Valuing a Lost Opportunity: An Alternative Perspective

on the Illiquidity Discount

- Jamil Baz, Steve Sapra, Christian Stracke, and Wentao Zhao

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Private investment opportunities seem to have been filling investors’ portfolios. These investment vehicles come with a discount to pay investors for taking on illiquidity risk. Readers of this article are treated to the development of a theory and a practical model that quantifies the illiquidity discount. In this version, the authors cast the illiquidity discount as an opportunity cost that emanates strictly from investor expectations of alpha “opportunities” in the current public and private markets As a relatively clean estimate of opportunity cost, alpha does not require a risk model or estimates of risk premiums but can be discounted at the risk-free rate. The authors decompose and model the return stream from the expected alpha into two components. The first component is continuously generated from investing in known sources of alpha (selection, timing) and the second is generated infrequently as a jump component and offers significant alpha opportunities at specific points in time. Full details of the intricacies of the mathematical framework and estimation methods are explained quite well in the article. Assuming that the investor, manager, asset allocator, etc., possess at least an average level of skill (dubious, but more on this assumption later), the authors address the following 2 questions.

- What is the size of the illiquidity discount?

- How is the relationship between the illiquidity discount and the business cycle characterized within the opportunity cost framework?

What are the Academic Insights?

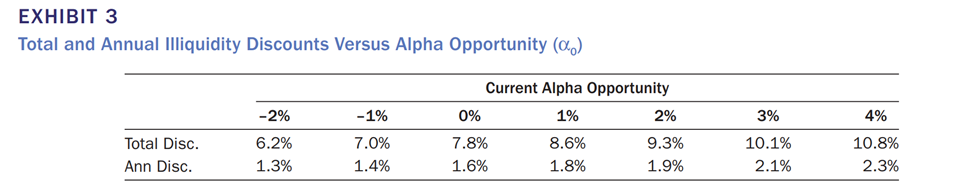

- 1.6% TO 1.9%. In general, the theory predicts the discount will vary depending on how significant investors view the alpha opportunity. If the opportunity is substantial and a high probability scenario, investors will demand a relatively large discount. On the other hand, if the alpha landscape is perceived to be relatively scarce and low probability, the demanded discount will be considerably lower. If normal or usual alpha opportunities are expected, the price for illiquidity will be somewhere in-between. Given an investor has average skill, the authors estimate the discount to range to be 1.6% to 1.9% annually. See Exhibit 2 below for discounts across investment horizons from 1 to 10 years and the average vs. an expert/Buffet-style investor.

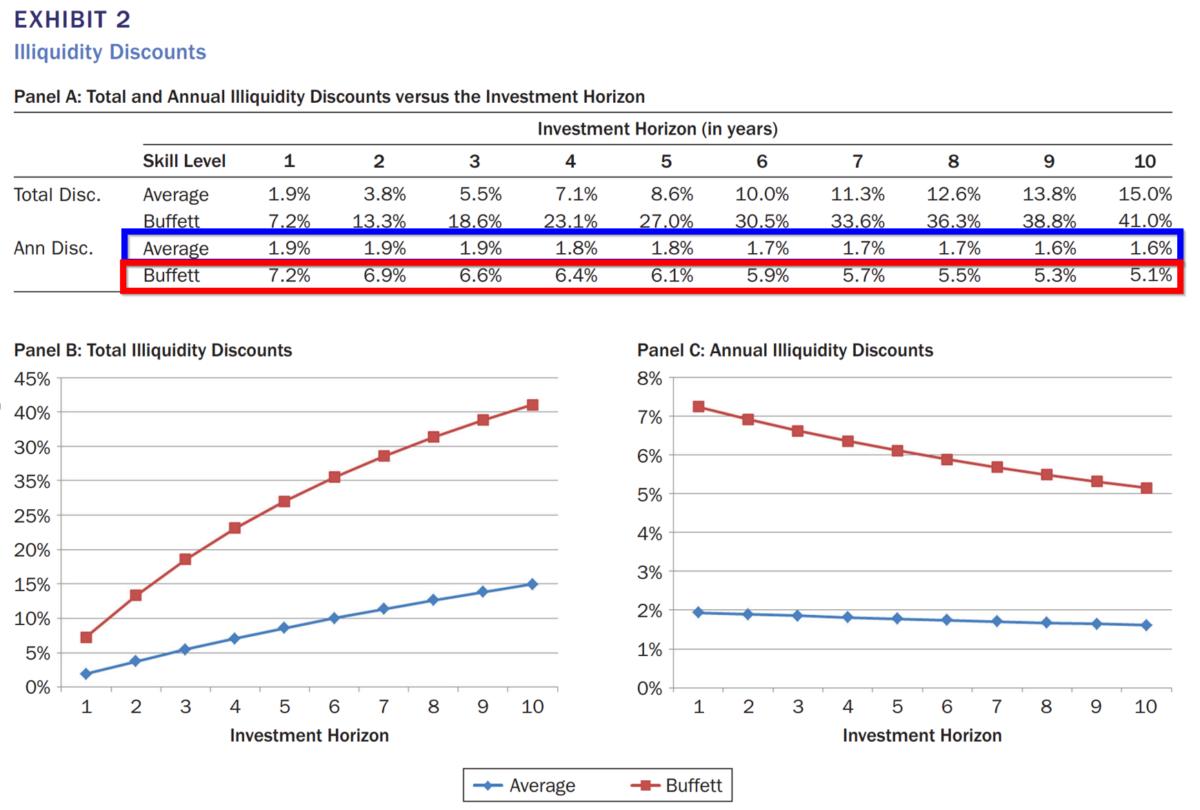

- The authors propose a COUNTERCYCLICAL relationship. When the business cycle is in a negative phase (recession), alpha opportunities are likely to be perceived as plentiful, and scarce during the opposite scenario (late expansion). Turns out that this proposition has actually been confirmed empirically (Nadauld et al. 2018). Without estimating the size of the spread across all investment horizons, the authors instead present the 5 year scenario in Exhibit 3 below. Note that when the current alpha equals a long run alpha of 1%, the discount is 1.8% as reported in Exhibit 2. When alpha is scarce at -2% rising to an abundant 4%, the discount required rises from 1.3% to 2.3%.

Why does it matter?

As illiquid investments are built in more and more portfolios it’s good to have an understanding of what type of risk premium we should expect to be paid for taking another layer of risk. This article provided one interesting look at how we can evaluate and quantify that risk.

The large caveat in the room: The assumption that investors have at least an average amount of skill (defined as beating the market, alpha, and so on) is difficult to reconcile with the empirical evidence we all are familiar with. Analysis of the performance of average investors, fund managers, asset allocators, those who select managers, and other market participants provide convincing evidence that skill is effectively nonexistent. The authors anticipate this criticism and devote a fair amount of discussion suggesting that it is not the evidence of skill that is necessary, but the belief the investor has in his/her own prowess that matters. Therefore, the theory and empirical evidence presented here still work. I would tend to agree. There is ample evidence that investors tend to overestimate their own abilities in a variety of contexts, including investing.

The most important chart from the paper

Abstract

The illiquidity discount is the valuation discount investors apply to investments as compensation for their lack of immediate marketability. The authors analyze the concept of the illiquidity discount in the specific context of private investments whereby investors are precluded from accessing their capital, potentially for periods as long as several years. Although many explanations have been put forth for why such discounts should exist, as well as for their magnitude, the authors posit an alternative explanation based on the concept of opportunity cost: By holding an illiquid asset, an investor forgoes the potential excess returns that could have been generated by trading the liquid markets. The authors derive a basic mathematical model to show that the illiquidity discount should be directly related to the magnitude of trading opportunities on the horizon. Investors who believe their future investment opportunities to be favorable should command commensurately large illiquidity discounts for tying up capital. This implies that more skilled investors should require larger illiquidity discounts than their less skilled counterparts. Finally, the authors conjecture that the equilibrium illiquidity discount priced into private markets at any given time is primarily a function of investors’ perceived skill rather than actual skill. This highlights an important behavioral component to the pricing of private investments.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.