Improving U.S. Stock Return Forecasts: A “Fair-Value” CAPE Approach

- Joseph Davis, Roger Aliaga-Diaz, Harshdeep Ahluwalia, and Ravi Tolani

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

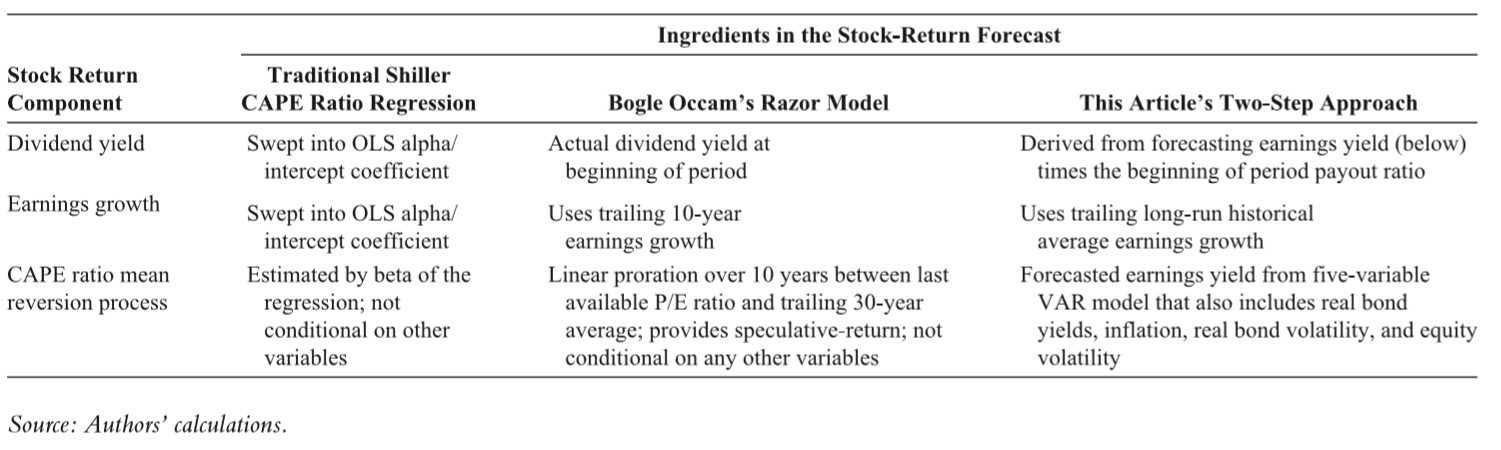

The authors propose and test an enhanced Shiller model that incorporates macroeconomic conditions, by modeling real bond yields and volatility, equity volatility and inflation, in a 2 step approach to forecasting equity returns. The underlying thesis is that the level of mean reversion in the CAPE ratio varies with the state of the economy and is not a fixed long-run target.

- Can forecast accuracy be improved with an enhancement to the long-term mean reversion form of the Shiller CAPE ratio by incorporating macroeconomic conditions into the estimate?

- Comparison of Stock Forecasting Approaches:

What are the Academic Insights?

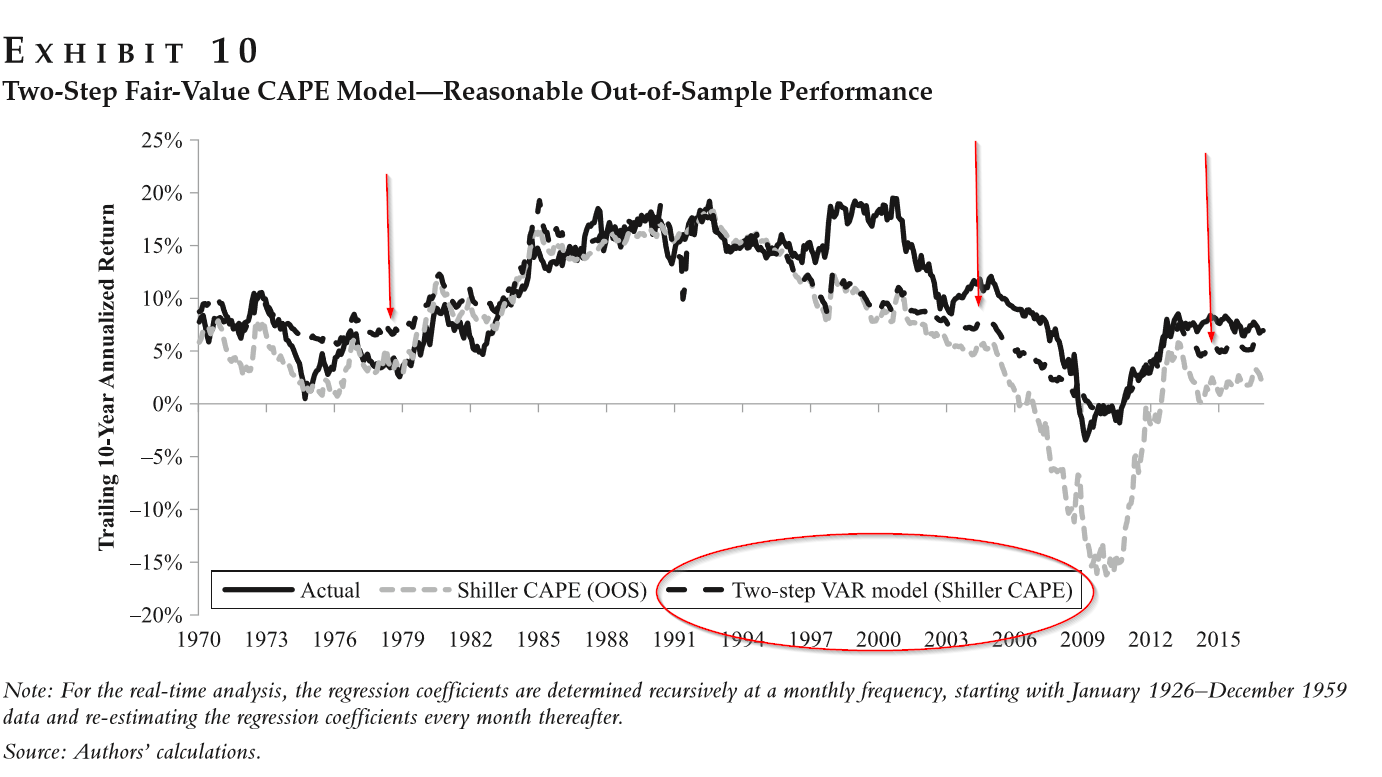

- YES. The mean forecast error of the 2-step model post-1985 is 4.1% compared to 7.8% for the traditional model, with immaterial differences prior to that period. The authors attribute the outperformance to several issues:

- The Shiller model has exhibited next to no mean reversion, falling below its long-term average only one time since 1985;

- The notion that the CAPE ratio has a steady-state level is unrealistic and in fact, the level of mean reversion varies with the state of the economy;

- Lower real bond yields imply lower real earnings yields and therefore higher CAPE ratios. In the absence of a large difference between real bond yields and their long term averages at the point in time the forecast is made, the models should (and do) perform similarly.

Why does it matter?

The weakening of the out of sample performance of the traditional CAPE model is likely a reflection of instability in the mean reversion process that is the foundation of the model. The average return to which stocks have reverted and the speed of the reversion have not been constant over time. Notwithstanding any estimation bias that may exist, the explicit relationship between bond yields/cost of capital and earnings yields/expected return on equity have a measurable impact on the Shiller CAPE forecast. Instability in this relationship means that the CAPE ratio itself may not revert to a fixed long run average and the consequent instability in the CAPE ratio corresponds to material changes in real yields over the period of this study.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

The accuracy of U.S. stock return forecasts based on the cyclically-adjusted P/E (CAPE) ratio has deteriorated since 1985. A primary reason has been that traditional CAPE regressions assume the CAPE ratio reverts mechanically to its long-run average, regardless of the macroeconomic environment. In this article, the authors propose an enhancement to standard CAPE-based forecasts that conditions mean reversion in the CAPE ratio on real (not nominal) bond yields, expected inflation rates, and financial volatility in a VAR model. The forecasted results are promising for both real and nominal returns, with out-of-sample forecast errors approximately 50% lower than traditional approaches. The differences are economically meaningful and statistically significant over the forecast period examined. At present, low real bond yields imply low real earnings yields and an above-average “fair-value” CAPE ratio. Nevertheless, with Shiller’s CAPE ratio now well above its fair value, the model proposed by the author predicts nominal U.S. stock returns centered near 5% over the next decade.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.