Do risk management practices work? Evidence from hedge funds

- Gavin Cassar and Joseph Gerakos

- Review of Accounting Studies

- A version of this paper can be found here.

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- Are there variations in the methods that funds use to manage risk?

- Do hedge funds practicing risk management outperform other funds during periods of financial crisis?

- Are there differences in the type of risk management practices in terms of performance?

- Are there competing explanations that may also explain the outperformance of risk-managed hedge funds?

What are the Academic Insights?

- YES. The study reports the frequency and details of risk management practices for hedge funds including: (i) portfolio risk models (VAR 43.7%, Stress testing 52.1% Scenario analysis 46.4%, at least one of these 58.3%, one type only 7.7% , two types only 8.9%, all three types 36.4%, no models or testing 47%). (ii) existence of heads of risk management (dedicated 34%, no trading authority 25.8%, hedging authority only 4.2%, full trading authority 70.1%, dedicated and no trading authority 22.4%), and (iii) position limits (hard limits 16.6%, guidelines 26.9%, no limits 56.4%). Formal portfolio risk models are more likely to be used by funds using leverage. Funds with longer holding periods are less likely to have position limits. Dedicated risk officers are associated with funds that hold relatively more positions and that have higher levels of proprietary capital. Apparently increases in risk oversight occur when fund managers employ relatively more of their personal wealth in the fund.

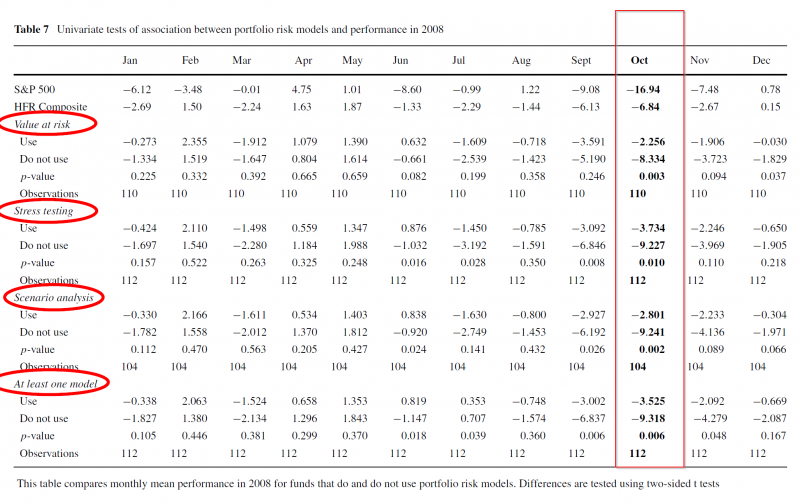

- YES. Funds with more extensive risk management practices including formal models of portfolio risk performed relatively better than funds using no risk management. Tables 7 and 8 from the paper (Table 7 is reproduced below) present univariate and multivariate analyses of the monthly performance for the S&P 500 Index, the HFR Composite and hedge funds during the financial crisis of 2008. After controlling for size, age, style, and other portfolio exposures, hedge funds using at least one risk model returned 6% (statistically significant) in excess of funds that did not use a risk model during October 2008. Similar results were found for the specific subset of funds utilizing long/short equity strategies, while also controlling for portfolio risk exposures and style returns.

- YES. The authors break down the differences in performance between funds using and those not using specific risk management methods on a monthly basis for the study period. The strongest results were found with users of VAR models, Stress-testing, or Scenario analysis. Funds using formal risk models exhibited better performance with a range of 5.8% to 7.7% when compared to nonusers during October 2008. Both multivariate and univariate tests were included and all coefficients were statistically significant. Portfolio risk models dominated other risk management techniques in reducing downside risk.

- NOT REALLY. The authors report little to no support for competing explanations including manager ability/education, incidence and magnitude of portfolio risk exposures, fund quality and overall risk “culture.” Tests of components of the investment “contract” including management and performance fees, the existence of lockup provisions, redemption controls and redemption fees were also conducted. Results of all empirical tests conducted appear to be robust to these alternative issues.

Why does it matter?

The study uses a proprietary database of due diligence reports gathered and vetted by HedgeFundDueDiligence.com, which was commissioned by institutional investors. The express purpose of gathering the reports was to increase understanding of fund operations and risk practices and to improve the evaluation of hedge funds as investment vehicles. The detailed data items included here are not available in commercially available databases of hedge fund performance. One caveat: the sample represents only hedge funds open to new capital. However, the uniqueness of the data gathering period allows for the investigation of a much larger set of precise risk management practices during a period of time just prior to the catastrophic impact of the 2008 financial crisis on hedge funds. Furthermore, the juxtaposition of the time period when data was gathered and the subsequent extreme market performance provides evidence on the ability of risk managers to accurately set expectations and forecast a fund’s reaction to extreme events. The authors find that only managers of funds using formal portfolio models outperformed their peers during the crisis. Further only those using VAR models were able to anticipate the level of the performance of their funds in the short term extreme market conditions that occurred in 2008.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We examine hedge fund risk management practices and their association with left-tail risk during the 2008 financial crisis. Consistent with risk management practices reducing left-tail risk, funds in our sample that use formal risk models performed significantly better in the extreme down months of 2008. We find no evidence that having either position limits or a dedicated head of risk management is associated with reduced left-tail risk. Funds employing value at risk models had more accurate expectations of how they would perform in a short-term equity bear market.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.