The article utilizes a Hidden Markov Model (HMM) to identify regimes of shifting inflation.

Managerial Multitasking in the Mutual Fund Industry

- Kinlaw, Kritzman, Metcalfe and Turkington

- The Journal of Investment Management, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The research questions of the article are as follows:

- How can a Hidden Markov Model be applied to identify regimes of shifting inflation?

- What are the characteristics and descriptive information of the identified inflation regimes?

- Which economic variables are the determinants of inflation and how can their relative importance be measured?

- What implications do the findings have for policymakers in managing inflation?

- How can the findings guide investors in developing strategies based on the prevailing determinants of inflation?

What are the Academic Insights?

By applying a Hidden Markov Model to identify inflation regimes with data from 1960 to 2022 and by using an attribution technique based on the Mahalanobis distance to measure the sensitivity of these regimes to different economic variables, the authors find:

- A Hidden Markov Model (HMM) can be applied to identify regimes of shifting inflation by utilizing the characteristics of the observed data and their hidden regimes. In the context of the article, the HMM assumes that the observed values of inflation come from multiple distributions that switch according to a hidden regime characteristic.

- The analysis identifies four distinct regimes: a Steady regime in which inflation was stable and volatility was low; a Rising Stable regime in which inflation was rising and volatility was low; a Rising Volatile regime in which inflation was rising and volatility was high; and a Disinflation regime in which inflation was declining sharply.

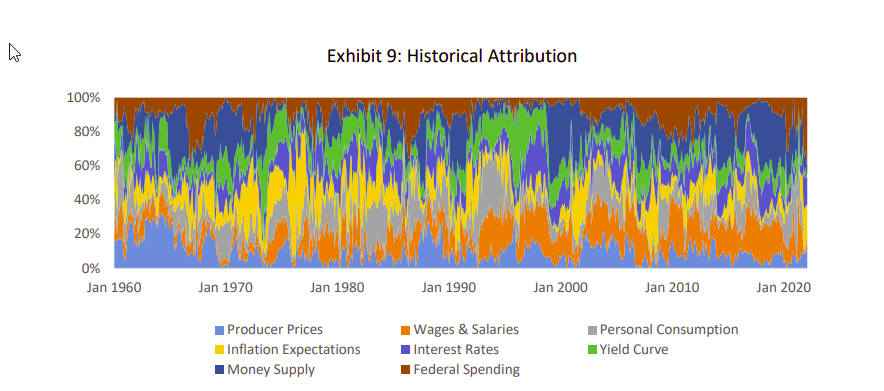

- The relative importance of the determinant variables is not constant because the analysis accounts for means and covariances that shift across regimes. From 1967 to 1977 it was mainly policy measures. From 1971 to 1978 it was inflation expectations. During the great financial crisis it was both inflation expectations and personal consumption. In 2020 with Covid it was demand factors while by 2021 it became inflation expectations and federal spending.

- This article has lots of complications for policy makers: 1) The HMM analysis helps policymakers identify different inflation regimes, such as steady, rising stable, rising volatile, and disinflation. Understanding the characteristics and persistence of these regimes is crucial for policymakers to assess the current state of the economy and make informed decisions. 2) The analysis reveals that the identified inflation regimes exhibit high persistence. This means that once an inflation regime is established, it is more likely to persist in the future. Policymakers need to consider this persistence when formulating monetary and fiscal policies. For example, if the economy is in a rising inflation regime with high volatility, policymakers might need to adopt more aggressive measures to curb inflationary pressures and stabilize the economy. 3) The HMM analysis provides insights into the performance of different policy measures under various inflation regimes. By examining the conditional returns for major asset classes during each regime, policymakers can evaluate the effectiveness of different policy tools in managing inflation and its impact on financial markets.

- The findings of the Hidden Markov Model (HMM) analysis on shifting inflation regimes can guide investors in developing strategies based on the prevailing determinants of inflation. Here are some ways in which investors can use the findings to inform their investment strategies:

- Regime identification: The HMM analysis helps investors identify different inflation regimes, such as steady, rising stable, rising volatile, and disinflation. Each regime has distinct characteristics that affect asset prices differently. Investors can align their investment strategies with the prevailing regime to optimize their portfolio allocations.

- Asset allocation: The analysis provides insights into how different asset classes perform under different inflation regimes. By examining the conditional returns for major asset classes during each regime, investors can determine which asset classes tend to outperform or underperform in specific inflation environments. This information can guide asset allocation decisions and help investors position their portfolios accordingly.

- Inflation-sensitive assets: Certain asset classes and sectors tend to be more sensitive to changes in inflation. For example, during rising inflation regimes, inflation-sensitive assets like commodities, real estate, and inflation-protected securities (such as TIPS) may perform well. On the other hand, during disinflationary periods, assets like fixed income securities and cash may be more attractive. Investors can adjust their exposure to these assets based on the prevailing inflation regime.

- Inflation expectations: The analysis includes inflation expectations as one of the variables considered in the HMM. Investors can monitor the dynamics of inflation expectations across different regimes to gauge market sentiment and positioning. Changes in inflation expectations can influence asset prices and market volatility, providing investment opportunities or risks. By staying informed about inflation expectations, investors can make more informed investment decisions.

- Risk management: Shifting inflation regimes can introduce volatility and uncertainty into financial markets. Investors can use the HMM findings to manage risk by diversifying their portfolios across different inflation regimes. By allocating assets across different inflation-sensitive and non-sensitive investments, investors can reduce the impact of sudden shifts in inflation on their overall portfolio performance.

- Active management: The HMM analysis suggests that different inflation regimes exhibit persistence. This indicates that investors may benefit from actively adjusting their investment strategies as the prevailing regime changes. By continuously monitoring economic indicators and regime probabilities, investors can adapt their strategies to capture potential opportunities or mitigate risks associated with shifting inflation regimes.

Why does this study matter?

This study is important because the findings from the HMM analysis provide policymakers with valuable insights into the nature and behavior of inflation regimes. This information can inform the design and implementation of monetary, fiscal, and regulatory policies to effectively manage inflation, stabilize the economy, and promote sustainable economic growth.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Investor Takeaways

The authors apply a Hidden Markov Model to identify regimes of shifting inflation and then employ an attribution technique based on the Mahalanobis distance to identify the economic variables that determine the trajectory of inflation. Their analysis enables policymakers to focus on the most effective tools to manage inflation, and it offers guidance to investors whose strategies might benefit from knowledge of the prevailing determinants of inflation. Their analysis reveals that as of February 2022, the most important determinant of the recent spike in inflation was spending by the federal government.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.