This article examines the research on gender bias and fund management. Specifically, we will focus on the gender-based attention bias.

Do Investors Pay Less Attention to Women (Fund Managers)?

- P. Raghavendra Rau and Jinhua Wang

- Working paper

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Gender-based attention bias refers to the tendency to pay less attention to women than men, and the research studies it at both the personal (where boys and girls receive differential attention in families, especially in developing countries) and professional level (where women are more likely to be ignored, interrupted, or experience their contributions being belittled than men within organizations). At the professional level, it has been shown to exist among attorneys, university faculty, court employees, and women-led IPOs.

In this context, the authors attempt to answer this research question in the mutual fund sector, by answering the following research question:

Is the flow-performance sensitivity for individual investors affected by managerial gender?

What are the Academic Insights?

The quick answer is YES. The authors study 172,672 retail investors’ monthly investment positions in 253 domestic stock funds from August 2017 to July 2019, for a total of 2.35 million user-fund month observations. A large fintech platform in China provided data.

They find:

- The flow-performance sensitivity for individual investors in China is similar to patterns documented in the prior literature for funds elsewhere in the world.

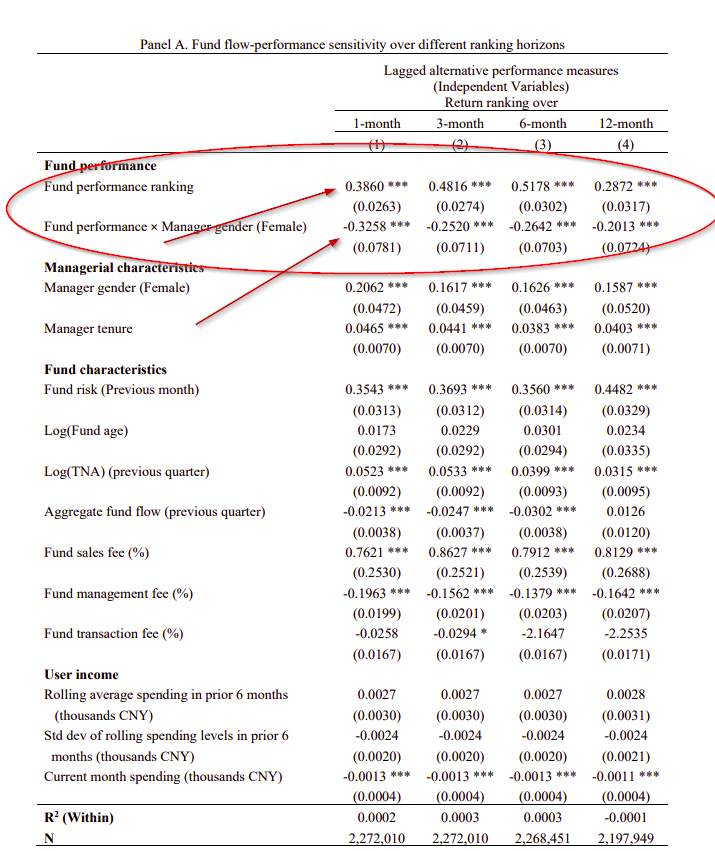

- Strong evidence of a differential flow-performance sensitivity between male and female-managed funds. Interacting the flow-performance sensitivity term with a gender dummy variable, they show that flow-performance sensitivity is significantly weaker for female-managed funds.

- Decreased flow sensitivity to performance for women across all the raw return horizons, from one- to 12-months. Simply put, when female-managed funds do well, they experience significantly lower fund inflows than male-managed funds. However, when these funds perform poorly, they experience relatively lower fund outflows than male-managed funds.

- The attention bias is reduced when performance drops, suggesting that investors pay less attention to female than male managers when performance increases but punish both sets of managers when performance drops. Using piecewise regressions, the decrease in flow sensitivity appears to exist across all performance levels for female managers except for the very top managers.

- Significant cross-sectional differences between investors. Female users appear to display lower levels of gender bias towards female-managed funds. Similarly, users living in smaller cities display stronger levels of gender bias away from female-managed funds.

- The level of gender bias appears to be innate to investors – an attention bias manifests even in the first set of investments made by a user on the platform.

- The attention bias uncovered in the sample appears irrational and cannot be explained by the difference in performance between male and female managers or the difference in media coverage between male and female managers.

The authors perform many robustness checks, each controlling for fixed effects at the investor level, allowing us to address potential omitted variable concerns arising from differing investor backgrounds or personalities. The results are also robust to including time-fixed effects, reducing a potential omitted variable bias caused by common economic shocks. All the regressions also control for manager characteristics, such as their educational backgrounds and length of tenure as managers for the funds, and fund characteristics, such as fund objectives, fund size, and fees.

Why does Gender Bias matter?

This study is a significant contribution because it is the first to document the existence of an individual investor-level gender-based attention bias away from women in the professional finance industry. Additionally, this study complements the literature on mutual fund flows associated with search costs and manager heterogeneities.

Gender bias appears particularly strong in the investment fund industry. In 2019, for example, women accounted for 37.5% of all lawyers, 49% of judges, 34.5% of economists, 19% of surgeons, and 26% of chief executives, according to the U.S. Census Bureau. In contrast, the percentage of funds managed by women has barely changed. It was 10.3% in 2016 and 11% in 2020 (Rau and Wang, 2022). While there are several explanations for the employment gap between men and women in various industries, Niessen-Ruenzi and Ruenzi (2018) propose a customer-based discrimination explanation specifically for the mutual fund industry. Because mutual fund investors appear to direct significantly lower flows to female-managed mutual funds than to male-managed funds, they argue that, in response, rational fund companies might choose to hire fewer women since fund companies generate their profits from fees charged on assets under management.

In contrast, this paper shows that attention bias works both ways. Though investors appear more sensitive to fund performance when the fund manager is male, the sensitivity is bi-directional. Investors are less sensitive to underperforming female managers. For mutual fund companies, this appears to have the beneficial effect of lowering the volatility of flows into the fund.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We document a gender-based attention effect in the sensitivity of mutual fund flows to fund performance using individual-level fund data from a fintech platform in China. Investors increase (decrease) flows to funds following positive and strong (negative and weak) prior-month performance. However, although there is no significant difference in the performance of male and female managers, the sensitivity effect significantly weakens if the fund manager is female. The effect persists after controlling for managerial characteristics and fund objectives, as well as individual investor fixed effects. Simply put, investors react less to the performance of female fund managers.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.