Can short sellers inform bank supervision?

- Bhanu Balasubramnian and Ajay Palvia

- Journal of Financial Services Research

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

There is a fair amount of empirical support for the idea that short sellers are informed traders and that significant negative excess returns are associated with high levels of short interest. On the banking side, supervisors act to identify problems and then take corrective actions to ensure the safety and soundness of banks. As part of that process, bank supervisors construct confidential ratings (CAMEL ratings) using on-site inspections and off-site monitoring of banks. “CAMELS” denotes the following attributes for a bank:

- Capital adequacy

- Asset quality

- Management

- Earnings

- Liquidity

- Sensitivity to market risk.

Bank supervisors identify weaknesses in these attributes that lead to a summary assessment of bank performance via confidential CAMELS ratings. The ratings are only disclosed to the top managers of the bank and never shared publicly. The question as to whether short sellers profitably anticipate poorly performing banks earlier than supervisors is the subject of this research.

- Do short sellers identify potential problems before bank supervisors are able to add that information to their assessments and subsequent changes in CAMELS ratings?

- Are the signals provided by short sellers accurate relative to supervisory assessments?

What are the Academic Insights?

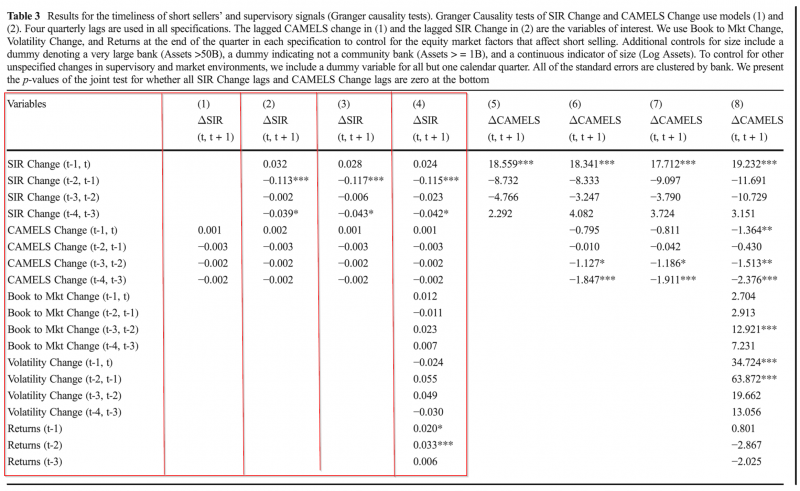

- YES. The authors confirm the hypothesis that short sellers utilize information regarding changes in bank fundamentals before that information is reflected in CAMELS ratings. Increases in outstanding short positions occurred at least one quarter ahead of downgrades in CAMELS ratings. The empirical results were robust to the book-to-market ratio, stock returns, and volatility of returns and “size.” Results were less compelling when upgrades in CAMELS were examined. ONE CAVEAT: the sample contained significantly fewer upgrades, relatively speaking.

- YES and NO. There is no relationship between changes in short interest and the ratio of future problem loans, while a 1 quarter change in a CAMELS downgrade precedes increases in future problem loans. Increases in short positions are observed 2 quarters prior to changes in CAMELS ratings and equity capital. A significant decrease in short interest is observed 3 quarters prior to an increase in ROA, while the CAMELS rating changes one quarter ahead of a change in ROA. Interestingly, banks with high analyst coverage have significant increases in short selling prior to deteriorating performance, but no relationship before improvements in performance. Results are magnified for banks when options are traded, but weaker when high bid-ask spreads are observed. Apparently, short sellers are accurate predictors of bank performance but use different fundamentals.

Why does it matter?

The subprime crisis identified weaknesses in the banking oversight and provoked enhanced regulation in supervisory oversight of the banking system. And although there is significant research establishing the efficacy of various banking supervisory assessments, none have looked at market signals contained in short seller information. It appears that tests of the timeliness of changes in short interest are predictive of a bank’s deteriorating performance much more accurately than when bank performance improves. Short sellers appear to target banks that are likely candidates for significant downgrades in their CAMELS rating. Perhaps monitoring increases in short interest would enable supervisors to identify potentially vulnerable banks.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We investigate the timeliness and accuracy of supervisory information and short sellers’ signals to assess whether short sellers have the potential to inform bank supervision. We find that short interest in the bank’s equity increases prior to downgrades in supervisory ratings but does not decrease prior to upgrades in supervisory ratings. Our tests of the relative forecasting accuracy of short sellers’ signals and supervisory ratings indicate short sellers accurately assess the changes in both deteriorating and improving bank fundamentals but do not focus on the same fundamental variables as supervisors. Our results indicate that short sellers’ signals have the potential to complement the supervision in monitoring banks’ risk.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.