Abstract: One of the problems for investment funds is that success contains the seeds of destruction as cash inflows follow outperformance.

In his seminal 2005 paper, “Five Myths of Active Portfolio Management,” Jonathan Berk suggested asking, “Who gets money to manage?” He answered that since investors have access to databases that provide returns histories, and everyone wants to have their money managed by the best manager, money will flow to the best manager first. Eventually, the best manager will receive so much money that it will impact their ability to generate superior returns, and their expected return will be driven down to the second-best manager’s expected return. At that point investors will be indifferent to investing with either manager, so funds will flow to both managers until their expected returns are driven down to the third-best manager. This process will continue until the expected return of investing with any manager is the benchmark expected return – the return investors can expect to receive by investing in a passive strategy of similar riskiness. At that point, investors are indifferent between investing with active managers or just indexing, and an equilibrium is achieved.

The research findings support the assumption of Berk’s theoretical model. Studies such as the 2015 paper, “Scale and Skill in Active Management,” and the 2019 paper, “Do Mutual Funds Have Decreasing Returns to Scale? Evidence from Fund Mergers,” have found that equity mutual funds experience diseconomies of scale. Lubos Pastor, Robert Stambaugh, and Lucian Taylor, authors of the 2020 study “Fund Tradeoffs,” found that funds face greater diseconomies of scale when trading a larger portion of the portfolio or holding a portfolio of less liquid securities. Similarly, Mehdi Khorram, author of the November 2020 study, “Returns-to-Scale Effect in Corporate Bond Mutual Funds,” found decreasing returns to scale among corporate bond funds. He noted that the corporate bond market is less liquid than the equity market, making the diseconomies of scale even more of a problem for corporate bonds, especially high-yield bonds, than for equities.

Quant/systematic (passive) versus fundamental (active) strategies

An interesting question is whether the diseconomies of scale have a greater impact on quantitative (systematic) approaches or fundamental (discretionary management) approaches. To answer that question, Richard Evans, Martin Rohleder, Hendrik Tentesch, and Marco Wilkens, authors of the study “Diseconomies of Scale in Quantitative and Fundamental Investment Styles,” published in the September 2023 issue of the Journal of Financial and Quantitative Analysis, examined diseconomies of scale for the two equity investment approaches over the period 1990-2018. They used separate accounts (SAs) data where the investment approach was self-identified. Their final sample contained 1,780 SAs of which 363 were quants and 1,417 were fundamentals.

They began by noting:

“While fund size is easily measured, it does not differentiate among different mechanisms for diseconomies of scale including liquidity – the increased trading and price impact costs associated with investing a larger pool of assets, information processing – the increased difficulty of timely identification of an increasing number of profitable investment strategies, and hierarchy costs – the cost or delay of communicating soft information throughout a larger firm as more people with more diverse functions and specializations are involved in the investment process.”

They added that automated (systematic) analysis, with primary dependence on hard information and little or no communication or feedback loops required between different investment professionals at the firm, may have lower hierarchy and information processing costs:

“These lower hierarchy/information processing costs may translate into more stocks held and less concentrated positions, consistent with lower liquidity costs, as a larger number of potential investments may be quickly analyzed and selected by the algorithm. At the same time, the rapid decision-making process may generate higher turnover, consistent with higher liquidity costs.”

Following is a summary of their key findings:

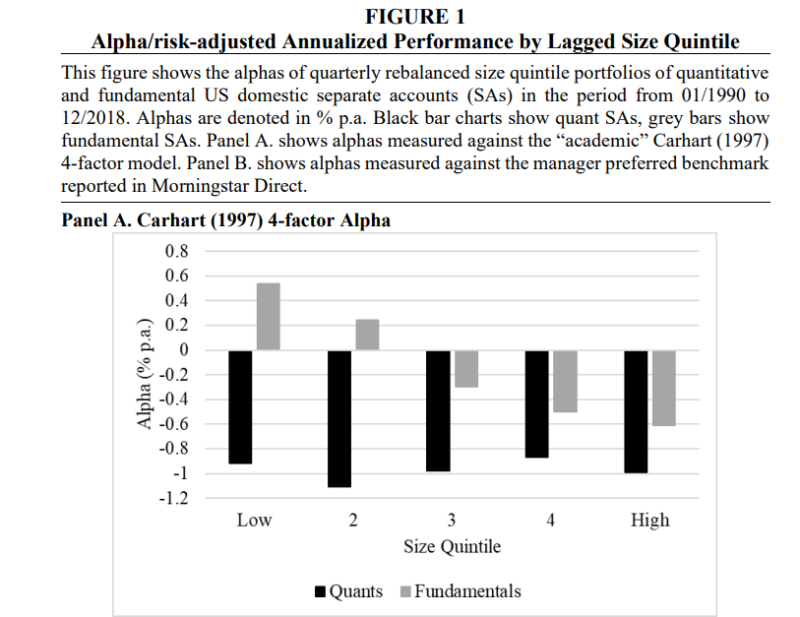

- Sorting SAs by the quintile of their total invested assets, there was a monotonically decreasing risk-adjusted performance for fundamental SAs with a statistically and economically significant alpha difference of -1.15% annualized. But sorting quant SAs by size generated a flat relationship between size and risk-adjusted performance with an insignificant difference of -0.06% between the largest and smallest size quintiles.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

- A one-standard-deviation increase in assets was associated with a decrease of future Carhart alpha of 0.832% per quarter. However the coefficient for quant SAs was statistically insignificant, and the point estimate was close to zero.

- Consistent with prior literature, higher expense ratios were associated with lower future performance.

- More liquid quants were significantly cheaper.

- Both quant and fundamental SAs became cheaper as they grew, with quants becoming cheaper at a slightly faster pace.

- Quants relied more heavily on factor-based strategies, and their strategy, as measured by deviation in the factors, was more consistent over time.

- Higher minimum investment amounts were associated with higher future SA performance, while a retail investor focus was associated with lower SA performance, both consistent with better monitoring by more sophisticated and institutional investors.

- Market risk betas were near 1 for both groups but slightly lower for fundamental strategies.

- Fundamentals had higher average SMB betas, while quants had higher HML betas on average.

- Fundamentals had no significant exposure to the momentum factor, while quants had a significant exposure, consistent with momentum being a quant strategy rather than a fundamental one.

- The relationships are held after controlling for other variables such as expense ratios.

- Quantitative SAs held more diversified portfolios of higher liquidity stocks than fundamental SAs and held less concentrated positions, thereby reducing their expected liquidity costs.

- Consistent with lower information processing/hierarchy costs, the speed of information diffusion was higher for quant SAs.

- Quant SAs also had higher fund turnover (110% versus 54%) than fundamental SAs. However, the lower observed diseconomies of scale for quant SAs suggest that the effects of this higher turnover were outweighed by the effects of portfolio liquidity.

- Accounting for these differences helped to explain the differences in diseconomies of scale, which were 2.7 times as great for fundamental SAs.

The authors concluded: “We find that quant strategies are less plagued by diseconomies of scale compared to fundamental strategies.” They added: “Because both the quantitative and fundamental SAs are investing in similar securities, the difference in diseconomies of scale is striking.”

Investor takeaways

The research on both equity and corporate bond funds demonstrates that fund size causes fund performance erosion due to the illiquidity effects. A larger fund must place bigger orders in the market. This moves the prices against the fund, especially in the corporate bond market in which most transactions are performed in over-the-counter markets. In addition, while the research shows that fund managers are skilled, skill doesn’t translate into outperformance due to the diseconomies of scale.

The evidence demonstrates that decreasing returns to scale implies that the performance of actively managed funds should be expected to decrease after experiencing positive shocks in size resulting from mergers or cash flows. In addition to market efficiency, this is a major reason why there is no evidence of persistence of outperformance beyond the randomly expected in actively managed equity and bond funds – providing yet another reason to avoid them. Forewarned is forearmed.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future. For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy or confirmed the adequacy of this article. LSR-23-577

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.