CFO Gender and Financial Statement Irregularities

- V.K.Gupta, S. Mortal, B. Chakrabarty, X. Guo, D. B. Turban

- Academy of Management Journal, 2019

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

There are estimates that although approximately 15% of public firms may engage in accounting fraud annually, but less than 1% are actually caught. It can be important to develop tools for diagnosing financial misreporting like the Financial Statement Deviation (FSD) to measure the level of irregularities in financial statements (higher the FSD Score and the greater the likelihood that numbers in the financial statement contain errors and/or were manipulated) without the need of accounting data. By using FSD, this paper investigates whether executive gender has an impact on corporate decisions and actions. Specifically, the authors ask the following questions:

- Do firms with female CFOs have a lower likelihood of financial misreporting than comparable firms with male CFOs?

- Is the relation between CFO gender and financial misreporting contingent on governance mechanisms (e.g., institutional ownership and analyst coverage) such that misreporting of firms with male CFOs will differ more from that of firms with female CFOs when governance is weak?

What are the Academic Insights?

The sample is made up of 2,186 unique US-based firms and 18,659 firm-year observations. By intersecting six different databases (Execucomp, Compustat, Institutional Shareholder Services, CRSP, IBES, and Thomson Reuters) the authors find(1):

- Female CFOs represent 8% of our sample, consistent with other findings that women remain underrepresented in the top tiers of public corporations

- The correlation between Female CFO and financial misreporting (as captured by FSD Score) is negative and significant (correlation = -.03, p < .05), implying that firms with female CFOs have a lower likelihood of financial misstatement

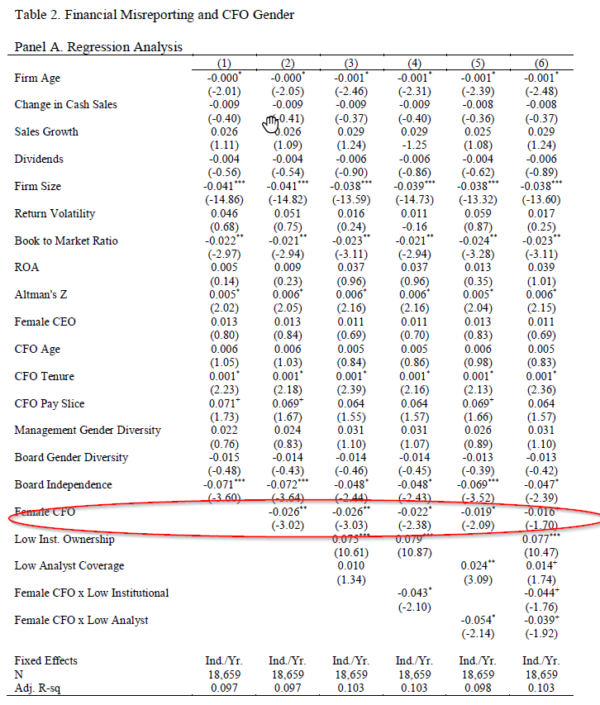

- Using panel regression, there is a significant negative effect (β = -0.026, t = -3.02, p < .01) of having a female CFO on the likelihood of financial misreporting (that is, FSD Score), indicating that female CFO firms have 2.6% lower FSD Score than male CFO firms. This is an economically meaningful effect in comparable literature

- Firms with female CFOs have a significantly lower likelihood of financial misreporting compared to firms with male CFOs when institutional ownership is low

- Similarly, firms with female CFOs have a significantly lower likelihood of financial misreporting compared to firms with male CFOs when analyst coverage is low

Why does it matter?

This study extends and confirms the literature on the relation between the upper echelon gender heterogeneity and corporate misconduct such as earnings quality (Krishnan & Parsons, 2008) and securities fraud (Cumming et al., 2015). Understanding whether executive gender influences firm-level outcomes is important as the ascent of women to the upper echelons of the corporate world challenges the “implicit masculine bias” in scholarly understanding of managerial decision-making (Ho, Li, Tam, & Zhang, 2015).

Additionally, this research extends ongoing scholarship on corporate governance, which generally sees governance mechanisms as agnostic to the gender of the executive. As increasing numbers of women ascend to executive positions, the issue of how governance mechanisms have differential influence depending on the gender of the executive is a worthy topic for future scholarship and of considerable interest to managers and other organizational stakeholders.

The Most Important Chart from the Paper:

Abstract

The increasing presence of women in upper echelon positions draws attention to the possible effects of executive gender on corporate decisions and actions. In this study, we formulate theory about the impact of CFO gender on financial misreporting to generate two key insights. First, we hypothesize that firms with female CFOs will have a lower likelihood of financial misreporting than comparable firms with male CFOs. Second, we argue that the relation between CFO gender and financial misreporting will be contingent on governance mechanisms (e.g., institutional ownership and analyst coverage) such that misreporting of firms with male CFOs will differ more from that of firms with female CFOs when governance is weak. Our results, based on a novel leading indicator of the likelihood of financial misreporting, provide support for our predictions. Various alternative econometric specifications, including (but not limited to) exogenous shocks, propensity score matching, and modeling treatment-effects, random effects, firm-fixed effects, and hybrid effects provide general support for our theory and hypotheses. Implications and directions for future research are discussed.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.