Short sellers play a valuable role in keeping market prices efficient by preventing overpricing and the formation of price bubbles in financial markets. Market efficiency is important because an efficient market allocates capital efficiently. If short sellers were inhibited from expressing their views on valuations, securities prices could become overvalued and excess capital would be allocated to those firms.

The importance of the role played by short sellers has received increasing academic attention in recent years. Research into the information contained in short-selling activity, including the 2016 study “The Shorting Premium and Asset Pricing Anomalies,” the 2017 study “Smart Equity Lending, Stock Loan Fees, and Private Information,” the 2020 studies “Securities Lending and Trading by Active and Passive Funds” and “The Loan Fee Anomaly: A Short Seller’s Best Ideas,” and the 2021 study “Pessimistic Target Prices by Short Sellers,” has consistently found that short sellers are informed investors who are skilled at processing information (though they tend to be too pessimistic). That is evidenced by the findings that stocks with high shorting fees earn abnormally low returns even after accounting for the shorting fees earned from securities lending. Thus, loan fees provide information in the cross-section of equity returns. Interestingly, while retail investors are considered naive traders, the authors of the 2020 study “Smart Retail Traders, Short Sellers, and Stock Returns” found that retail short sellers are informed traders who profitably exploit public information when it is negative. The theory is that the high costs and the risk of unlimited losses, and the resulting absence of liquidity-motivated short selling, make short sellers more informed than average traders.

New Research

Ekkehart Boehmer, Zsuzsa Huszar, Yanchu Wang, Xiaoyan Zhang, and Xinran Zhang contribute to the literature with their study “Can Shorts Predict Returns? A Global Perspective,” published in the May 2022 issue of The Review of Financial Studies, in which they used multiple short sale measures to examine the predictive power of short sales for future stock returns in 38 countries over the period July 2006-December 2014. They began by noting: “In many countries, short sales are prohibited: stock borrowing and lending may be illegal, restricted, or undesirable; and short sellers may face high transaction costs. These factors make trading costly, and potentially lower the profits from short sales to the point that these trades become unattractive, even for informed short sellers. In some extreme cases, prohibitive shorting costs could eliminate shorting activities entirely, even if short sellers possess valuable private information. Meanwhile, short sellers may find it difficult to obtain private information in these markets and, therefore, some foreign markets may not experience the benefits of short selling. This suggests that the relevant trading and regulatory environments can play an important role for short sellers. Moreover, this cross-country variation raises the important question of what factors would affect the costs and benefits of short selling, and thus the predictive power of short selling for future returns, or the informativeness of short selling.” Such differences motivated their examination of short selling in 38 countries.

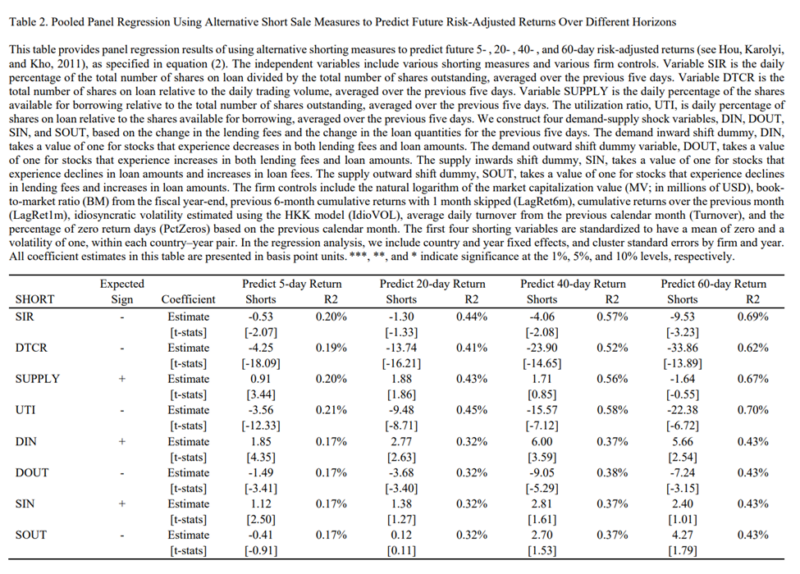

Boehmer, Huszar, Wang, Zhang, and Zhang hypothesized that “the predictive power of short sales for future stock returns, depends on the costs and benefits of short selling. These costs and benefits depend on the state of short sale regulations (including uptick rules, short sale bans, and the presence of effective security lending markets), overall market development (such as country-level openness or GDP per capita), short selling fees, liquidity, and pricing efficiency.” To test their hypothesis, they examined eight alternative short sale information measures from previous literature, including the short interest ratio (shares on loan scaled by shares outstanding), the days-to-cover ratio (shares on loan scaled by trading volumes), loan supply (shares available for loans scaled by shares outstanding), utilization ratio (shares on loan scaled by shares available for loans) in the stock lending market, and four measures of demand and supply shocks in the stock lending market. Following is a summary of their findings:

- Only five countries had more than a 5 percent average loan supply (the percentage of shares on loan): Canada, the Netherlands, Switzerland, the U.K., and the U.S. (where high institutional ownership and active institutional trading support a large loan supply in the OTC market), which has the highest loan supply (17 percent).

- Most of the shorting measures predicted returns over horizons ranging from five to 60 days, with the days-to-cover ratio (a one standard deviation increase predicted a 13.74 basis points drop in the future 20-day risk-adjusted returns with a large t-stat of -16.2) and the utilization ratio (a one standard deviation increase predicted a 9.48 basis points lower 20-day future returns with a t-stat of -8.71) having the most robust predictive power for future stock returns in the global capital market.

- The predictive power of the various short-selling measures displayed large variation across countries.

- The uptick rule and the naked short sale ban both increased the cost of shorting, reduced information efficiency, and increased the potential benefits of shorting. Therefore, these regulations improve the predictive power of short selling most significantly.

- The predictive power of shorts is stronger in countries with non-prohibitive short sale regulations, in less-developed countries (proxied by GDP per capita), and for stocks with relatively low liquidity, high shorting fees, and lower price efficiency.

- The existence of a centralized stock lending market reduces the direct and indirect costs of shorting and increases market efficiency. In this latter case, the overall predictive power of short selling is expected to decline because it might attract more uninformed than informed short sellers to the market.+

Their findings led Boehmer, Huszar, Wang, Zhang, and Zhang to conclude that:

“(our) results suggest that the short sellers in our sample countries are, on average, informed about future stock returns.”

Their findings also led them to make the following recommendation to regulators:

“Lowering shorting cost generally improves price efficiency, but regulators need to be aware that close to zero shorting cost might encourage large-scale uninformed short selling and might reduce overall price efficiency.”

The research on short selling has led some “passive” (systematic) money management firms(1) to suspend purchases of small stocks that are “on special” (2). Dimensional has done extensive research on securities lending. Using data for 14 developed and emerging markets from 2011 to 2018, DFA found that stocks with high borrowing fees tend to underperform their peers over the short term. Moreover, stocks that remain expensive to borrow continue to underperform, but the persistence of high borrowing fees is not systematically predictable. While the information in borrowing fees is fast decaying, it can still be efficiently incorporated into real-world equity portfolios.

Dimensional also found that while high borrowing fees are related to lower subsequent performance, it is not clear if this information can be used to make a profit by selling short stocks with high fees. Borrowing fees are just one cost associated with shorting; short sellers must also post collateral, typically at least 100 percent of the value of borrowing securities, and incur transaction costs. In addition, its research shows there is a relatively high turnover in the group of stocks that are on loan with high borrowing fees. For example, fewer than half of high-fee stocks are still high-fee one year after being identified as such. Therefore, excluding these stocks may lead to high costs if buy and sell decisions are triggered by stocks frequently crossing the high-fee threshold. After considering the trade-offs between expected return, revenue from lending activities, diversification, turnover, and trading costs, Dimensional believes that an efficient approach to incorporate these findings into a real-world investment process is to consistently exclude from additional purchase small-cap stocks with high borrowing fees.

Avantis takes a different approach in designing its fund construction rules. It tries to avoid holding securities that tend to have characteristics associated with high borrowing fees and shorting. AQR also uses the information in some of its portfolios—a high shorting fee is used as a signal to sell short the hard-to-borrow names, assuming AQR forecasts a positive expected return (net of the fee). It does so based on the academic evidence showing that high short-fee names are predictive of lower returns even net of their higher fee.

Individual investors can also benefit from the research findings without shorting stocks. They can do so by avoiding purchasing high-sentiment stocks where borrowing fees are “on special.”

Before concluding, there is one more important point to cover. As noted, short sellers play a valuable role in keeping market prices efficient by preventing overpricing and the formation of price bubbles in financial markets. It is the limits to arbitrage, the high risks, and the high costs of shorting that allow some inefficiencies to persist, explaining the information provided by short sellers. The recent GameStop episode in which retail investors banded together to engineer a short squeeze demonstrated just how risky shorting can be, with the potential for unlimited losses. That type of risk (3) was one that had never been experienced and almost certainly was not expected.

Compounding the risks of shorting is that, as Xavier Gabaix and Ralph Koijen demonstrated in their 2021 study “In Search of the Origins of Financial Fluctuations: The Inelastic Markets Hypothesis,” markets have become less liquid and thus more inelastic. Gabaix and Koijen estimated that today $1 in cash flows results in an increase of $5 in valuations. One explanation for the reduced liquidity is the increased market share of indexing and passive investing in general. Reduced liquidity increases the risks of shorting. Adding further to the risks is the now-demonstrated ability of retail investors to “gang up” against shorts (who might be right in the long term but dead before they reach it). The bottom line is that the limits to arbitrage have now increased, allowing for more overpricing of what can be called “high sentiment” stocks, making the market less efficient.

Investor Takeaways

There is a large body of evidence demonstrating that short sellers are informed investors who play a valuable role in keeping market prices efficient—short-selling leads to faster price discovery. Another important takeaway is those fund families that invest systematically, such as those mentioned above, have found ways to incorporate the research findings to improve returns over those of a pure index replication strategy. It seems likely this will become increasingly important, as the markets have become less liquid, increasing the limits to arbitrage and allowing for more overpricing.

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party data is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Mentions of specific fund companies is for informational purposes only and should not be construed as a recommendation of the fund or fund companies. Buckingham Strategic Wealth and Buckingham Strategic Partners are not affiliated with the above-mentioned fund companies. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth®. Neither the Securities and Exchange (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-22-298

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.