The article explores the limitations of traditional country-level stock market indexes constructed based on issuing firms’ domicile. Additionally, it introduces a new type of national stock market index called the EMindex, which is based on companies’ business activities rather than their domicile. The EMindex aims to provide a better representation of a country’s economic risk by considering all firms operating in that country, whether domestic or foreign.

Geographic Investing: Stock Return Indexes Based on Company Operations

- Dumas, Gabunya and Marston

- FAJ, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- How do traditional country-level stock market indexes, constructed based on the issuing firms’ domicile, accurately represent a country’s economic risk when many companies earn substantial revenues abroad?

- Can a new kind of national stock market index, based on companies’ business activities rather than their domicile, provide a better representation of the economic risk of a country?

- How does the newly proposed EMindex, which considers domestic and foreign firms operating in a country, compare to traditional national and domestic indexes that partially account for the source of revenues?

- What are the advantages of using revenue information to inform a risk-factor model in stock market indexes, particularly in the context of the increasing role of foreign multinationals in a country’s economy?

- Can geographic indexes based on company operations (EMindexes) offer improved country indexes for portfolio construction, better security selection, and provide a firmer basis for constructing diversified portfolios compared to traditional national and domestic indexes?

What are the Academic Insights?

By studying, the authors find:

- Traditional country-level stock market indexes are constructed using stocks from companies whose domicile is in the country in question. The problem with this approach arises when many of these companies earn a significant portion of their revenues from operations conducted abroad. In such cases, the index may not accurately represent the economic risk of that country. For instance, consider a country like the Netherlands, which hosts many multinational corporations that conduct a substantial part of their business activities outside the country. The traditional stock market index for the Netherlands, constructed based on the domicile of these firms, would not fully reflect the actual risks and returns associated with investing in the operations taking place within the Netherlands.

- YES – a new kind of national stock market index based on companies’ business activities rather than their domicile has the potential to provide a better representation of the economic risk of a country.

- The newly proposed EMindex, which considers domestic and foreign firms operating in a country, offers distinct advantages compared to traditional national and domestic indexes that partially account for the source of revenues. In fact, it:

- takes into account all firms operating in a country, whether they are domestic or foreign. This provides a comprehensive representation of the country’s economic activities and risks, capturing the contributions of both domestic and international companies

- provides a more accurate assessment of the country’s economic risks. This can help investors and asset managers better manage risks associated with investing in the country

- offers investors a more reliable basis for making investment decisions in a country, as it reflects a more accurate picture of the country’s economic conditions and potential risks and returns

- The advantages are:

- Improved Diversification: Including revenue-based information in the risk-factor model enables better diversification in the stock market index. Investors can gain exposure to a broader range of economic activities within the country, reducing concentration risk and enhancing portfolio diversification.

- Better Risk Management: By accurately reflecting the revenue sources of companies, the risk-factor model provides a more reliable basis for risk management. Investors can identify potential sources of risk and assess their impact on the overall portfolio, leading to more effective risk management strategies.

- Addressing Globalization Trends: In an era of increasing globalization, where foreign multinationals play a significant role in national markets, revenue-based information becomes crucial in understanding the interconnectivity of economies and their impact on individual countries’ risk profiles.

- Real-time Monitoring: Revenue information is typically reported periodically, allowing for real-time monitoring of economic trends and changes in business activities. This dynamic data can help investors adjust their strategies and allocations accordingly.

- YES – geographic indexes based on company operations, such as the EMindexes, can indeed offer improved country indexes for portfolio construction, better security selection, and provide a firmer basis for constructing diversified portfolios compared to traditional national and domestic indexes. Here’s how they achieve these advantages:

- they consider the business activities and revenue sources of all companies operating within a country, irrespective of their domicile. This provides a more comprehensive representation of the country’s economic landscape compared to traditional national indexes that focus solely on the domicile of firms

- they better capture the country’s overall economic performance, offering investors a more accurate country-specific index for constructing portfolios

- they nable investors to identify companies with significant business activities within a particular country, regardless of their headquarters’ location. This approach provides a more reliable basis for security selection by focusing on the actual economic exposure of the companies rather than their domicile

- they incorporate both domestic and foreign firms with substantial activities in a country. This inclusion enhances diversification opportunities, allowing investors to access a more diverse set of economic activities within the country

Why does this study matter?

This study is essential as it sheds light on the limitations of traditional indexing approaches and introduces a novel methodology, the EMindex, to address these limitations. By incorporating revenue information and considering the presence of foreign multinationals, the EMindex provides a more comprehensive and accurate representation of a country’s economic risks and opportunities, making it a valuable tool for investors and researchers in finance.

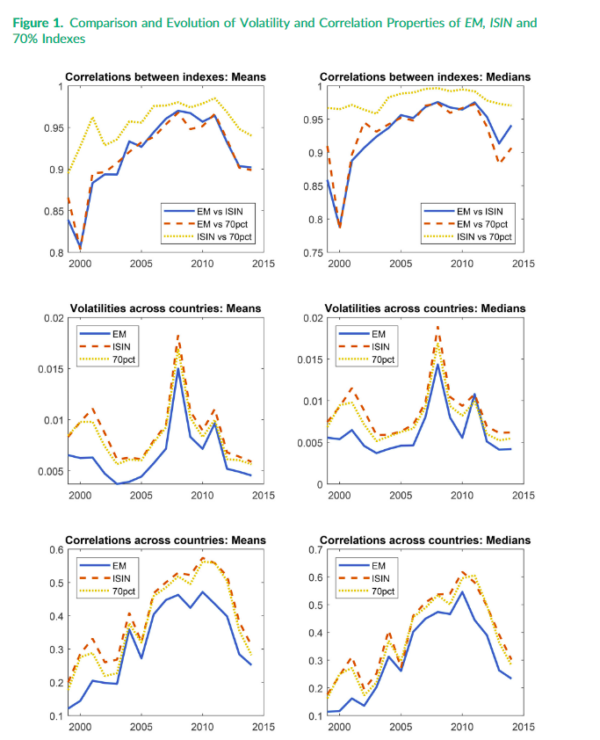

The Most Important Chart from the Paper:

Abstract

Portfolio allocations to firms of various geographic areas should be guided by underlying risks of operations. In most statistical studies of international stock returns, a firm is included in a country’s index if its headquarters is located in that country, a classification scheme that ignores the operations of the firm taking place in multiple geographic areas. In prior work, we have proposed a model of country factors that is based on the business activities of all firms operating in a country, be they domestic firms or multinationals. In the present paper, we compare the resulting indexes with the domestic revenue exposure indexes already available in the industry. We conclude that our new indexes allow a portfolio manager to track geographic risk much more accurately.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.