1. Introduction

Financial time series that are structured as data sampled at a uniform time interval, e.g., hourly, daily, weekly, or monthly, are called discrete-time time series and referred to, from a digital signal processing (DSP) perspective, as being in the “time domain.” Technical market analysts generally study financial time series in the time domain. For example, a price chart displays time series values at each discrete time sample observation.

Since financial time series data are digital by nature, various digital filtering-based indicators, such as moving averages and time series momentum, are used by analysts to transform and analyze them, e.g., to identify trading opportunities presented by trends. Given that financial time series, by their nature, are challenging to analyze due to non-stationarity, volatility, noise, and other factors, analysts are interested in the ability of such indicators to rapidly respond to changes in trend direction while also minimizing noise that can result in “whipsaw” trading losses.

This article examines four digital filters commonly used for trend-following:

- moving average

- linear weighted moving average

- exponential smoothing

- time series momentum

from a time domain perspective, employing the following specifications:

- delay time

- rise time

- lag

- trend reversal time.

These specifications are compared to the filter variance reduction ratio, a measure of noise rejection, to illustrate the inherent trade-off between filter responsiveness and noise minimization.

Note that time series can also be analyzed in the DSP “frequency domain,” where they are considered as being composed of sinusoidal functions or frequency components, each of which has a specific amplitude (a measure of maximum displacement from equilibrium) and phase (a measure of angular shift). Previous articles in this series have analyzed financial time series and various technical indicators in the frequency domain. For example, see [1], which examines the frequency domain characteristics of the four filters and several others. It also contains a review of DSP-related terminology and topics, such as low pass filters, differentiators, frequency response, etc.

2. Time Domain Concepts

This section provides brief overviews of the time domain concepts used in this article. More detailed discussions of these and related concepts can be found in various textbooks, such as [2] and [3].

Unit Pulse Response

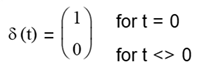

The unit pulse response of a discrete-time linear time-invariant (LTI) system, such as a digital filter, is its output as a function of time in response to a discrete-time unit pulse input. The unit pulse function is denoted by δ(t), the Kronecker delta function, where:

The unit pulse function is illustrated in the following graph.

The response of a filter to a unit pulse input completely defines the filter, i.e., both its time domain and frequency domain responses, since the unit pulse contains all frequencies. In the time domain, the filter response to a unit pulse input is represented by its unit pulse response coefficients h(i), where each h(i) coefficient denotes the filter response to the time-shifted unit pulse δ(t-i).

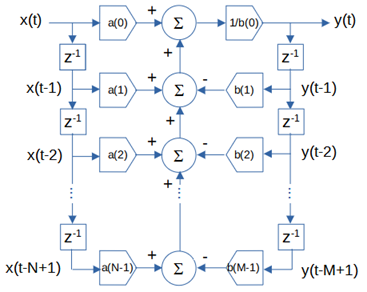

Digital filters can be implemented in two ways:

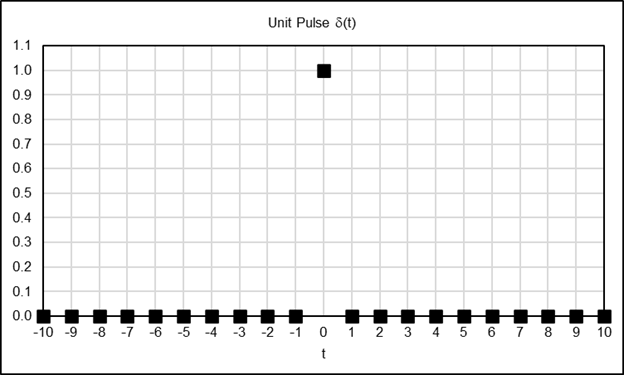

Finite impulse response (FIR) filters, such as moving average, linear weighted moving average, and time series momentum, use only current and past input values x(t-i). The general FIR filter equation is:

where

- N = number of filter input samples

- x(t-i) = filter input sample at integer time t-i for i = 0, 1, 2, …, N-1

- a(i) = filter coefficient of filter input x(t-i)

- y(t) = filter output at integer time t

- b(0) = filter coefficient of filter output y(t).

For FIR filters, the filter coefficients a(i) are equal to the unit pulse response coefficients h(i).

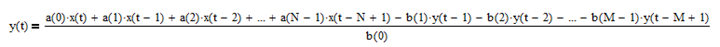

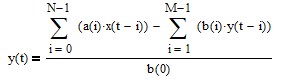

Infinite impulse response (IIR) filters, such as exponential smoothing, use current and past input values x(t-i) as well as past filter output values y(t-i). The general IIR filter equation is:

where

- N = number of filter input samples

- M = number of filter output samples

- x(t-i) = filter input sample at integer time t-i for i = 0, 1, 2, …, N-1

- a(i) = filter coefficient of filter input x(t-i)

- y(t-i) = filter output sample at integer time t-i for i = 0, 1, 2, …, M-1

- b(i) = filter coefficient of filter output y(t-i).

Calculating the unit pulse response coefficients h(i) for IIR filters is more complex. See [4] for descriptions of several calculation methods.

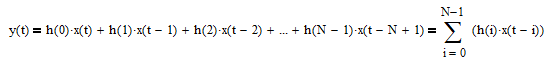

A filter operates on a discrete-time input x(t) by multiplying its unit pulse response coefficients h(i) with the corresponding input values x(t-i), a procedure called “convolution”:

where

- N = number of filter unit pulse response coefficients

- x(t-i) = filter input sample at integer time t-i for i = 0, 1, 2, …, N-1

- h(i) = filter unit pulse response coefficient of filter input x(t-i)

- y(t) = filter output at integer time t.

For both FIR and IIR filters, the unit pulse response coefficients are used as the basis for calculating the time domain specifications, as explained in Section 4.

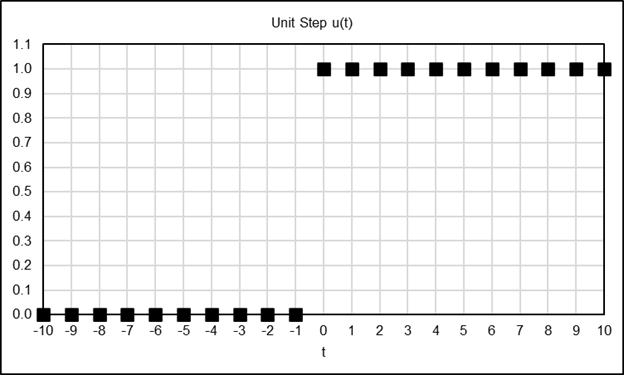

Unit Step Response

The unit step response of a discrete-time LTI system or filter is its output as a function of time in response to a discrete-time unit step input. The unit step function is denoted by u(t) where:

The unit step function is illustrated in the following graph.

For example, the unit step is used to model an abrupt change in the input, such as when a voltage is applied to a circuit by turning on a switch. Security prices are also subject to sudden jumps and drops in response to economic and political events, company and industry news, earnings reports, etc. The unit step responses of the filters are used to measure delay time and rise time, as explained in Section 4.

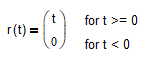

Unit Ramp Response

The unit ramp response of a discrete-time LTI system or filter is its output as a function of time in response to a discrete-time unit ramp input. The unit ramp function is denoted by r(t) where:

The unit ramp function is illustrated in the following graph.

The unit ramp represents a linear trend with a slope of +1. The unit ramp response of a filter is associated with lag, as explained in Section 4.

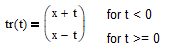

Unit Trend Reversal Response

In this article, the unit trend reversal response of a LTI system or filter is determined using its output as a function of time in response to a discrete-time input in the shape of an isosceles triangle, with the left edge having a slope of +1 (a positive unit ramp) and the right edge having a slope of -1 (a negative unit ramp). The unit trend reversal function represents an Idealized change in trend direction and is denoted by tr(t) where:

and x is the trend reversal point value at integer time t = 0. The following graph illustrates an example where x = 10.

The unit trend reversal responses of the filters are used to calculate trend reversal time, as explained in Section 4.

3. Overview of the Filters

This section provides brief overviews of the four filters analyzed in this article. For additional details, see [1].

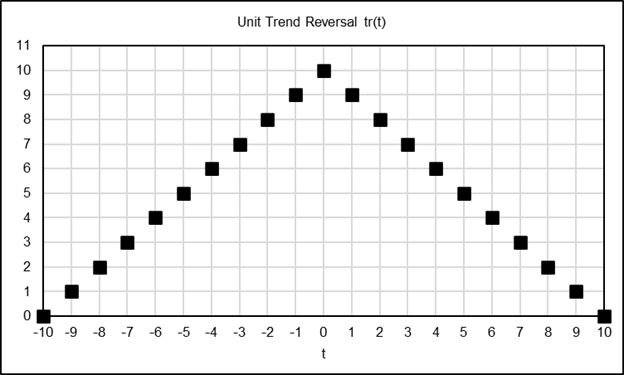

Moving Average (MA)

Moving average (MA) is a FIR low pass filter where the filter coefficients have equal values. Low pass filters pass low frequencies (long periods) and attenuate high frequencies (short periods) in the input signal and are commonly used to reduce noise, since noise is associated with high frequencies. The equation of a MA filter with a length of N integer time samples is:

where x(t-i) is the filter input, e.g., prices, at integer time t-i. A commonly-used trading signal is generated when the current price crosses above (buy) or below (sell) the moving average.

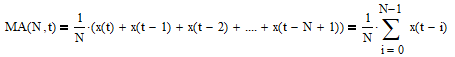

Linear Weighted Moving Average (LWMA)

Linear weighted moving average (LWMA) is a FIR low pass filter where the filter coefficients are linearly weighted with the greatest weights placed on the most recent input values. The equation of a LWMA filter with a length of M integer time samples is:

Similar to the MA filter, a commonly-used trading signal is generated when the current price crosses above (buy) or below (sell) the linear weighted moving average.

Exponential Smoothing (ES)

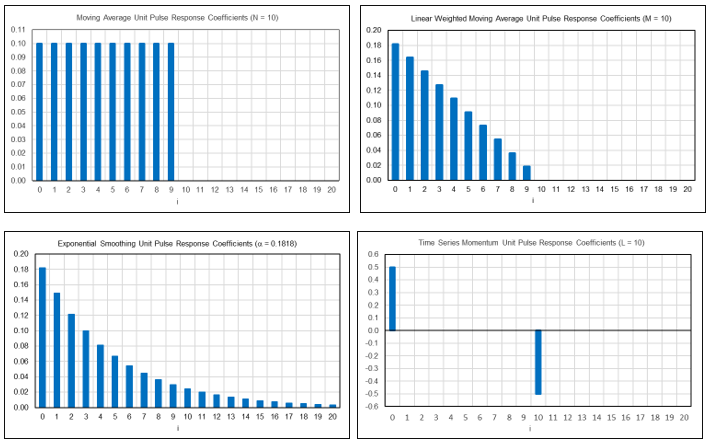

Exponential smoothing (ES) is an IIR low pass filter where a smoothing constant α is applied to the current input value and (1 – α) is applied to the previous filter output value. The equation of an ES filter with smoothing constant α is:

where 0 <= α <= 1. Similar to the MA and LWMA filters, a commonly-used trading signal is generated when the current price crosses above (buy) or below (sell) the exponential smoothing.

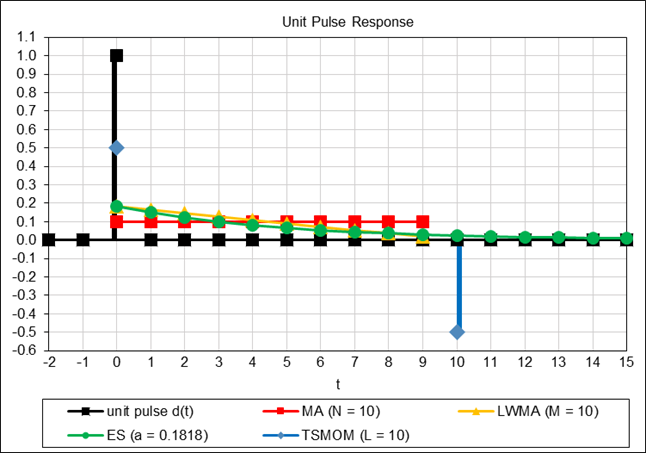

Time Series Momentum (TSMOM)

Time series momentum (TSMOM) is a FIR differentiator which calculates the difference between two samples of an input signal that are separated in time by a lookback, a fixed number of time samples. The output of a differentiator is proportional to the rate of change, i.e., the derivative with respect to time, of the input, so differentiators are commonly used to detect changes in trend. The TSMOM equation with a lookback of L integer time samples is:

TSMOM is the simplest FIR differentiator, since it only uses two input time samples. The filter gain is often set to 1.0 but is set here to 0.5 so that the maximum magnitude frequency response of the filter is 1.0 (0 dB). A commonly-used trading signal is generated when TSMOM output changes sign, i.e., crosses above (buy) or below (sell) zero.

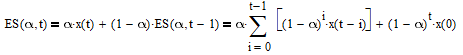

Example Filter Unit Pulse Response Coefficients

The graphs below show representative examples of the unit pulse response coefficients of the four filters, using the indicated parameter values, i.e., moving average length N = 10, linear weighted moving average length M = 10, exponential smoothing constant α = 0.1818, and TSMOM lookback L = 10, with the exponential smoothing coefficients displayed limited to the first 21.

4. Filter Time Domain Specifications

This section details the filter time domain specifications analyzed in this article. The specifications are calculated using the unit pulse response coefficients h(i) of the filters. The specification equations of the filters can be found in the appendices.

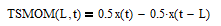

The graph below shows the unit pulse responses of the four filters, using the example filter parameter values. (Note: The square markers in the following response and specification graphs indicate the discrete values at each integer time t. The connecting lines have been added for visual enhancement and do not represent continuous values.)

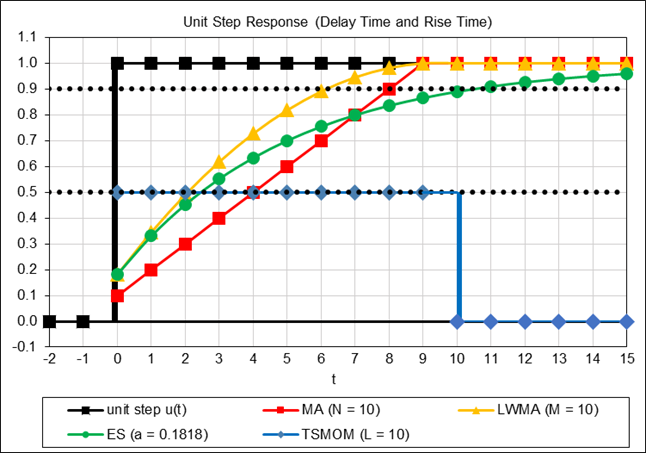

Delay Time

Delay time τd is measured as the number of time steps, starting at t = 0, that is required for the filter output to rise from 0% to 50% (0.5) of its final value in response to a unit step input. Delay time can be calculated using the following equation:

and solving for τd.

The graph below illustrates the delay times of the four filters, using the example filter parameter values. The delay time is observed when the filter output reaches the 0.5 level.

Rise Time

Rise time τr is measured in this article as the number of time steps required for the filter output to rise from 0% to 90% (0.9) of its final value in response to a unit step input. On this basis, rise time can be calculated using the following equation:

and solving for τr.

Note that different starting and ending percentages can be selected to measure rise time, depending on the type of filter and other considerations. In the case of TSMOM, which is a differentiator, rise time is measured as the number of time steps required for the filter output to rise from 0 to the 0.5 level, since the filter gain is 0.5. In this case, the rise time equation is:

The graph above also illustrates the rise times of the four filters, using the example filter parameter values. In the case of TSMOM, the delay and rise times are both the same, i.e., zero.

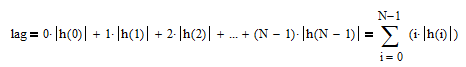

Lag

Lag is defined as the average age of the data passing through the filter [5]. It is related to the steady-state error (i.e., delay) in the filter output in response to a unit ramp input. Lag can generally be calculated as the sum of the absolute values of the time-weighted filter unit pulse response coefficients h(i):

where N = number of filter unit pulse response coefficients and |h(i)| = absolute value of the unit pulse response coefficient for i = 0, 1, 2, …, N-1. As noted in [1], all of the unit pulse response coefficients of low pass filters are positive and sum to 1.0, whereas some of the unit pulse response coefficients of high pass, bandpass, bandstop, and differentiator filters are negative and all the coefficients sum to 0.0.

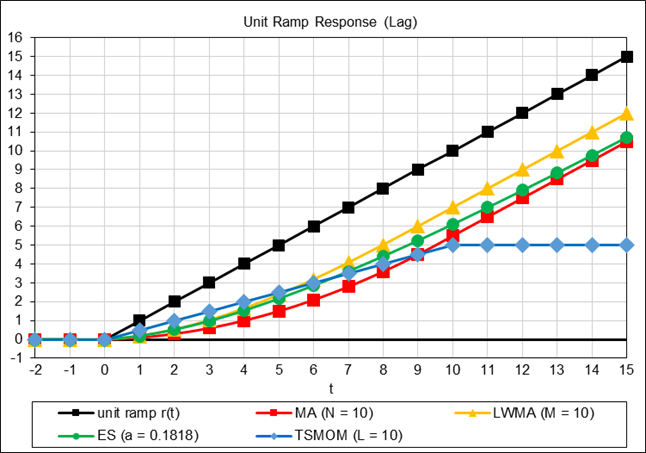

The graph below indicates the lags of the four filters, using the example filter parameter values. Note that using a ramp input with a slope other than +1 results in the same relative filter responses.

As explained in [1], MA, LWMA, and ES are first order low pass filters, which are modeled on the assumption that the underlying process of the input has a locally constant mean value and does not contain trends. They are designed to estimate the mean value of the input and not to estimate trends. As a result, the output of a first order low pass filter will lag the input if it contains a trend. For the two FIR low pass filters MA and LWMA, the steady-state error (i.e., delay) between a unit ramp input and the filter output equals the lag at the point the filter output reaches steady-state at 100% rise time, which occurs at time step t = N – 1 for MA and t = M – 1 for LWMA. Since ES is an IIR low pass filter with an infinite response time, it can be considered to occur at approximately 99% rise time, which is at time step t = [-4.6052 – ln(1 – α)]/ln(1 – α) where ln is the natural logarithm. For TSMOM, a differentiator, the filter output reaches steady-state and equals the lag at time step t = L. Prior to reaching steady-state, filter response is said to be in a transient state as it adjusts over time to the change in the input.

Trend Reversal Time

In the case of MA, LWMA, and ES, trend reversal time is the number of time steps, starting at t = 0, required for the filter output to intercept the unit trend reversal function input following the trend reversal point where the trend changes direction. In the case of TSMOM, trend reversal time is the number of time steps required for filter output to intercept the zero line following the trend reversal point.

The following graph illustrates the trend reversal times of the four filters, using the example filter parameter values. Note that using a trend reversal input with slopes other than +1 and -1 results in the same relative filter responses.

The equations used to estimate the trend reversal times of the filters that appear in the appendices were determined by applying least squares regression to a series of measurements of the intercept or zero-line crossing times of each filter across a range of filter parameter values. All of the regression models have coefficients of determination R2 very close to 1 and small standard errors of estimate S, as shown in the appendices.

As a side note, as demonstrated in [1], a TSMOM filter with lookback L changes sign at the same time as a MA filter with length N passes an inflection point, i.e., the MA changes direction, when L = N. This mathematical relationship can be observed in the graph above, where the TSMOM with L = 10 crosses below the zero line at the same time as the MA with N = 10 changes direction and starts to decrease, both occurring at time step t = 6 in this example.

Additional discussion regarding filter trend reversal response can be found in [6].

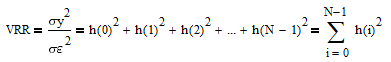

Variance Reduction Ratio

For time series containing normally distributed random noise ε(t) ~ N(0, σε2), the variance reduction ratio (VRR) of a filter measures the reduction in the variance of the filter output y(t) relative to the variance of the filter input and is calculated by summing the squares of the filter unit pulse response coefficients h(i) [5]. VRR is the ratio of the filter output variance to the input variance:

where N = number of filter unit pulse response coefficients and h(i) = unit pulse response coefficient for i = 0, 1, 2, …, N-1. Note that this calculation is equivalent to the Herfindahl-Hirschman Index [6]. The smaller the ratio, the greater the noise reduction. For example, VRR = 0 indicates complete noise reduction, whereas VRR = 1 indicates no noise reduction.

5. Filter Specification Comparison

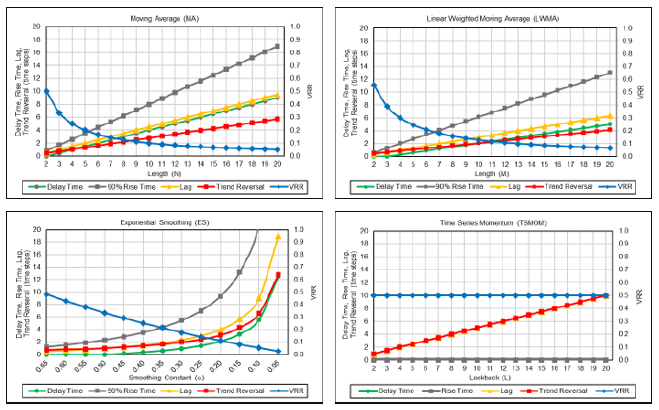

The following graphs show the specifications of the four filters across a range of filter parameter values. As mentioned previously, the specification equations of the filters can be found in the appendices. The graph data values are also displayed in the appendices in tabular form.

For the three low pass filters, the graphs indicate that the larger the filter lengths N or M or the smaller the smoothing constant α, the smaller the VRR but also the greater the delay time, rise time, lag, and trend reversal time. For TSMOM, a differentiator, lag and trend reversal time increase with increasing L, with the trend reversal time equal to the lag, whereas delay time and rise time (both zero) and VRR remain constant.

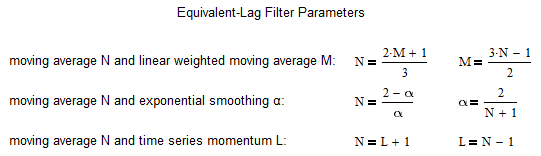

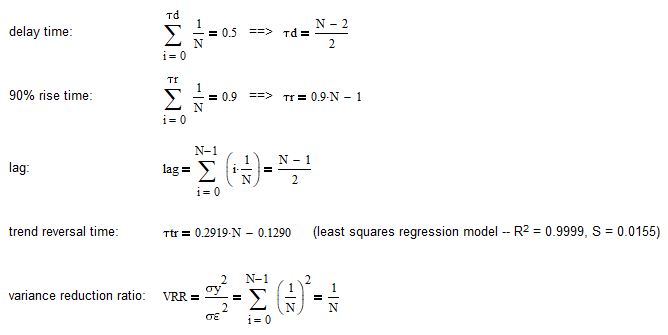

In order for the filter specifications to be comparable, the filter parameter values need to be standardized. Since lag is commonly used when calculating equivalent filter parameters, the method chosen here is to convert the filter parameters to the corresponding moving average lengths so they have equivalent lag, i.e., equivalent average age of the data passing through them. Note that this method equates the low pass filters at their corresponding -6 dB (quarter power) cutoff frequencies [1]. The filter parameter conversion equations are shown below, and the equivalent MA N values are included in the appendix tables:

The graphs below show the filter specifications standardized on their equivalent-lag MA filter lengths.

The graphs indicate that:

- On an equivalent-lag basis, the three low pass filters have approximately equal VRRs, with LWMA being slightly lower than the others. TSMOM, a differentiator, has the highest VRR, i.e., the least noise reduction, of all the filters.

- With respect to the trade-off with VRR, among the three low pass filters, ES has the shortest delay time and MA has the shortest 90% rise time and trend reversal time. On the other hand, MA has the longest delay time and ES has the longest 90% rise time and trend reversal time.

- TSMOM has the shortest delay time and rise time (both zero) of all the filters, but it also has the longest trend reversal time, with the trend reversal time equal to the lag.

Acknowledgements

I would like to thank Valeriy Zakamulin and Larry Stabile for reviewing this article and providing many helpful comments and suggestions.

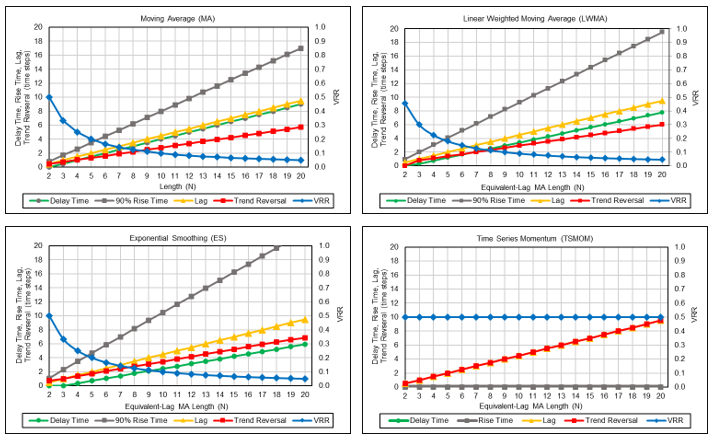

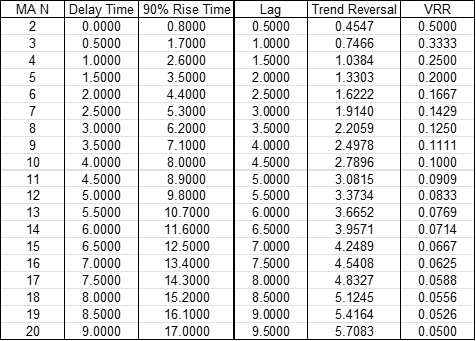

Appendix 1 – Moving Average (MA) Filter Specifications

Equations

Graph Data Values

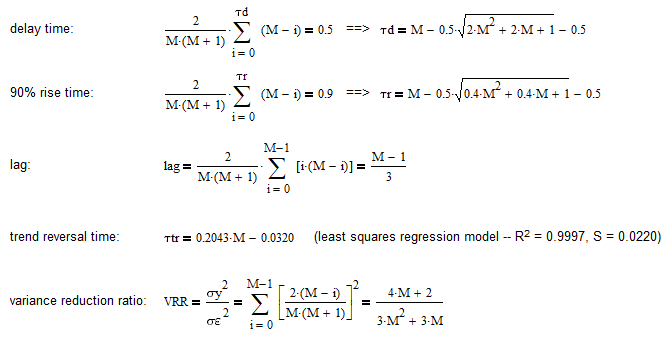

Appendix 2 – Linear Weighted Moving Average (LWMA) Filter Specifications

Equations

Graph Data Values

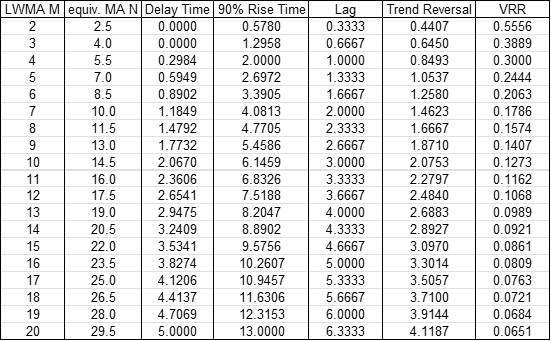

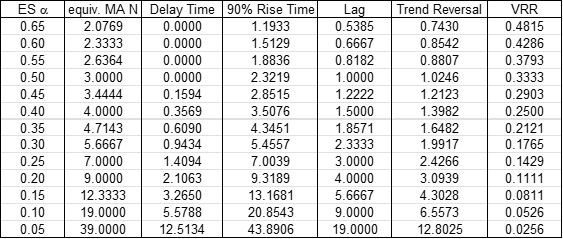

Appendix 3 – Exponential Smoothing (ES) Filter Specifications

Equations

Graph Data Values

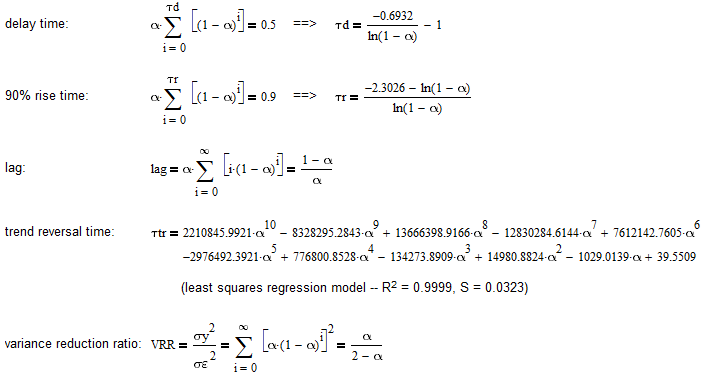

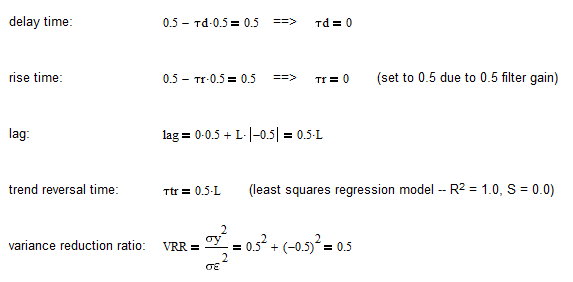

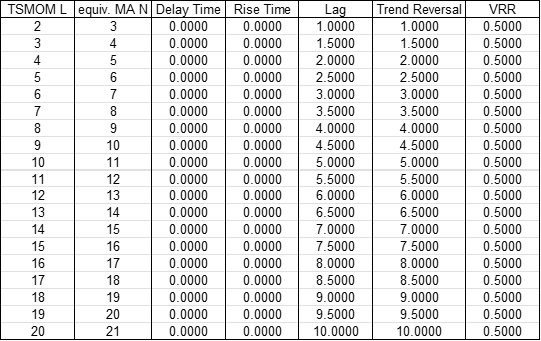

Appendix 4 – Time Series Momentum (TSMOM) Filter Specifications

Equations

Graph Data Values

References

[1] Stern, H., “An Introduction to Digital Signal Processing for Trend Following”, August, 2020, updated: September, 2023; available online at https://alphaarchitect.com/2020/08/an-introduction-to-digital-signal-processing-for-trend-following/. [2] Schwarz, R. J. and Friedland, B., Linear Systems, McGraw-Hill, 1965. [3] Oppenheim, A. V., Willsky, A. S., and Young, I. T., Signals and Systems, Prentice Hall, 1983. [4] Fessler, J., EECS 260 – Ch. 8: IIR Filters, June 9, 2003, University of Michigan; available online at https://www.eecs.umich.edu/courses/eecs206/public/lec/part8.pdf. [5] Brown, R. G., Smoothing, Forecasting, and Prediction of Discrete Time Series, Prentice Hall, 1962. [6] Zakamulin, V., Market Timing with Moving Averages: The Anatomy and Performance of Trading Rules, Springer, 2017.About the Author: Henry Stern

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.