Race influences professional investors’ financial judgments

- Lyons-Padilla, Markus, Monk, and Eberhardt

- Proceedings of the National Academy of Science

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Asset allocators are trillion-dollar influencers. They manage more than $69.1 trillion dollars globally on behalf of governments, universities, charities, foundations, and companies. They do so by distributing capital to professional fund managers to generate returns. Additionally, we know that professional money managers lack diversity. In fact, fewer than 1.3% of assets across 4 classes (mutual funds, hedge funds, real estate, and private equity) are managed by women and people of color.

The authors of this study ask the following:

- Is there an investor bias against funds managed by people of color?

- Do biases exist predominantly at weaker levels of performance?

- Do biases exist most strongly at the top levels of performance?

What are the Academic Insights?

By designing and conducting an experiment* among 180 asset allocators tasked to evaluate four venture capital funds ( based on metrics of overall performance ratings of the team, evaluations of investment skills, attributions of competence, attributions of social fit, expectations of how much the fund would raise, and the likelihood of taking a meeting with the team, beginning due diligence, and investing in the team), the authors find:

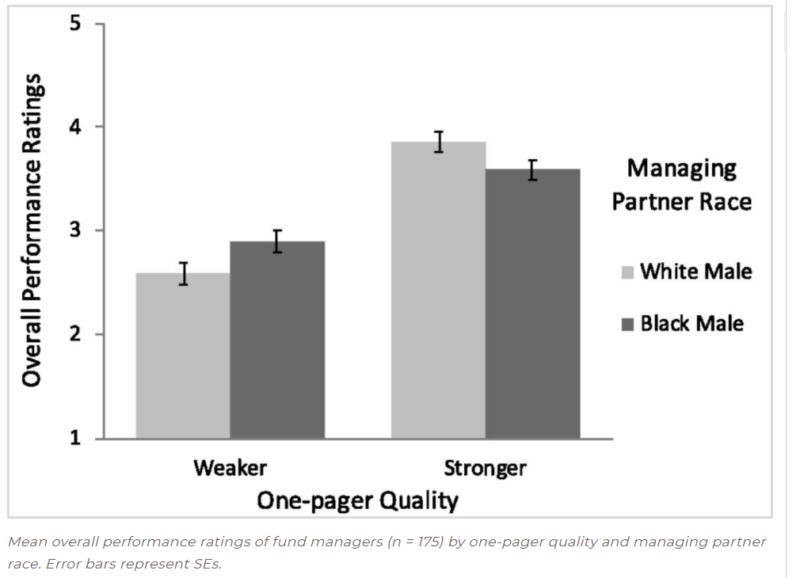

- YES- the authors find the existence of bias against managed funds operated by people of color, but only in the stronger quality group.

- NO-To the contrary, there is evidence of bias in favor of the black-male team in the weaker-quality condition. Whereas asset allocators exhibited a preference for the stronger white-male-led team in the overall performance ratings as described above, post hoc analyses showed higher ratings for the black-male–led team than the white-male-led team in the weaker-quality condition. The higher ratings of the racially diverse weaker-quality team did not translate to anticipated funding.

- YES- Post hoc comparisons revealed that asset allocators rated the stronger white-male-led team marginally higher than the stronger-quality black-male–led team.

Why does it matter?

This paper finds that asset allocators may not realize that they are missing opportunities for higher financial returns by undervaluing high-performing funds led by people of color or by overvaluing white-male-led funds. In fact, asset allocators might be violating their fiduciary obligations (i.e., to generate the highest possible returns for their investors) by not investing in funds led by people of color that could produce returns as high or higher than white-male–led funds. A possible solution proposed by the authors:

“Organizations could train asset allocators to overcome their biases by revamping their investment criteria and strategies and ensuring they are knowledgeable about the success of firms led by people of color. Diversity, in fact, is not only a moral obligation; it is a fiduciary one “

The Most Important Chart from the Paper:

Abstract

Of the $69.1 trillion global financial assets under management across mutual funds, hedge funds, real estate, and private equity, fewer than 1.3% are managed by women and people of color. Why is this powerful, elite industry so racially homogenous? We conducted an online experiment with actual asset allocators to determine whether there are biases in their evaluations of funds led by people of color, and, if so, how these biases manifest. We asked asset allocators to rate venture capital funds based on their evaluation of a 1-page summary of the fund’s performance history, in which we manipulated the race of the managing partner (White or Black) and the strength of the fund’s credentials (stronger or weaker). Asset allocators favored the White-led, racially homogenous team when credentials were stronger, but the Black-led, racially diverse team when credentials were weaker. Moreover, asset allocators’ judgments of the team’s competence were more strongly correlated with predictions about future performance (e.g., money raised) for racially homogenous teams than for racially diverse teams. Despite the apparent preference for racially diverse teams at weaker performance levels, asset allocators did not express a high likelihood of investing in these teams. These results suggest first that underrepresentation of people of color in the realm of investing is not only a pipeline problem, and second, that funds led by people of color might paradoxically face the most barriers to advancement after they have established themselves as strong performers.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.