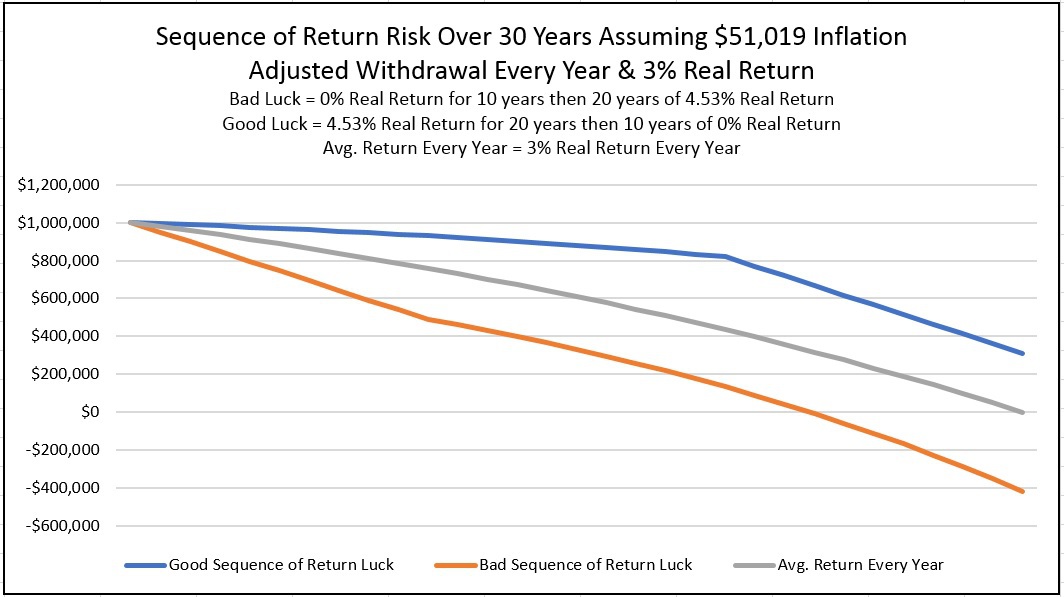

To help understand Sequence of Return Risk, consider the following chart:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

The chart above shows 3 different retirees each with a $1,000,000 portfolio at age 65. Each takes out an inflation-adjusted $51,019 every year for the next 30 years and each earns the same inflation-adjusted 3% Time Weighted Return (TWR). The only difference is that each earns the return in a different sequence. Good Luck (blue line) earns 4.53% real return for 20 years then earns 0% real for the last 10 years. Bad Luck earns 0% real return for the first 10 years then earns 4.53% real for the last 20 years. Average Luck earns a constant 3% real return through the whole period.

Good Luck gets to the end of their retirement with almost $300,000 left of their original $1,000,000 portfolio, Average Luck ends with exactly $0 of their original portfolio and Bad Luck ran out of money after about 25 years.

Why the difference in ending values?

It is simply a matter of luck — retirement success is influenced by the returns that an investor earns when their portfolio is largest (presumably right at retirement). Therefore, investors right around retirement are most at risk of stock market declines.

Capital Market & Other Assumptions

Before we look at how much a stock market decline hurts a new retiree, we need to make some assumptions and have a set of capital market assumptions (CMA). For this purpose, we will use the CMAs recently published by AQR. Please read the paper by AQR to understand how they build their assumptions.

We will use AQR’s global equity return assumption of 4.2% and their 1.1% real return assumption for US Investment Grade bonds. We will assume an annually rebalanced portfolio of 50% global stock and 50% US investment grade bonds (ignoring taxes and other costs). These assumptions lead to a portfolio with a forward-looking 2.65% real return and a 10% real standard deviation.

We plug these assumptions into portfoliovisualizer’s Monte Carlo simulator and we see that a 3.5% withdrawal rate leads to a modeled 80% success rate over a 30 year period of time. One interesting thing to note is that the “4% rule of thumb” isn’t anywhere close to “safe” given these CMAs as it shows only a 65.9% success rate!

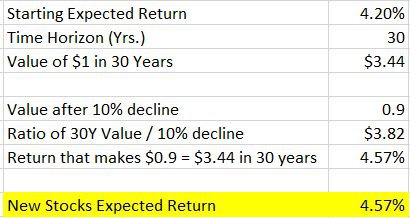

The final piece of information we need is to understand how to adjust our equity capital market assumptions for stock price declines, as when stock prices drop the forward-looking returns should increase. To do this, we will compute the expected value of $1 invested in stocks in 30 years (the time frame) at a 0% decline. Next, we solve for the rate of return with a lower starting price that equals the same value in 30 years. Let’s look at an example for a 10% decline in stock prices, below:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

As you can see from the table, above, $1 growing at 4.2% real becomes $3.44 (inflation-adjusted) after 30 years. Therefore, if stocks decline 10% then the remaining $0.9 must grow at 4.57% real to become the same $3.44 in 30 years. Therefore, after a 10% decline in stocks, the expected return should increase to 4.57% real.

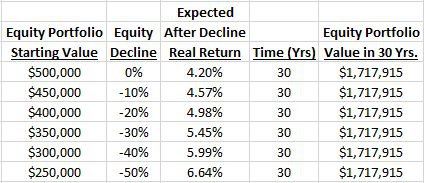

We use this method to update the CMAs for portfolios. Please see the table, below, for the specific equity expected returns after a price decline. As expected, the more stock prices drop the higher the forward-looking expected returns.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

How Much Does It Hurt A New Retiree When Stocks Decline?

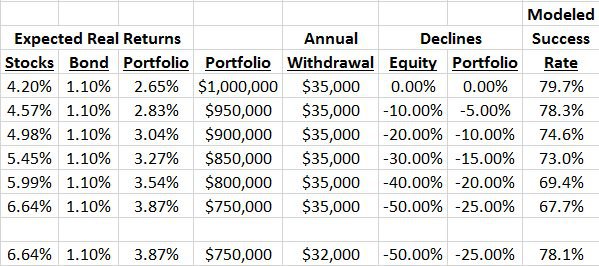

To study how much various stock market declines hurt a new retiree with a 30 year time horizon (without adjusting their real withdrawal amount), we use the portfoliovisualizer.com Monte Carlo simulation engine and our CMAs (with dynamic adjustments) to power through several scenarios to study the results, below:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

What we see from the table above is that as the portfolio value declines (and the real dollar amount of withdrawals stays unchanged), the success rate declines from 79.7% to 67.7% given a 50% stock decline (25% portfolio decline).

There are a couple of additional items of note:

- Given a 50% stock decline (25% portfolio decline), the success rate decreased less than I would have expected (from 80% to 68%). This is good news for investors around retirement!

- An investor is able to absorb a 20% stock decline (10% portfolio decline) and the success rate only decreases by about 5%. This goes to show that even a 20% stock decline shouldn’t really register as much more than noise for most investors.

- The very last line in the table shows a 50% stock decline (25% portfolio decline) but permanently changes the level of real withdrawals to see what adjustment might be necessary to increase the success rate of the portfolio back to 80%. The answer is less than a 10% (but permanent) decrease in the withdrawal amount.

- Given a 50% stock decline (25% portfolio decline) a modest decrease in withdrawals combined with a willingness to accept a slightly lower success rate can keep a newly minted retiree on track with their goal.

- Given these results, part of the Risk Capacity decision might include the ability of an investor to decrease withdrawals given a very steep stock market decline. If they have an ability to decrease spending by 5-10%, then the investor shouldn’t worry too much about a 50% stock market decline.

- These results are only relevant for a 50/50 stock/bond portfolio and for a 30-year time horizon. The results will change (and perhaps dramatically) for different asset allocations and different time horizons. Finding the right asset allocation for your personal circumstances is something you should talk to your adviser about!

About the Author: Andrew Miller

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.