The traditional financial theory attributes security returns to market- or factor-based risk, with no role ascribed to other influences. In this research, the authors argue for including investor demand as an additional variable in explaining returns.

Can changes in investor demand generate systematic changes in security returns?

Overall, our analysis shows that demand effects caused by institutional frictions can be a first-order determinant of the cross-section of expected returns.

Discontinued Positive Feedback Trading and the Decline of Return Predictability

- Itzhak Ben-David, Jiacui Li, Andrea Rossi, Yang Song

- Working Paper, NBER

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- Is there a measurable effect of a shift in investor demand on the predictability of equity factors and mutual fund returns?

What are the Academic Insights?

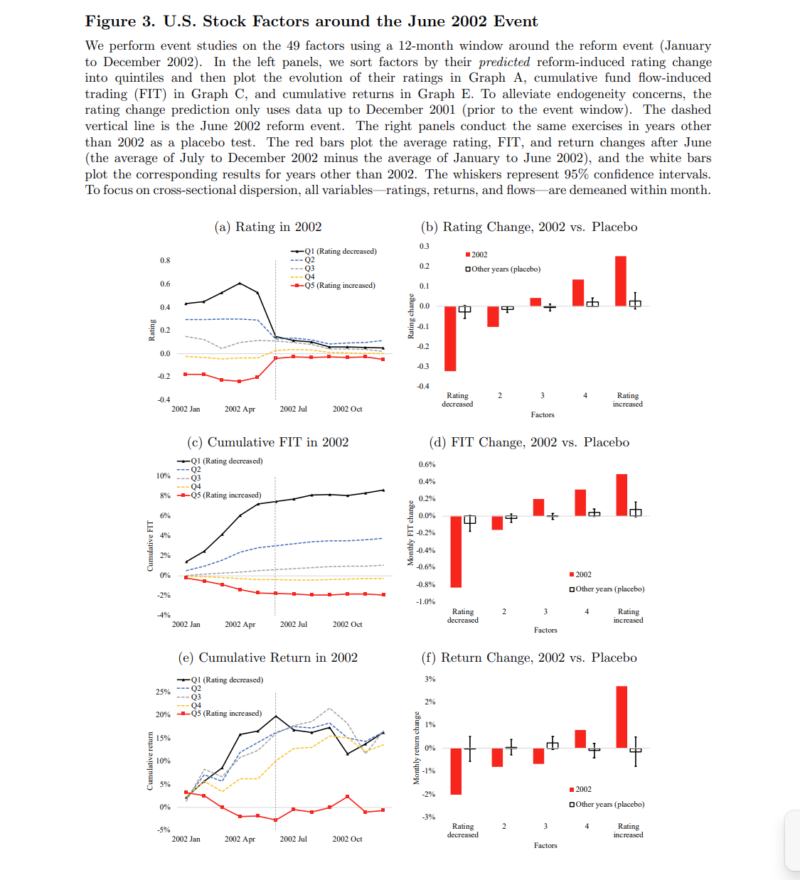

- YES. The empirical analysis began with testing the reaction of equity factors and mutual funds to changes in Morningstar’s US rating system in June 2002, using an event study methodology. Depending upon data availability 49 equity factors were constructed and used, otherwise 153 factors from Jensen et al (2023) were used. Measures of profitability for momentum-type factors declined by 23.9 bps more than any other factor. See the left side of Figure 3, below. Similar results were obtained when the “momentum crash” occurred documented by Daniel and Moskovitz, 2016. Other equity factors also declined in profitability but were not as pronounced as found with momentum. When the analysis was extended to other countries, the momentum decline was not observed. In addition, our results are robust to excluding the “momentum crash” period (Daniel and Moskowitz, 2016). The authors conclude that since June 2002, there has been a significant and persistent decline in the momentum factor in the US.

Why does it matter?

The results presented here contribute to the somewhat inconsistent dialogue on how changes in investor demand affect price changes. The Morningstar rating reform was used as the proxy for investor demand changes because it was expected to provide a “sharper inference.” It does appear to differentiate between US and non-US factors and mutual fund returns, but not sufficient to justify the conclusion that “demand effects caused by institutional frictions can be a first-order determinant of the cross-section of expected returns.”

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We show that demand effects generated by institutional frictions can influence systematic return predictability patterns in stocks and mutual funds. Identification relies on a reform to the Morningstar rating system, which we show caused a structural break in style-level positive feedback trading by mutual funds. As a result, momentum-related factors in stocks, as well as performance persistence and the “dumb money effect” in mutual funds, experienced a sharp decline. Consistent with the proposed channel, return predictability declined right after the reform, was limited to the U.S. market, and was concentrated in factors and mutual funds most exposed to the mechanism.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.