What Explains Momentum? A Perspective From International Data

- Amit Goyal, Narasimhan Jegadeesh, and Avanidhar Subrahmanyam

- working paper

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

A lot of ink has been spilled on a seemingly simple question: Why does the momentum factor exist? We have done our fair share contributing to the question and our collective conclusions are in our book Quantitative Momentum. We walked away from the question and determined the following:

- We will never really know why the momentum factor actually exists. But we know that is does exist and it is arguably stronger than value.

- The arguments as to why momentum exists can be boiled down into two primary camps:

- momentum is an underreaction phenomenon

- momentum is an overreaction phenomenon.

- Our most informed guess is that momentum is driven by underreaction and this is best captured via the so-called ‘From-in-the-Pan‘ algorithm, which we use in our own investment processes — i.e., Quantitative Momentum.

- Of course, we have discussed research that suggests that momentum is not an underreaction phenomenon, but rather, an overreaction problem. The most compelling evidence for this is based on data from 19th century Imperial Russia stock market –we appreciate the out of sample nature of the data, even though it is obviously outdated.

This brings us to a new paper from well-established financial economists on the topic of momentum. The authors seek to shed light on the topics above and address the following questions in the context of international markets, which have been studied less intensely than US markets:

- What drives the momentum factor in international markets?

- When are momentum effects strongest?

What are the Academic Insights?

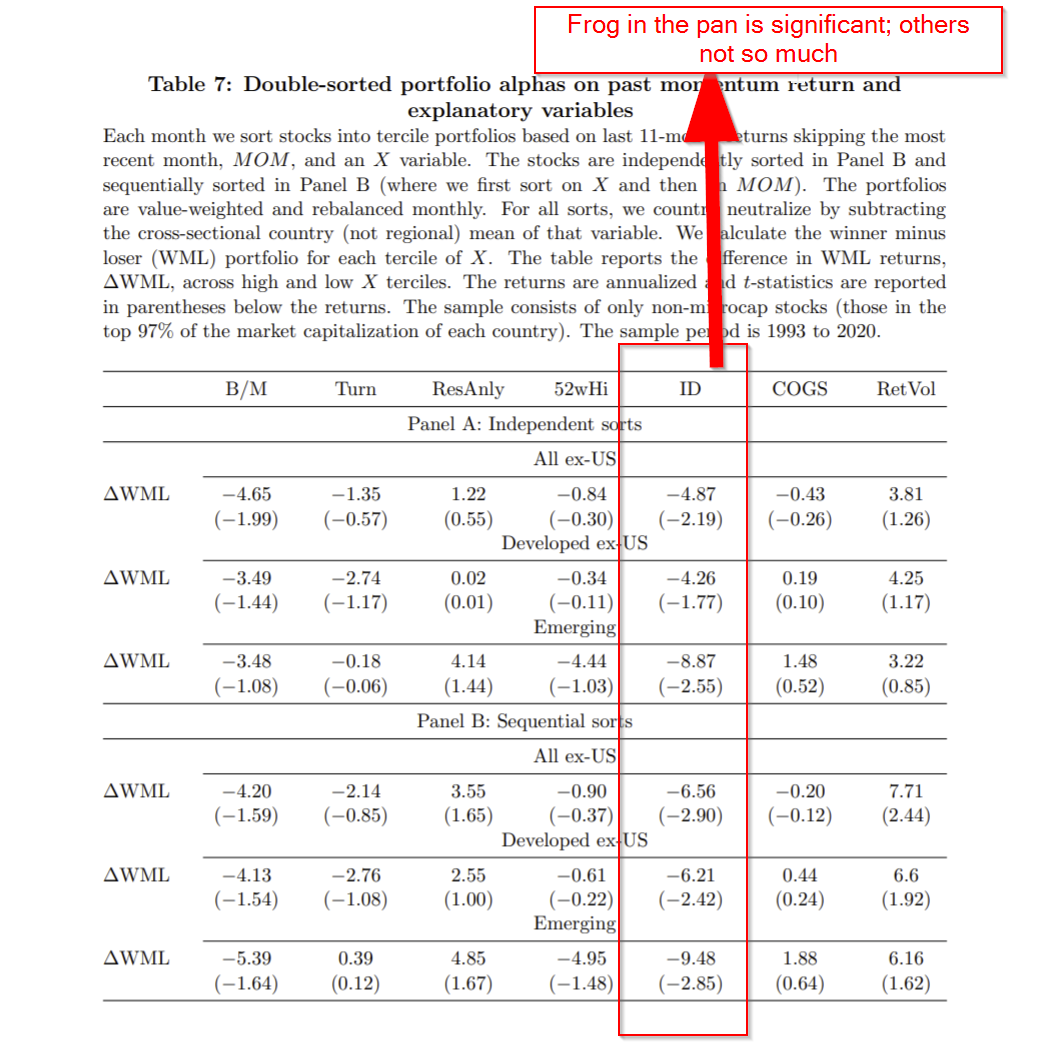

- And the winner is…Frog in the Pan momentum! The authors state the following: “Across all of our tests, we find remarkably robust support for the FIP hypothesis of DGW (2014).”

- The authors confirm results that have been found in the US context — momentum factor profits tend to be higher in up-markets and in markets with lower volatility.

Why does it matter?

Momentum, from an empirical perspective, seems to be a settled issue — excess returns exist and they are very strong across many markets and asset classes — even more so than the so-called value factor. However, from a practitioner perspective, momentum gets very little love and the number of value-based products outweighs the number of momentum-based products over 2 to 1.(1)

This paper is especially interesting because it highlights the robustness of the momentum factor outside of US markets and sheds light on why momentum exists and how to best measure it. Perhaps these results will encourage more investors to consider momentum as a counterpart to their value portfolios? Who knows…

Having conducted an inordinate amount of research on the momentum factor, we find it comforting (likely due to confirmation bias!) that independent researchers have identified the same thing we have found — frog in the pan is a robust way to measure momentum if one is seeking to take advantage of the momentum factor.

The most important chart from the paper

Abstract

There is as yet no consensus on why equity markets permit momentum. Our analysis uses out-of-sample international data to consider a “horse race” across momentum rationales based on overconfidence, slow diffusion of information, limited attention, anchoring bias, and real options. Our central finding in cross-sectional analyses is that the frog-in-the-pan (FIP) hypothesis, which posits that due to limited attention, investors underreact to information that arrives gradually rather than in concentrated doses, consistently wins. Also, internationally, momentum is stronger in less volatile markets and in up-markets. Information flows more gradually during these market states, implying additional support for FIP.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.