An often-overlooked corner of the investing world is the futures market. Maybe it’s the fear of taking delivery of 1,000 barrels of oil, the mechanics of daily cash settlement, or new terminology and lingo (e.g., “contango” and “backwardation”). In this article, Wes asked that I explain futures via the lens of someone who is not buried in the material on a daily basis (the last time I tackled the subject was when I was studying for my CFA exam almost 5 years ago!).(1)

Why on earth would you want to learn more about commodity futures contracts (and futures contracts more broadly)?

The first reason is that many equity investors have futures exposure via the ETF market (e.g., commodity ETFs, alternative ETFs, and so forth). The second reason is that futures markets have the potential to improve portfolio diversification, so equity investors who don’t have futures exposure should learn more about them. (Wes has a much more thorough discussion about the potential advantages of commodity futures that is available here). For our purposes though, simply knowing that we have an underappreciated asset class that has characteristics that diversify a long equity portfolio is reason enough to take a fresh look and build a foundation of knowledge to expand upon.

The best place to start, as always, is in the beginning. The first documented contracts similar to futures were traded in Japan on rice dating back at least to the 1700s. However, the modern futures market was born out of necessity in Chicago during the mid-1800s. During this time Chicago had established itself as the central hub of commodity trading. Farmers brought the commodity to Chicago and dealers would soak up that supply. It’s easy to grasp that grain supply is extremely lumpy while demand is very linear. This dichotomy between supply and demand caused wild price swings, and would at times stretch storage capacity within Chicago to such limits that prices would be so low farmers would dump their product instead of transporting it back to the farm. To minimize this, dealers and farmers started making agreements with each other to deliver product at a later date for a specific price. As these agreements became more popular they started trading hands in a secondary market. From these humble beginnings, today’s standardized futures contracts were born. Today’s futures market is gigantic, for example, the open interest on Corn alone exceeds 1.4 million contracts. (2)

Because of the size and quantity of the commodity underlying the futures contract, each contract represents a large economic position. For example, one corn futures contract is settled to 1,000 bushels of corn (roughly 56,000 lbs). This means that, although margin requirements are small, the final value of a futures contract is large. You clearly don’t want to enter into a futures contract and have to worry about counterparty risk. To remedy the counterparty risk inherent to futures trading, an institution known as a clearinghouse was created. We’ll get into the details of how margin works, but the clearinghouse would receive a margin payment from both the buyer and seller and would guarantee both sides of the transaction. The creation of the clearinghouse eliminated the large counterparty risk of futures contracts and made the market more transparent, trustworthy, and liquid.

Today, the futures market is both far-reaching and deeply ingrained into the financial world. If you are a child of the ’80s, you’re probably familiar with the concept of trading orange juice futures (thanks to the movie Trading Places), but you can now trade futures on a wide array of products including commodities, government bonds, equity indices, and many other financial products.

I’m an Equity Investor. How Can I Learn About Futures?

I’m an equity/option guy. I have been my whole life. So there are several features of futures contracts that aren’t intuitive. That said, this is nothing we can’t handle — it’s not like we’re trying to understand fixed-income here!

Futures are public agreements to buy or sell a standardized underlying commodity or financial product for a set price at a later date in time. The exchanges set nearly all the terms of a futures contract except the price. The specifics of the underlying asset, delivery date, delivery location, settlement type, etc. are all standardized by the exchange. The standardization of a futures contract is the key feature that allows it to be actively traded in a secondary market. Since all contracts are identical, except for the price, a futures contract can be closed at any time by buying or selling the identical contract. Contrast this with a forward contract–which is basically a futures contract that is completely customized–there is no way to close a forward contract without going back to the original counterparty and trying to close it out.

For equity investors, one of the key concepts to understand is that a future is a “contract,” it is not an asset. A long-holder of a futures contract does not “buy a future,” rather they own the right to purchase an asset at a later date. The person going long the futures contract does not pay the seller of the futures contract. Unlike an equity transaction, there is no immediate exchange of cash flow between the buyer and seller. So just to make this clear, let’s assume you go long a futures contract on Oil with a price of $65.00. When you go long this contract you don’t go out and pay the seller $65.00 today, rather $65.00 is the price you will pay for the underlying asset when you take delivery.

Step 1 accomplished: Understanding that futures aren’t stocks. The next step in understanding futures contracts is getting a grasp of how margin works in the context of futures contracts.

Understanding Margin & Daily Cash Settlement Process on Futures Contracts

As equity investors, the very mention of the word “margin,” elicits knee-jerk reactions–this is especially the case for value investors who are trained to avoid leverage at all costs. The greatest stock investor of all time, Warren Buffett, explains why leverage is a bad word: (3)

History tells us that leverage all too often produces zeroes, even when it is employed by very smart people.

We understand the concept that investors can borrow up to 50% of an equities value (under Reg-T Margin rules, and use that capital to buy assets. We also understand that leverage amplifies both our gains and losses.

However, “margin” in the futures market has a potentially different interpretation than in the equity market.

In the stock market, “margin” means that a loan has been made and you are borrowing money to increase your exposure to a particular stock. In the futures market, the word margin is used to describe an amount of money deposited into a clearinghouse to hold the futures contract. The beginning amount of money to be deposited is set by the clearinghouses and is called the Initial Margin. The initial margin set by the clearinghouse is usually quite small, typically less than 10% of the futures price. Another differentiating factor between equity margin and futures margin is that both the buyer and seller of the futures contract must deposit money into a margin account. This collateral gives the broker confidence that when the contract settles, both sides of the futures contract will be able to close out their positions with limited counterparty risk.

Along with the difference in the margin, another feature of the futures market that equity investors aren’t familiar with is the daily cash settlement. We don’t recognize gains and losses on a daily basis in our equity holdings. Futures, on the other hand, are marked to market on a daily basis (technically these are sec 1256 contracts). The marking to market process means that the gains and losses are posted and realized daily to the margin accounts of each party in the futures contract. The low margin requirements associated with futures contracts can be good or bad, depending on your perspective. The benefit is that futures are extremely capital efficient, but the cost is there is a lot of implicit leverage embedded in a futures position that is held via the maintenance margin (e.g., 5% of the notional futures value). This large implicit leverage obviously creates a problem if there are large price swings in the price.

Let’s use a Gold Bar Futures Contract as an example to understand the mechanics of the margin account, daily cash settlement, and the maintenance margin requirements.

Position: Long 10 February 2018 Gold Bar Contract at $100.00.

Initial Margin: $5.00 per Contract. We’ll have the initial margin of $50.00 (10 Contracts x $5.00 per Contract).

Maintenance Margin: $3.00 per contract, in other words, anytime our balance falls below $30 we’ll have to add funds to the margin account.

Just to summarize our theoretical position:

- We’ve entered into 10 Gold Bar Futures contracts where we’ve guaranteed to be a buyer of 10 gold bars at $100 apiece in February of 2018.

- The only money that we have to deposit is our initial margin which is set at $5 per contract ($50 total because we have 10 contracts) and this money goes to the clearinghouse, NOT the seller of the futures contract.

- We can expect to receive a margin call anytime our margin balance falls below $3 per contract ($30 total in our margin account).

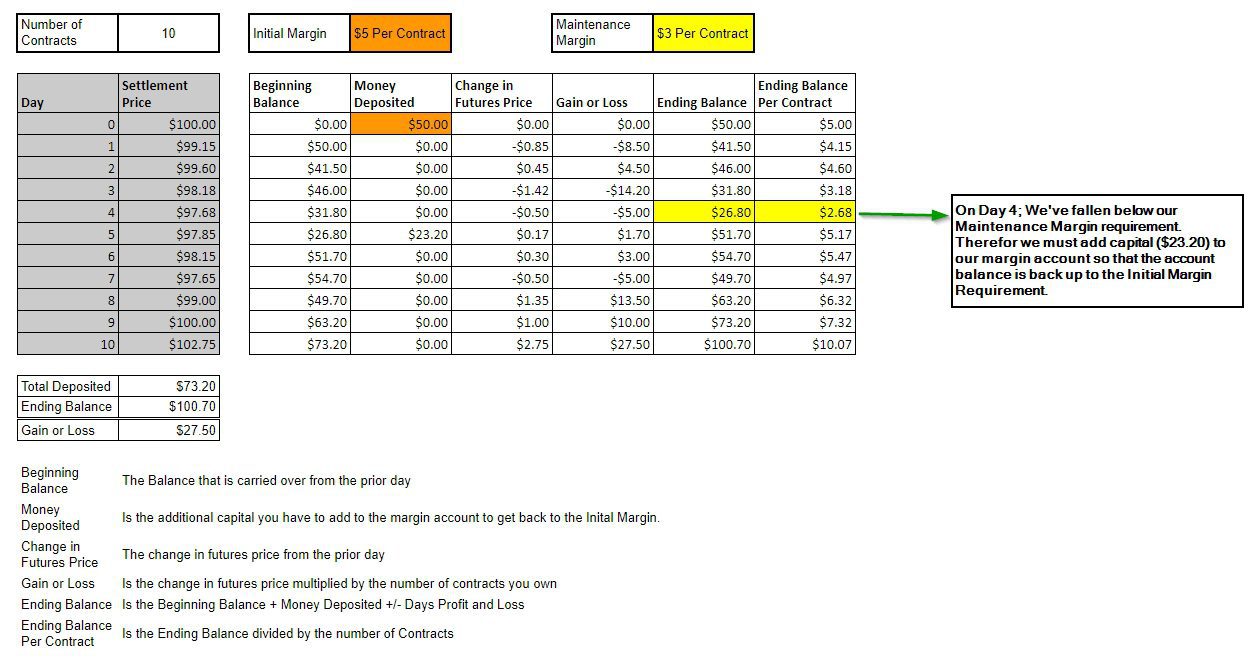

Figure 1: Daily Cash Settlement Process of Futures Contracts

Note: Download the Spreadsheet that generated the chart.

On day “0” we deposit our initial margin requirement of $50. After the first day of trading, our Gold Bar Futures contract had a closing price of $99.15. The $0.85 drop in Gold Bar Futures, meant $8.50 (0.85 x 10 contracts) is withdrawn from our margin account at the end of the day; the opposite happens for the investor who is short the 10 contracts. The gold bar futures market remains bearish for several days and on day 4 our margin balance has fallen below the maintenance margin level of $3 per contract ($30 for us). With only $26.80 in our margin account, we are required to add funds to the margin account. Unlike in the equity market, where a margin call requires you to get back to the maintenance level of 25-30% capital, in the futures market once you’re below the maintenance margin you must deposit enough funds to get back to the initial margin requirement. Therefore, in our example, we must deposit an additional $23.20 after day 4 to get our margin account back up to the Initial Margin (not just back to the maintenance margin!). Luckily, As expected, the Gold Bar Futures market turns in our favor after day 4 and by the end of day 10 we’ve accumulated a substantial profit and our margin balance is $100.70.

One final point in regards to the closing price of the day. As you can see the “Settlement Price” of the futures contract is determining the cash flows in and out of margin accounts. Unlike stocks, where the final price of the stock is simply the last trade of the day, in the futures market, the Settlement Price is the average of the last few trades of the day. This process eliminates the ability of one final trade at an unrealistic price to cause massive shifts in cash between margin accounts that are unjustified.

The settlement process: I’m taking delivery of what?

The settlement process of a futures contract can strike fear into the hearts of even the bravest equity investors. Probably because they’ve heard too much folklore regarding commodity futures. For example, perhaps they heard a story from a fellow stock investor about the trader who had to ask a neighbor to borrow his pickup and take physical delivery of 1000 bushels of corn…this sounds a bit overwhelming.

But is this realistic? Certainly possible, but easily avoidable. Let’s dig in.

As expiration approaches futures contracts can be settled in one of three ways.

- The future holder can offset their position.

- Depending on the product settlement, the contract may operate via a cash settlement.

- The dreaded physical delivery. (see above)

Whether a product settles to cash or via physical delivery is set by the exchange. Some futures contracts, such as oil futures have physical delivery, but others, VIX futures, for example, settle to cash rather than physical delivery. We’ll continue our gold bar futures example below, and run through the settlement process in each way.

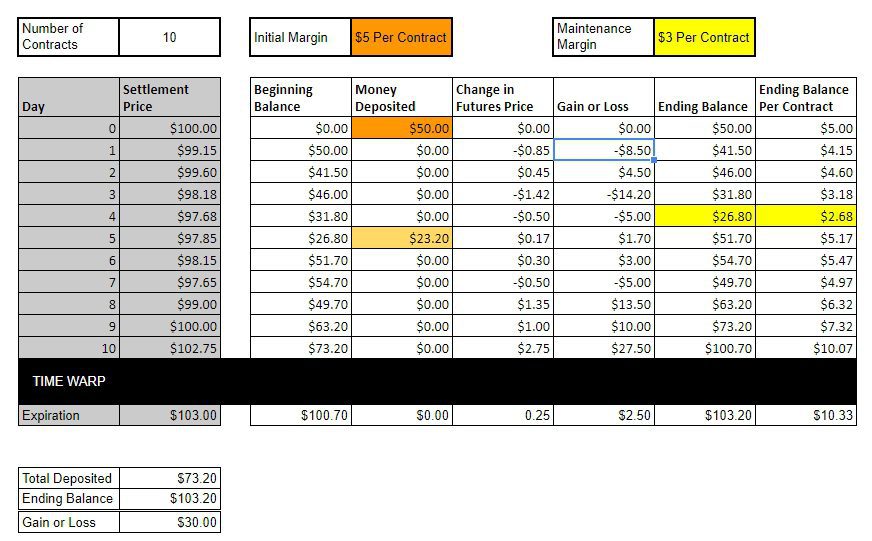

Figure 2: Futures Contract at Expiration

Note: Download the Spreadsheet

So here we are on expiration day and the futures contract closes at $103.00.

Let’s just run through 3 examples of how we can terminate this contract.

1) Offset the position

The most frequently used method to settle a futures contract is via offsetting the position. As the end of expiration day approaches the 10 long futures contract we bought at $100 are being priced at $103. We’ve decided that we don’t necessarily want to take delivery of 10 gold bars (assuming gold bars have physical delivery). Since we don’t want to take delivery, we must offset our position. To offset our position we simply go to the futures market and sell 10 identical (thanks, homogenization) Feb 2018 gold bar futures contracts. Now that we hold long 10 gold bar futures contracts and short 10 gold bar futures contracts from the clearinghouse’s perspective we no longer have a position. Therefore we’ll have a marked-to-market profit of ($103 – $100 = $3 per contract). $3 times 10 contracts means that we have a $30 profit on a total outlay of $73.20. It should be noted that the offsetting process can be done at any time during the contract life.

2) Cash Settlement

The Cash Settlement Process has similar cash flow characteristics as the offsetting process but does not require the long or the short to go into the open market and sell/purchase the offsetting position. Rather, when the contracts expire the margin accounts of the buyer and seller would be marked to market. In our example (let’s now assume Gold Bar Futures settle to Cash) our margin account would be marked to market and we’d have $103.20 to withdraw, after taking into account the 73.20 of that margin balance that we deposited, we’d again end up with a $30 profit ($103.20-$73.20). Cash settlement allows us to avoid commissions and other closing costs associated with the offsetting process.

3) Physical Delivery

The vast majority of all futures contracts end either settled by offsetting or via cash settlement. The rare exception is physical delivery. (Let’s now assume that Gold Bar Futures settle via Physical Delivery). Expiration has arrived and we are still long our original 10 Gold bar futures contracts that we bought at $100, and we’ve decided to join Kyle Bass

and own physical gold.(5) The exchange will typically set the timeframe of when and where delivery must occur. In our example delivery is the day following expiration at Fort Knox. The short is going to have to deliver our 10 bars of gold to Fort Knox, and we are going to have to deliver $1000 ($100 x 10 contracts) to the short. We now have the 10 gold bars that we paid $1000 dollars for, the gold bars we receive are actually worth $103.00 a piece since the futures expired at $103. This leaves us with a gain of $30 again, but it goes unrealized.

So we’ve built a solid foundation of information about a single futures contract including what it is, the mechanics of holding the position, daily cash settlement, and expiration. In the next article, we’ll take a quick basic look at the pricing mechanism for futures contracts, get more familiar with the relationship of futures prices with the spot price of the underlying asset, and understand the relationship of near to long-term futures contracts.

Basics of Pricing and Valuing Futures Contracts

Price is what you pay, value is what you get. – Attributed to Warren Buffett

As equity investors, we are all familiar with Warren’s quote and we love to think we have a special talent for finding places where there is a difference between price and value. In the futures market, price and value have slightly different connotations.

Pricing a futures contract is the process in which we decide what the fair price we should exchange the commodity (or underlying asset) for at the expiration of the contract. With standardized contracts, the need to price a contract isn’t entirely necessary as the market is very efficient at creating non-arbitrage futures contract pricing.(6)

However, to fully understand Futures Contracts it is imperative to understand the arbitrage pricing process. You’ll see that the price of the futures contract is set by the spot price, interest rates, carrying and storage costs, and a convenience yield. All terms we will get into shortly.

So how do we set the price of a futures contract?

Pricing a futures contract is simply analyzing the relationship or the choice between owning the underlying asset over the same period of time as holding a futures contract. In an arbitrage-free world, the choice between owning the futures contract and owning, storing, and enjoying the underlying should be zero. So given the choice between owning a gold bar for a year and owning a 1-year gold bar futures contract should be a wash. If there was an imbalance in this relationship it would be quickly eroded by someone arbitraging the advantage away. So the futures contract’s price is set such that holding the futures contract and holding the underlying are worth exactly the same.

In our gold bar example at the onset of the futures contract, we have two choices. First, you could outright purchase the gold bar for $100, pay the storage costs and receive the convenience yield, alternatively, you can simply own the futures contract. Obviously, these two options have to be worth the same amount otherwise it would create an arbitrage opportunity.

Let’s start by pricing the most basic futures contract of all, one with no storage costs, carrying costs, or convenience yield. The only thing we need to consider is the cost of borrowing (interest rates). In this simplified case the Futures Price = Spot Price * (1 + interest rate)T(7)

Spot Price: $100

Interest Rate: 5% Annually

Duration of Future Contract: 1 year

Futures Price in the Market: $105

So when we are pricing the futures contract we’re looking to be sure that the price in the market is in line with our calculations. This would be a no-arbitrage price.

Using our formula for Futures Pricing we get the following:

Futures Price = Spot Price * (1 + interest rate)T

= $100 * (1 + .05)1 year

= $105

Using the formula we’ve found that our calculated price of the futures contract is equal to that of the markets.

As one can see, no value has accrued to either the buyer or the seller of the futures contract at initiation with a settlement price of $105. The buyer of the futures contract can throw their $100 they didn’t spend buying a gold bar into the bank and in a year’s time they’ll have precisely $105 to pay the seller of the futures contract for their gold bar. On the other side of the trade, the seller of the futures contract can go out and buy a gold bar for $100 today and will receive $105 for the gold bar in one year when they sell it to the buyer of the futures contract. Neither side has a distinct advantage.

This basic formula is the foundation on which we build a pricing formula that more accurately reflects the real world. To more accurately represent the real world we must take into account storage costs, cash flows that accrue to the holder of the underlying asset, and any convenience (or benefit) the holder of the asset receives. Though our focus in this article is primarily on commodity futures, which don’t have cash flows associated with them, realize that when pricing a bond or equity futures contract you’d also have to take into account the cash flows the bond or stockholder would receive in the form of coupon payments or dividends.

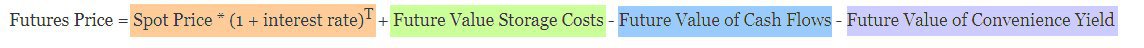

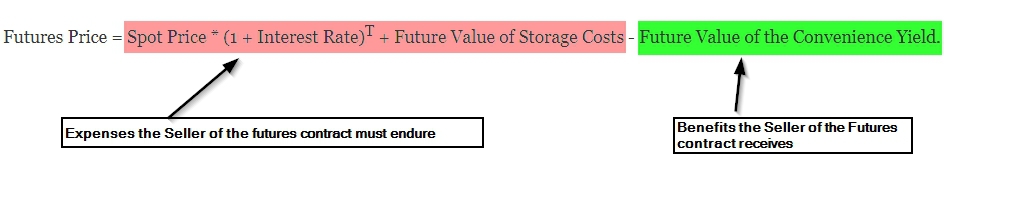

With the simple bolt-ons we can build out the formula for pricing a futures contract to be:

Now we’ve gotten down how to price a futures contract, let’s take a quick review of the valuation process of a futures contract. Luckily we’ve basically covered Valuing a futures contract already. First, let’s recall that at initiation the value of a futures contract is set to zero. What we have to also realize is that in Figure 1 the daily settlement process resets the value of the futures contract to zero every night. In other words, the marking to market process that is the daily cash settlement revalues the futures contract to zero each night. The only time a futures contract has “value” is day to day between the marking to market process. Inter-day the value of a futures contract before the daily settlement process is simply the gain or loss that has accumulated since the account was last marked to market. Once the futures contract has been settled and marked to market again, the value goes back to zero.

Defining Contango and Backwardation

Now that we’ve covered our bases on pricing and valuing a futures contract, we can start looking at what causes Contango and Backwardation. Contango and Backwardation simply describe the relationship of the futures price to the spot price of the underlying asset. If you’re unfamiliar with the spot price, it is simply the price you would pay to go out and purchase the underlying asset on the open market right now. What you frequently hear quoted in the market as the price of oil, say $64.50, is the price that you’d have to pay for a barrel of oil if you pulled up with your tanker truck and took delivery at that moment in time. That price for immediate delivery of oil is the spot price.

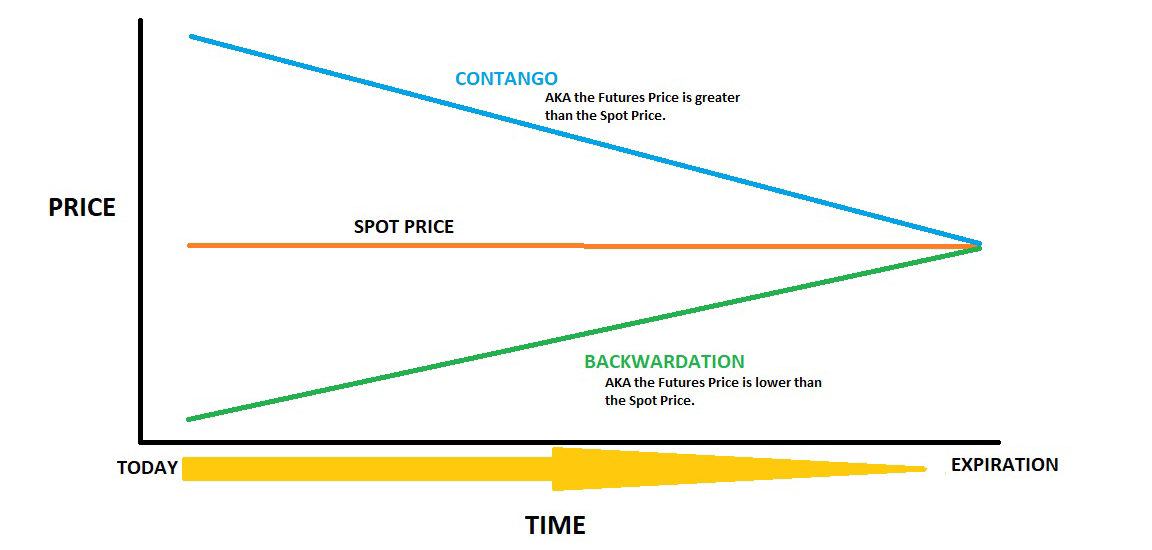

Contango describes a time when the futures contract price is higher than the spot price. For example, if today’s spot price for oil is $64.50 a barrel and the price for the 1-year futures contract was $75 a barrel the market would be in Contango. You can obviously see that the futures price is higher than the spot price.

Backwardation describes a time in which the futures price is less than the spot price. So a one-year oil futures contract would be priced at $60 when the spot price of oil is $64.50.

To understand what can cause either of these situations we simply take a quick glance at our formula again. (8)

When we glance at the formula we can note that 3 factors are driving the futures price. Borrowing costs, storage costs, and the convenience yield. As the diagram above displays both borrowing costs and storage costs are expenses to the seller of the futures contract, the convenience yield, however, is a benefit to the seller of the futures contract. So a market in contango (higher futures than spot prices) happens when the borrowing costs and storage costs are larger than the convenience yield. Backwardation occurs when the convenience yield is larger than the borrowing and storage costs.

All else equal, a market in backwardation or contango is going to merge towards the spot price as time moves on. Why should this happen? It’s quite simple when you recall that 3 things have an impact on the futures price. Interest gets closer and closer to zero as time passes. Storage costs approach zero as expiration approaches. Lastly, the convenience yield of holding the physical diminishes to zero as expiration approaches. In other words, you wouldn’t pay a premium or a discount to the spot price for a futures contract that expires the next second…At expiration the Futures Price = Spot Price.

Figure 3: Backwardation and Contango Explanation

Imagine the price of a futures contract as being on a journey. The journey, no matter where it begins, always ends at the spot price on expiration. So a futures contract that’s in contango (futures price > spot price) is inevitably going to find its way down to the spot price at expiration. In essence, the premium you paid for the futures contract over the spot price is going to erode over the term of the futures contract. There will be an expected outflow of cash via your margin account as the futures price falls towards the spot price (assuming no change in the spot price). On the flip side, when you invest in a futures contract that is in backwardation, the futures contract you hold is going to drift up towards the spot price. So imagine buying an oil futures contract that settles in 10 days and is currently priced at $64.50; with the current spot at $65.00. Even if the spot price remains unchanged over the next 10 days you can expect your long futures contract to drift up to $0.50.

Thus far we’ve covered what an individual futures contract in contango or backwardation does. Futures markets though are made up of several futures contracts expiring at different times. Not only can you buy a June Oil Futures contract but you can also purchase oil futures contracts that expire in July, September, and beyond. When we look at the entire universe of futures contracts in a given market, we’re said to be looking at the futures curve.

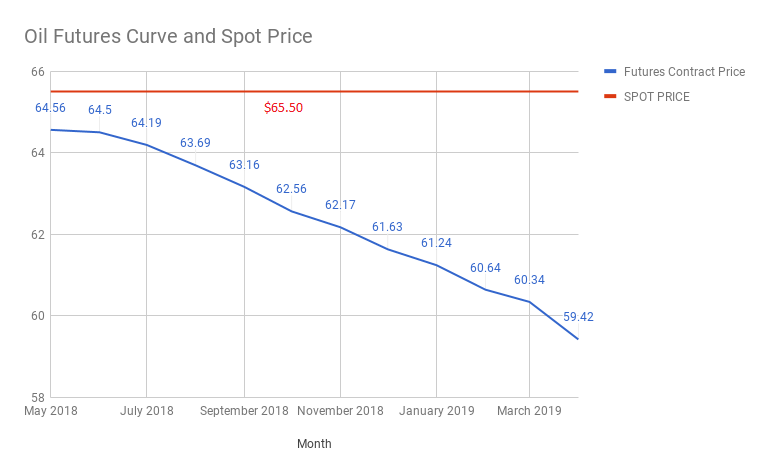

This is an actual look at the futures curve for WTI oil, as of March 2018. The oil futures market at this particular time is in backwardation. In other words, all futures prices are currently below the spot price of $65.50.

Figure 4: WTI Oil Futures Curve (9)

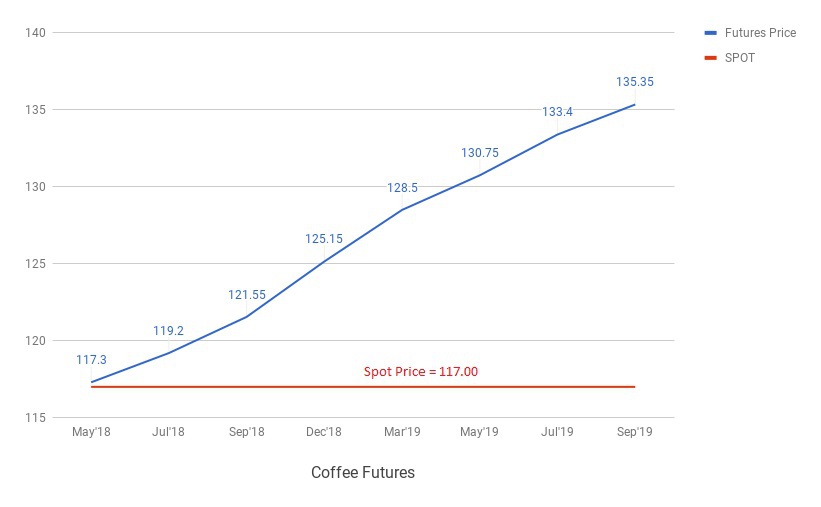

On the other hand, the current Coffee futures market is in contango. With a current spot price of $117.00.

Figure 5: Coffee Futures Curve (10)

Putting our Education Into Action with an Analysis of USO

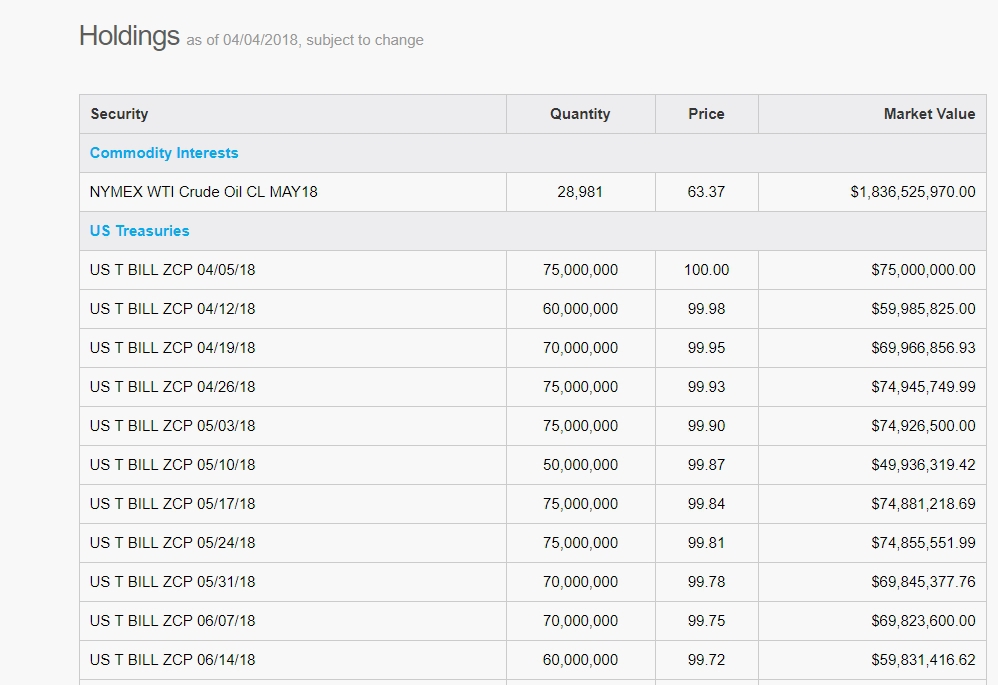

With a fundamental understanding of futures contracts, let’s work on an application of our knowledge. Suppose you read Wes’ article on all the benefits of commodity futures and you’ve decided that he’s struck gold here and you want a simple way to access the commodity market. The first place most of us equity guys look is the ETF market. And why not? Who needs to know this futures mumbo jumbo when we can just blindly purchase an ETF, right? Well, the problem arises when you pop the hood (i.e., read the prospectus) of the specific commodity ETF in mind. The first thing you’re going to find under the hood of commodity ETFs are futures contracts. For example, let’s explore USO, an oil ETF designed to track the daily price movements of WTI Crude Oil, and see what they are holding.

Right there at the top of the list is roughly 29,000 of the nearest term (11) futures contracts. The only other holding is US TBills, aka cash. So by holding a commodity ETF, all we’ve done is outsourced our futures investing to someone else, and we pay them 0.77% annually to do that for us. This could be a very reasonable price to pay, but it’s important to be aware of what we are paying for when buying an ETF. An outside alternative would be to simply manage oil futures on our own (see Interactive Brokers, for example).

What does USO need to do to manage its oil futures portfolio?

As the May expiration approaches, USO is holding futures contracts that settle physical delivery of 29 Million barrels(12) of WTI. Since it’s perfectly clear that the managers of USO don’t want to take physical delivery of 29 million barrels of oil, we know that they are going to have to go out into the open market and offset their May position.

Looking at figure 4 we can see that the managers of USO are going to go into the open market and sell 29,000 oil futures contracts, and simultaneously purchase 29,000 of June oil futures contracts. The oil market as of this writing is in backwardation and the further you go out into the future the larger the difference between the spot and futures price becomes.(13) So our managers are going to go out into the open market and sell the May futures contracts with a settlement price of $64.56 and simultaneously purchase the June contracts that have a settlement price of $64.50. This process of moving from the May contract to the June contract is called rolling. Now recall we’re trading futures here, so we aren’t receiving $64.56 and paying $64.50. There is no net proceed of 6 cents that accrue instantaneously, however, as we switch from the May contract to the June contract that 6 cents, assuming no change in the spot price, will flow through to the margin account as the June expiration approaches.

Since shifting from the May to June contract results in an increase in the underpricing of the future contract vs the spot price, there is a positive roll yield. A market in backwardation can create a strong tailwind for holding futures contracts. When the oil futures market is in contango (futures prices are greater than the spot price) a negative roll yield is created and holding futures comes with an inherent cost that eventually flows to the margin account.Conclusion

The futures market is an exciting corner of the financial markets, that oftentimes investors who focus on equities consider, but we don’t fully understand. The goal of this writing was to give everyone a good foundation of knowledge to start digging deeper into the futures market. There is an ocean of information out there and we’ve gone about a foot deep We should now understand the characteristics of the futures market, how the price of the futures contract against the spot price can impact the cash flows to the margin account, and how moving from one futures contract to another can impact your returns.

Hope you liked the post and please let us know if you have any questions or see anything that needs fixing.

Appendix: Practice Questions

I put together some questions and answers to help ensure understanding.

Click on the links below and you’ll access the files:

Questions

Answers

References[+]

| ↑1 | Please note that I don’t claim to be the world’s expert on commodity futures, but I’ve gleaned enough to reach an intermediate level. This begs the question: Why would you listen to someone who isn’t an expert? Well, experts are often burdened with the curse of knowledge, and while they may understand a subject thoroughly, they can have a tough time explaining something to people who are not experts but want to learn more about the subject. This essay is my attempt to help non-experts get a better grasp of how commodity futures work from the vantage point of someone who can relate to the challenges of trying to learn more about a foreign subject. |

|---|---|

| ↑2 | http://www.cmegroup.com/trading/agricultural/grain-and-oilseed/corn_quotes_volume_voi.html?optid=300 |

| ↑3 | This is ironic since Buffett has used leverage his entire life to magnify his own investment results. |

| ↑4 | This image was edited by adding the comment “Hey Kids hope you like corn.” |

| ↑5 | http://www.businessinsider.com/kyle-bass-explains-why-he-had-the-university-of-texas-take-physical-delivery-of-1-billion-in-solid-gold-2012-3 |

| ↑6 | See “The Mechanics of Commodity Futures Pricing” in this post by Wes for more details. |

| ↑7 | T is simply the time of the contract represented as a percent of the year. In our example, it’s 1, but if the duration of the Futures contract was 3 months it would be 3/12 or 0.25 |

| ↑8 | (Note that I removed the Future Value of Cash flows because we’re predominantly focused on commodity futures in this article, which has no interim cash flows). |

| ↑9 | Pricing information from CME website. http://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude.html |

| ↑10 | Pricing data for Coffee futures were obtained from the Intercontinental Exchange (ICE) website https://www.theice.com/products/15/Coffee-C-Futures/data |

| ↑11 | May is the closest expiration for oil futures as of this writing 4/4/18 |

| ↑12 | Each futures contract settles to 1,000 barrels of Crude. 1,000 barrels x 29,000 contracts = 29,000,000 barrels of oil. |

| ↑13 | The oil market is frequently in backwardation, even when spot prices are expected to rise because the convenience yield for holding physical oil is fairly high. The bulk of the convenience yield in oil is due to the optionality that holding the physical asset affords you. |

About the Author: Rich Shaner, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.