Given the strong empirical evidence demonstrating the persistence, pervasiveness, robustness, and implementability of premiums for the factors of size, value, momentum, and profitability in the cross-section of returns, investors may be tempted to gain exposure to those factors across industries and countries. Intuitively, some industries and countries may appear smaller, of deeper value, or more profitable. Thus, they may deliver the size, value, and profitability premiums more commonly associated with individual stocks. To determine the efficacy of an industry or country approach to factor investing, the research team at Dimensional examined whether the strategies captured differences in expected returns beyond what was already reflected in security-level factors. They also examined whether the relatively high turnover of industry or country momentum strategies could impair their practical relevance.

Data and Sorting Variables

Their U.S. sample consisted of all common stocks traded on the NYSE/AMEX/Nasdaq exchanges and covered the period July 1974-December 2021, where the inclusion of Nasdaq stocks determined the start date. The non-U.S. sample consisted of common stocks and covered the period July 1994-December 2021, where the start date was determined by data availability. Their sorting variables were aggregate characteristics at the industry and country levels. They used market-cap weighting to define aggregate characteristics:

- Size: total market capitalization.

- Value: book-to-market equity ratio.

- Profitability: operating income before depreciation and amortization minus interest expense divided by book equity.

- Momentum: weighted-average return over the most recent month (“1-1 momentum”) and compounded weighted-average return over the prior year, skipping the most recent month (“12-2 momentum”).

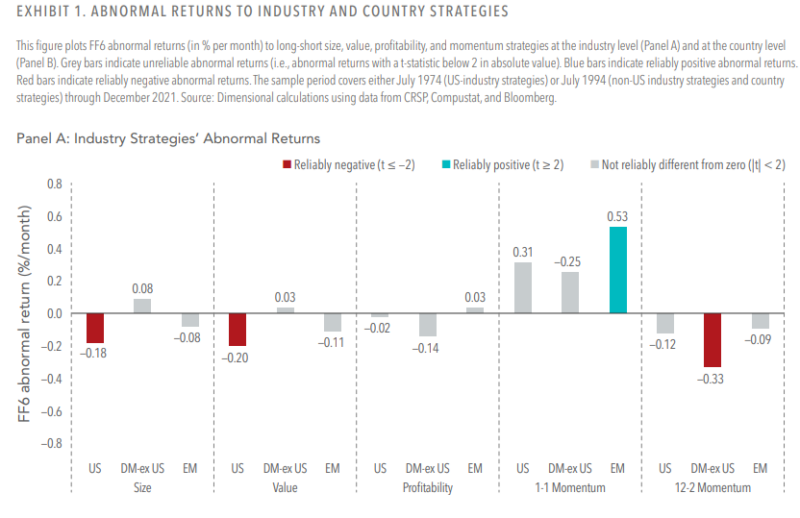

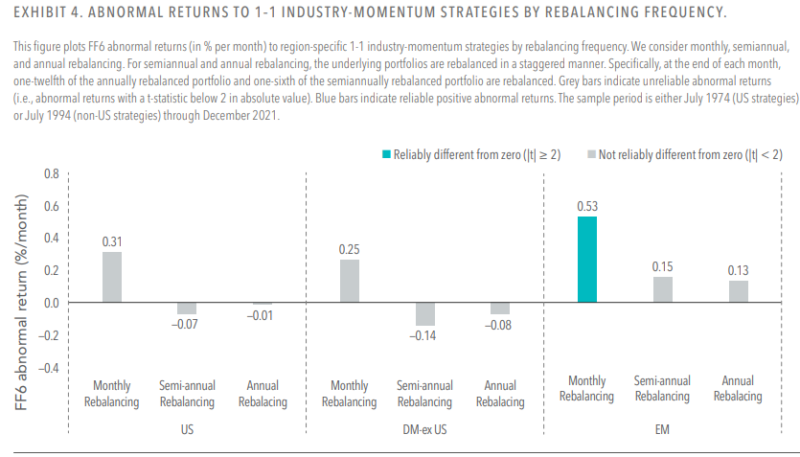

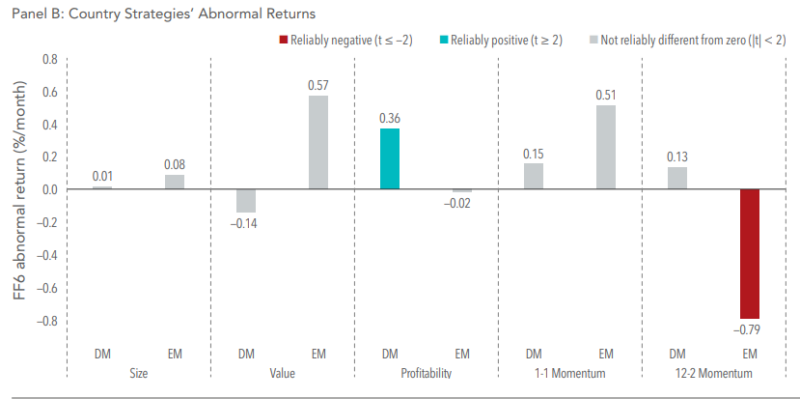

They then sorted industries within a country on a given aggregate characteristic and formed three country-specific industry portfolios corresponding to low (30%), neutral (40%), and high (30%) levels of the characteristic. For regions outside the U.S., they aggregated the country-specific industry portfolios by their countries’ market capitalizations to regional industry portfolios—improving diversification and removing country bets for the non-U.S. industry portfolios. The sorts on aggregate size, book-to-market, and profitability were rebalanced annually at the end of June, while those on past performance were rebalanced monthly. Following is a summary of their key findings:

- For the industry strategies, only the 1-1 momentum strategy in emerging markets generated a reliably positive abnormal return. However, it was strongly attenuated and unreliable when the rebalancing was less frequent—the need for frequent rebalancing can lead to transaction costs that dramatically reduce the real-world profitability of simulated strategies, raising concerns about the effect’s relevance in live portfolios. In the U.S., the size and value strategies showed reliably negative abnormal returns.

- For the country strategies, only the profitability strategy in developed markets generated a reliably positive abnormal return. In emerging markets, the 12-2 momentum strategy showed reliably negative returns.

The evidence led Dimensional to conclude: “Any benefits to pursuing the premiums at the industry and country levels are few and far between.” They added: “Aggregating from the relatively large number of securities to the relatively few number of industries tends to wash out important cross-sectional variation in the characteristics and lead to more concentrated portfolios prone to noisier realized returns.” Also noteworthy is that allocating to industries and countries can lead to unintended concentrations (without an increase in expected returns) because some industries and countries tend to show up disproportionately often in one end of the spectrum when sorting on the characteristics—for example, the personal services industry was almost always in the small portfolio, utilities tended to be in the value portfolio, and tobacco products were almost always in the high-profitability portfolio.

Investor Takeaways

Dimensional’s research demonstrated that, in both developed and emerging markets, industry and country strategies add little on top of security-level allocations in the pursuit of the size, value, profitability, and momentum premiums. In addition, since allocating to industries and countries can lead to unintended concentrations without an increase in expected returns, investors are best served by using security-level sorts along with sensible diversification to build systematic factor-based strategies.

Postscript

While Dimensional found that interindustry value strategies have not added value, John Campbell, Stefano Giglio, and Christopher Polk, authors of the March 2023 study “What Drives Booms and Busts in Value?,” showed that while the classic value strategy bets on the convergence of valuation ratios both across and within industries, the intra-industry component of such a bet typically contributes much more to value’s average outperformance. Thus, investors building value-oriented portfolios might want to consider funds that are industry neutral, or perhaps put limits on how much a portfolio can deviate from an industry-neutral approach.

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed here are their own and may not accurately reflect those of Buckingham Strategic Wealth, LLC or any of its affiliates. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-477

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.