Intangible Capital and the Value Factor: Has Your Value Definition Just Expired?

- Noël Amenc, Felix Goltz, and Ben Luyten

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

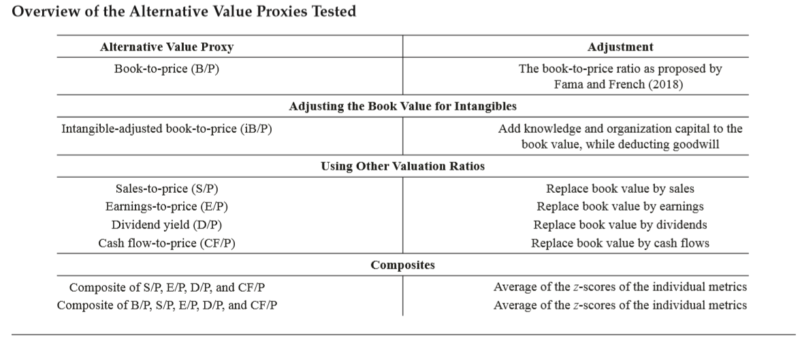

Many in the academic and practitioner research world are arguing that the reported B/P ratio is approaching it’s “expiration date” because of the importance of intangibles, R&D, brand value, and so on. For a different perspective you can read Larry Swedroe’s review of this paper and these topics here. While the determination of true “intrinsic value” remains in the domain of active managers, it is not a requirement for value factor investors. Instead, value as a factor, requires the identification of specific firm attributes like B/P, E/P, etc., that are related to differences in the cross-section of expected returns for stocks. It follows that If intangible capital improves the ability for value metrics to differentiate or explain those return differences then it should be included in the calculation. The objective of this research is to examine two solutions to the problem inherent in the practice of calculating a B/P ratio that omits the impact of intangible or unrecorded capital. First, the authors include intangibles in the calculation of book value, and then compare that approach to using other value ratios and composites to identify the value factor in stocks.

- Does adjusting the book value ratio to include unrecorded intangibles improve value performance?

- Or is it better to use other valuations ratios to define value?

What are the Academic Insights?

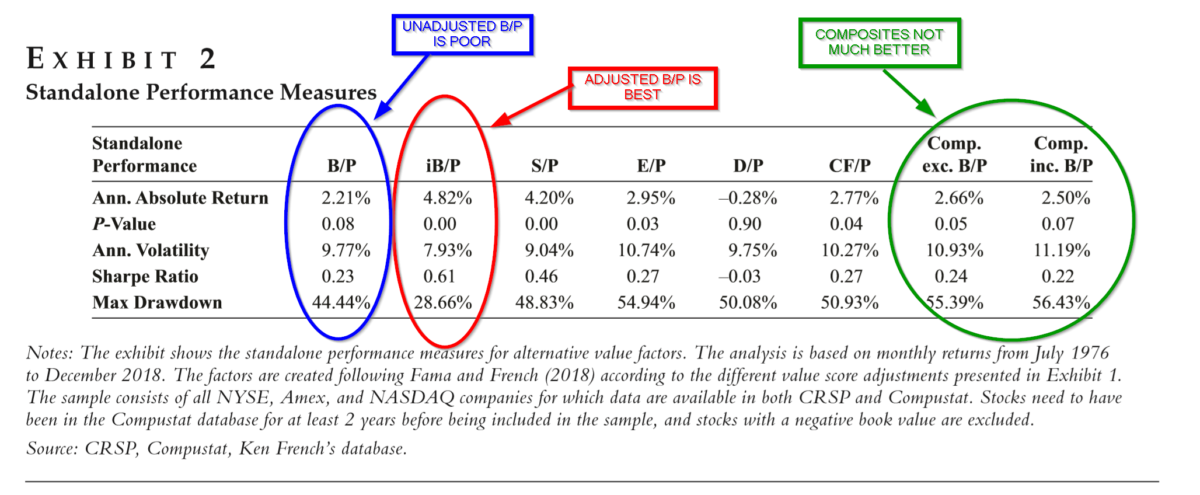

- YES. Results presented in Exhibit 2 show that alternate (to B/P) value metrics are generally superior. Sharpe ratios, returns, and drawdowns based on S/P, E/P, CF/P outperform the standalone B/P, with D/P the only exception. The largest improvement occurs with the adjusted B/P, where the addition of intangibles to the calculation more than doubles the annualized return. These results are consistent with other findings, both from academics and practitioners, including factor index providers.

- NO. In a multifactor framework, the results on alternative value definitions are less interesting when compared to an intangibles-adjusted B/P ratio. Using a six-factor model (market, size, momentum, low volatility, high profitability, and low investment) none of the alternative value ratios delivered an excess return. However, for the intangibles-adjusted B/P, the excess return estimated from the risk model delivered an alpha of 2.09% (p-value=.02). The alpha remained positive and significant when other value metrics and the six other factor exposures were included. However, the alpha delivered for alternative value metrics was not significant when the adjusted B/P and other risk factors were included. For portfolio construction, adding an adjustment for intangibles provides performance benefits not associated with simply using other value metrics and may be a more promising solution. It appears that for most of the alternate definitions of value, excluding adjusted B/P and D/P exhibited large and significant exposures to the profitability factor, ranging from .32 for the composites and .09 for the standard B/P. The authors argue the factor overlap that emerged from the study implied a reduction in factor diversification for multifactor products.

Why does it matter?

Although beyond the scope of this summary, the authors argue that including intangibles in the definition of a value metric can be motivated not only from a risk perspective but also from a behavioral point of view. Complementing those arguments, we find recommendations in the accounting literature for converting various items in the financial reports into sources of intangible capital: R&D expenses converted into knowledge capital; advertising expenses into brand capital and a portion of SG&A expenses into organizational capital. Using those reinterpretations of reported financial data, researchers have provided empirical evidence on the positive relationship between high organizational capital, high brand and high knowledge capital, all measured relative to market value and expected stock returns. This research builds on that foundation and suggests that in the context of the practical reality that investors commonly hold multifactor portfolios, adding overlapping exposures contained in composite value definitions may not be the best solution to the B/P problem.

The most important chart from the paper

Abstract

Many index providers claim that the book-to-price ratio is no longer a sufficient descriptor of the value factor. They argue that it has become outdated because reported book value ignores investments into intangible assets. As a solution, they propose including other valuation ratios, such as earnings-to-price, sales-to-price, cash flow-to-price, or dividend yield. However, this solution overlooks a superior alternative: Intangible capital can be estimated and added to the book value. In this article, the authors compare these alternative solutions. Beyond a naïve analysis of performance, they ask (1) whether improvements persist when considering implicit exposure to other factors and (2) whether they align with a risk-based explanation for the value factor. The authors show that including unrecorded intangibles in the book value increases the value premium and aligns with risk-based explanations. By contrast, other valuation ratios do not add investment value beyond picking up implicit exposure to factors other than value. Such valuation ratios also fail to improve the alignment of value strategies with risk-based explanations.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.