In “Your Complete Guide to Factor-Based Investing” Andrew Berkin and I provided six criteria that had to be met in order to determine which exhibits in the “factor zoo” are worthy of investment. For a factor to be considered, it must meet all of the following tests. To start, it must provide explanatory power to portfolio returns and have delivered a premium (higher returns). Additionally, the premium return must be:

- Persistent—It holds across long periods of time and different economic regimes.

- Pervasive—It holds across countries, regions, sectors, and even asset classes.

- Robust—It holds for various definitions (for example, there is a value premium whether it is measured by price-to-book, earnings, cash flow, or sales).

- Investable—It holds up not just on paper, but also after considering actual implementation issues, such as trading costs.

- Intuitive—There are logical risk-based or behavioral-based explanations (anomalies can persist due to limits to arbitrage) for its premium and why it should continue to exist.

Within the equity universe, the only factors that met all of those criteria were market beta, size, value, momentum, and profitability/quality. With the exception of momentum, these factors have a low turnover. The concern over high turnover anomalies is that they may not survive real-world transaction costs. In addition, they lack risk-based explanations, suggesting they are mispricing phenomena. A good example of that is the short-term (one-month) reversal effect which shows strong returns on paper but is generally considered to be beyond the reach of investors after accounting for market frictions.

Supporting that hypothesis are the findings of Mamdouh Medhat and Maik Schmeling, authors of the study “Short-term Momentum,” published in the March 2022 issue of The Review of Financial Studies. (an older version can be found here). They found that highly liquid stocks actually continued to exhibit short-term momentum, and all of the reversal effect was caused by highly illiquid, low turnover stocks—stocks with high transaction costs and high shorting fees which led to overvaluation and the reversal effect. The high turnover meant that paper alphas were being generated from entirely different portfolios every month, alphas that could not be captured. On the other hand, short-term momentum persisted in more liquid, and less costly to trade, stocks. The fact that the largest, most liquid stocks actually exhibited short-term momentum with economically and statistically significant premiums was an important new finding, allowing long-only investors to exploit the short-term momentum of stocks with very low transaction costs. Another takeaway is that the finding that the short-term reversal effect in low turnover stocks was subsumed by high trading costs does not mean the information was without value. For example, a fund considering buying a microcap stock could delay buying based on the short-term reversal signal.

New Research

David Blitz, Matthias Hanauer, Iman Honarvar, Rob Huisman, and Pim van Vliet contribute to the literature with their June 2022 study “Beyond Fama-French Factors: Alpha from Short-Term Signals” in which they argued that short-term signals are too easily dismissed because of concerns over implementation costs. Their hypothesis was that:

“Gross and net performance can be improved substantially by shifting the focus from a single signal to a combination of multiple short-term signals that have been thoroughly established in the literature. Integrating signals with low correlations gives powerful diversification benefits, resulting in higher gross returns and lower volatility. For instance, it is well known that momentum and reversal effects are simultaneously present in the short run. Concentrating on just one of these effects while ignoring the other is inefficient.”

They added that intelligent design could improve naïve trading strategies that simply construct the new top and bottom portfolios every month. Instead, trading strategies can use more advanced rules using buy and hold ranges that only replace stocks if their attractiveness drops below a certain threshold, providing savings in trading costs that readily outweigh the loss in gross returns. As a good example, Dimensional has long used buy-and-hold ranges in their systematic, quant-based strategies—as have many other quant-based fund families. In addition, in their 2021 study “Putting an Academic Factor into Practice: The Case of Momentum” Ronen Israel, Tobias Moskowitz, Adrienne Ross, and Laura Serban of AQR Capital Management demonstrated that real-world, live, patient trading strategies resulted in actual trading costs being an order of magnitude smaller than previous studies suggested— just 12.6 bps for global stocks, 6.4 bps for the US, and 13.2 bps for developed markets excluding the U.S.

For their database Blitz, Hanauer, Honarvar, Huisman, and van Vliet used all stocks in the MSCI World standard index, a highly investable large cap universe, covering the period December 1985-December 2021. The average number of stocks over their 36-year sample period was 1,750, varying between a low of 1,296 and a high of 2,065. Their focus was on five short-term signals.

- Industry-relative reversals are defined as a firm’s return minus its industry return over the prior month.

- One-month industry momentum.

- Analysts’ earnings revisions measured over the past 30 calendar days—using the number of upwards earnings revisions minus the number of downward earnings revisions divided by the total number of analysts over the past 30 calendar days.

- Same month stock return effect, ranking stocks at the end of calendar month T on their average return in calendar month T+1 during the preceding 10 years (seasonality effect).

- One-month idiosyncratic volatility is calculated by regressing the daily returns of a stock over the previous month on the market, size, and value factors of Fama and French and taking the standard deviation of the regression residuals. For this short-term risk signal, the relation with subsequent stock returns was negative.

They then created a composite strategy by first normalizing each of the five short-term metrics cross-sectionally using standard robust z-scores, capped at plus and minus 3, and then averaging the scores. For all individual variables and the multi-signal composite, they applied regional neutrality, ranking stocks separately within each of the three main regions: North America, Europe, and Japan & Pacific. They also controlled for common factors of beta, size, value, momentum, profitability, and investment. They chose to use equal weighting to avoid concentrating in a few ultra-large cap stocks. Equal weighting is often criticized as it overweights illiquid stocks. However, that is not a problem here as the universe is restricted to large caps.

For their efficient trading strategy, they chose a strategy used in prior research where the long (short) portfolio consists of the stocks that currently belong to the top (bottom) X% plus the stocks selected in previous months that are still among the top (bottom) Y% of stocks. For instance, with X=10% and Y=50%, the initial long portfolio is simply the top decile, while in subsequent months, the long portfolio consists of all stocks in the top decile plus all the stocks selected in previous months that continuously remained among the top 50% stocks since. Specifically, they used 15%, 10%, and 5% for X, and for Y they used 30%, 50%, and 70%, respectively. The same buy-and-hold trading rules were applied to the short portfolio. In order to assess the net profitability of their short-term strategies, they computed break-even trading cost levels, defined as the average trading costs at which the six-factor alpha becomes zero. These break-even trading cost levels can be compared with estimated trading costs for large-cap stocks which the authors of the aforementioned study, “Putting an Academic Factor into Practice: The Case of Momentum,” found to be just 6.4 bps for the US, and 13.2 bps for ex-U.S. developed markets. These should be good estimates for the costs that sophisticated investors should be able to obtain. Following is a summary of their key findings:

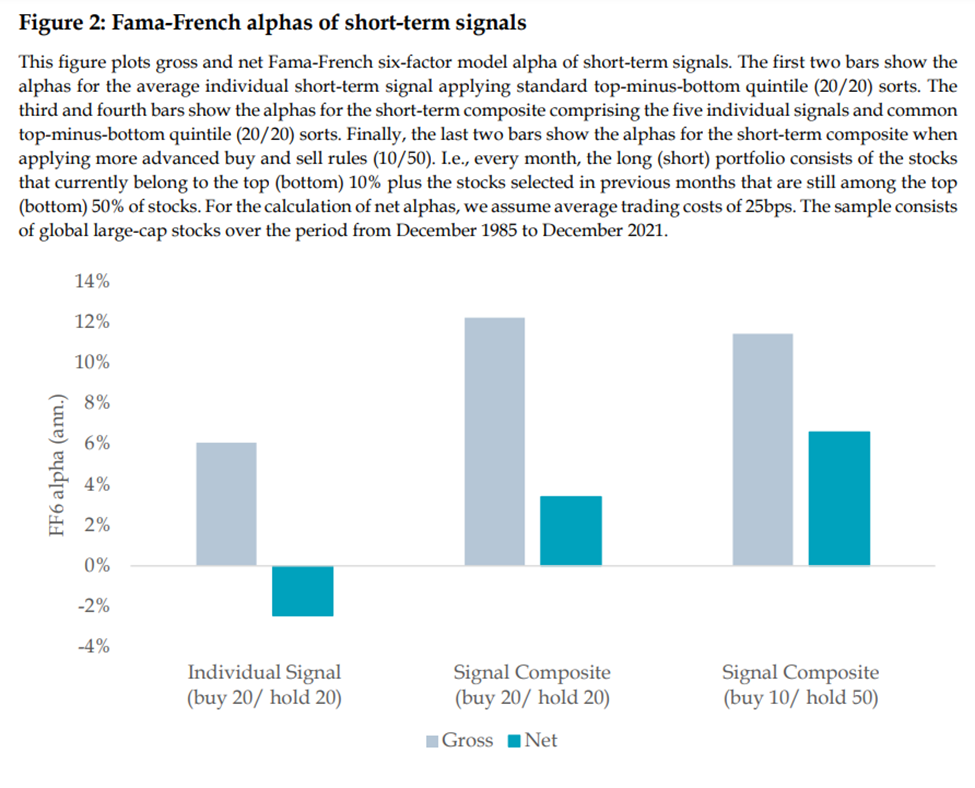

- While individual short-term signals have an average Fama-French six-factor gross alpha of more than 6 percent per year, their high turnover (more than 1,000 percent) would lead to a net alpha of less than -2% when considering realistic transaction costs of 25 basis points per single trip. T-stats were all highly significant, between 3 and 8.

- The correlations of the individual signals were generally low or negative, suggesting that combining signals would provide diversification benefits.

- Combining the individual signals into a composite boosted the gross alpha by 6 percent to above 12 percent per year (highly statistically significant), but transaction costs still eroded more than two-thirds of this return as turnover remained about 1,000 percent. However, that still left room for alpha, especially if investors could execute below the 25-basis point estimated trading costs used.

- Applying more sophisticated buy and sell rules on the composite only slightly decreased the gross alpha but lifted the annual net alpha above 6 percent due to substantially lower turnover.

- The results cannot be explained by other market frictions such as short selling limitations or implementation lags as the performance is just as strong on the long side as on the short side, and the alpha was robust to incorporating an implementation lag of one to two days that would apply for a real-time implementation of the strategy.

- The alpha was persistent through time and significant within the separate North America, Europe, Pacific & Japan, and Emerging Markets regions.

Blitz, Hanauer, Honarvar, Huisman, and van Vliet summarized their findings:

“Our results imply that high-turnover anomalies are rejected too easily based on market friction arguments… A composite strategy comprising short-term reversal, short-term momentum, short-term analyst revisions, short-term risk, and monthly seasonality signals generates economically and statistically highly significant net alphas, at least when efficient trading rules are applied.”

They added this note:

“We do not claim that our set of short-term signals or their combination is optimal. Instead, our aim is merely to show that a straightforward combination of several well-known short-term signals can already be highly profitable after costs when using efficient yet straightforward portfolio construction techniques.”

Investor Takeaways

The fundamental factors used in current asset pricing models provide high explanatory power to the cross-section of stock returns over investment horizons of a year or longer, but at shorter horizons, a myriad of other dynamics appear to be at play. Since risk-based or fundamental explanations do not appear to be plausible, these are typically considered to be mispricings caused by a variety of investors’ behavioral biases. The implication for investors is that uncorrelated alpha opportunities appear to still exist (such as short-term momentum and reversals). However, the available alpha opportunities seem out of reach for investors such as index providers with low rebalancing frequencies and sizable implementation lags (i.e., the gap between the announcement and effective date of index changes). That’s just another in a long list of negatives of pure index replication strategies discussed here. On the other hand, systematic quant strategies can exploit these anomalies.

Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third-party which are deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party data may become outdated or otherwise superseded without notice. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements, or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability, or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products, or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® and Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission, nor any other federal or state agency have approved, confirmed the accuracy, or the adequacy of this article. LSR-22-312

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.