Is “Not Trading” Informative? Evidence from Corporate Insiders’ Portfolios

- Luke DeVault, Scott Cederburg & Kainan Wang

- Financial Analyst Journal, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Plenty of research ( most recently, Cziraki et al. 2021) shows that insider buys contain value-relevant information while insider sales include little to no information. But what about the action of “not trading”?

The authors of this study ask the following:

Are the trades of portfolio insiders informative about the stocks they choose not to trade, those they choose not to buy, and those they choose not to sell?

What are the Academic Insights?

By studying SEC Form 3 and Form 4 filings provided by Thomson Reuters from 1992 to 2020, the authors find:

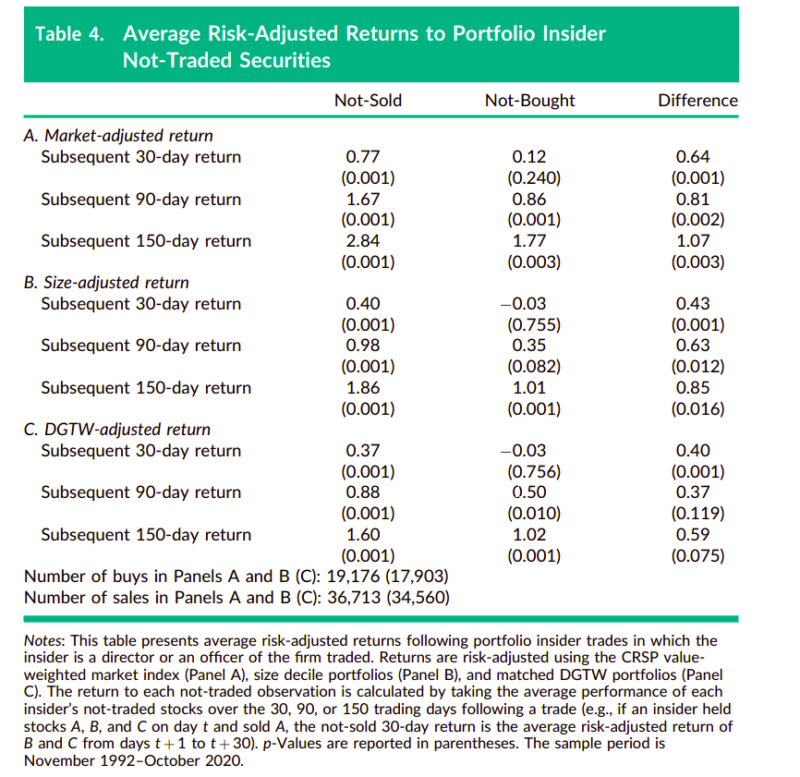

- YES, but only those they choose not to sell. In fact, on average not-sold stocks earn large abnormal returns following a portfolio insider’s sale. This abnormal performance is long-lasting. A strategy that buys not-sold stocks following the required disclosure of portfolio insider sales earns significant alphas even after incorporating trading costs, and strategies that use longer holding periods are particularly successful after costs given their lower turnover and the long-term nature of the positive signals about not-sold stocks. For example, with an annual holding period, the not-sold portfolio earns a monthly CAPM alpha of 39 bps (annualized 4.7% alpha, statistically significant at the 5% level) and a monthly Carhart alpha of 37 bps (annualized 4.5% alpha, significant at the 1% level). The authors also show that the not-sold signal can complement other trading strategies like momentum. In fact, the research shows that buying not sold stocks that are also past winners earns particularly high alphas.

Why does it matter?

This study contributes to the academic work on stock returns following insider trades and to a growing literature studying insider inaction. Overall it suggests that traders can capitalize on the information about not sold stocks revealed by portfolio insider sales.

The Most Important Chart from the Paper:

Abstract

Some individuals, e.g., those holding multiple directorships, are insiders at multiple firms. When they execute an insider trade at one firm, they may reveal information about the value of all—both the traded insider position and not-traded insider position(s)—the securities held in their “insider portfolio.” We find that insider “not-sold” stocks outperform “not-bought” stocks. Implementable trading strategies that buy not-sold stocks following the disclosure of a sale earn alphas up to 4.8% per year after trading costs. The results suggest that even insider sales that are motivated by liquidity and diversification needs can provide value-relevant information about insider holdings.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.