- Matthias x. Hanauer, Jochim G. Lauterbach

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the Research Questions?

As a non-academic finance person, I was never really exposed to academic research until I started working on articles for Alpha Architect. Fortunately (or unfortunately, depending on your perspective), I am now very familiar with the so-called “cross-section of expected returns” debates. (explained here). This research seeks to identify the core factors that explain why stock move the way they do. The literature was boring when the world was defined by the CAPM — i.e., one factor explains everything about stock returns. But ever since Fama and French wrote down their 3 factor model, the cross-section of expected return debate has greatly expanded. Researchers have looked at expanded models and datasets. This particular paper expands our knowledge on stock returns by examining emerging markets.

The researchers seek to answer the following questions:

- How well does Fama and French’s model perform in emerging markets?

- Can we develop a model that has superior forecasting abilities in emerging markets than the Fama-French five factor model?

What are the Academic Insights?

This study utilized data on 28 emerging countries from Thomas Reuters Datastream and Worldscope to cover the period from July 1995 – June 2016. To make the results more robust the research team filters the data in several ways. First, they applied dynamic screens to have companies with positive market caps, positive book values, as well as fundamental data (i.e., sales, cogs, earnings, etc.), they then removed all financial companies, and excluded all micro-cap stocks.

They utilize this data to analyze the impact of 17 anomalies and their abilities to show return predictability in equal weighted sorts as well as value-weighted sorts in an attempt to eliminate the data being skewed by smaller or larger stocks.

So what exactly did they find?

- Yes, the Fama-French five-factor model (beta, size, value, profitability, and investment factors) are documented in emerging markets.

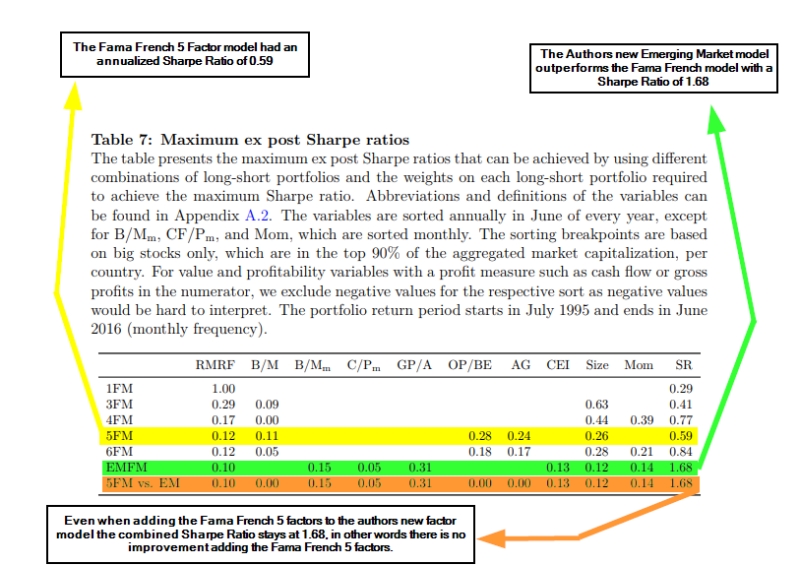

- Yes, the research team proposes a more specific factor model for emerging markets that includes cash flow-to-price, gross profitability, composite equity issuance, and momentum. They found that factor definitions as done by Fama and French are less robust than the alternate definitions the authors derived.

Why does it matter?

This paper uses emerging market data to build a new model with revised factor definitions. What makes this paper interesting is that it highlights that factor model definitions are rarely perfect and nobody has the right answer. Despite Fama and French’s best efforts with their 5-factor model, momentum still matters (as it does in frontier markets). Also interesting is the fact that beta is not priced, all else equal (not good for the CAPM camp).

What are the most important charts from the paper?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Using monthly stock returns from 28 emerging market countries and a total sample period of 21 years, we investigate the predictive power of a broad set of factors. We document that the factor definitions of the Fama and French (2015) five-factor model are less robust compared to alternative factor definitions. In contrast, the anomalous returns associated with cash flow-to-price, gross profitability, composite equity issuance, and momentum are pervasive as they show up in equal- and value-weighted portfolio sorts as well as in cross-sectional regressions. In contrast to financial theory and in line with previous findings, we do not find a positive cross-sectional relationship between risk and return. Finally, return forecasts derived from the alternative factor definitions are superior in their out-of-sample predictive ability to the ones derived from the five-factor model.

About the Author: Rich Shaner, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.